In-Depth Analysis of SPDR S&P 500 ETF Trust (SPY): Market Dynamics and Valuation Insights

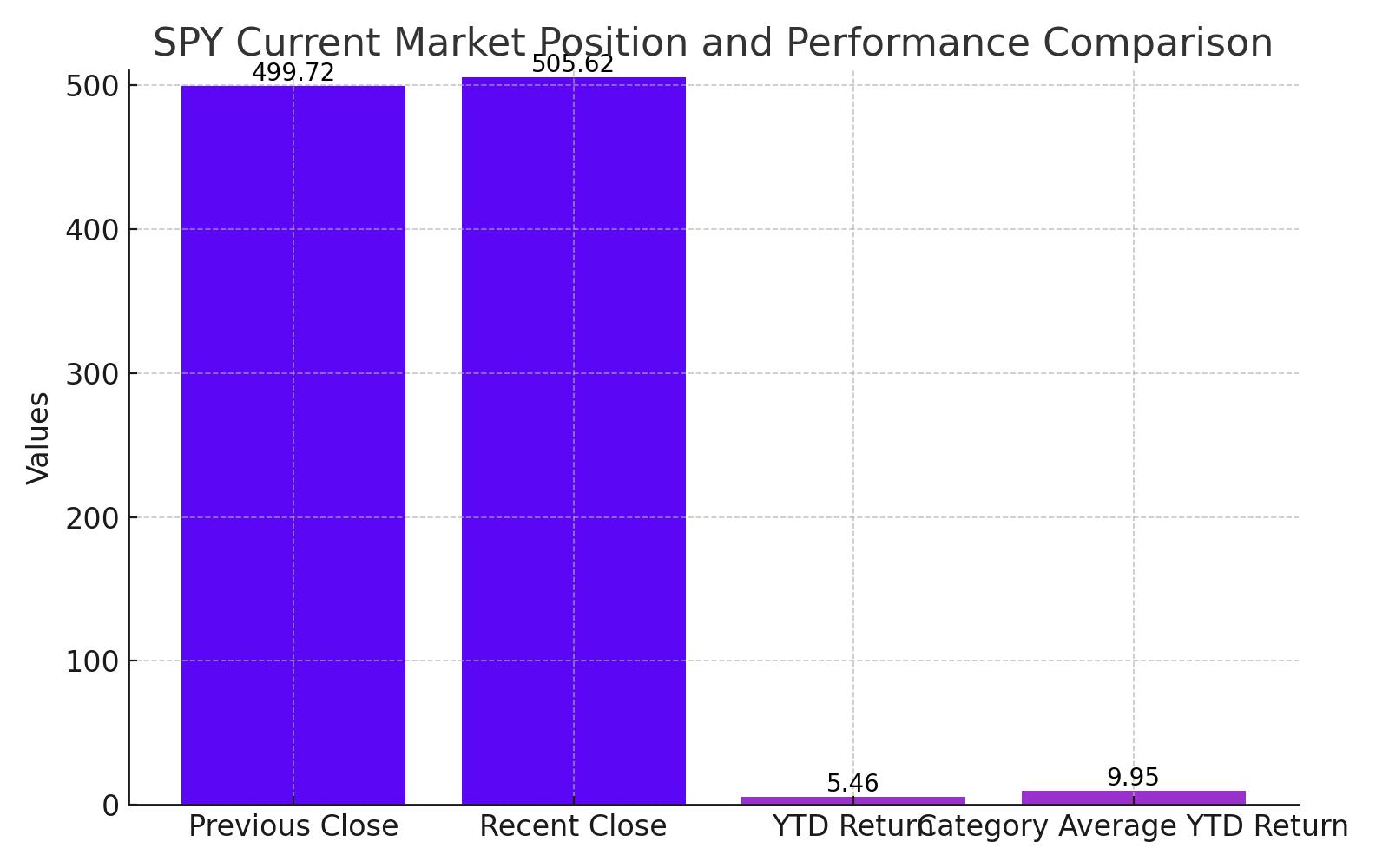

Current Market Position of SPY

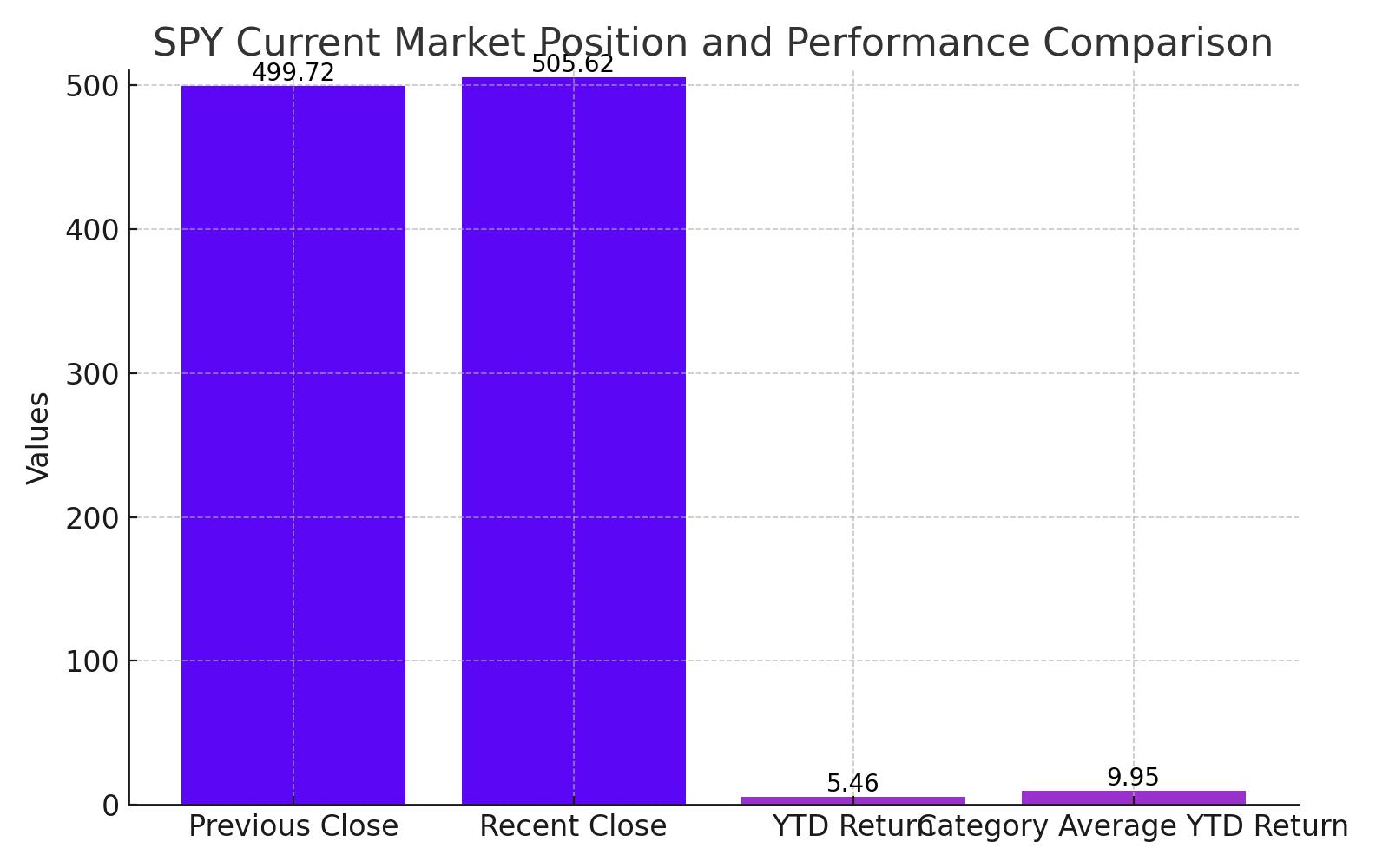

The SPDR S&P 500 ETF Trust (NYSEARCA:SPY), representing a broad spectrum of the U.S. equities market, closed recently at $505.62, marking a modest increase from the previous close of $499.72. This ETF, which is designed to track the S&P 500, has shown a year-to-date (YTD) daily total return of 5.46%, underperforming its category average of 9.95%. This difference highlights a relative lag in capturing the upward market trends seen in other large blend categories.

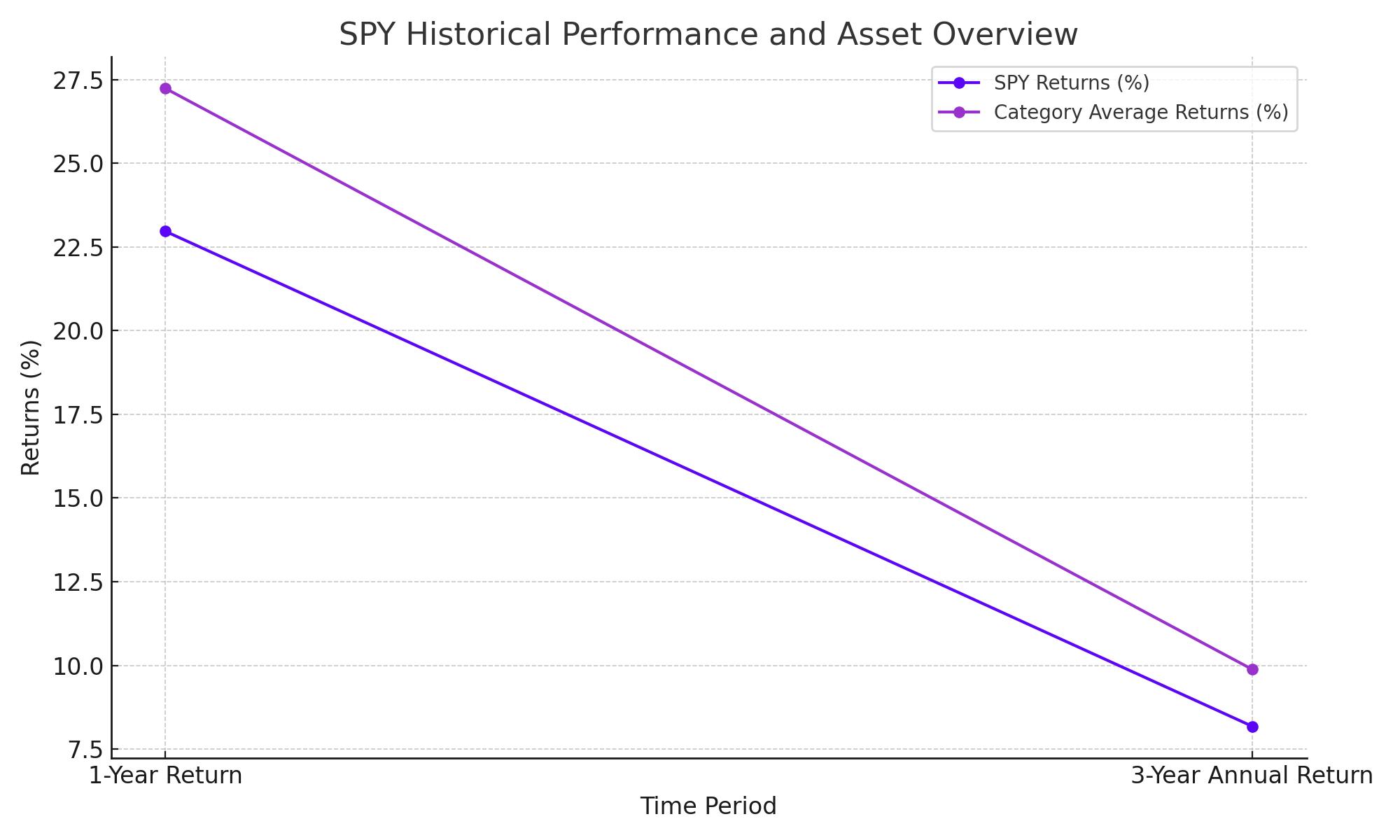

Historical Performance and Asset Overview

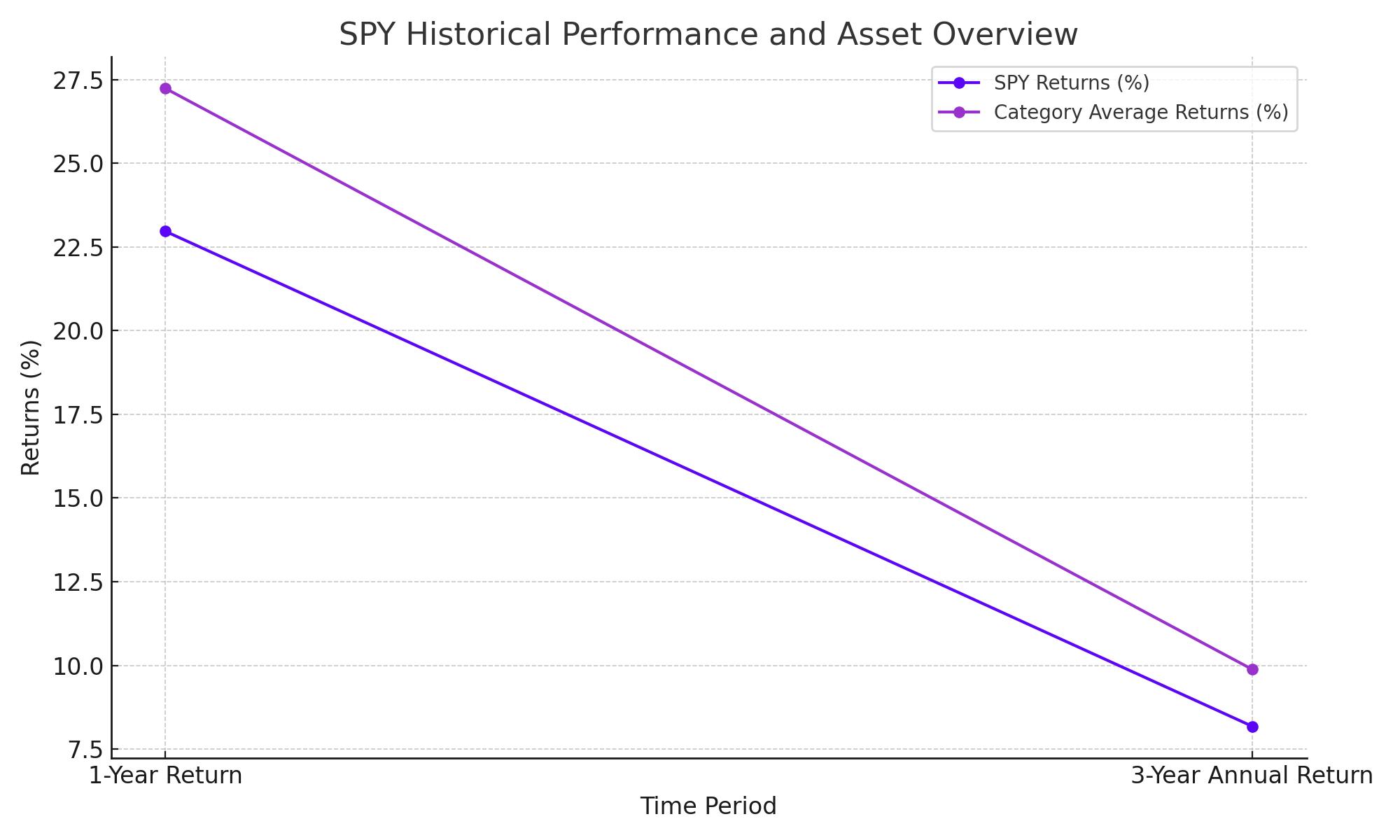

SPY's performance over the years offers a mixed picture. While the 1-year return stands at a robust 22.97%, outpacing the category's 27.24%, the 3-year annual return of 8.18% trails behind the category average of 9.88%. The ETF manages net assets worth $536.15 billion, making it one of the largest and most significant in its class. The ETF’s expense ratio at 0.09% remains competitively low, enhancing its appeal to cost-conscious investors.

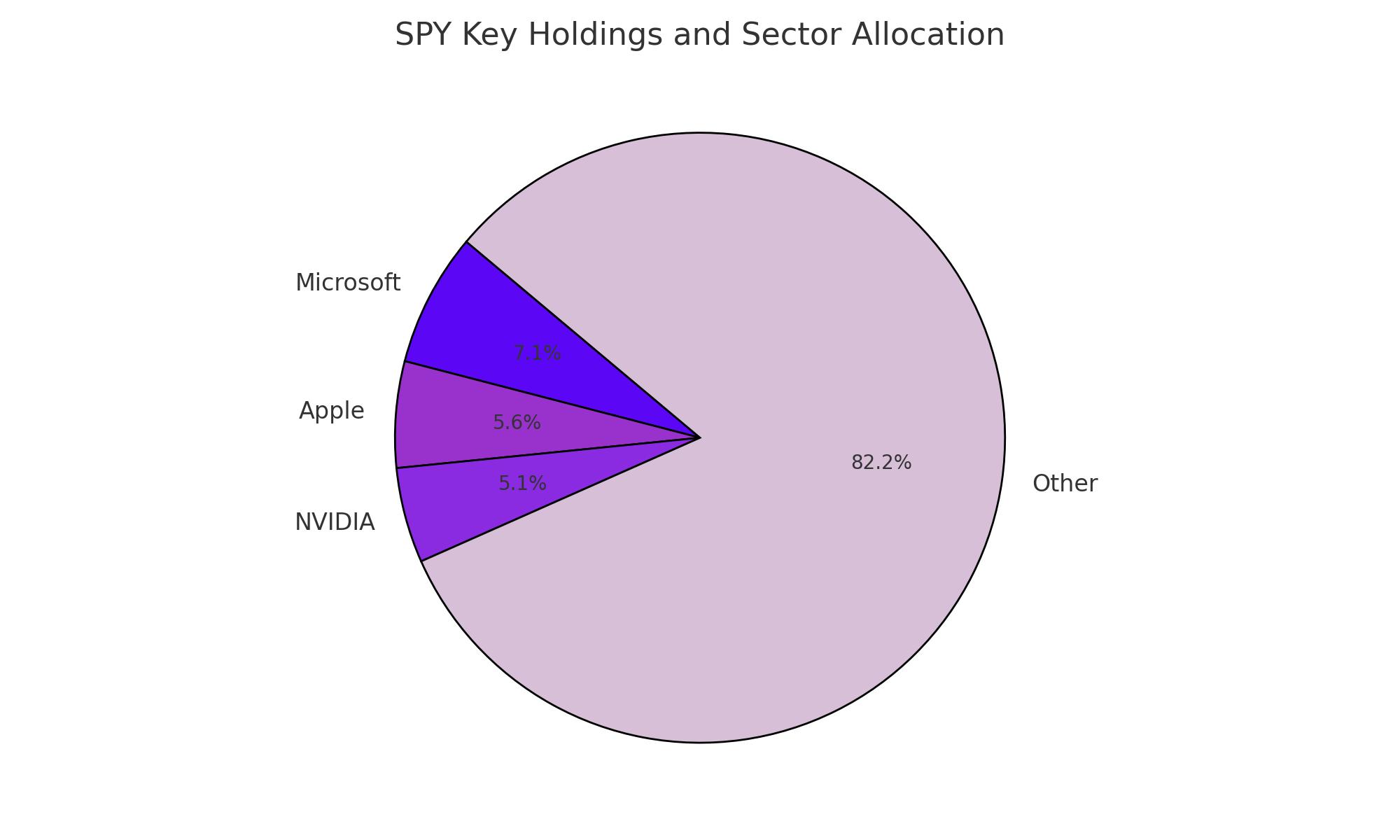

Key Holdings and Sector Allocation

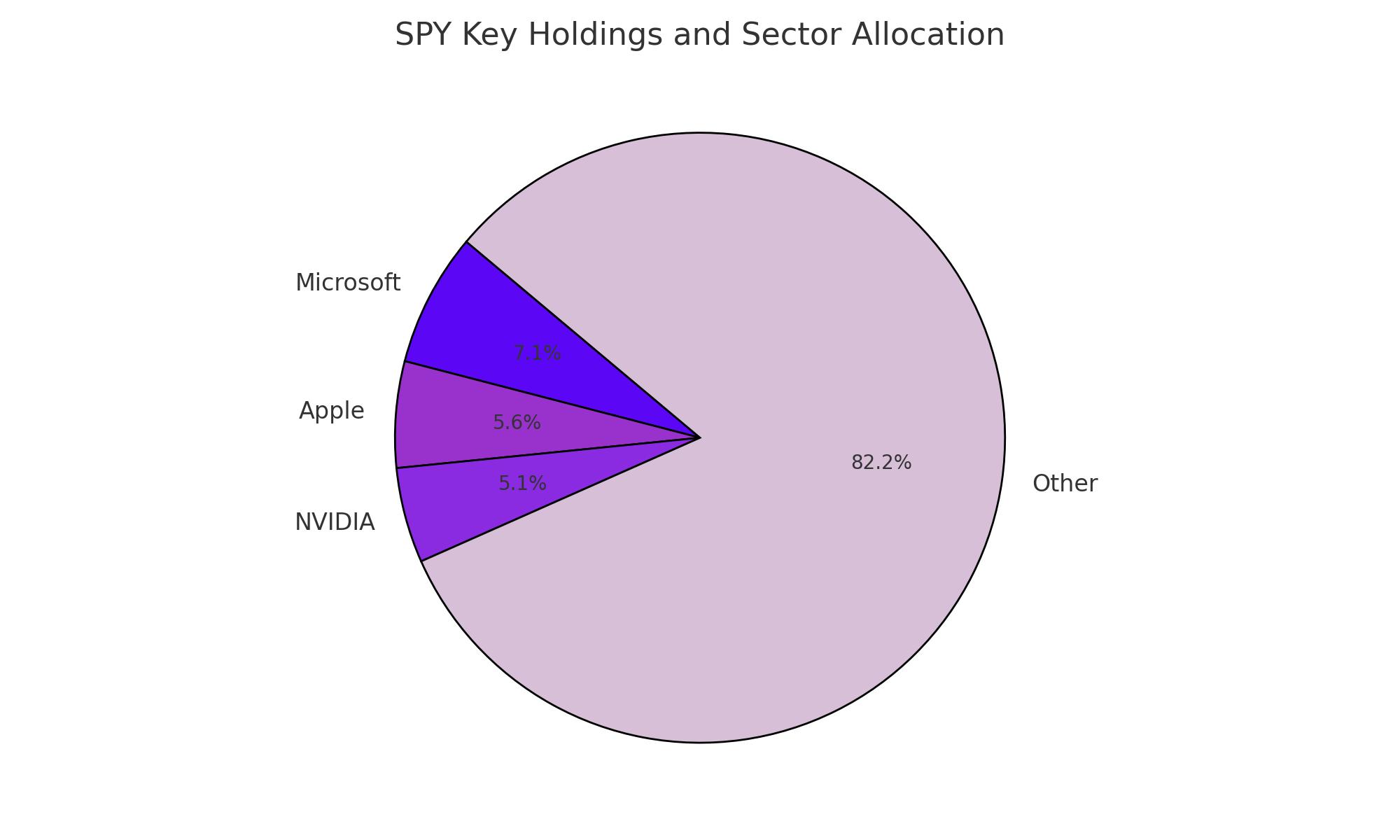

The ETF's portfolio is heavily weighted towards technology (30.58%), reflecting a significant exposure to major tech giants like Microsoft, Apple, and NVIDIA, which alone constitute over 17% of its assets. This concentration in high-tech sectors positions SPY to capitalize on the tech industry's growth but also exposes it to sector-specific downturns.

Portfolio Composition and Sector Exposure

SPY’s asset allocation is heavily tilted towards technology, with significant stakes in Microsoft (7.07%), Apple (5.63%), and NVIDIA (5.05%). While this sector focus aligns SPY with growth trajectories in tech, it also exposes the ETF to volatility inherent in the tech sector, particularly in periods of market correction.

Valuation and Market Outlook

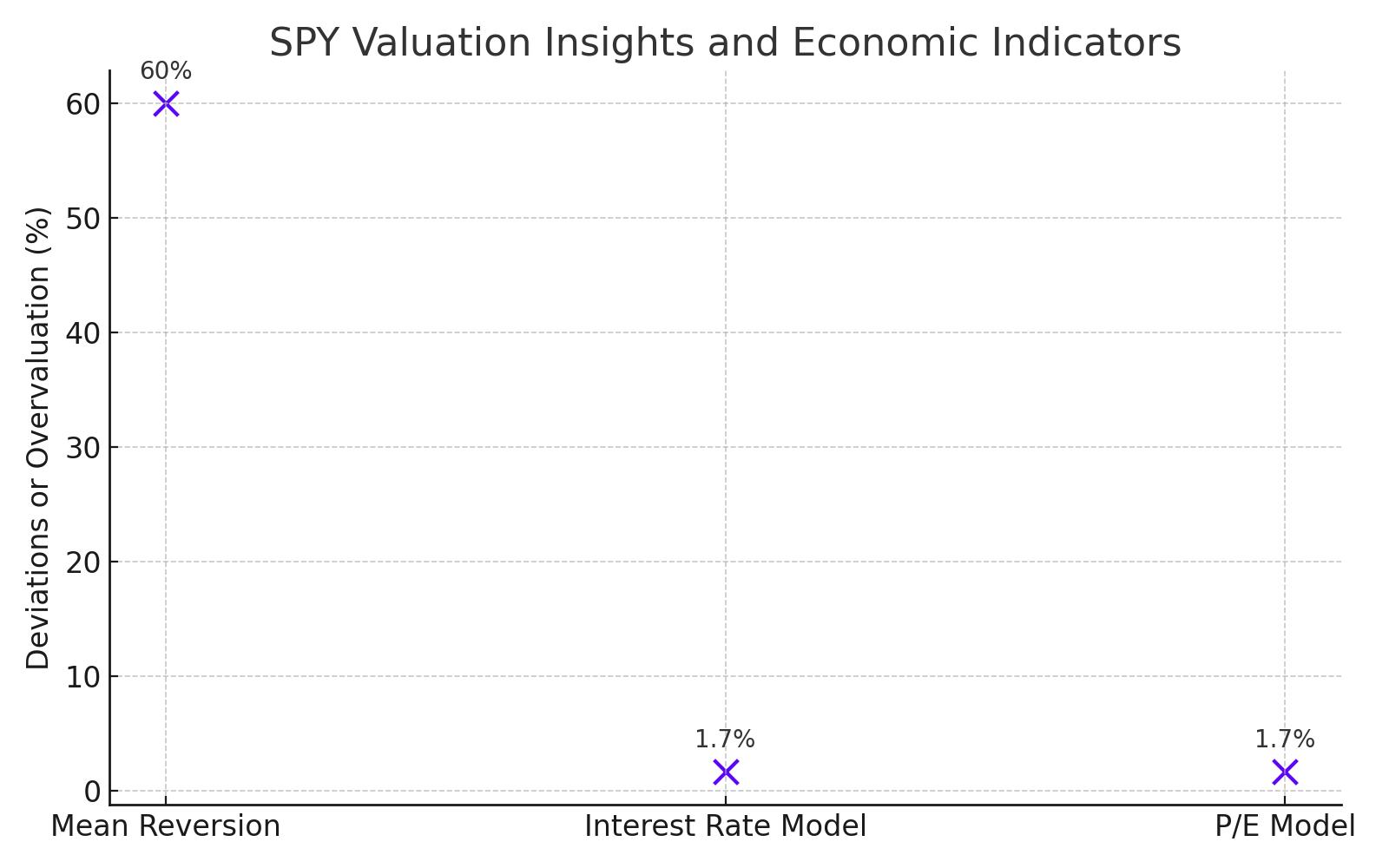

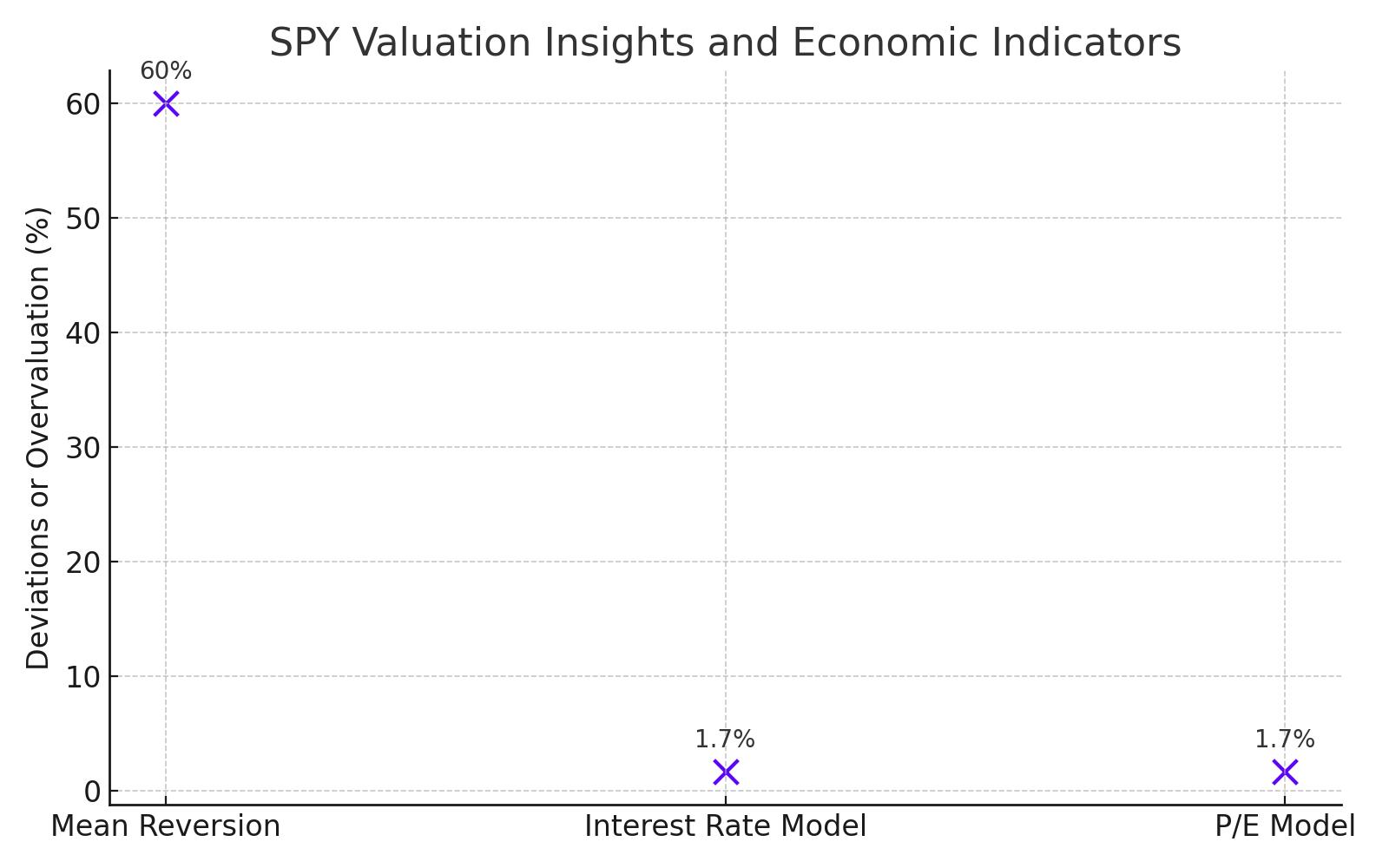

Current valuation models raise red flags about potential overvaluation:

- Mean Reversion Model: Indicates the S&P 500 is 60% above its historical trend, suggesting a significant overvaluation that might correct.

- Interest Rate and P/E Models: Both suggest that the S&P 500, and by extension SPY, are approximately 1.7 standard deviations above the norm, reinforcing concerns about sustainability of current price levels.

Macroeconomic Challenges and Implications for SPY

Persistent Economic Headwinds

The SPDR S&P 500 ETF Trust (SPY) is navigating a complex macroeconomic landscape marked by significant challenges. Several key economies, including those of the United Kingdom, Germany, and Japan, are experiencing recessions or notable slowdowns, directly affecting global market sentiments. In the United States, persistently high inflation, coupled with record-high consumer debt levels, is putting additional strain on economic stability. These conditions are likely to dampen investor enthusiasm, potentially leading to a subdued performance for SPY.

U.S. Economic Outlook

Current U.S. economic indicators are less than favorable for equity markets. With inflation stubbornly high, the Federal Reserve's monetary policies may continue to lean towards maintaining higher interest rates longer than previously anticipated. High rates could restrict economic growth and consumer spending, further complicating the investment landscape for equities, including sectors heavily represented in SPY.

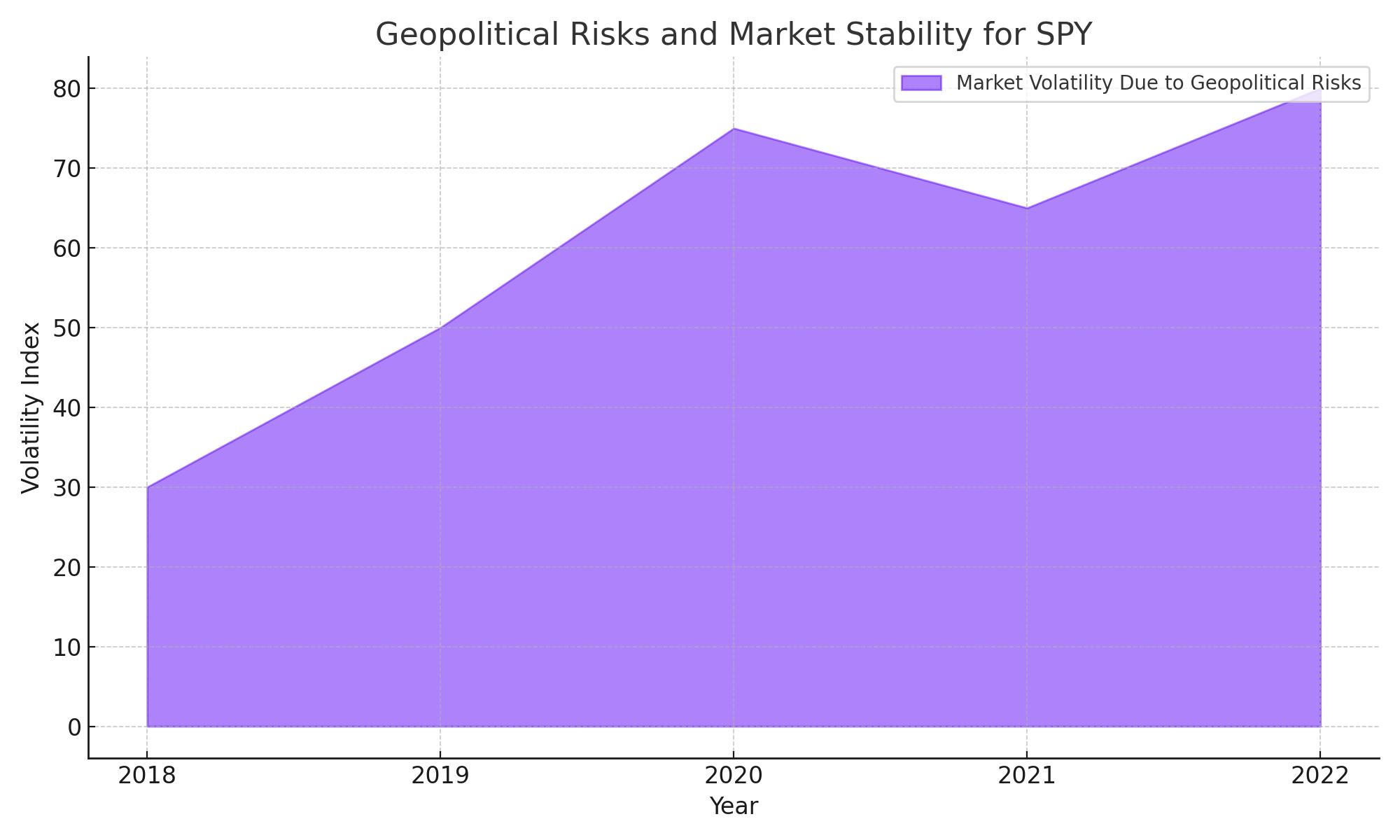

Geopolitical Risks Affecting Market Stability

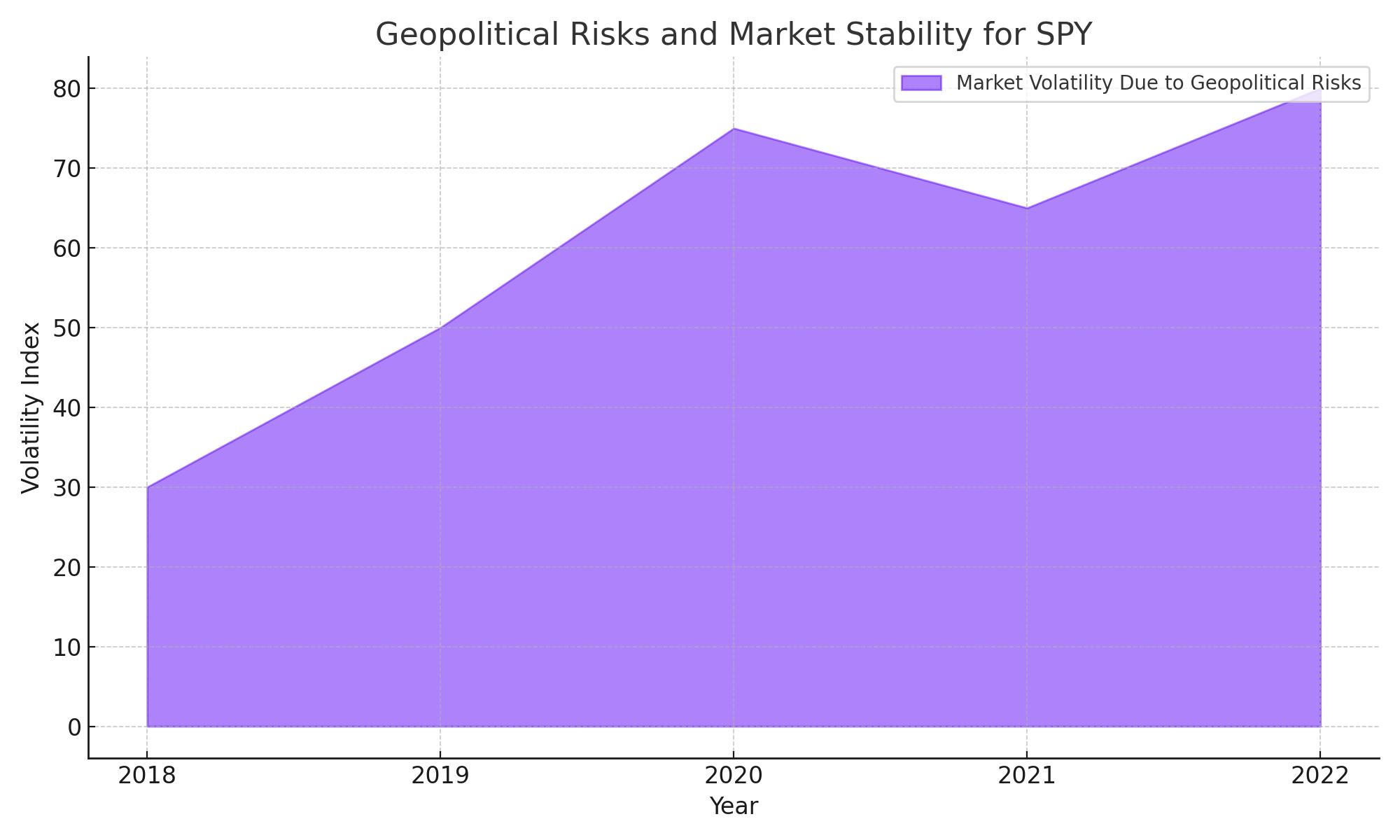

Escalating Tensions and Market Impact

Geopolitical instability remains a critical concern, with ongoing tensions in Eastern Europe and volatile situations in the Middle East. These regions are pivotal to global energy markets, and any escalation in conflict could disrupt oil supply chains, leading to higher energy prices and increased market volatility. Such developments would likely have a negative impact on SPY, as rising energy costs could erode corporate profitability and consumer spending, two engines of stock market growth.

Investment Strategy: Cautious Approach and Sell Recommendation

Bearish Outlook Based on Valuation and Risks

Given the confluence of high valuations indicated by multiple financial models and the looming economic and geopolitical risks, adopting a bearish outlook on SPY appears prudent. The ETF's current price levels suggest it is significantly overvalued, with metrics such as the price-to-earnings ratio and Buffett Indicator pointing to potential market corrections ahead.

Tactical Portfolio Adjustments

For investors currently holding SPY, considering a sell strategy may be wise to capitalize on any recent gains before a potential market downturn. The combination of macroeconomic pressures and heightened geopolitical risks could weigh heavily on market performance, making this an opportune time to reassess and possibly reduce exposure to broad market indices like SPY.

Conclusion: Vigilance and Strategic Adjustment Recommended

The analysis indicates that while SPY has historically been a robust vehicle for investment, the current market dynamics characterized by elevated valuations and a multitude of risk factors provide compelling reasons for caution. Investors are advised to remain vigilant and be prepared to make strategic adjustments to their portfolios in response to emerging economic data and geopolitical events. This cautious approach will help mitigate risks while positioning for potential market stabilization and recovery when conditions improve.

That's TradingNEWS