Crude Oil Market Analysis: Current Dynamics and Future Prospects

Understanding the Impact of Supply and Demand, Geopolitical Factors, and Economic Indicators on Crude Oil Prices | That's TradingNEWS

Crude Oil Market Analysis: Navigating Current Dynamics and Future Prospects

Market Overview and Technical Indicators

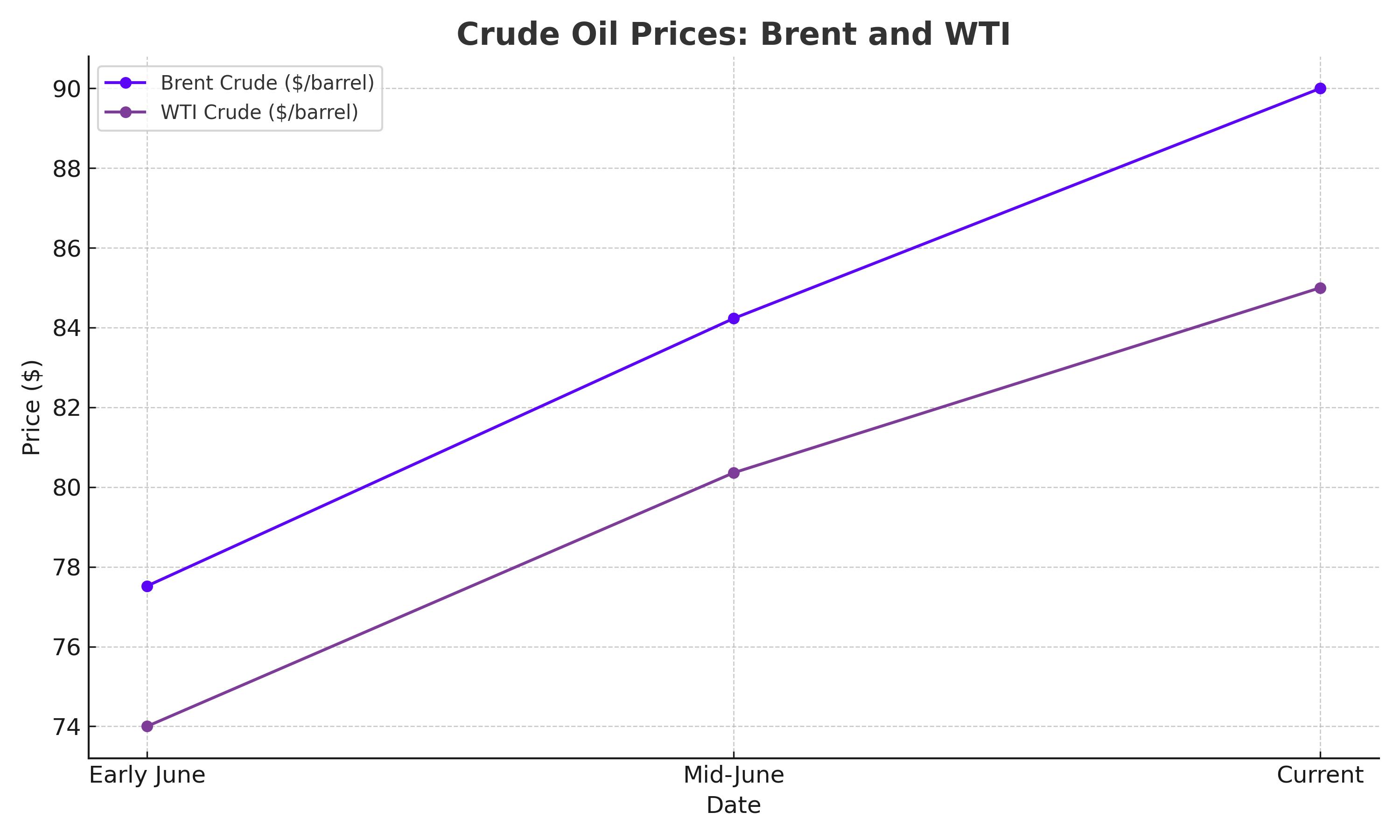

Crude oil prices are experiencing a stable phase, with Brent crude futures at $84.23 per barrel and U.S. West Texas Intermediate (WTI) crude futures at $80.36 per barrel as of recent trading. Both benchmarks saw a 2% rise on Monday, reaching their highest levels since April. Brent, after an early-June low of $77.52, remains below its mid-April peak of $90. The current stability comes as traders anticipate a summer demand boost, despite strong supply concerns.

Supply and Demand Dynamics

Global crude oil inventories and refined product storage in key locations like the United States and Singapore remain high. U.S. crude inventories are projected to have fallen by 2.3 million barrels for the week ending June 14, indicating potential demand increases. However, global oil demand growth slowed to 890,000 barrels per day (bpd) year-on-year in Q1 2024, with further deceleration expected in Q2.

Impact of Economic Indicators

The oil market's movement is significantly influenced by upcoming U.S. Retail Sales data, forecasted to rise by 0.2% in May. Positive data could bolster the U.S. Dollar, exerting downward pressure on oil prices. Analysts are also focused on U.S. oil inventory data, which could either confirm or challenge the developing optimism around rising demand at the start of the summer driving season.

Geopolitical and Economic Factors

Geopolitical tensions and economic policies play crucial roles in oil price dynamics. Political uncertainty in France, driven by President Macron's call for a snap election, adds to the Eurozone's economic instability. Moreover, the European Central Bank (ECB) officials emphasize maintaining current interest rates to avoid inflation pressures, contrasting with market expectations for potential rate cuts.

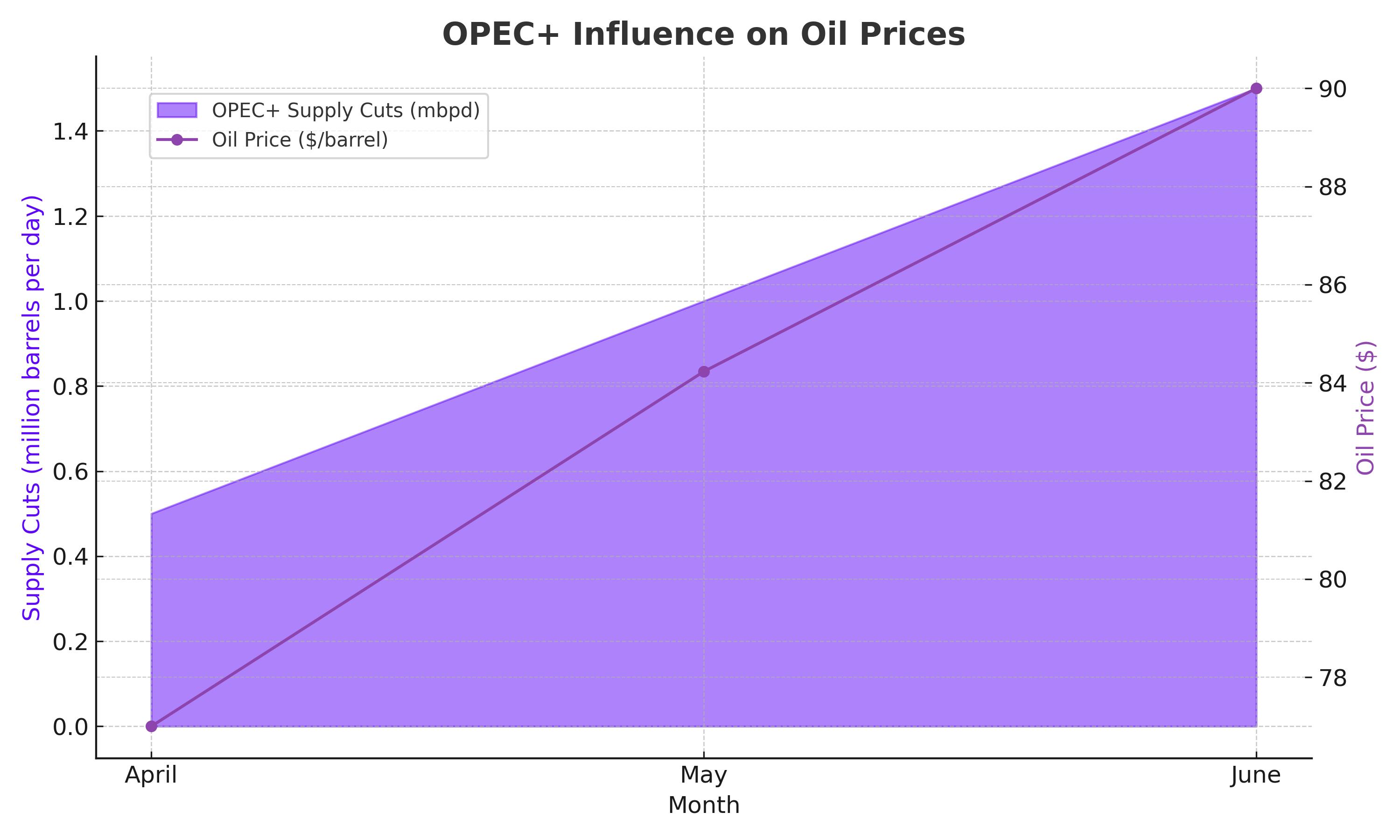

OPEC+ Influence and Market Sentiment

OPEC+ group's supply cuts are a critical factor in the oil market. Analysts remain cautiously optimistic about the price impact of these cuts in the near term. The OPEC+ group's unchanged demand growth outlook of 2.25 million bpd for 2024 signals stagnation in supply growth, potentially supporting higher prices.

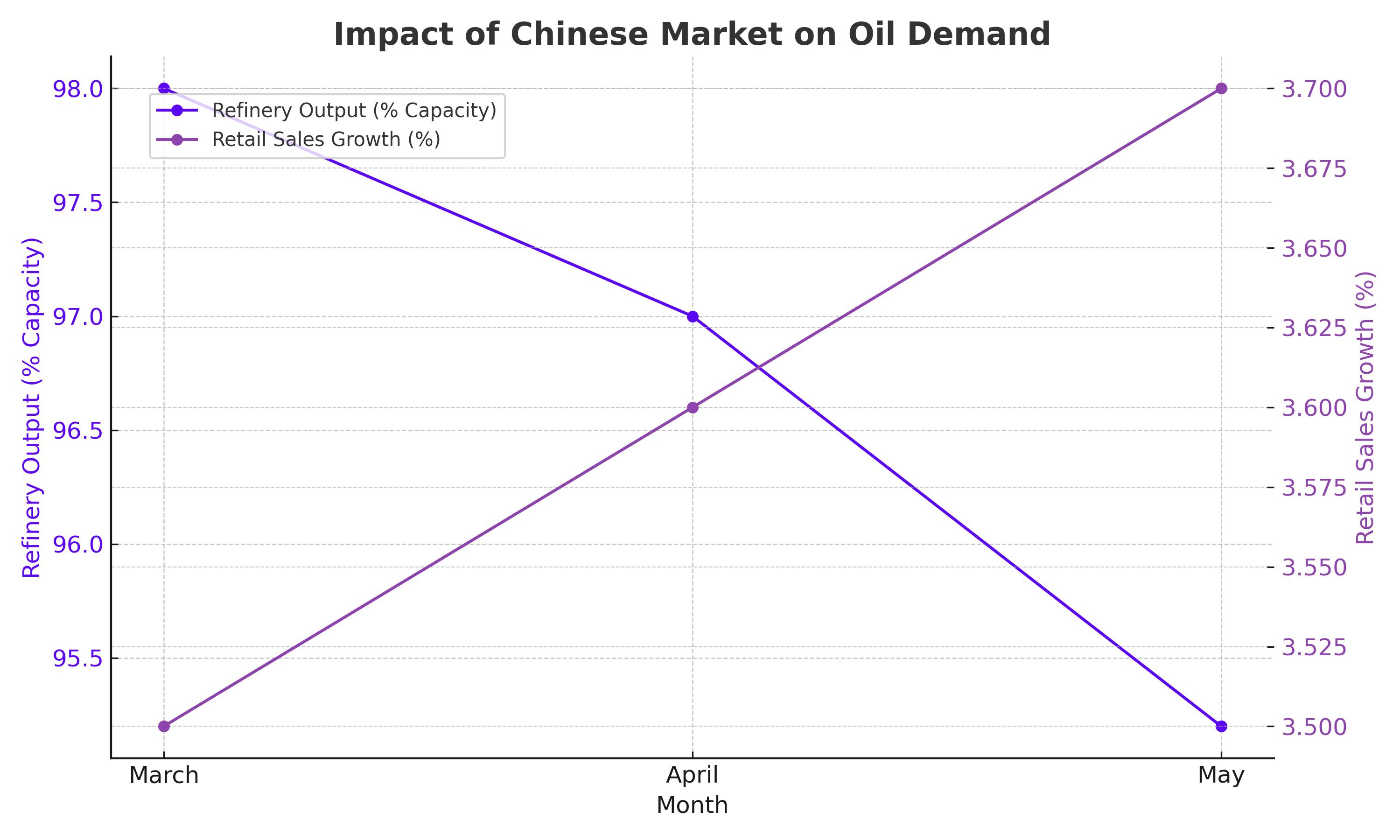

Chinese Market Impact

China, the world's largest importer of crude oil, has shown mixed economic signals. May's refinery output slipped by 1.8% year-on-year due to planned maintenance and rising crude costs. However, a 3.7% rise in retail sales provided some bullish sentiment, although industrial output and fixed asset investment disappointed.

Investor Sentiment and Market Movements

Investors are closely monitoring the U.S. Federal Reserve's comments on interest rates, with several representatives scheduled to speak. U.S. crude oil futures maintained above $80 per barrel on Tuesday, reflecting strong gains despite mixed economic data from China. Analysts suggest that recent rallies in energy prices may largely be due to speculators covering short positions.

Future Prospects and Conclusion

The oil market is anticipated to tighten in the third quarter, with expectations of higher summer fuel demand drawing down inventories. However, gasoline demand in the U.S. has been disappointing, being 2% lower year-over-year, which might increase pressure on gasoline prices. Asia's gasoline weakness has also led to refinery run cuts, with Singapore gasoline cracks dropping below $5 per barrel.

Overall, while oil prices have recovered from mid-June lows, uncertainty remains around the outlook for crude demand, particularly from China. The market's strength could be sustained if the U.S. Federal Reserve's comments this week are perceived as positive. Investors should remain vigilant, considering both geopolitical developments and economic indicators to navigate the volatile oil market effectively.