Coterra Energy (NYSE: CTRA): Oil Gains Drive Strong Cash Flow and Shareholder Rewards

With $246M in free cash flow and growing oil production, Coterra Energy proves it’s ready for long-term growth | That's TradingNEWS

Coterra Energy Inc. Stock (NYSE: CTRA)- Comprehensive Analysis of Coterra Energy’s Financial Landscape and Future Prospects

Institutional Activity and Stock Performance

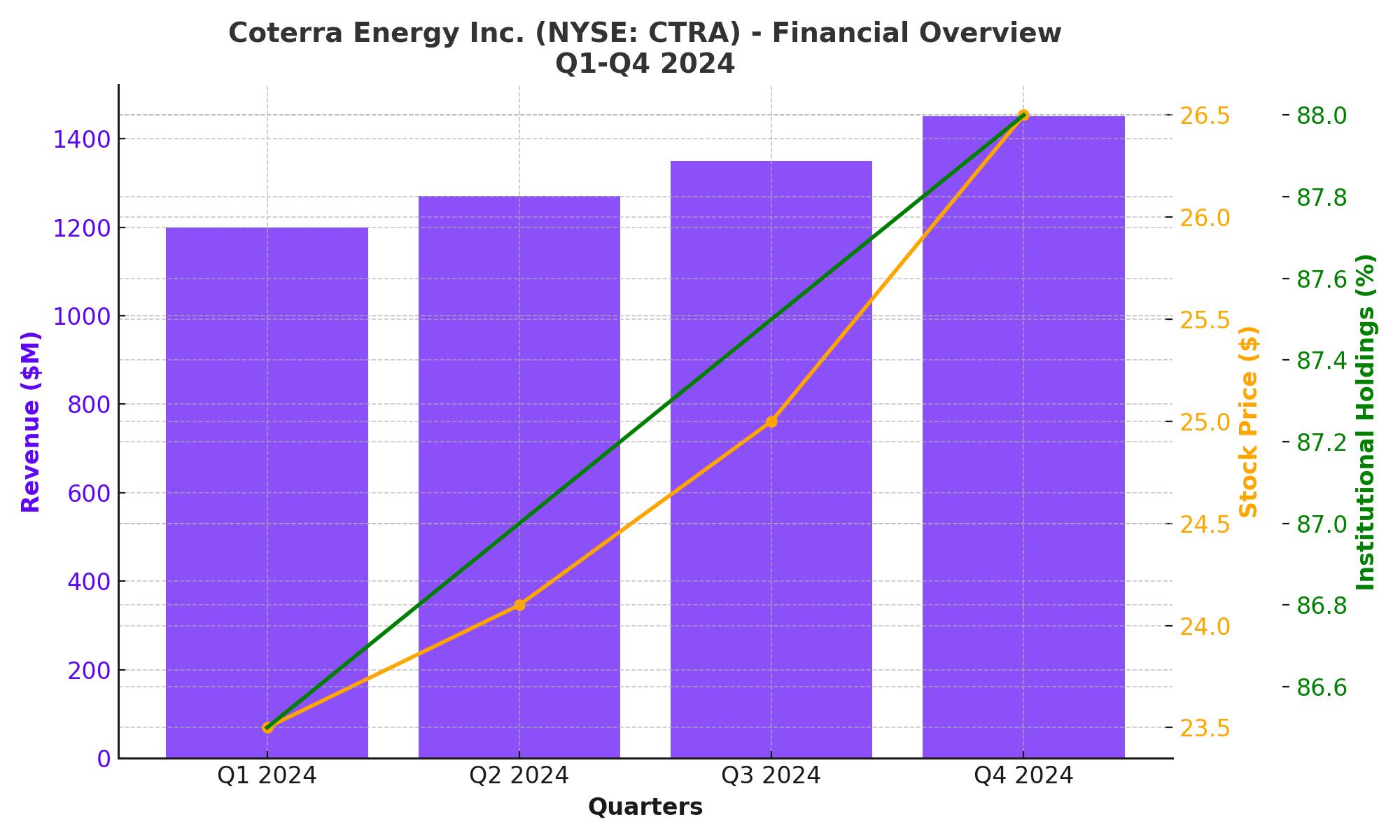

Coterra Energy Inc. (NYSE: CTRA) has seen recent institutional activity that indicates steady interest in the stock. Washington Capital Management Inc. acquired a new stake of 25,500 shares valued at approximately $611,000 during the third quarter of 2024. Similarly, Fifth Third Bancorp, TCW Group Inc., and Quent Capital LLC have all increased their holdings in Coterra. Fifth Third Bancorp added 399 shares, now holding 71,138 shares worth $1.89 million. This accumulation highlights institutional confidence, as 87.92% of Coterra's stock is owned by institutional investors, showing that it remains a solid player in the energy sector.

The stock has experienced a decrease in price over the past few months. Trading around $24.10, with a market capitalization of $17.93 billion, the stock price remains 20% off its 52-week high of $29.89. Its 50-day moving average is $23.86, signaling some stabilization after a volatile period. Coterra’s price-to-earnings (P/E) ratio is 14.11, with a price-to-earnings-growth (PEG) ratio of 1.41. Its debt-to-equity ratio of 0.16 indicates a strong balance sheet compared to industry peers.

Wall Street Forecasts for Coterra Energy Stock (NYSE: CTRA)

Financials and Dividend Strategy

In the second quarter of 2024, Coterra reported revenues of $1.27 billion, slightly below estimates of $1.32 billion. Its net margin stands at 23.18%, and the company’s return on equity (ROE) is 10.48%. While earnings per share (EPS) of $0.37 missed consensus by $0.02, this was largely due to fluctuating gas prices, which are a significant portion of its revenue.

Coterra’s dividend strategy remains one of its strong suits. It declared a $0.21 dividend per share, providing an annualized yield of 3.49%. The company's dividend payout ratio is 48.55%, reflecting a balanced approach between returning capital to shareholders and retaining earnings for reinvestment. Free cash flow in Q2 was $246 million, enabling sustained dividend payments and share buybacks. Currently, Coterra has $1.3 billion remaining in its $2 billion share repurchase program, further reinforcing its commitment to shareholder returns.

Production Overview

Coterra’s production profile is heavily weighted toward natural gas, which accounts for 69% of its output. The remainder is composed of 16% oil and 15% natural gas liquids (NGLs). With operations spread across the Permian Basin, Marcellus Shale, and Anadarko Basin, the company has diversified its exposure across the U.S.'s most productive basins.

Permian Basin: Coterra operates 296,000 acres in this oil-heavy region. Although natural gas dominates its portfolio, oil and NGL production from the Permian accounts for 35% of its total production on a BTU basis. The Wolfcamp and Bone Springs shales are key targets for growth in this area, and Coterra is expected to drill 57 wells in the Windham Row project in the Delaware Basin, which could improve capital efficiency.

Marcellus Shale: Coterra holds 186,000 acres here, producing 57% of its output on a BTU basis. However, this region’s economics are gas-dominated, which makes it vulnerable to the low gas prices seen recently, particularly in the Appalachian region.

Anadarko Basin: The 182,000 acres in this region focus primarily on the Woodford Shale, with production here being a blend of natural gas liquids and natural gas. This diversification in basin exposure helps mitigate regional risks and smooth out the effects of localized pricing pressures.

Macroeconomic Headwinds and Commodity Pricing

Natural gas prices have been volatile, with Henry Hub futures trading around $2.47/MMBtu as of mid-October 2024. Appalachian prices are particularly weak, with Eastern Gas South prices hitting $1.61/MMBtu and West Texas’ Waha hub prices even dipping into negative territory, down to -$1.17/MMBtu due to pipeline constraints. However, forward curves for 2025 show a potential recovery, with prices estimated to climb toward $3/MMBtu. Oil prices, meanwhile, provide some balance to the revenue stream, with West Texas Intermediate (WTI) futures closing at $71.74 per barrel.

Return on Equity and Growth Potential

With a 9.9% ROE, Coterra lags behind the broader industry average of 18%. However, it has managed a robust 38% net income growth over the past five years, largely due to efficient capital reinvestment. Despite softer gas prices, Coterra’s oil production in the Permian and its NGL output have supported its earnings profile. The company’s three-year median payout ratio of 48% demonstrates a balanced reinvestment strategy, with analysts expecting a drop in the payout ratio to 28% by 2027, which could drive ROE growth to 16%.

Insider Activity and Shareholder Sentiment

Insider transactions provide an insightful look into the confidence of Coterra’s leadership. Recently, insiders have displayed optimism, with no major sell-offs reported. For detailed insider transactions, refer to Coterra Energy Insider Transactions. Investors might also find a deeper analysis of Coterra’s overall performance at Coterra Stock Profile.

Competitors and Industry Position

Coterra competes with a host of gas-producing peers, including EQT Corporation (NYSE: EQT) and Antero Resources (NYSE: AR) in the Marcellus region, as well as with Devon Energy (NYSE: DVN) and EOG Resources (NYSE: EOG) in the Permian. One of Coterra's strategic advantages is its integration of infrastructure assets, which allows it to mitigate pipeline constraints that have plagued competitors, particularly in Appalachia.

Coterra’s Forward Guidance

Looking ahead, Coterra projects total production between 645,000 and 675,000 barrels of oil equivalent per day (BOE/D) for the year, along with an oil output target of 105,500-108,500 BOE/D. Its capital expenditure for 2024 is forecasted at $1.75-$1.95 billion, largely aimed at drilling new wells in its Permian acreage. With free cash flow estimates of $1.3 billion and discretionary cash flow around $3.2 billion, the company’s financial outlook remains strong.

Strategic Outlook for Investors

Coterra Energy’s combination of natural gas, oil, and NGLs offers a balanced portfolio that should help it weather short-term commodity price fluctuations. The company's emphasis on shareholder returns, particularly through dividends and buybacks, makes it attractive to income-oriented investors. Given its current stock price and favorable forward-looking metrics, the stock appears to present a buy opportunity, particularly with upside potential to $31 per share, representing over 20% growth from current levels.

For real-time analysis and stock performance, visit Coterra Energy Real-Time Chart.

Conclusion: Operational Strength and Long-Term Potential

Coterra Energy (NYSE: CTRA) continues to demonstrate a robust operational framework driven by its strategic diversification across natural gas (69% of production), oil (16%), and natural gas liquids (15%). Despite the persistent headwinds in natural gas pricing, with Henry Hub futures hovering around $2.47/MMBtu and regional prices like Appalachian dropping to $1.61/MMBtu, Coterra's growing oil production in the Permian Basin helps to balance its revenue streams. With a market capitalization of $17.93 billion, Coterra’s disciplined capital management has generated $558 million in operating cash flow and $246 million in free cash flow in Q2 2024 alone. The company's focus on shareholder returns through a 3.49% dividend yield and its ongoing $1.3 billion share repurchase program make it a valuable prospect for investors. With production targets of 645,000-675,000 BOE/D for 2024 and an expected free cash flow of $1.3 billion, Coterra is well-positioned to navigate future market conditions effectively.

That's TradingNEWS

NASDAQ:AMD Crashes to $89—But $2B Oracle AI Deal Hints at Massive Comeback