Chipotle Mexican Grill (NYSE:CMG) Stock Analysis: Strong Growth & High Valuation

Evaluating Chipotle's Financial Performance, Market Expansion, and Investment Potential in 2024 | That's TradingNEWS

Chipotle Mexican Grill (NYSE:CMG) Stock Analysis: Comprehensive Evaluation of Current Market Dynamics

Overview of Recent Stock Performance

Chipotle Mexican Grill (NYSE:CMG) experienced a significant decline on Monday, falling over 5%, as the initial excitement surrounding its 50-for-1 stock split faded. After hitting a record closing high on June 18, the shares have steadily declined by approximately 13% since the split took effect on June 26. Despite this, CMG has added about a third of its value in 2024, reflecting robust year-to-date performance.

Stock Split Impact and Market Sentiment

Chipotle’s historic 50-for-1 stock split aimed to make its shares more accessible to individual investors. The stock price, previously above $3,200, was adjusted to around $65. Despite the split, fundamental aspects of the company remain unchanged. The outstanding share count expanded 50-fold to 1.4 billion, effectively slicing the stock into smaller, more affordable units. Since the split announcement in March, shares have risen 17%, reflecting bullish market sentiment.

Financial Performance and Growth Projections

Revenue and Earnings Growth

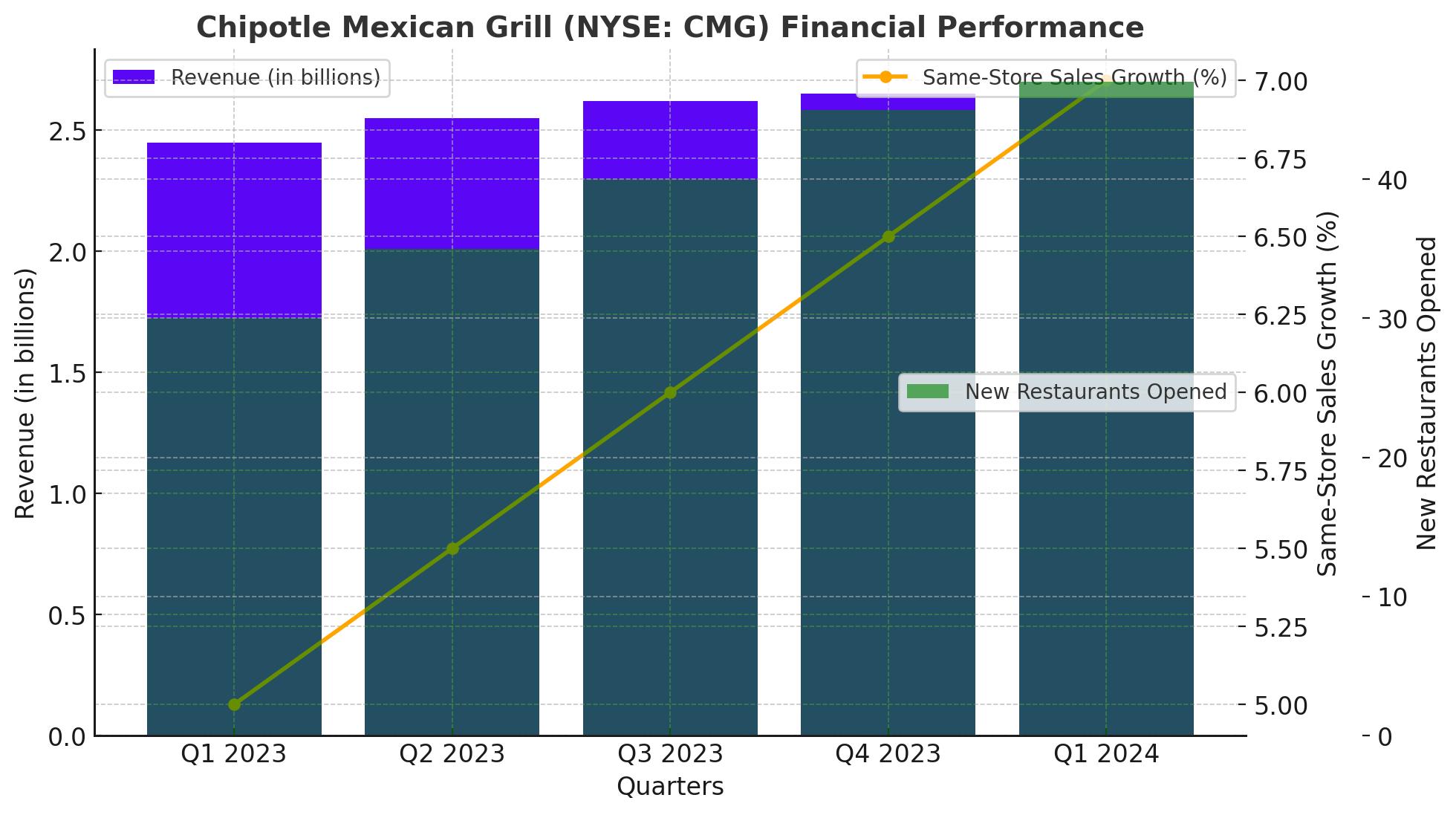

Chipotle’s Q1 2024 financial results showcased strong performance, with revenue increasing by 14.1% to $2.70 billion, supported by a 7% rise in same-store sales and the opening of 47 new restaurants. The operating margin also improved, reaching 16.3%. The company's consistent profitability is highlighted by an average operating margin of 11.5% over the past five years, and a store-level operating profit margin of 27.5% in Q1 2024.

Long-Term Expansion Plans

Management is optimistic about long-term growth, aiming to double the number of stores in North America to 7,000, up from the previous target of 6,000. This expansion strategy, combined with investments in digital sales and new service models like Chipotlane drive-thrus, positions Chipotle for sustained growth.

Market Position and Competitive Landscape

Sector Performance and Competitive Edge

Chipotle operates in a highly competitive fast-casual dining sector, where it distinguishes itself through a focus on fresh, customizable meals made with high-quality ingredients. This strategy appeals to health-conscious consumers and provides a competitive edge over other fast-food chains. Despite higher prices, Chipotle’s strong brand and consistent product quality have allowed it to maintain market leadership.

Peer Comparison and Market Share

Chipotle holds a broad-based market share of 11.07%, positioning it favorably against smaller competitors. Analysts from Goldman Sachs have highlighted Chipotle's potential to outperform smaller peers, especially as consumer tailwinds fade and traffic and unit growth become increasingly crucial for sustaining growth.

Valuation Metrics and Investment Potential

Current Valuation and Price Multiples

Chipotle’s stock currently trades at a price-to-earnings (P/E) ratio of 68.98x, which is considered high. However, this elevated multiple is justified by the company’s robust growth trajectory and strong financial performance. Despite high valuation metrics, the company's consistent earnings growth and strong return on equity (ROE) of 44.37% underscore its potential for long-term value creation.

Absolute Valuation and Growth Projections

Using a two-stage discounted cash flow (DCF) model, Chipotle's fair price target is estimated at $87.76 by December 2025, significantly higher than the current price of $65.86. This valuation reflects expectations of continued strong free cash flow growth, supported by the company’s strategic expansion plans and operational efficiencies.

Technical Analysis and Market Trends

Technical Indicators and Momentum

Technically, Chipotle’s stock has shown strong momentum, trading above its 10-, 50-, 100-, and 200-day moving averages. The relative strength index (RSI) of 57.51 suggests that the stock is not overbought, indicating potential for further upside. However, the stock has formed a strong support level just shy of $60 and a resistance level under $70, which could guide near-term price movements.

Earnings Report and Market Reactions

Chipotle’s next earnings report is expected on July 24. Market reactions to the report will likely be influenced by the company's ability to meet or exceed expectations, particularly in terms of same-store sales growth and operating margins.

Conclusion: Buy, Sell, or Hold?

After a thorough analysis of Chipotle Mexican Grill, Inc. (NYSE:CMG), it is evident that the company boasts strong fundamentals, robust growth prospects, and a solid market position. However, the current high valuation may pose a risk if the company fails to meet market expectations. Based on the comprehensive evaluation of financial performance, market dynamics, and technical indicators, it is recommended to Hold Chipotle stock for now, with a potential for reevaluation post the upcoming earnings report. For real-time updates and detailed stock performance, investors can refer to the Chipotle Real-Time Chart.

Note: Always conduct your own research and consider your financial situation and investment objectives before making any investment decisions.

That's TradingNEWS

NASDAQ:AMD Crashes to $89—But $2B Oracle AI Deal Hints at Massive Comeback