Can Oil Prices Rebound Beyond $75 Amid Global Uncertainty?

With WTI at $70.31 and Brent at $73.78, the market teeters between supply concerns and weakening demand. Geopolitical tensions and China's slowing growth weigh heavily on the outlook | That's TradingNEWS

Oil Prices Under Pressure: Will WTI and Brent Recover Amid Global Supply and Demand Uncertainty?

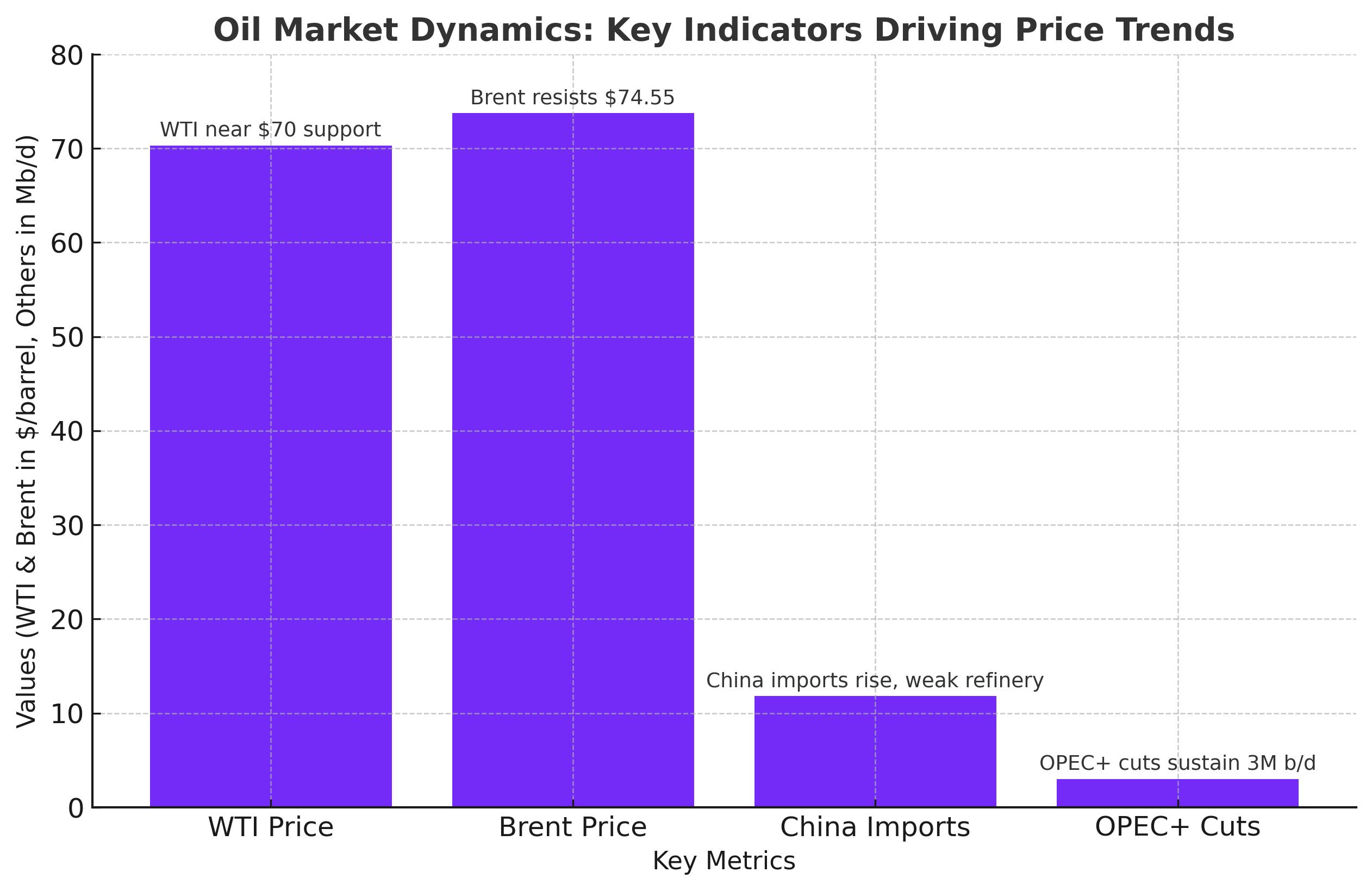

Crude oil prices are experiencing significant volatility, with West Texas Intermediate (WTI) trading around $70.31 and Brent crude at $73.78. The recent fluctuations are driven by geopolitical tensions, supply constraints, and mixed signals from key markets like China. The global oil market, which has been buoyed by OPEC+ production cuts and U.S. sanctions on major producers, now faces challenges from slowing demand growth and weakening economic indicators in top importers like China. Amidst these dynamics, the question remains: can oil prices sustain their current levels, or will they face further downward pressure?

WTI Oil Prices React to Geopolitical Risks and Rate Expectations

West Texas Intermediate (WTI) oil has struggled to maintain upward momentum, retreating after a strong rally last week that pushed prices to $71.46. Current trading levels around $70.31 highlight market uncertainty ahead of a critical Federal Reserve decision on interest rates. The expected 25-basis-point rate cut could provide a short-term boost to oil prices by stimulating economic activity and energy demand. However, persistent geopolitical risks are shaping the market narrative.

The United States has hinted at additional sanctions targeting Russian and Iranian oil exports. Treasury Secretary Janet Yellen recently suggested measures against "dark fleet" tankers and Chinese financial institutions involved in facilitating Russian oil trade. These actions, aimed at curbing revenue flows to these major producers, have heightened concerns over potential supply disruptions. In addition, armed clashes near Libya’s Zawiya refinery forced a temporary suspension of operations, further tightening short-term supply. Despite these developments, traders remain cautious, as broader economic concerns weigh on long-term price stability.

Brent Crude Finds Resistance Amid Mixed Market Sentiment

Brent crude prices, currently hovering around $73.78, have faced resistance near the $74.55 level. Recent price movements reflect the market's struggle to reconcile supply risks with a less optimistic demand outlook. Ongoing production cuts by OPEC+ have helped stabilize prices, but forecasts from the International Energy Agency (IEA) suggest that the global oil market will remain well-supplied through 2025.

China’s crude oil import data has added complexity to the demand picture. November saw a notable increase in imports, with daily rates averaging 11.81 million barrels—a 14.3% year-over-year rise. However, much of this oil appears to have been funneled into storage rather than immediate refining, as evidenced by an estimated surplus of 1.77 million barrels per day. This trend highlights weak demand from Chinese refiners, despite price incentives offered by suppliers like Saudi Arabia and Iraq. The lack of a robust recovery in China’s economic activity has tempered expectations for a significant rebound in global oil consumption.

OPEC+ Production Cuts and Supply Risks Shape Market Dynamics

OPEC+ continues to exert influence over global oil markets through coordinated production cuts. The cartel's decision to extend its output reductions has supported prices, but the impact has been partially offset by strong non-OPEC supply growth. Analysts from ING and Commonwealth Bank of Australia have highlighted this dynamic, with non-OPEC producers expected to outpace consumption growth in the coming years.

Additionally, geopolitical risks remain a key driver of supply concerns. The situation in Libya underscores the fragility of oil infrastructure in conflict zones, while Nigeria faces challenges related to pipeline ruptures and regulatory hurdles. Shell's announcement of the Bonga North deepwater project, expected to peak at 110,000 barrels per day by the end of the decade, represents a longer-term effort to stabilize production. However, Shell’s plans to divest onshore assets in Nigeria indicate a strategic shift that could reduce output from one of Africa’s largest producers.

Technical Analysis: WTI and Brent Support and Resistance Levels

From a technical perspective, WTI crude faces immediate resistance at $71.46, with additional barriers at $75.27 if buyers regain control. On the downside, support levels are marked at $70.11, with stronger backing near $67.12—a level that previously held prices in mid-2023. For Brent, the key pivot point is $73.57, with resistance at $74.55 and $75.35. Failure to maintain support at $73.57 could trigger a deeper pullback, targeting $72.56 or even $71.91.

Momentum indicators for both benchmarks reveal a cautious outlook. The Relative Strength Index (RSI) suggests consolidation, while the 50-day and 200-day Exponential Moving Averages (EMAs) point to near-term stability. However, a sustained break above resistance levels would be required to confirm a bullish reversal.

China’s Role in the Oil Market

China’s role as the world’s largest crude importer continues to influence global oil prices. Recent data indicates a mixed picture: while November imports rose sharply, the increase was largely absorbed into inventories rather than active consumption. Falling tanker rates on key routes to China reflect this subdued demand, raising questions about the sustainability of import growth in 2025.

Economic stimulus measures announced by Beijing have yet to translate into tangible increases in oil consumption. With China’s economy normalizing after post-pandemic recovery efforts, the outlook for incremental demand growth remains muted. This dynamic presents a challenge for oil bulls, as hopes for a robust recovery in Chinese demand appear increasingly unlikely.

Outlook for 2025: Supply, Demand, and Geopolitical Considerations

Looking ahead, the global oil market faces a delicate balance between supply and demand. While OPEC+ production cuts and geopolitical tensions could provide upward pressure on prices, non-OPEC supply growth and slowing demand in key markets present countervailing forces. ING strategists project modest demand growth in 2025, driven by cyclical and structural factors.

The geopolitical landscape will also play a crucial role. The Biden administration’s sanctions on Russian and Iranian oil exports aim to tighten global supply, but the effectiveness of these measures remains uncertain. Similarly, China’s efforts to diversify energy imports and build strategic reserves could shape the demand outlook in unexpected ways.

Final Thoughts on Oil Prices

As WTI and Brent crude navigate a complex web of geopolitical risks, supply dynamics, and economic uncertainties, the path forward remains uncertain. Current price levels around $70.31 for WTI and $73.78 for Brent reflect the market's cautious optimism. While short-term factors such as Federal Reserve rate cuts and OPEC+ actions could provide support, long-term stability will depend on resolving broader issues, including China's demand recovery and geopolitical tensions. For now, oil markets remain a battleground of competing forces, with opportunities and risks in equal measure.

That's TradingNEWS

Read More

-

GPIX ETF At $52.52: 8% Yield And Dynamic S&P 500 Income Upside

13.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs Surge Toward $1B As XRPI Hits $11.64 And XRPR $16.48 With XRP Near $2

13.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Hovers Near $4.07 Support After 22% Weekly Slide

13.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen at 154–158 Range as BoJ 0.75% Hike and Fed Cut Debate

13.12.2025 · TradingNEWS ArchiveForex