NASDAQ:MRVL Positioned for Sustained Growth Amid AI Surge

Marvell Technology Group, listed as NASDAQ:MRVL, has emerged as a key player in the AI-driven semiconductor industry, leveraging strategic alliances and groundbreaking product innovations to achieve impressive growth. The company’s data center revenue soared 98% year-over-year in Q3 FY2025, showcasing its ability to capitalize on increasing hyperscaler investments. This growth is reflected in the stock’s 103% rally since August 2024, solidifying its status as one of the standout performers in the tech sector’s AI boom. Real-time stock data for MRVL can be accessed here.

Strategic Partnership with AWS Drives Momentum

Marvell's five-year partnership with Amazon Web Services (AWS) is central to its current success. This collaboration focuses on delivering custom AI silicon and advanced networking solutions tailored to meet AWS’s growing demands for cutting-edge data center infrastructure. AWS’s capital expenditures in FY2025 are expected to exceed $75 billion, a significant increase from the previous year’s $48.4 billion, driven by investments in generative AI and cloud computing. These investments have created a robust pipeline for MRVL’s innovations, including its next-generation 1.6T 3-nanometer DSP, which reduces power consumption by over 20%, addressing the hyperscalers’ critical need for energy efficiency in high-density data centers.

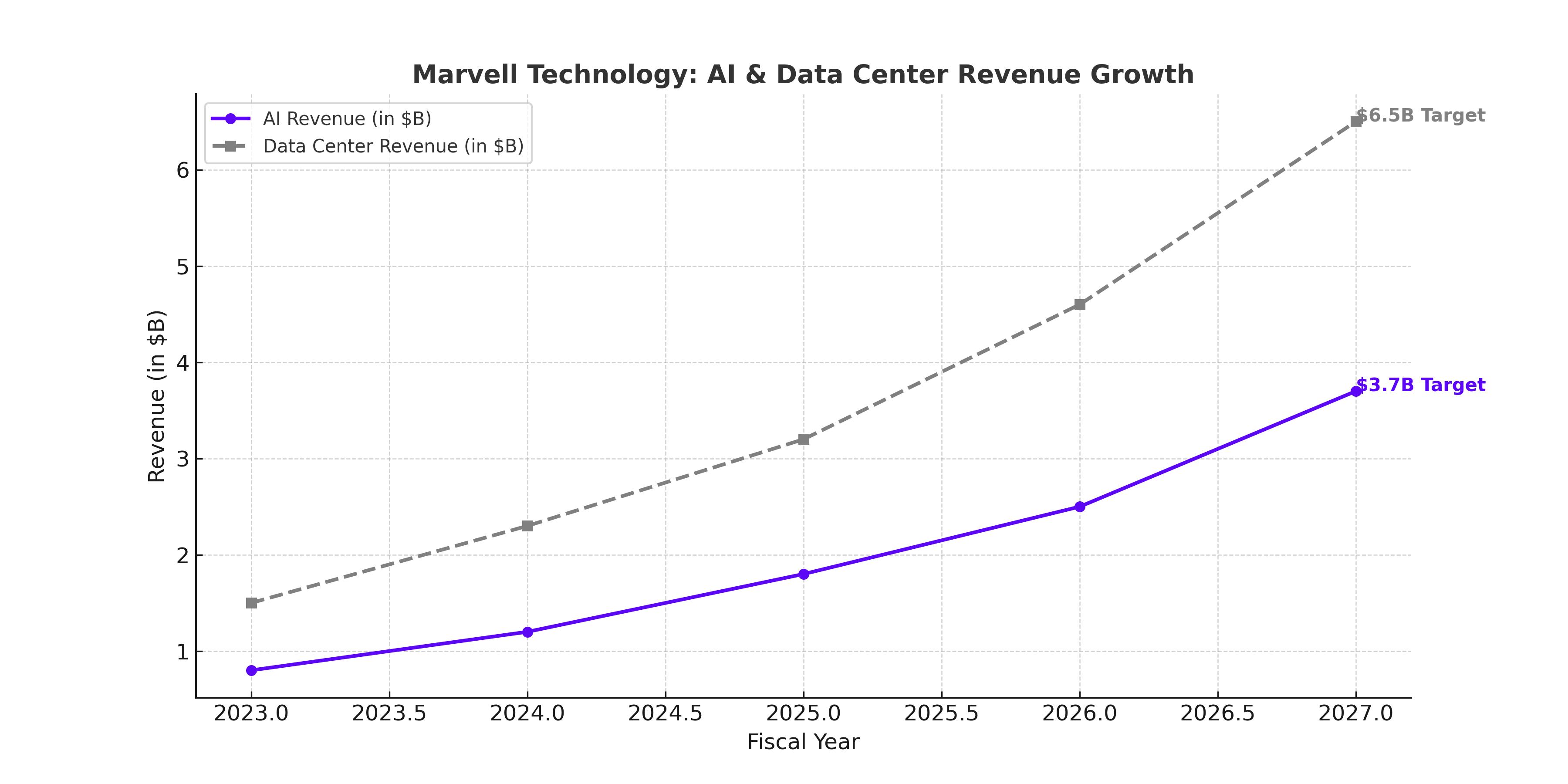

AI Revenue Growth Exceeds Expectations

Initially, Marvell set a target of $1.5 billion in AI-related revenue for FY2025. However, the company’s accelerating momentum suggests it will exceed this projection. For FY2026, MRVL aims to achieve $2.5 billion in AI revenues, representing a remarkable 66% year-over-year increase. This growth is supported by the company’s advanced portfolio of AI-focused solutions, including high-bandwidth memory (HBM) architectures, optical DSPs, PCIe retimers, and Ethernet switches. These innovations enhance performance, efficiency, and cost-effectiveness, making Marvell a preferred partner for hyperscalers like AWS and others.

Marvell’s increasing commitments to its manufacturing partners, including a 123% year-over-year rise in obligations to Taiwan Semiconductor Manufacturing (TSM), underscore the surging demand for its products. These commitments suggest a strong pipeline of orders, ensuring sustained growth as the company scales production to meet AI-driven requirements.

Stock Valuation and Growth Potential

Marvell’s stock currently trades at a forward P/E ratio of 75.88x, significantly above its historical averages of 42.05x (1-year) and 38.51x (5-year). This elevated valuation reflects high market expectations for the company’s future performance. While expensive compared to peers like NVIDIA (47.44x) and Broadcom (36.18x), Marvell’s projected earnings growth of 40–50% annually through FY2027 supports its premium valuation. Analysts forecast adjusted EPS of $3.68 for FY2027, indicating a potential upside of 35% to a price target of $154.70.

Despite its recent rally to $126.15, the stock may present better entry opportunities at lower levels. A pullback to the $94–$104 range would provide a more favorable risk-reward profile, allowing investors to capitalize on the company’s long-term growth potential.

Risks and Considerations

While Marvell’s outlook is overwhelmingly positive, it is not without risks. The company’s heavy reliance on data center revenues could expose it to potential slowdowns in hyperscaler capital expenditures. Additionally, challenges in other segments, such as automotive and consumer electronics, may weigh on overall growth if demand remains tepid. Rising competition from industry giants like NVIDIA, AMD, and Broadcom further underscores the need for continued innovation and execution.

Higher interest rates and macroeconomic uncertainties could also impact Marvell’s valuation, as these factors often weigh on growth-oriented stocks. However, the company’s focus on high-margin AI solutions and its ability to secure long-term partnerships mitigate some of these risks.

Future Prospects and Recommendations

Marvell’s growth trajectory remains firmly supported by its strategic partnerships, innovative product portfolio, and robust demand for AI-driven solutions. The company’s ability to consistently exceed expectations positions it as a leader in the semiconductor industry. While the current valuation reflects optimism, a pullback to the $94–$104 range would present a compelling buying opportunity for long-term investors.

Investors already holding the stock should view MRVL as a strong hold, with significant upside potential through FY2027. For those considering entry, monitoring price movements and capitalizing on potential corrections could enhance returns, especially as the company continues to scale its AI-related revenues and expand its market share. The combination of robust fundamentals, strong partnerships, and innovative products makes Marvell Technology a standout choice in the semiconductor sector.