Charles Schwab (NYSE:SCHW) Stock: Is It Finally Time for a Big Breakout Above $100?

Schwab’s Earnings Beat Estimates, But Will Rising Interest Rates Push the Stock Even Higher? | That's TradingNEWS

NYSE:SCHW – Charles Schwab’s Stock Faces Pressure, but Is It a Buying Opportunity?

Is Charles Schwab (NYSE:SCHW) Positioned for a Strong 2025 After a Volatile Year?

Charles Schwab (NYSE:SCHW) ended 2024 with a 9% increase in stock price, a respectable performance in a turbulent market, but still far below its highs. The company saw earnings per share grow in low single digits, struggling with net interest revenue pressures and deposit declines, but it also made significant strategic moves, including the largest account integration in industry history with TD Ameritrade.

Despite market concerns, Schwab’s fundamental business remains highly resilient, generating billions in cash flow while maintaining strong profitability metrics. With the Federal Reserve's interest rate trajectory still uncertain, is Schwab an undervalued financial powerhouse poised for a breakout, or do lingering risks warrant caution?

Net Interest Revenue Pressure Weighs on Performance – Will It Rebound?

Schwab’s net interest revenue (NIR) has been under pressure as deposits declined faster than the company’s asset repricing. The company still carries $50 billion in high-cost supplementary funding, which wasn’t necessary but acted as a buffer during the 2023 banking crisis.

Higher interest rates should theoretically benefit Schwab by increasing its lending margins. However, because of client "cash sorting"—the movement of funds from low-yield sweep accounts to higher-yield money market funds—Schwab hasn’t been able to capitalize fully on these rate hikes. The key issue is timing. The company's securities portfolio is repricing, but it’s doing so slowly, while deposit outflows have been immediate.

However, there’s a silver lining. Schwab Bank balances increased for three consecutive months this fall, suggesting a potential stabilization. This is crucial because a return to more predictable net interest income would significantly improve earnings power heading into 2025 and beyond.

TD Ameritrade Integration Was a Massive Undertaking—Will It Drive Future Growth?

Schwab’s successful integration of 17 million TD Ameritrade accounts was a monumental task. This was the largest industry account conversion in history, and while it’s a long-term win for Schwab’s business model, it led to short-term net new asset (NNA) growth slowdowns.

Schwab’s historical NNA growth rate is between 5–7% annually, but recent quarters have come in below that range, with the company attributing the weakness directly to Ameritrade account churn. December saw an improvement, hinting at a return to historical averages.

Schwab’s ability to attract and retain client assets is critical to its long-term success. In Q4 2024, the company attracted $115 billion in core net new assets, a 21% increase quarter-over-quarter. Over the full year, Schwab brought in $367 billion in net new assets, showing that the franchise still has a strong grip on client acquisition.

With over 36.5 million active brokerage accounts, Schwab remains one of the largest wealth management platforms in the U.S. This scale advantage, combined with its brand strength, means it can weather short-term headwinds better than smaller competitors.

Earnings Beat in Q4 2024—Can Schwab Sustain the Momentum?

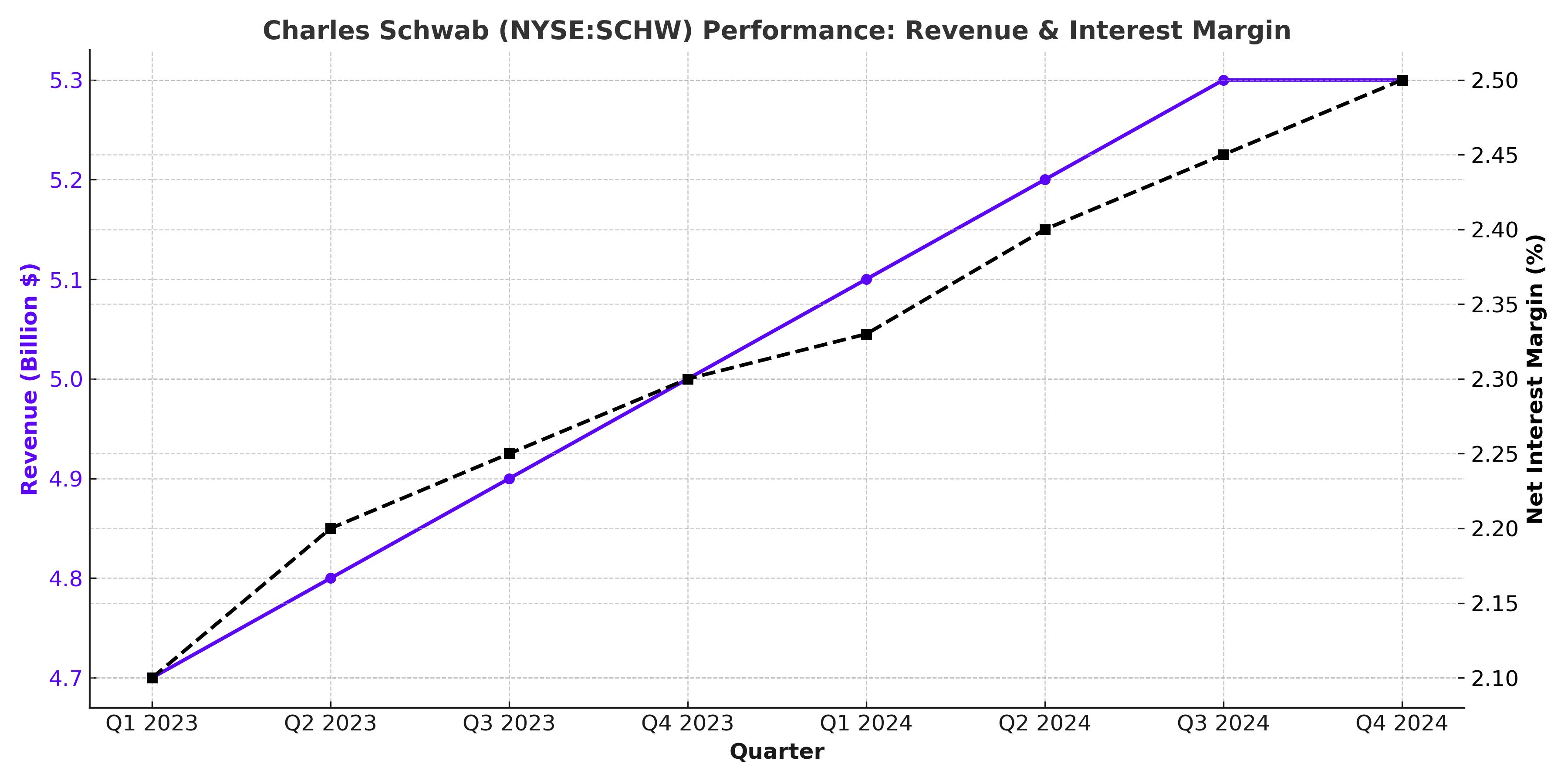

Schwab exceeded market expectations in Q4 2024, reporting $5.3 billion in revenue, up 20% year-over-year, and non-GAAP EPS of $1.01, beating estimates by $0.10. The company’s net interest margin (NIM) came in at 2.33%, improving by 25 basis points from the prior quarter.

Schwab's return on tangible equity (ROTE) stood at 36%, a strong indicator of profitability. Few financial firms can match this level of capital efficiency, showcasing Schwab’s ability to generate robust earnings even amid macroeconomic headwinds.

For 2025, Schwab projects its net interest margin to rise to 2.80%, which could act as a major earnings growth driver. If interest rates stabilize at higher levels and deposit outflows slow, Schwab’s core business could see a significant earnings rebound.

Dividend Growth Shows Confidence – But Is It Enough?

Schwab raised its dividend by 8% to $0.27 per share, reflecting confidence in its long-term earnings power. While the current 1.2% dividend yield is below industry averages, Schwab’s ability to grow dividends consistently is an attractive trait for long-term investors.

The company’s payout ratio remains low, meaning there’s plenty of room for further dividend hikes if earnings growth materializes as expected. Schwab has a strong history of dividend growth, with its annual dividend increasing at a 15% compound annual rate since 2015.

Valuation – Is Schwab Undervalued Compared to Peers?

Schwab is currently trading at a 15.5x forward P/E, which is below its five-year average of 20x and significantly cheaper than Interactive Brokers (IBKR), which trades at 26.9x earnings.

If Schwab were to revalue back to its historical P/E multiple, the stock could appreciate by 29%, reaching a fair value of approximately $103 per share.

Key Risks – What Could Go Wrong?

Despite the positive outlook, Schwab faces several risks:

- Failure to Attract New Assets – If net new asset growth stalls or declines, Schwab’s earnings potential could take a hit. The company must sustain its strong asset-gathering momentum to justify its valuation.

- Interest Rate Uncertainty – If the Federal Reserve cuts rates aggressively, Schwab’s net interest income could decline, impacting overall earnings.

- Operational Execution – The TD Ameritrade integration was successful, but Schwab must now demonstrate strong client retention and engagement to fully capitalize on its expanded platform.

Is Schwab a Buy, Sell, or Hold?

Schwab’s 2024 challenges created an opportunity for long-term investors. The company successfully navigated deposit outflows, integrated millions of new accounts, and continues to grow its client base at a rapid pace.

With a 15.5x P/E ratio, strong net new asset growth, and a stabilizing interest rate environment, Schwab presents a compelling risk-reward profile.

Price Target:

- Base case: $95–$100 in 2025 (+20% upside)

- Bull case: $103 if asset growth accelerates (+29% upside)

- Bear case: $75 if interest rate cuts impact NIR (-10% downside)

Verdict: BUY. Schwab’s fundamentals remain strong, and the stock’s valuation leaves room for a significant rebound.