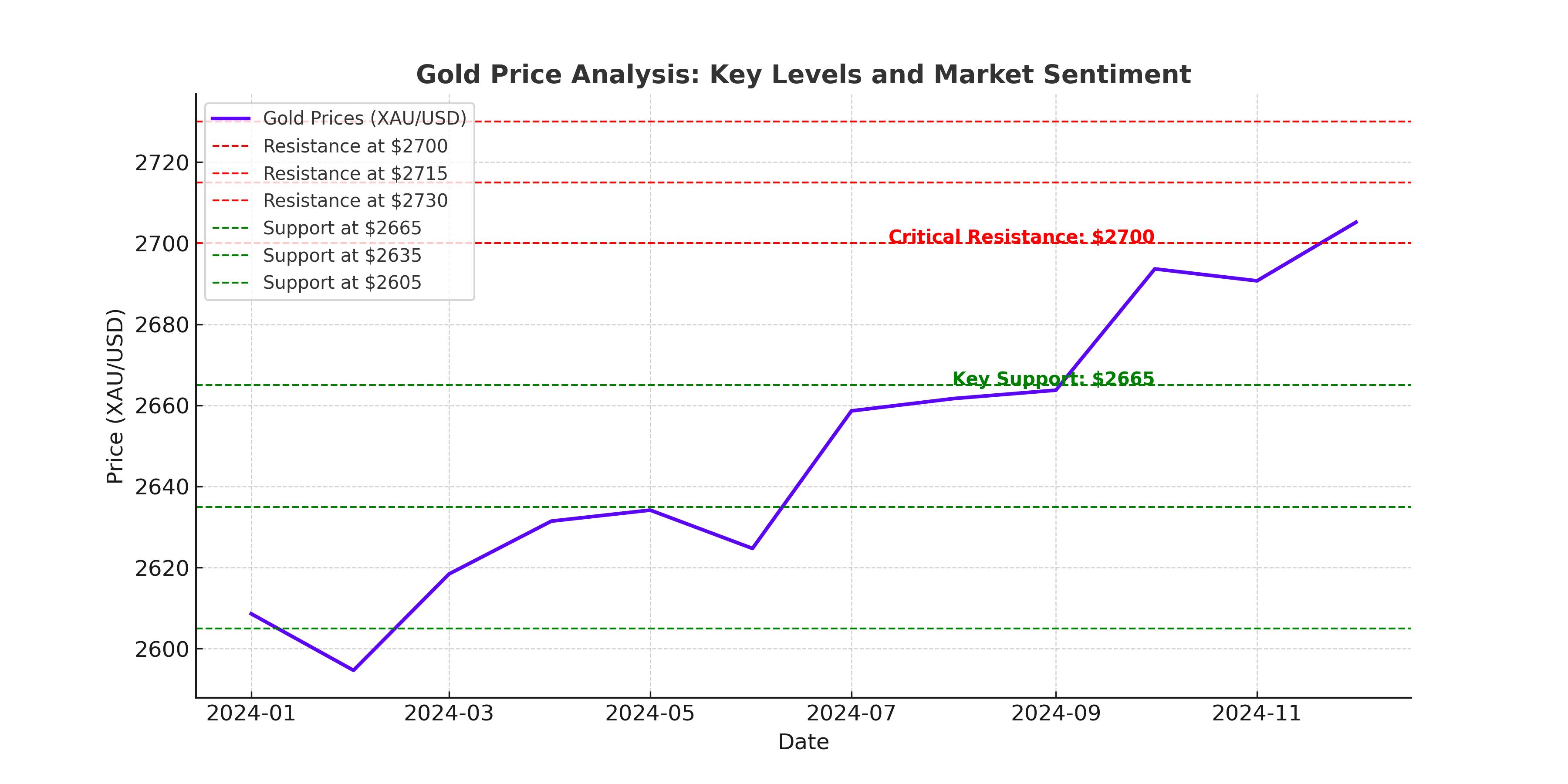

Can Gold (XAU/USD) Hold Above $2,700 Amid Surging Yields?

Gold struggles near $2,700 as rising U.S. yields and a strong dollar challenge its rally. Will safe-haven demand and inflation fears support the metal? | That's TradingNEWS

1/13/2025 11:26:51 PM

Gold Price Analysis: XAU/USD Approaches Key Psychological Resistance

Gold (XAU/USD) remains a focal point for investors as prices hover near the critical psychological barrier of $2,700 per ounce. Currently trading at $2,678.09, the yellow metal has retreated from its December highs of $2,693.40 amid strong headwinds from rising U.S. Treasury yields and a surging U.S. Dollar. Market participants are now weighing the impact of robust U.S. labor data, heightened geopolitical tensions, and Federal Reserve policies on the near-term trajectory of gold prices.

Read More

-

DGRO ETF Price Forecast: Is iShares’ Dividend Growth Fund Still a Buy Near $71?

26.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Trade Tightens as XRPI, XRPR and Bitwise XRP Slip with XRP-USD Near $1.90

26.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Jumps Above $6 as Arctic Blast Knocks U.S. Output to Two-Year Low

26.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Slides to 154: Intervention Chatter Replaces Dip-Buying Before Fed

26.01.2026 · TradingNEWS ArchiveForex