ASML (NASDAQ:ASML): Unmatched Monopoly in EUV Technology with Bullish Growth Ahead

ASML Dominates the Semiconductor Industry through EUV Monopoly

ASML Holding N.V. (NASDAQ:ASML) has cemented its place as a pivotal player in the semiconductor industry, with its stock currently trading around $645.00, reflecting significant market confidence. ASML's exclusive hold over extreme ultraviolet (EUV) lithography technology, vital for manufacturing high-end semiconductor chips, provides an unparalleled competitive advantage. EUV technology has redefined chip production, enabling the creation of nanometer-scale chips essential for industries ranging from artificial intelligence to advanced automotive systems.

ASML’s position is reinforced by a strategic moat built over decades. Developing an EUV lithography system requires an intricate blend of physics, engineering, and proprietary technology. These systems involve firing plasma 40 times hotter than the sun to produce EUV light, directing it through mirrors smoother than atoms. This unmatched complexity has left potential competitors decades behind, ensuring ASML's dominance in the high-tech chip production value chain.

Revenue Growth and Market Outlook Signal Long-Term Strength

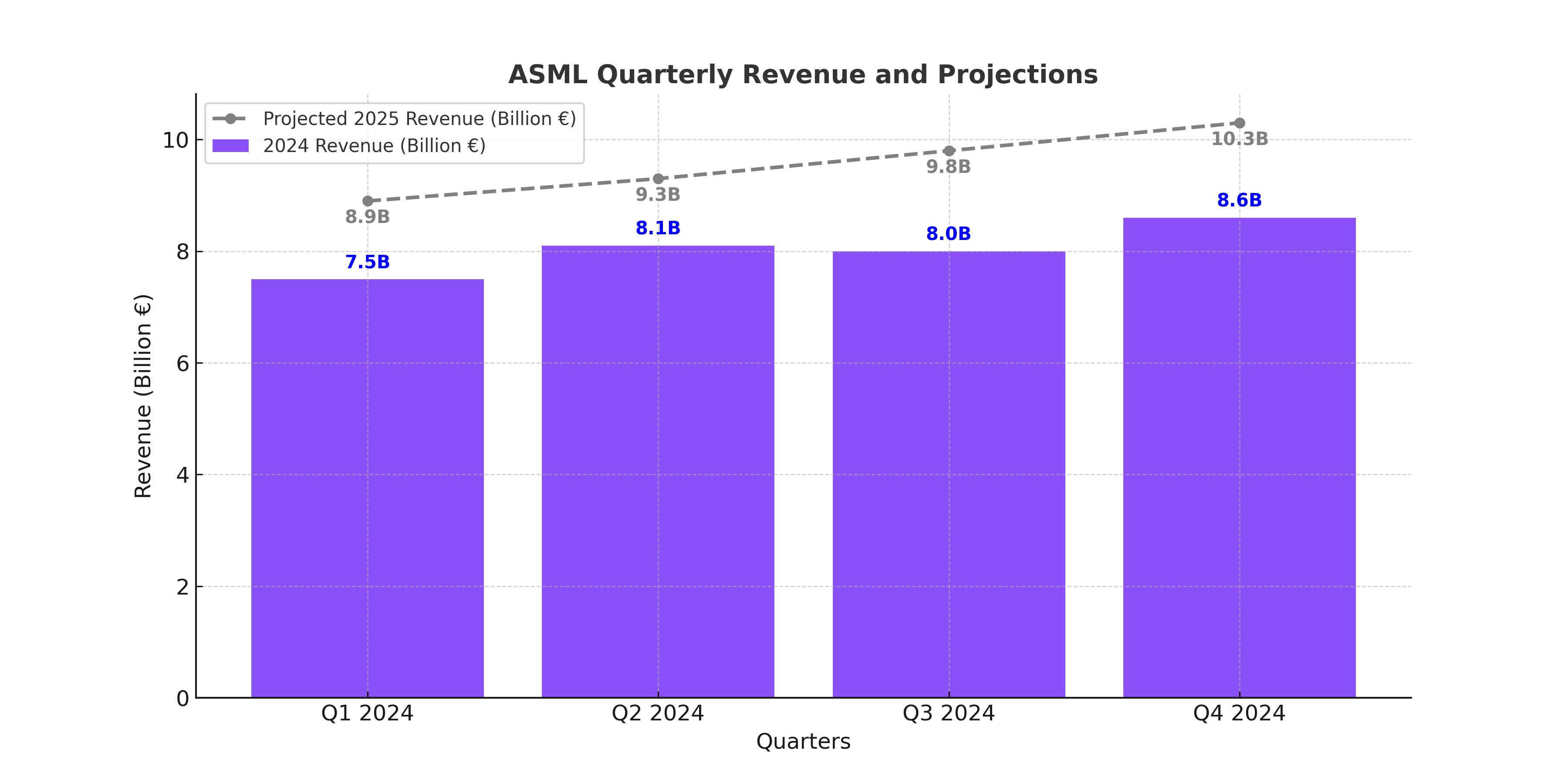

ASML's financial performance underscores its critical role in the semiconductor industry. In Q3 2024, the company reported €8 billion in net sales and maintained an impressive gross margin of 50.8%. With a backlog exceeding €39 billion, ASML’s demand outlook remains robust. Despite global challenges, ASML has reaffirmed its long-term revenue projections, estimating revenues between €44 billion and €60 billion by 2030.

Artificial intelligence and geopolitical shifts are key drivers of growth. The global AI market is forecasted to reach $4 trillion by 2030, fueling the need for dense and efficient chips that can only be produced using ASML’s EUV machines. Furthermore, geopolitical dynamics such as the CHIPS Act in the U.S. and Europe's prioritization of local chip manufacturing have significantly boosted demand for ASML’s lithography systems.

China Export Restrictions and Risks to Watch

Despite its dominance, ASML faces headwinds. Export restrictions to China, accounting for nearly 20% of its sales, have reduced market opportunities. However, ASML’s ability to offset these challenges lies in capturing demand from other regions. As global tensions push nations to prioritize domestic semiconductor production, ASML benefits as the primary supplier for advanced chip-making tools.

Additionally, ASML’s reliance on a concentrated customer base—including giants like TSMC, Samsung, and Intel—poses revenue fluctuation risks. Even minor disruptions in capital expenditure by these companies could significantly impact ASML. However, its deep integration into their manufacturing processes mitigates long-term risk.

Technological Edge and Expanding Moat

ASML’s dominance extends beyond EUV to its development of High Numerical Aperture (High NA) EUV lithography systems. These advanced tools, capable of sub-2nm resolutions, position ASML at the forefront of next-generation chip manufacturing. High NA technology, set to revolutionize AI, 6G, and quantum computing, ensures ASML remains indispensable for cutting-edge industries.

Its partnerships with key suppliers like Trumpf (lasers) and Zeiss (optical systems) further strengthen its monopoly. These exclusive relationships ensure that ASML remains the sole beneficiary of the most advanced components, safeguarding its market position for decades to come.

Financial Projections and Valuation Signal Upside

ASML’s financial strength and forward-looking projections paint a compelling picture for investors. EBITDA is projected to grow at an annualized rate of 13.7% through 2026, while free cash flow is expected to increase by 45.8%. This financial trajectory supports substantial shareholder returns through dividends and share buybacks.

Using EPS estimates of $56.25 for 2030 and a conservative P/E ratio of 24x, ASML’s stock could reach $1,344, reflecting an 87% upside from current levels. A slightly higher valuation multiple of 26x places the target price above $1,450, doubling returns for long-term investors.

Conclusion

ASML Holding N.V. remains a cornerstone of the global semiconductor ecosystem. With its unmatched monopoly over EUV lithography and leadership in High NA systems, ASML is set to capitalize on burgeoning demand from AI, quantum computing, and next-generation technologies. While geopolitical risks and market cyclicality require caution, ASML’s robust fundamentals, technological edge, and shareholder-focused financial strategy make it a compelling buy. For real-time updates on ASML’s stock performance, visit ASML Real-Time Chart.