Introduction to JEPQ: A Unique High-Yield Offering

The JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) has rapidly emerged as a favorite for income-focused investors, offering a standout blend of high monthly income and reduced volatility. Launched in May 2022, the ETF leverages a strategic combination of Nasdaq 100 components and equity-linked notes (ELNs) to generate consistent premium income while mitigating the higher volatility associated with growth-heavy tech stocks. JEPQ’s monthly distribution yield currently stands near 10%, with a beta of just 0.7, making it a compelling option for investors seeking stability and robust income potential.

Portfolio Composition and Sector Insights

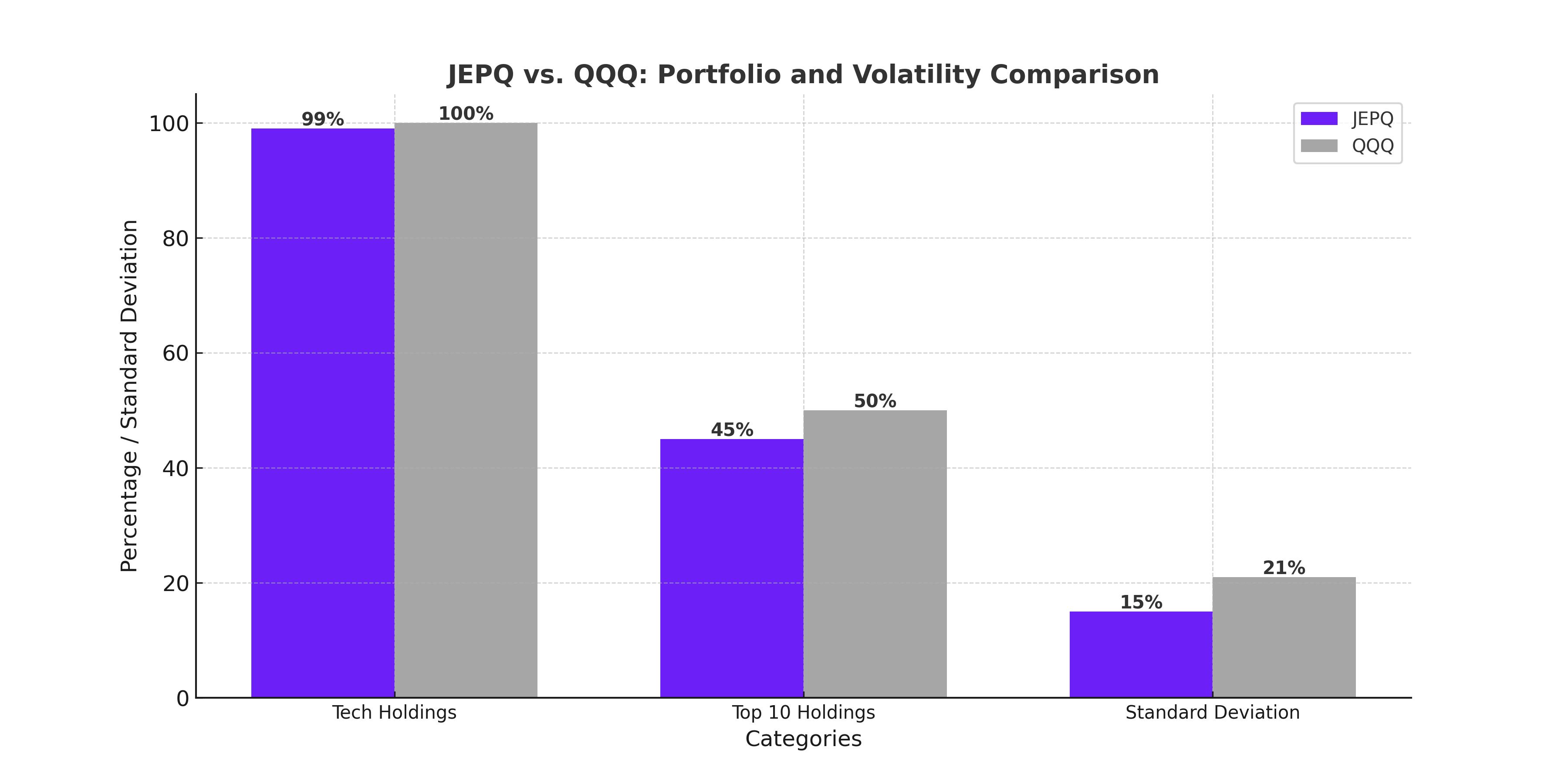

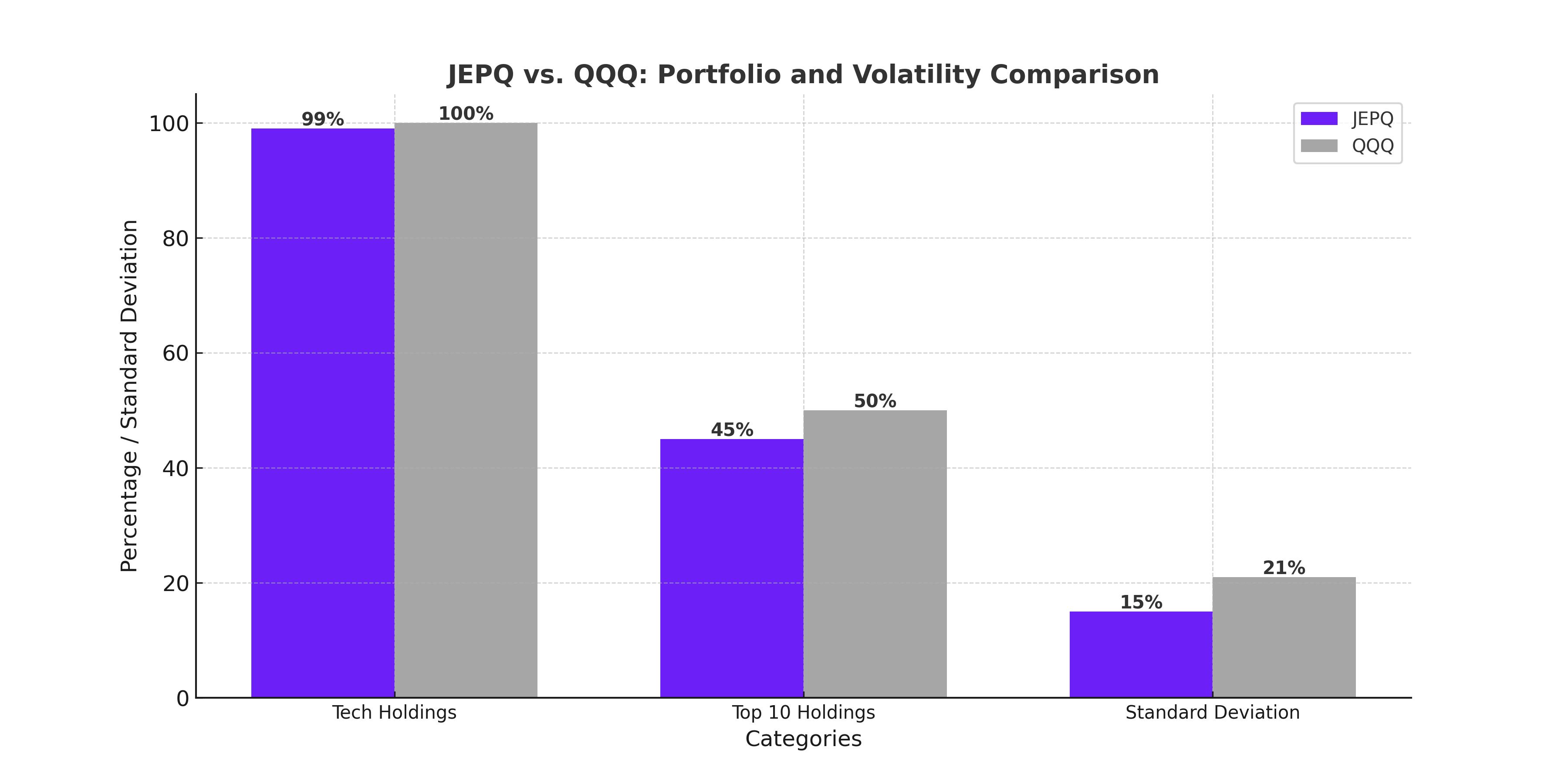

JEPQ’s portfolio is tech-heavy, aligning with the Nasdaq 100's focus on innovation leaders like Apple (AAPL), Microsoft (MSFT), and NVIDIA (NVDA). The ETF holds approximately 99 securities, with the top 10 holdings accounting for 45% of its allocation. Unlike its benchmark, JEPQ slightly underweights its top holdings to reduce concentration risk, further smoothing returns. The ELNs, custom-designed in-house by JPMorgan, add another layer of income generation, making JEPQ’s distributions more resilient in volatile markets.

This allocation positions JEPQ as a middle ground between growth-focused ETFs like the Invesco QQQ Trust ETF (QQQ) and income-heavy REITs or junk bonds. For example, QQQ’s historical standard deviation sits at 21%, while JEPQ delivers a lower 15%—a testament to its ability to temper volatility without sacrificing returns.

JEPQ's Performance: Balancing Yield and Stability

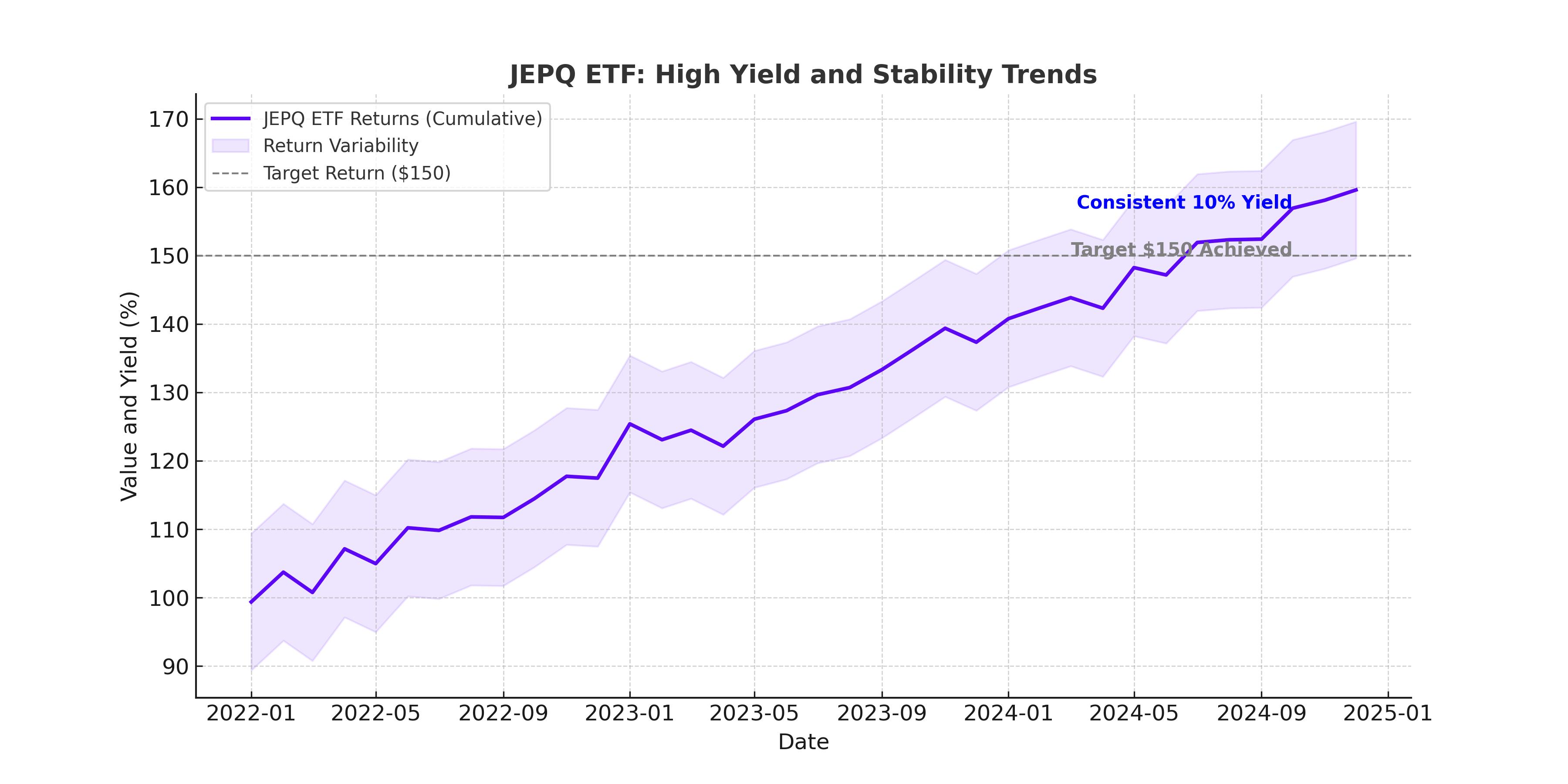

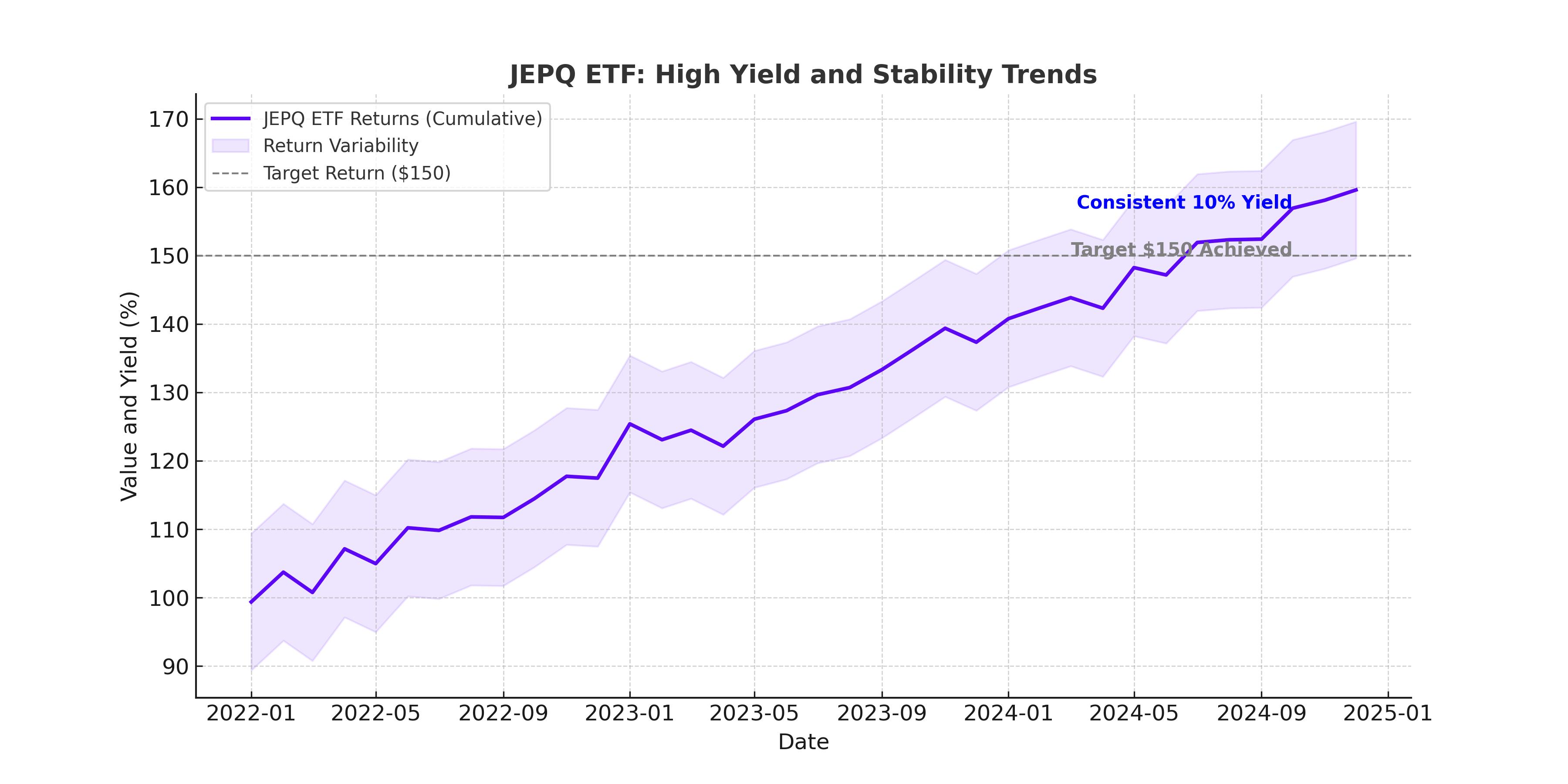

Since its inception, JEPQ has consistently outperformed traditional high-yield instruments like REITs, MLPs, and junk bonds in total return, all while maintaining lower volatility. For example, from mid-2022 to late 2023, JEPQ delivered a total return of approximately 19% on an annualized basis, outperforming the S&P 500 ETF (SPY) while offering significantly higher income.

JEPQ’s yield is a standout feature, offering investors a stable 10% annualized distribution. This is particularly impressive when considering the ETF’s ability to capture 74% of the Nasdaq 100's upside while limiting downside capture to just 50%. During periods of heightened volatility, such as in 2022, JEPQ’s income spiked, providing a buffer against market downturns.

ELNs: A Core Component of JEPQ’s Strategy

JEPQ’s reliance on equity-linked notes distinguishes it from traditional covered-call strategies. While covered calls provide upfront income, ELNs offer flexibility by tailoring risk and reward profiles to current market conditions. JPMorgan's expertise ensures these instruments align with the ETF’s objectives, delivering steady payouts even during challenging periods. For instance, JEPQ’s income remained robust throughout 2023 despite Nasdaq volatility, showcasing the effectiveness of its ELN strategy.

Tax Implications for JEPQ Investors

One downside to JEPQ’s income-oriented structure is its tax treatment. Distributions are taxed as ordinary income, with a tax expense ratio of approximately 30%. For comparison, QQQ and SPY have tax expense ratios of just 5% and 6%, respectively. This makes JEPQ particularly suited for tax-advantaged accounts, where its high yield can be fully realized without eroding returns.

Risk Assessment: Is JEPQ Right for You?

JEPQ’s concentrated exposure to the tech-heavy Nasdaq 100 introduces higher market risk during downturns. While its volatility is mitigated by ELNs, the ETF is not immune to drawdowns, as seen during its 12% decline in 2022. Additionally, the reliance on ELNs introduces counterparty risk, albeit minimal given JPMorgan’s financial strength.

Investors should also temper their expectations for capital appreciation. By design, JEPQ sacrifices some upside potential in exchange for higher income, making it less suitable for those seeking growth. Instead, it excels as a stable income generator within a diversified portfolio.

JEPQ in Portfolio Context

JEPQ pairs well with complementary ETFs like the JPMorgan Equity Premium Income ETF (JEPI) and Simplify Volatility Premium ETF (SVOL). While JEPI offers a value-focused alternative with lower volatility, SVOL adds diversification by shorting volatility. Together, these ETFs can create a balanced income portfolio with reduced correlation to broader equity markets.

For conservative investors, JEPQ should be limited to 5% of an income portfolio, paired with safer fixed-income assets like intermediate treasuries. Aggressive investors may allocate up to 10% or combine JEPQ with JEPI for diversified income exposure.

Final Thoughts: JEPQ as a Strong Income Solution

JEPQ stands out as one of the best high-yield ETFs for income investors, combining the growth potential of the Nasdaq 100 with the stability of active income management. Its 10% yield, low beta, and innovative use of ELNs make it an excellent choice for retirees and income-focused investors alike. While it may not suit those seeking aggressive capital appreciation, JEPQ excels in delivering reliable, high-yield income with lower volatility. For detailed real-time charts and further insights, visit JEPQ’s profile.

That's TradingNEWS