Crude Oil Market Dynamics: An In-Depth Financial Analysis

Delve into the latest trends in crude oil prices, including the impact of geopolitical factors and Federal Reserve decisions on market movements | That's TradingNEWS

In-Depth Market Analysis: Crude Oil Dynamics and Financial Implications

Overview of Recent Crude Oil Market Dynamics

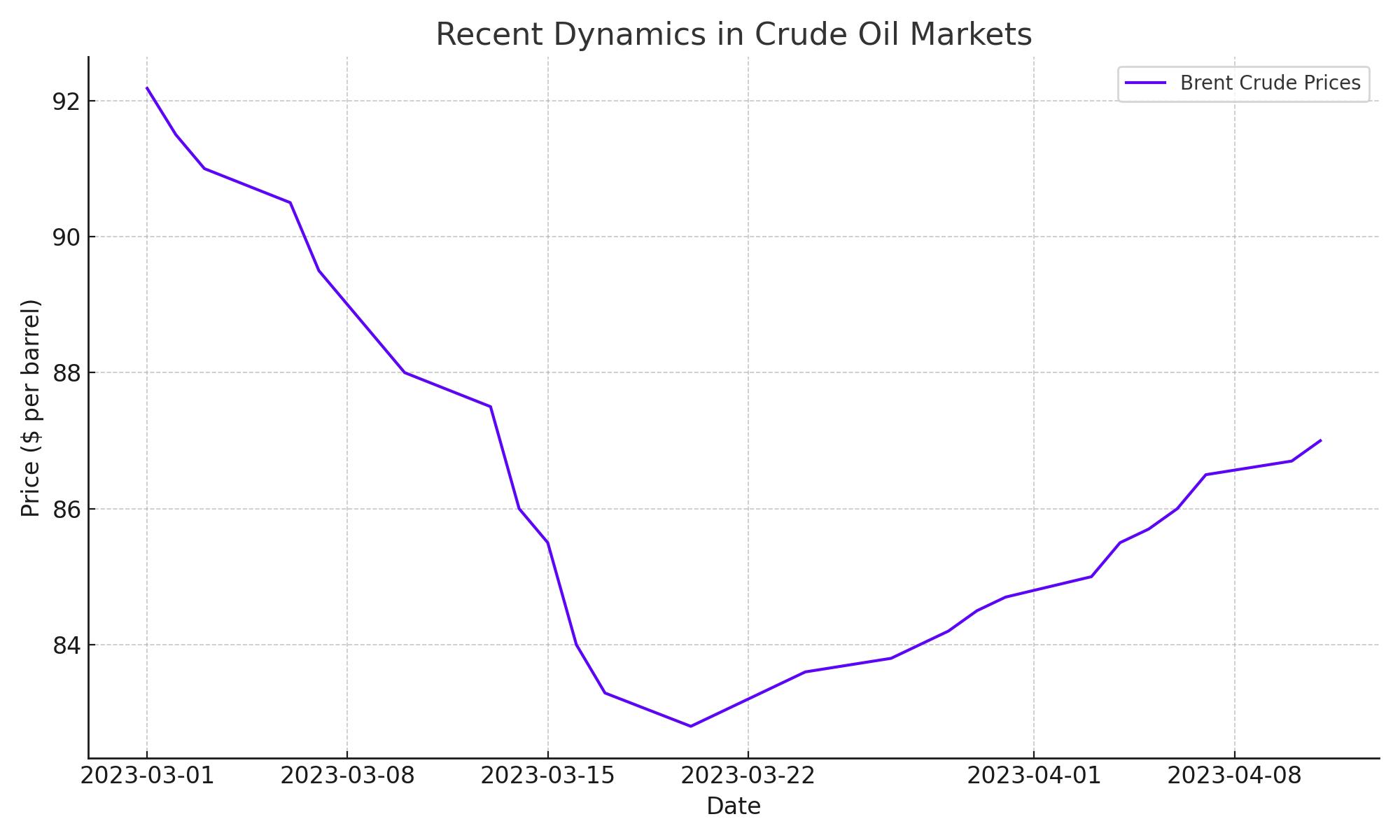

Crude oil markets have experienced notable fluctuations, with Brent crude futures dropping 3% to a seven-week low of $83.29 per barrel. This decline reflects a growing concern over an increase in US crude stockpiles, which suggests a potential softening in demand. Additionally, the geopolitical landscape, particularly the possibility of a ceasefire in the Middle East, has also played a role in reducing the commodity's risk premium, with Brent crude now approximately 10% below its April 2024 peak of $92.18 per barrel.

Impact of the Federal Reserve's Policies on Oil Prices

The Federal Reserve's recent decisions have also left a significant imprint on oil price movements. The Fed's maintenance of interest rates and the slowing of US Treasury holdings reduction have introduced a level of uncertainty in the markets. Despite this, the Fed’s mixed signals about future rate hikes—indicating they are not forthcoming—have contributed to the volatility seen in crude oil prices.

Technical Analysis and Price Movements

From a technical standpoint, both Brent and WTI crude oil have shown a decline of nearly 3%, signaling a bearish trend in the short term. Technical analysis indicates that if Brent crude can sustain above the $83 level, there might be potential for a rebound towards higher resistance levels near $85 per barrel. Conversely, a break below this threshold could lead to further declines, testing support levels around $80 per barrel.

Economic Indicators and Market Reactions

Recent data from the Energy Information Administration (EIA) reported an unexpected rise in US crude stockpiles by 7.3 million barrels, contrary to the anticipated decline. This surprise increase has contributed to the bearish sentiment in the oil markets. Moreover, US crude oil production surged to 13.15 million barrels per day, marking a significant rise and suggesting an easing in supply constraints.

The Influence of Economic Policies on Oil Prices

Recent global economic developments have played a pivotal role in shaping oil market dynamics. Notably, the Federal Reserve's decision to stabilize the federal funds rate at a range between 5.25% and 5.5% has had broad implications. This policy stability tends to strengthen the U.S. dollar, which in turn impacts global oil prices, given that oil transactions are primarily denominated in dollars. A stronger dollar can make oil more expensive for holders of other currencies, potentially dampening international demand.

Moreover, adjustments in the Fed’s balance sheet, particularly the reduction of asset purchases, are crucial for the financial liquidity in the markets, which indirectly influences commodity trading, including oil. These adjustments have contributed to shifts in investor sentiment and have affected the speculative dynamics within oil markets.

Market Sentiment and Investment Insights

Current investor sentiment in the oil market is characterized by a degree of caution, influenced by a mix of supply dynamics and geopolitical uncertainties. The recent data indicating a rise in U.S. crude stockpiles by 7.3 million barrels, against expectations of a decrease, suggests a potential oversupply, which could suppress prices if not matched by corresponding demand.

Additionally, geopolitical tensions, particularly in the Middle East, significantly affect market sentiment. The ongoing negotiations for a ceasefire in the region, if successful, could lead to a decrease in the risk premium currently embedded in oil prices. However, the efficacy of OPEC's production cuts remains in question, as key members like Iraq and the UAE have been reported to produce above their quotas. These factors collectively contribute to the complexity of forecasting oil price movements, as they introduce substantial uncertainty into the market.