Costco NASDAQ:COST Strategic Growth and Robust Financial Performance

Analyzing the Impact of Membership Growth, Expansion Plans, and Financial Metrics on Costco's Market Position and Investment Potential in 2024 | That's TradingNEWS

Deep Dive into Costco Wholesale Corporation's Financial Health and Strategic Positioning

Company Overview: A Retail Giant with a Competitive Edge

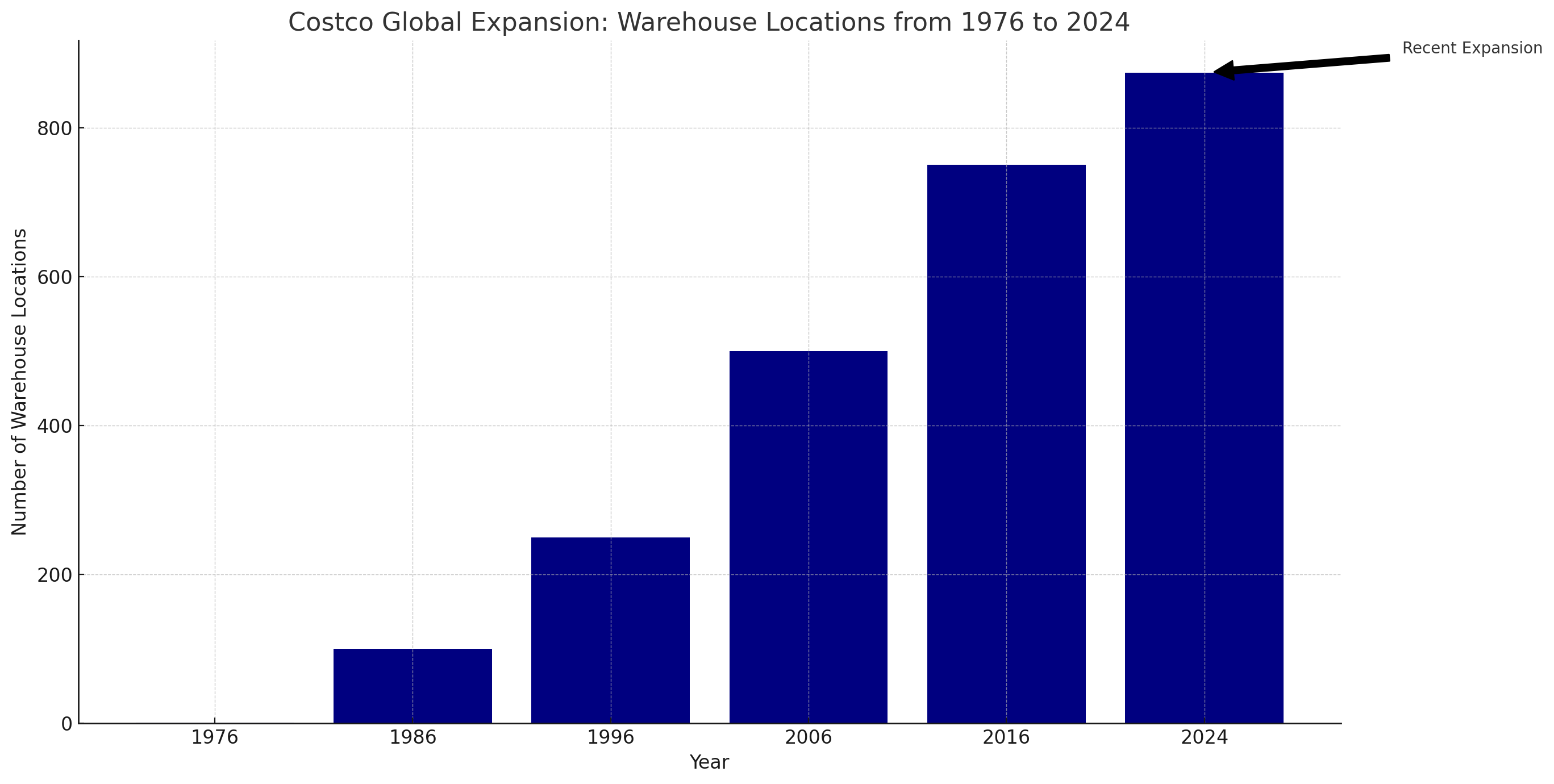

Costco Wholesale Corporation (NASDAQ:COST) is a powerhouse in the retail sector, headquartered in Issaquah, Washington. Since its founding in 1976 by James Sinegal and Jeffrey Brotman, Costco has expanded to 874 warehouse locations globally. The company's business model, which combines low margins with high volume, not only fosters significant customer loyalty but also drives sustainable growth year over year.

The Membership Model: A Key Driver of Success

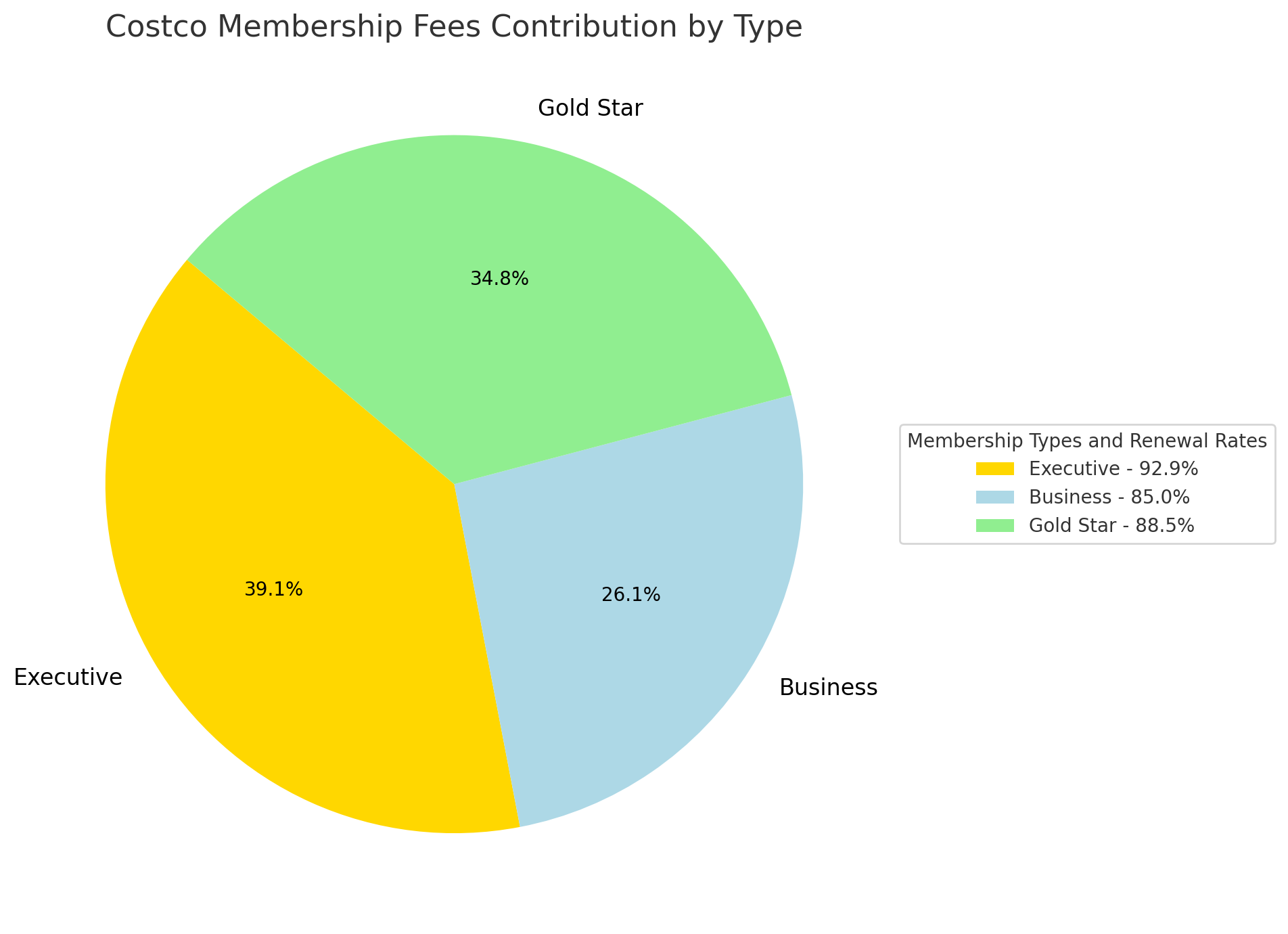

A standout feature of Costco's strategy is its membership-only model, which has proven to be a formidable competitive advantage. The company boasts 73.4 million paid members and 132 million cardholders worldwide. These members contribute significantly to the company's bottom line, with membership fees totaling $4.6 billion in fiscal 2023. The impressive renewal rates—92.9% in the US and Canada and 90.5% globally—speak volumes about the loyalty and satisfaction of Costco's members.

Financial Performance: Robust Revenue and Strategic Growth

Costco's financials reflect a healthy and growing business. In the second quarter of 2024, the company reported total revenue and net sales of $58.44 billion and $57.33 billion, respectively, marking a 5.7% year-over-year increase. This growth, primarily driven by the robust membership fees, which saw an 8.2% increase from the previous year, highlights the effectiveness of Costco's business model.

Earnings Highlights

Costco's EPS for the second quarter stood at $3.92, surpassing consensus estimates by $0.31. This performance was bolstered by a $94 million tax benefit and the ongoing growth in membership fees. The company's net profit margin improved significantly, reaching 3% compared to 2.4% in fiscal 2019.

Future Outlook and Expansion Plans

Looking forward, Costco plans to open 30 new warehouses in fiscal 2024, with a focus on the US market. This expansion is supported by strong sales volumes and the potential for further penetration into the retail market. The strategic initiatives such as Costco Next and the enhancement of e-commerce platforms are expected to drive future growth.

Challenges and Risks: Navigating a Competitive Landscape

Despite its strong position, Costco faces challenges including potential membership fee hikes, leadership transitions, and intense competition from both brick-and-mortar and online retailers. The recent appointment of Ron Vachris as CEO and Gary Millerchip as CFO could signal strategic shifts which need to be closely monitored.

Valuation and Stock Performance

Costco's stock performance has been robust, with a notable increase of approximately 45% over the past year. However, recent corrections provide a potential entry point for investors. A detailed DCF analysis suggests a fair value of $848.18 per share, indicating that the stock is currently undervalued and presents a buying opportunity.

Strategic Summary and Buy Recommendation

In summary, Costco's strategic focus on membership growth, expense management, and e-commerce integration positions it well for sustained long-term growth. The combination of a strong business model, strategic expansion, and robust financials supports a buy rating for Costco's stock, with a target price of $848.18.

For more detailed financial insights and real-time stock updates, interested parties can visit the official trading news pages for Costco's stock overview and insider transactions. Costco Stock Profile and Insider Transactions provide additional data and analysis crucial for making informed investment decisions.