NASDAQ:COIN - Coinbase Poised to Dominate the Evolving Crypto Ecosystem Amid Strategic Growth and Market Volatility

Coinbase Global, Inc. (NASDAQ:COIN) stands at the intersection of technological innovation, regulatory adaptation, and market expansion in the cryptocurrency sector. As one of the most influential public crypto exchanges globally, Coinbase has steadily built its dominance by addressing market challenges and capitalizing on emerging opportunities. Its performance and strategic positioning highlight its potential to shape the future of digital assets.

Institutional Investments Strengthen Coinbase's Position

Institutional interest in Coinbase has surged, with Banco Santander S.A. increasing its stake in the company by 12.7% in Q3 2024. The firm now owns 148,906 shares valued at $26.53 million, reflecting confidence in Coinbase’s ability to navigate the volatile crypto market. Other institutions, including Empowered Funds LLC and Fifth Third Bancorp, have also raised their holdings, underscoring the growing institutional appeal of NASDAQ:COIN. Institutional investors collectively own 68.84% of the company’s stock, highlighting robust confidence in Coinbase's long-term strategy.

However, insider transactions reveal a mixed narrative. Key executives, including COO Emilie Choi and Director Gokul Rajaram, sold shares worth a combined $50 million in Q3. While these sales may indicate profit-taking, insider ownership remains significant at 23.43%, signaling alignment with the company's future objectives. To explore more details on insider activity, visit Coinbase's insider transactions profile.

Q3 2024 Financial Performance Reflects Resilience Amid Market Volatility

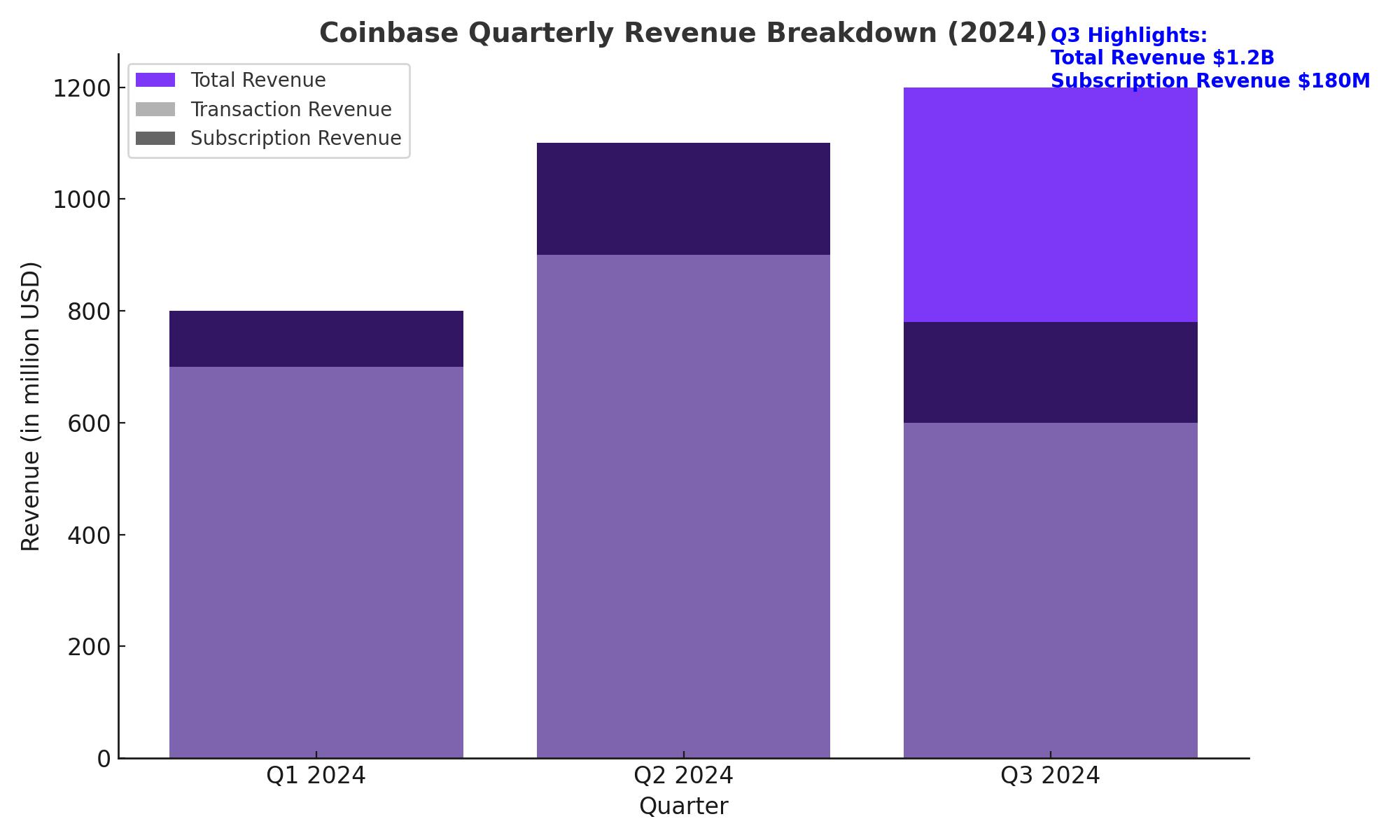

Coinbase’s Q3 2024 earnings showcased its adaptability, with revenue climbing 78.8% year-over-year to $1.2 billion. However, transaction revenue declined by 27% sequentially, largely due to subdued market activity and an 18% drop in trading volumes. Subscription and services revenue fell by 7%, but the company remains on track to achieve $2 billion in this segment by 2024, a substantial increase from $1.4 billion in 2023.

Net income for the quarter was $75 million, reflecting a 14.81% return on equity. Operating expenses declined by 6%, driven by gains on crypto holdings and reduced transaction costs. Coinbase's financial resilience amid fluctuating market conditions underscores its operational efficiency and strategic foresight.

For real-time price updates and performance metrics of NASDAQ:COIN, check out the live chart.

Technological Innovations Propel Coinbase’s Competitive Edge

Coinbase continues to enhance its technological framework to cater to a broader audience. The company’s Base Layer 2 blockchain solution has significantly reduced transaction costs to less than $0.01 while improving processing speeds. Its integration of user-friendly wallet features, including passkeys and biometrics, eliminates traditional barriers to crypto adoption. These innovations position Coinbase as a leader in democratizing access to blockchain technology.

In addition to Base, Coinbase introduced EURC, a Euro-backed stablecoin, in Q3. EURC's market capitalization doubled during the quarter, making it the largest Euro stablecoin globally. This initiative diversifies Coinbase’s revenue streams and enhances its global market reach.

Global Expansion Drives Market Penetration

Coinbase is capitalizing on favorable regulatory developments to expand its international footprint. The European Securities and Markets Authority's (ESMA) recent policy shift has opened doors for Coinbase to access 20 additional EU markets. In Southeast Asia, Coinbase is negotiating terms to penetrate one of the fastest-growing fintech ecosystems, further solidifying its global presence.

Regulatory Developments Create Growth Opportunities

Regulatory clarity remains a critical driver for Coinbase's growth. Recent discussions between Coinbase CEO Brian Armstrong and U.S. President-elect Donald Trump highlight the company’s proactive stance in shaping regulatory policies. Trump’s administration is reportedly considering appointing a crypto-specific advisory council, a move that could significantly benefit Coinbase.

In Europe, Coinbase’s MiFID license is expected to accelerate its entry into crypto derivatives markets, unlocking new revenue streams. The derivatives market is a high-growth segment, and Coinbase’s regulatory compliance positions it as a trusted platform for institutional clients.

Crypto Market Volatility: A Double-Edged Sword

Coinbase’s dependency on crypto market volatility remains both an opportunity and a risk. The company benefits from increased trading activity during volatile periods, but prolonged market downturns could impact revenue. Despite these challenges, Coinbase’s diversified revenue streams, including staking and subscription services, provide a buffer against market fluctuations.

Bitcoin’s recent surge to record highs, driven by institutional adoption and regulatory developments, underscores the potential for increased trading volumes on Coinbase’s platform. Similarly, the growing popularity of Ethereum and stablecoins could further enhance Coinbase’s market position.

Analyst Ratings and Market Valuation

Wall Street analysts maintain a cautiously optimistic outlook on NASDAQ:COIN. With a consensus price target of $251 and ratings ranging from "buy" to "hold," the stock is viewed as a high-risk, high-reward investment. Notable price targets include JMP Securities’ $320 and Needham & Company’s revised $375, reflecting bullish sentiment on Coinbase’s long-term potential.

Risks and Competitive Challenges

Despite its strengths, Coinbase faces significant risks. Regulatory uncertainties in the U.S. and potential reversals in policy could impact its business model. The company also faces intense competition from both traditional financial institutions and emerging crypto-native platforms.

Cybersecurity remains a critical concern, given the increasing sophistication of cyber threats targeting crypto platforms. Coinbase’s robust security measures have mitigated risks so far, but the potential for breaches underscores the importance of continued investment in cybersecurity.

Strategic Outlook for NASDAQ:COIN

Coinbase’s strategic initiatives, including technological innovation, global expansion, and regulatory engagement, position it as a pivotal player in the evolving crypto ecosystem. While challenges persist, the company’s ability to adapt and innovate offers a compelling growth narrative. Investors seeking exposure to the cryptocurrency sector should consider NASDAQ:COIN as a long-term play, balanced against the inherent volatility of the market.

For a detailed breakdown of Coinbase’s financials and strategic updates, visit the stock profile.