Comparing Giants: Amazon and Nvidia's Financial Strengths

An in-depth look at AMZN and NVDA's earnings, market strategies, and growth potential to guide investors in making informed decisions in the tech sector | That's TradingNEWS

Overview - Amazon VS. Nvidia

Amazon.com, Inc. (NASDAQ:AMZN) and Nvidia Corporation (NASDAQ:NVDA)

are two giants in their respective fields, each with unique strengths and considerable influence over technological and market trends. Amazon, a leader in e-commerce, cloud computing, and digital advertising, continues to show robust growth in various sectors. Meanwhile, Nvidia, renowned for its cutting-edge graphics processing units (GPUs), dominates the AI and data center markets. This analysis will delve into their recent financial performances, growth trajectories, and strategic positioning, offering insights into their future potential and current investment appeal.

Financial Performance and Market Position

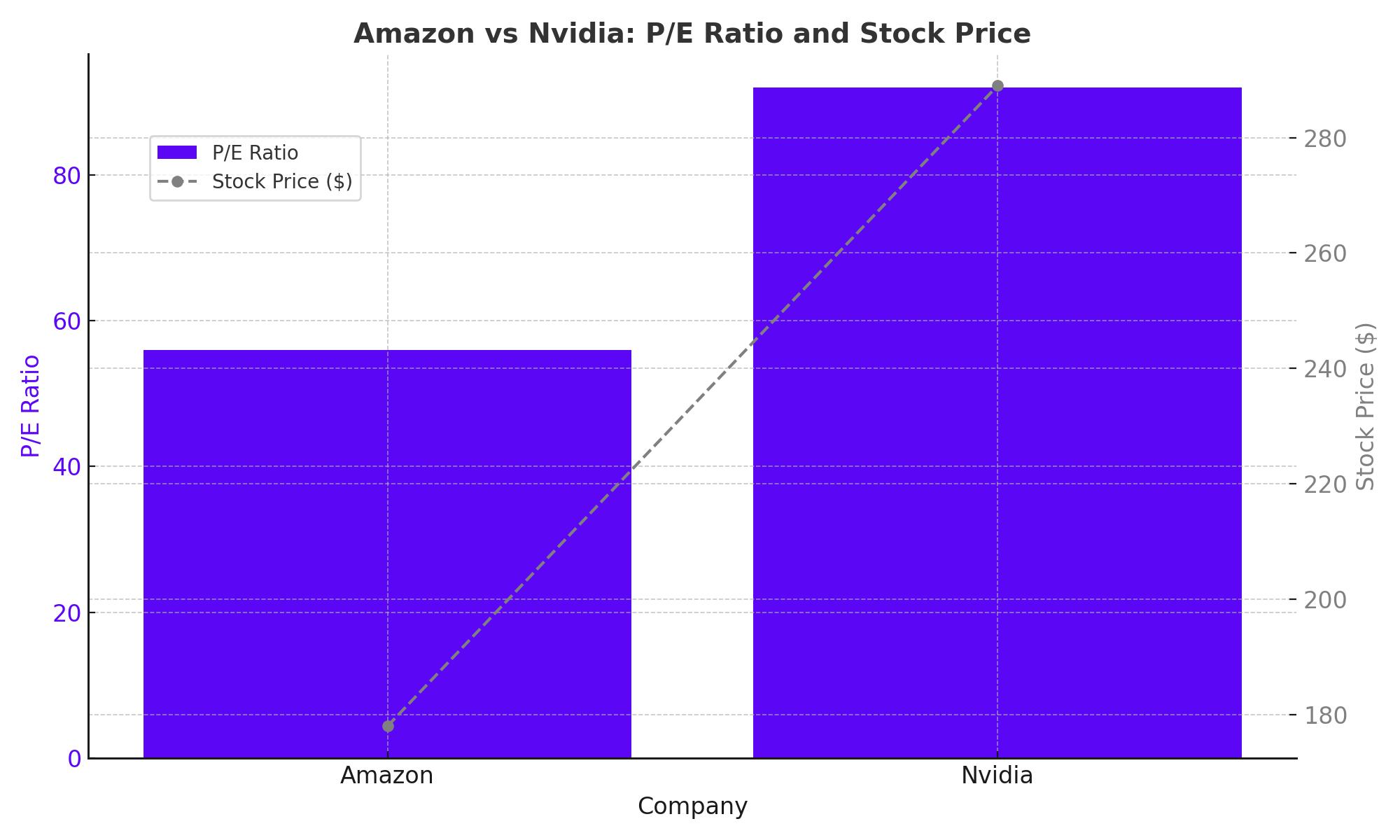

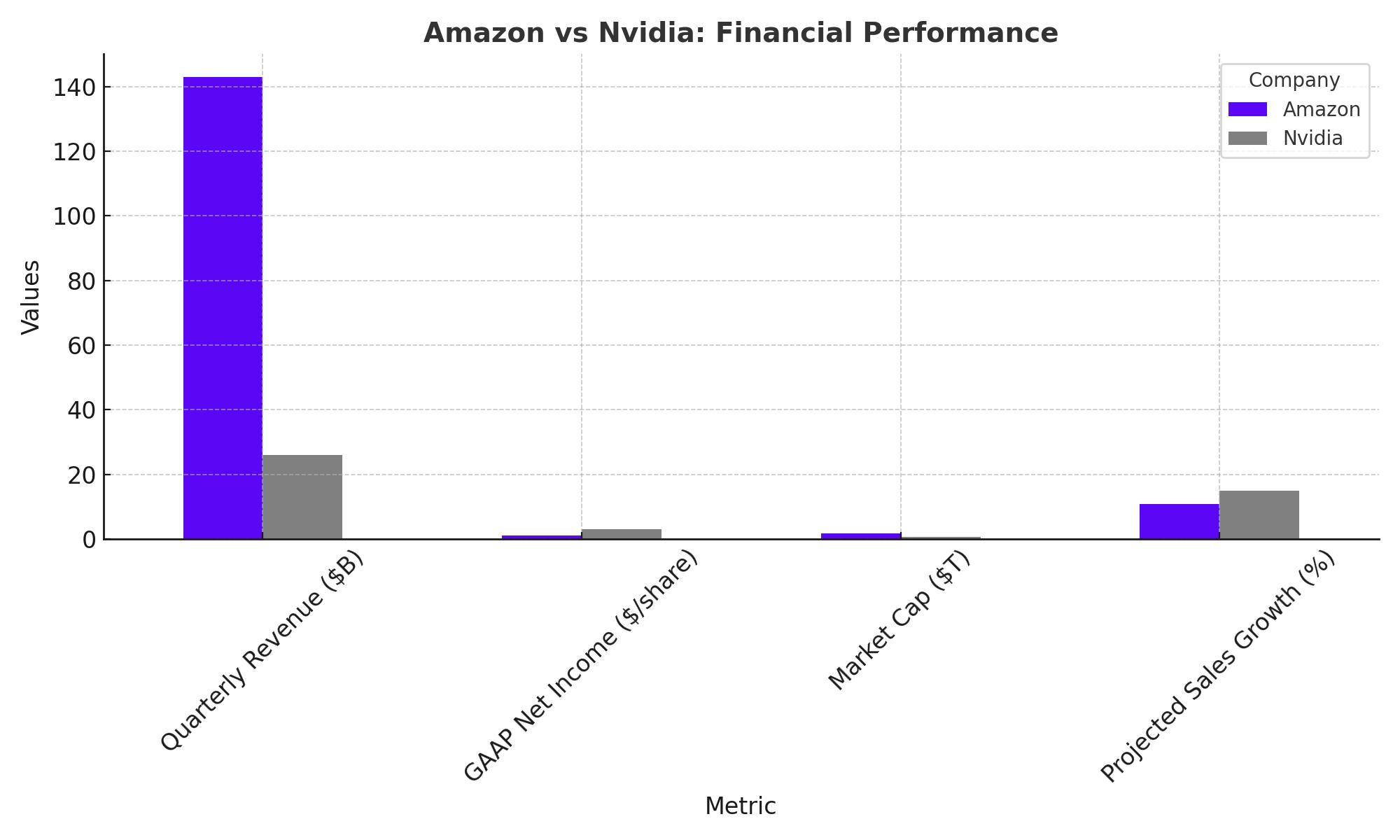

Amazon has reported impressive growth, with a recent quarterly revenue increase of 13% to $143 billion, significantly bolstered by its cloud computing and digital advertising segments. The company’s GAAP net income has tripled, reaching $0.98 per diluted share. Amazon's strong performance is underpinned by its dominant positions in e-commerce, where it holds the title of the world's most frequented online marketplace, and in cloud computing through Amazon Web Services (AWS), the largest provider of cloud infrastructure and platform services.

Strategic Growth Initiatives and Future Projections

Amazon is actively leveraging artificial intelligence to enhance efficiency and drive revenue growth across its various business units. Initiatives such as optimizing warehouse operations and introducing generative AI tools for content creation highlight its innovative approach. Financial analysts project Amazon’s sales to grow at an annual rate of 10.9% over the next five years, potentially reaching a market capitalization of $2.8 trillion by mid-2028. This forecast is supported by the company’s strategic expansions and the growing demand in its key markets.

For detailed real-time stock information, visit Amazon's Stock Profile.

Nvidia’s Expanding Influence in AI and Data Centers

Nvidia has emerged as a pivotal player in the AI revolution, thanks to its superior GPU designs that are crucial for AI training and applications. The company’s data centers generated $22.6 billion of its $26 billion in quarterly revenue, underscoring the critical role of AI in its growth strategy. Nvidia's other revenue streams, such as gaming and robotics, although smaller, contribute significantly to its diversified income sources.

Innovation and Market Expansion

Nvidia is not resting on its laurels; it continues to innovate aggressively, with a significant increase in its R&D spending—from $2.9 billion in 2020 to a projected $8.7 billion. This investment in technology development is essential as the company strengthens its lead in AI and explores new market opportunities.

For investor insights and insider transactions, refer to Nvidia's Stock Profile.