EUR/USD Price Analysis: Can the Pair Hold Above 1.0400 or Is a Breakdown Coming?

EUR/USD Faces Key Levels as Dollar Strength Remains Dominant

The EUR/USD pair is navigating a turbulent market landscape, currently trading around 1.0430, marking its third consecutive day in the red. The pair has already shed over 0.50% this week, erasing a large portion of last week’s gains, which saw a surge of 1.50%. The fundamental outlook for the euro remains uncertain, while the U.S. dollar continues to benefit from safe-haven demand and the Federal Reserve's cautious stance on rate cuts.

Momentum indicators suggest a shift in sentiment. The Relative Strength Index (RSI) has dropped to 53, reflecting a decline in bullish momentum, while the MACD histogram is printing decreasing green bars, indicating fading buying pressure. However, EUR/USD remains above the 20-day Simple Moving Average (SMA), meaning buyers still have a chance to regain control.

The convergence of the 100-day and 20-day SMAs around 1.0450 raises concerns about a potential bearish crossover, which could reinforce a downward trend. If the pair fails to hold this level, it could trigger a further decline toward 1.0370, a key Fibonacci retracement level.

Federal Reserve's Stance Puts Pressure on EUR/USD

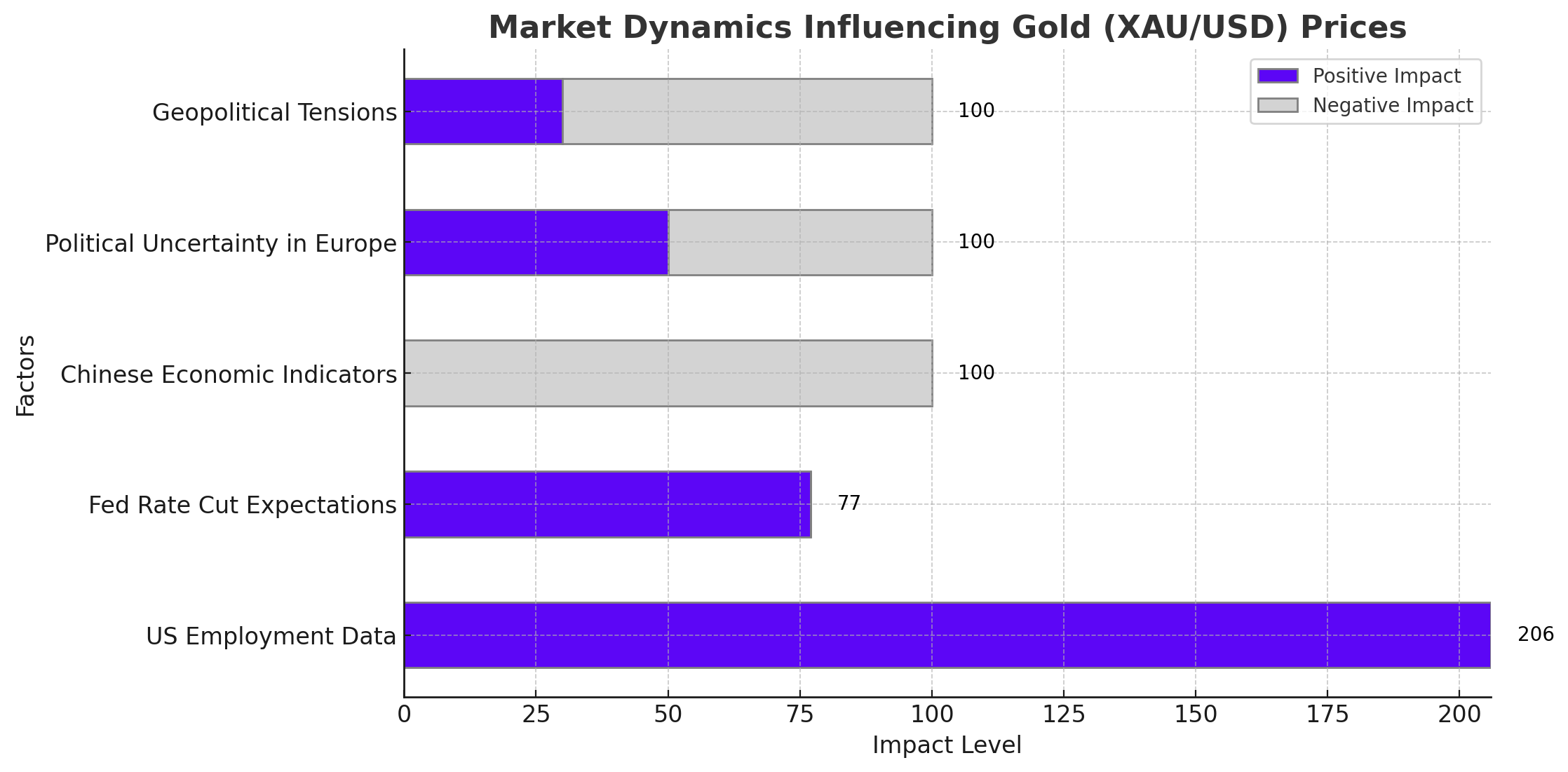

The Federal Reserve’s recent communications have provided no clear signals of an imminent rate cut. Governor Christopher Waller stated that the FOMC (Federal Open Market Committee) should remain cautious, reinforcing expectations that interest rates will stay high for longer. As a result, the U.S. dollar has maintained strength, keeping the EUR/USD pair under pressure.

Market participants were initially optimistic after weak retail sales data led to speculation that the Fed might ease its monetary stance. However, recent statements from Fed officials indicate that policymakers are in no rush to lower interest rates, keeping the dollar supported and limiting any significant upside for the euro.

Traders are now awaiting the upcoming FOMC meeting minutes, which may provide further clues about the Fed's policy direction. If the minutes indicate a willingness to keep rates steady, EUR/USD could extend its decline toward the psychological support level of 1.0200.

Geopolitical Tensions and the Euro's Struggles

The euro remains vulnerable to geopolitical risks, with the ongoing Russia-Ukraine conflict weighing on sentiment. Hopes for a peace deal faded after Ukrainian President Volodymyr Zelenskyy postponed a planned meeting in Saudi Arabia, where he was expected to discuss a ceasefire proposal. This unexpected delay raised concerns that the war could drag on, prolonging economic instability in Europe.

The initial rally in the euro earlier in the week came after reports suggested that former U.S. President Donald Trump was mediating peace talks between Ukraine and Russia. However, this optimism quickly faded as new tensions emerged, reinforcing the dollar’s safe-haven appeal.

Additionally, Russia has reportedly increased its demands in peace negotiations, further complicating the situation. If the war escalates further, the euro could face additional downward pressure, pushing EUR/USD below 1.0400 and potentially toward the 1.0200 level.

Technical Analysis: EUR/USD at a Crossroads

The EUR/USD technical setup presents a mixed picture. The pair attempted to break above the 1.0500 resistance level but failed, triggering a decline back toward support at 1.0430. The 30-SMA support remains a critical level to watch, as a break below could shift control firmly in favor of the bears.

From a broader perspective, if EUR/USD remains above the 20-day SMA, there is still a chance for a rebound. However, if the pair breaks below the 30-SMA, the next downside targets come into play:

- 1.0400: Key psychological and Fibonacci retracement support.

- 1.0370: 38.2% Fibonacci extension, a level that could attract renewed buying interest.

- 1.0200: Major support zone, aligning with the January low.

On the upside, bulls need to reclaim 1.0500 to regain control. A breakout above this level would open the door for a retest of 1.0533, followed by the 1.0610 resistance level.

Euro's Battle Against Dollar Strength: Will EUR/USD Drop Below 1.0400?

Despite recent attempts to rally, EUR/USD remains at risk of further declines due to the Federal Reserve's hawkish stance, geopolitical risks, and strong dollar demand. The upcoming FOMC meeting minutes and geopolitical developments in Ukraine will be key drivers for the pair’s next major move.

For now, traders should closely monitor EUR/USD’s ability to hold above 1.0400. A break below this level could accelerate losses toward 1.0200, while a rebound above 1.0500 would indicate a potential shift in momentum.