Chevron (NYSE:CVX) Ignites Momentum: Record Permian Growth, $75B Buybacks, and High-Yield Dividends

From massive production gains to strategic acquisitions, Chevron is redefining energy dominance with unmatched shareholder rewards | That's TradingNEWS

Chevron Corporation (NYSE:CVX): A Definitive Buy for Risk-Averse Investors with Strong Dividends, Bold Buybacks, and Robust Growth

Chevron Corporation (NYSE:CVX) remains a cornerstone of the energy industry, with a diversified portfolio, strong cash flow generation, and an aggressive approach to shareholder returns. Despite recent challenges, including a 31% year-over-year decline in Q3 2024 earnings due to lower average petroleum prices, Chevron has shown resilience, driven by strategic acquisitions, production growth, and cost optimization initiatives. These factors have contributed to its recovery from Q2’s dip, making it an attractive long-term investment, supported by a compelling valuation and a strong dividend yield.

Chevron’s Resilience Amidst Market Challenges

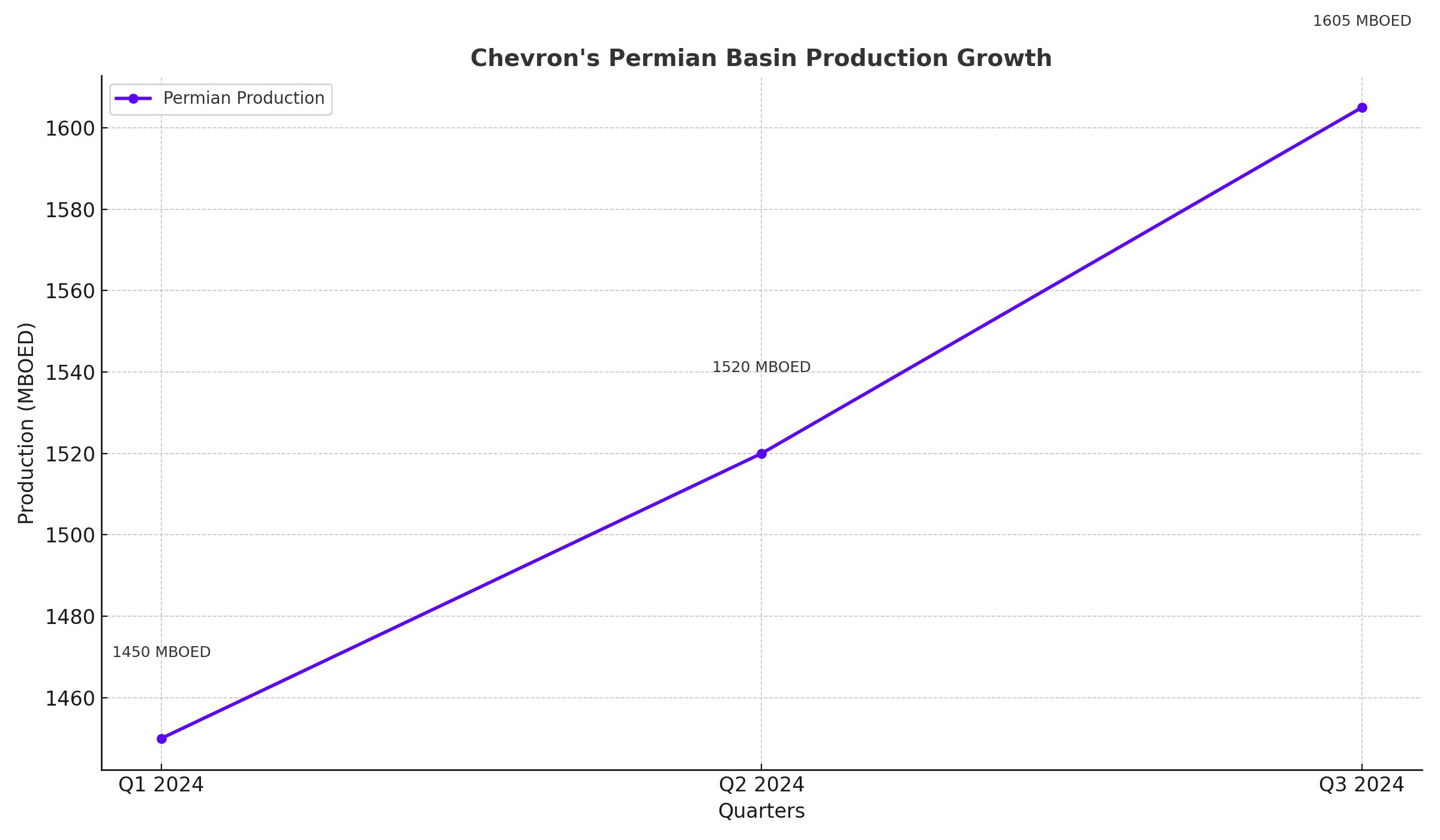

Chevron's earnings fell to $4.5 billion in Q3 2024, reflecting the impact of lower petroleum prices, with U.S. crude averaging $73.04 per barrel, a 9% decline year-over-year. However, the company’s production growth, particularly in the Permian Basin, highlights its operational strength. Following the $7.6 billion acquisition of PDC Energy in 2023, Chevron’s U.S. net oil-equivalent production reached 1,605 MBOED in Q3, a 14% year-over-year increase, driving total net production to a record 3,364 MBOED. This growth underscores Chevron’s strategic focus on high-growth regions and its ability to navigate volatile market conditions.

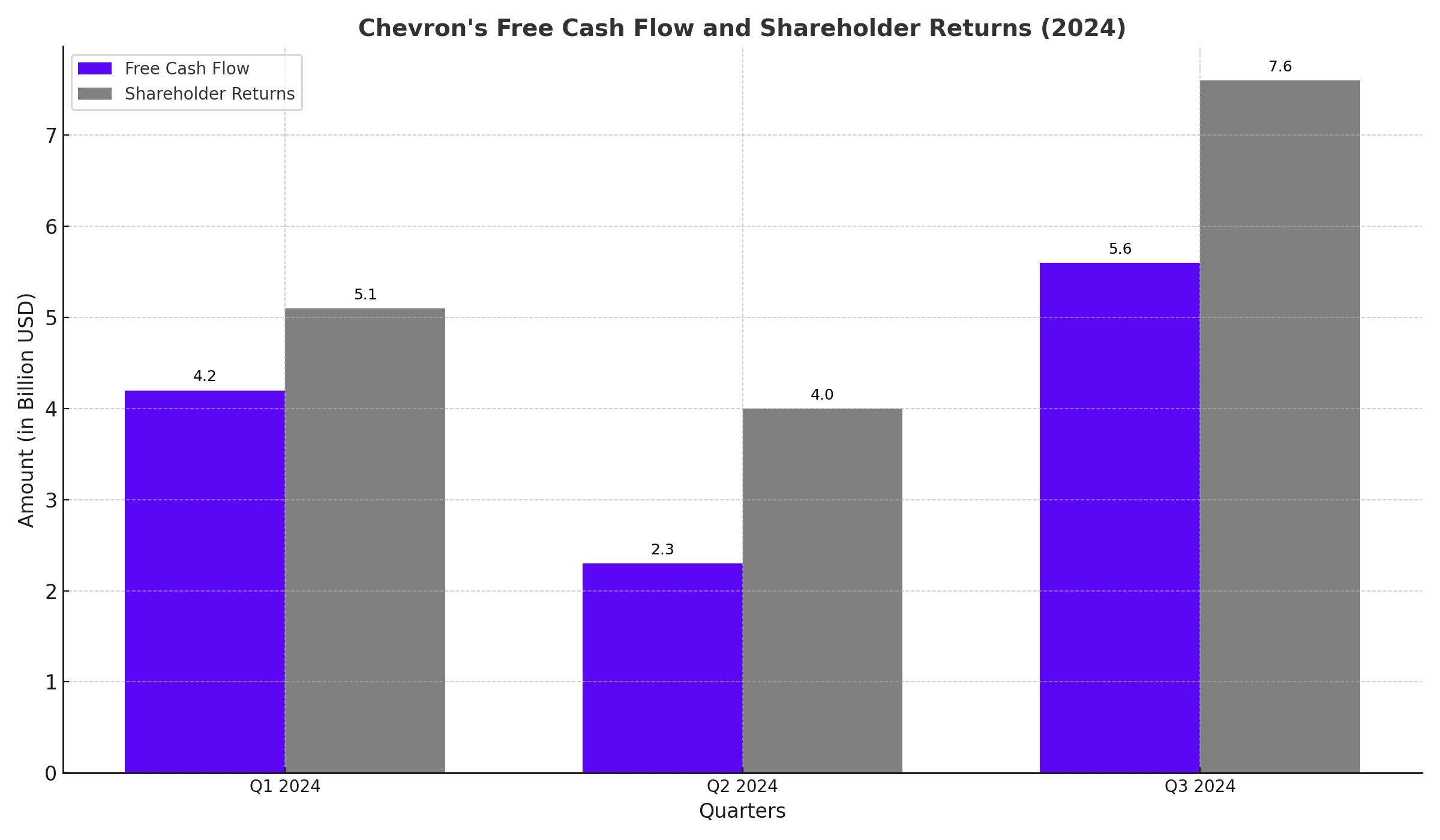

Free Cash Flow Strength and Shareholder Returns

Chevron’s ability to generate substantial free cash flow remains a cornerstone of its investment thesis. The company reported $5.6 billion in free cash flow in Q3 2024, a 144% increase quarter-over-quarter, aided by favorable working capital effects. Chevron’s commitment to returning cash to shareholders is evident in its $2.9 billion dividend payout and $4.7 billion in stock buybacks during the quarter. The company’s $75 billion share repurchase program, announced in 2023, reinforces its focus on maximizing shareholder value, with repurchases in Q3 exceeding the three-year average of $3.1 billion.

Chevron's Permian Basin Production Growth

Chevron's Dividend Yield vs Sector Average

Strategic Partnerships and Asset Optimization

Chevron's strategic partnerships and portfolio optimization efforts have positioned it as a leader in the energy sector. The acquisition of PDC Energy bolstered its Permian Basin presence, adding 25,000 net acres and contributing to record production levels. Additionally, Chevron’s asset sales, totaling $8 billion since its $10-15 billion divestiture target announcement, demonstrate its ability to streamline operations and focus on core growth areas. Notable transactions include the $6.5 billion sale of Canadian assets and a $1.3 billion divestiture of interests in Congo, underscoring Chevron’s commitment to high-grading its portfolio.

LNG Expansion and the Tengiz Project

Chevron’s investments in LNG and mega-projects like the Tengiz field in Kazakhstan exemplify its forward-looking strategy. The Gorgon and Wheatstone LNG projects, costing nearly $100 billion, have established Chevron as a key player in the LNG market, a critical component of the global energy transition. The Tengiz field, undergoing a $10 billion Wellhead Pressure Management Project (WPMP), is expected to increase production from 600,000 to 850,000 barrels per day gross, ensuring long-term output stability and enhancing ultimate recovery rates.

Hess Acquisition and Guyana’s Potential

Chevron’s $53 billion acquisition of Hess Corporation, pending resolution of arbitration claims over Guyana assets, represents a transformative step in expanding its production base. Guyana’s Stabroek Block, with vast untapped reserves, is expected to be a cornerstone of Chevron’s growth strategy, complementing its existing portfolio and boosting long-term cash flow.

Financial Metrics and Valuation

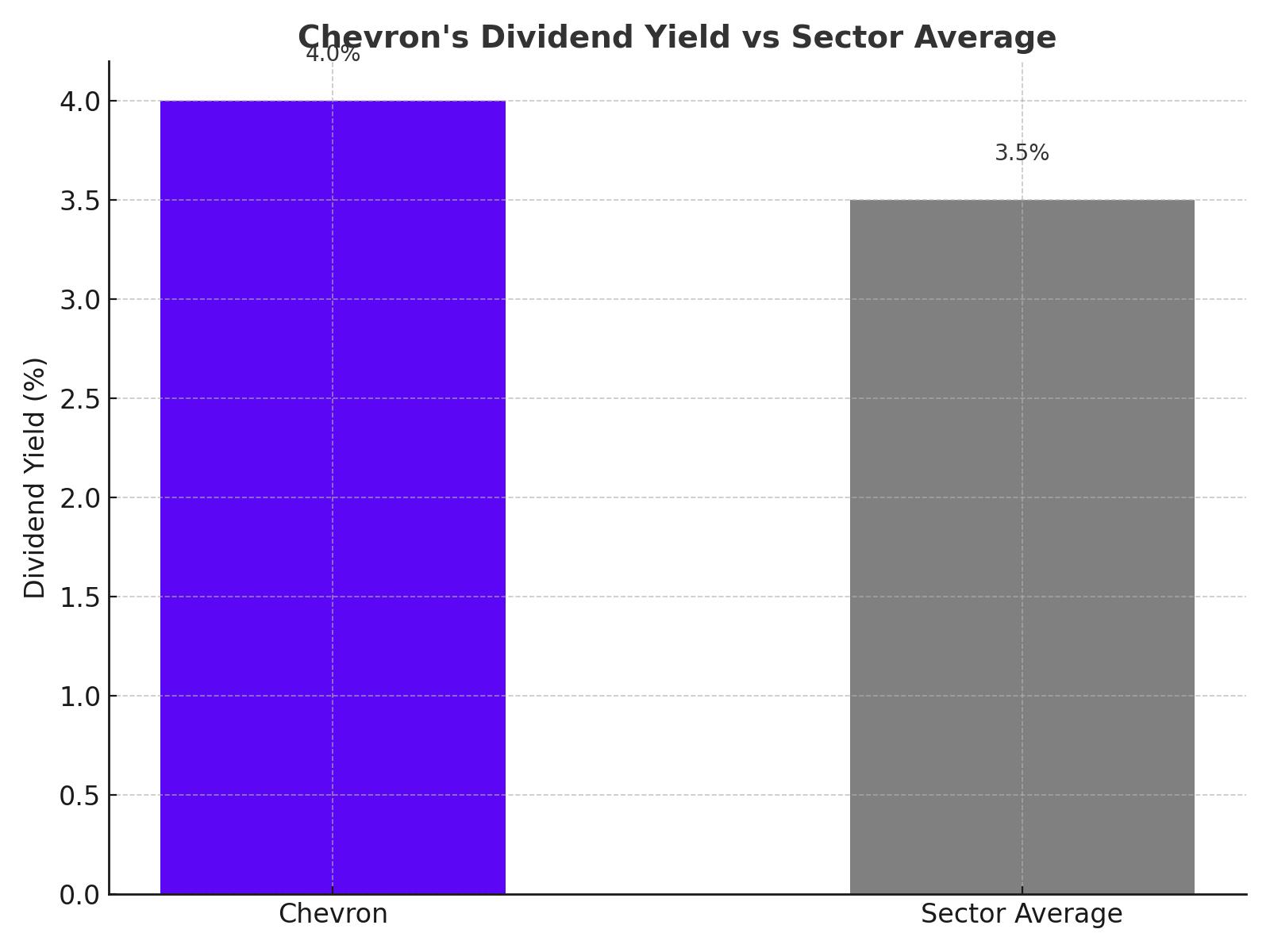

Chevron’s financial health remains robust, with $501.7 million in cash and equivalents at the end of Q3 2024. The company’s forward price-to-earnings ratio of 14.1x and earnings yield of 7.1% reflect a compelling valuation. Its dividend yield of 4%, supported by a payout ratio of 70%, surpasses the sector median of 46%, highlighting its shareholder-friendly approach. Compared to Exxon Mobil (NYSE:XOM), valued at a forward P/E of 14.5x, Chevron offers a slightly better earnings yield, underscoring its attractiveness as an investment.

Cost Management and Future Growth

Chevron’s commitment to cost reduction, targeting $2-3 billion in structural savings by 2026, aligns with its broader strategy of operational efficiency and cash flow maximization. The integration of PDC Energy has already yielded $150 million in synergies above initial expectations, showcasing Chevron’s ability to extract value from acquisitions. With plans to maintain Permian production at 400,000 barrels per day and expand LNG and Tengiz output, Chevron is well-positioned for sustained growth.

Risks and Opportunities

The primary risk for Chevron lies in potential declines in oil and natural gas prices, which could impact earnings and free cash flow. However, OPEC+ support for petroleum prices and Chevron’s diversified portfolio, including LNG assets, mitigate this risk. The use of debt for share buybacks, while a short-term concern, is offset by Chevron’s strong cash flow generation and disciplined financial management.

Final Outlook

Chevron’s strategic acquisitions, production growth, and commitment to shareholder returns position it as a leading player in the energy sector. The integration of high-growth assets like the PDC Energy portfolio and the anticipated completion of the Tengiz and LNG projects provide significant upside potential. With a strong dividend yield, aggressive buybacks, and a robust growth pipeline, Chevron (NYSE:CVX) is a compelling investment for risk-averse investors seeking exposure to the energy sector. For real-time performance, access the NYSE:CVX chart here. For insider activity, visit Chevron's insider transactions.