CrowdStrike Leads Cybersecurity Market with Record ARR and $150 Stock Price

Robust $4.01B ARR Growth, 31% Revenue Increase, and Strategic Wins Propel CrowdStrike to the Forefront of the $250B Cybersecurity Sector | That's TradingNEWS

CrowdStrike Holdings (NASDAQ:CRWD): Dominating Cybersecurity Growth with Strong Financial Performance

Surpassing $1 Billion in Quarterly Revenue: Record Milestone for NASDAQ:CRWD

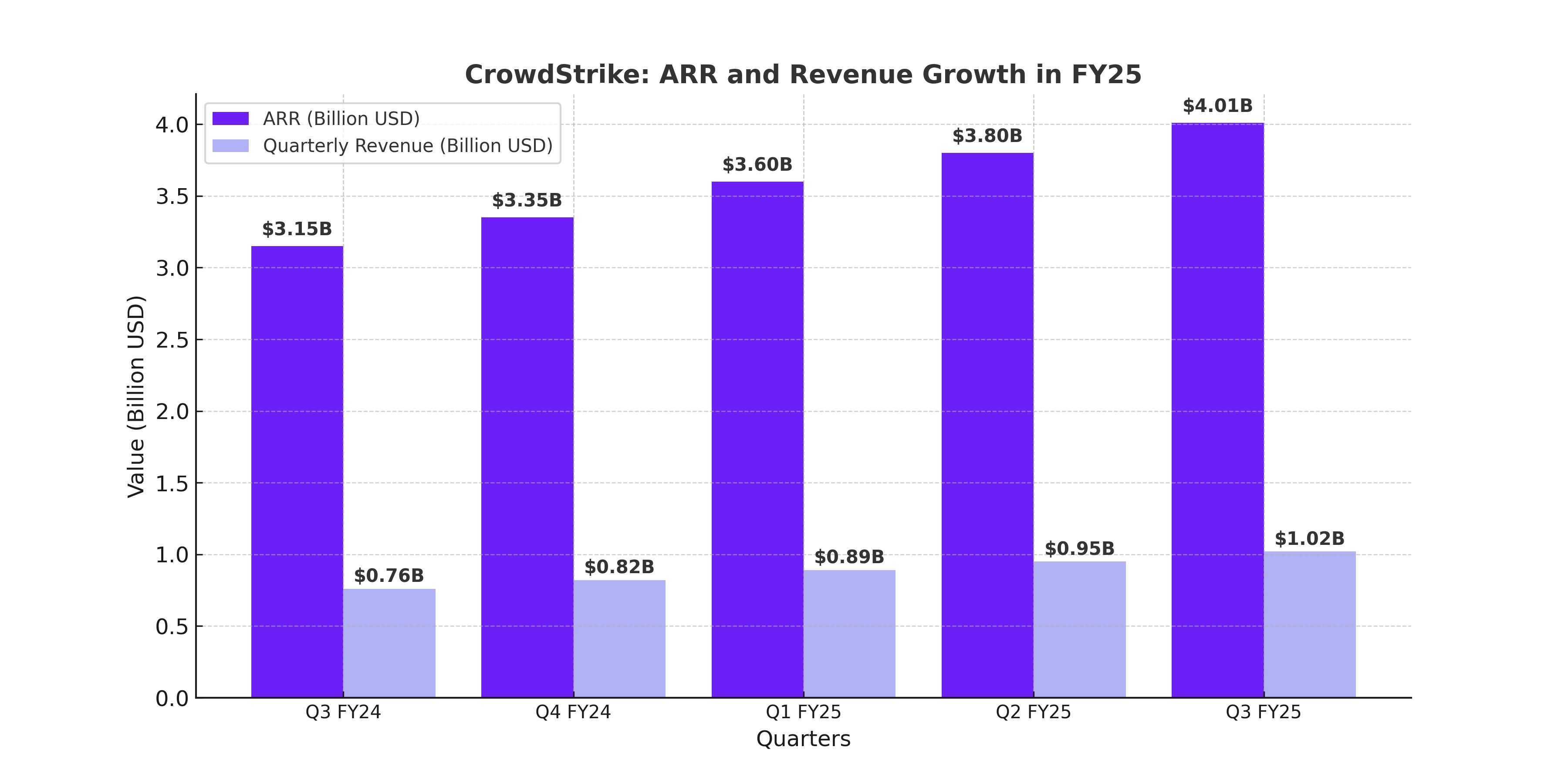

CrowdStrike Holdings (NASDAQ:CRWD), currently trading at approximately $150, achieved a historic milestone in Q3 FY25 by exceeding $1 billion in quarterly revenue. This marks a 31% year-over-year growth, with subscription revenue contributing a robust 30% increase. Such performance underscores CrowdStrike's ability to scale and capture an increasing share of the expanding cybersecurity market, where the demand for AI-driven solutions is accelerating.

Annual Recurring Revenue (ARR) reached $4.01 billion, growing 27% year-over-year. This highlights CrowdStrike's strength in attracting new customers while deepening relationships with existing ones. Net retention rates stood at an impressive 115%, reflecting expanded customer spending on the Falcon platform. The Falcon Flex model alone accounted for $1.3 billion in deal value, promoting multi-module adoption and larger contract sizes, critical to driving ARR and long-term revenue stability.

Falcon Platform’s Role in Multi-Module Adoption and Retention Success

The Falcon platform continues to play a vital role in CrowdStrike’s success. As of Q3 FY25, 66% of customers used five or more modules, while 20% adopted eight or more modules. These adoption metrics underscore CrowdStrike’s ability to execute its “land-and-expand” strategy effectively, increasing cross-selling opportunities and making the Falcon platform an integral part of its customers’ cybersecurity infrastructure.

Despite temporary challenges, such as the July outage and delays in pipeline activities, CrowdStrike demonstrated resilience by maintaining high gross retention rates of 97%. The operational setback highlighted the need for robust customer communication and trust-building, which the company handled adeptly.

High-Value Contracts and Enterprise Adoption Bolster Growth Prospects

The penetration into high-value markets is evident as CrowdStrike closed several eight-figure deals with Global 2000 companies. One notable win involved a major tech manufacturer consolidating four legacy vendors under the Falcon platform. These larger transactions highlight CrowdStrike's ability to address complex enterprise needs and strengthen its foothold in the upper-tier market.

The Falcon Flex subscription model has been instrumental in accelerating this enterprise adoption, with clients subscribing to more than nine modules on average. Flex contracts, averaging significantly higher value than traditional agreements, are designed to bundle services that enhance customer lifetime value.

Valuation and Strategic Focus on Long-Term ARR Goals

CrowdStrike’s forward P/E ratio of 97x reflects a 55% premium to its peers, such as Palo Alto Networks (PANW) and Zscaler (ZS). This premium valuation is justified by CrowdStrike’s leadership in cybersecurity innovation and its ability to maintain operational efficiency. The company’s free cash flow margin of 23%, combined with a “Rule of 51” efficiency metric, reinforces its long-term potential.

The strategic goal of reaching $10 billion in ARR by FY2031 is aligned with an estimated $250 billion addressable market for AI-native cybersecurity solutions. This ambitious target is supported by consistent investment in R&D, which fuels module innovation and customer retention.

Risks and Mitigation Strategies for NASDAQ:CRWD Investors

While CrowdStrike’s growth trajectory is strong, there are risks to consider. Renewal risks with Falcon Flex contracts and higher churn rates among smaller Managed Service Providers (MSPs) present challenges. However, these are mitigated by strong enterprise adoption and the increasing module adoption rates that drive customer stickiness.

Additionally, macroeconomic pressures could delay pipeline activities, but CrowdStrike’s robust $4.3 billion cash position provides a financial cushion to weather such uncertainties. The company’s commitment to operational excellence and innovation continues to position it as a leader in the cybersecurity industry.

Conclusion: NASDAQ:CRWD Is a Long-Term Buy with Strong Growth Fundamentals

CrowdStrike's stellar Q3 FY25 results, with record ARR surpassing $4.01 billion and an impressive 31% year-over-year revenue growth to $1 billion, solidify its status as a premier investment opportunity. Trading at approximately $150 per share, the company's strategic focus on scaling its Falcon platform and driving multi-module adoption has resulted in robust customer retention rates of 97%. With significant enterprise wins, such as multi-million-dollar Falcon Flex contracts averaging $1.3 billion in deal value, CrowdStrike is uniquely poised to capitalize on the $250 billion AI-driven cybersecurity market. This unmatched performance positions CrowdStrike as a key leader in a sector with massive long-term growth potential.

That's TradingNEWS

Read More

-

GDX ETF at $88 While Gold Tests $4,400: Are Gold Miners Poised for $100?

19.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETF Boom: XRPI at $10.94 and XRPR at $15.49 as XRP-USD Clings to the $1.80–$1.90 Zone

19.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Hovering Near $3.92 As Weather, LNG And Storage Collide

19.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen Near 157 as BoJ’s 0.75% Rate Hike Backfires on the Yen

19.12.2025 · TradingNEWS ArchiveForex