Crude Oil Prices Break $80: What's Driving the Surge in WTI and Brent?

Supply Constraints and Geopolitical Tensions Propel Oil Prices to Multi-Month Highs | That's TradingNEWS

Global Oil Prices Surge Amid Mixed Supply and Demand Signals

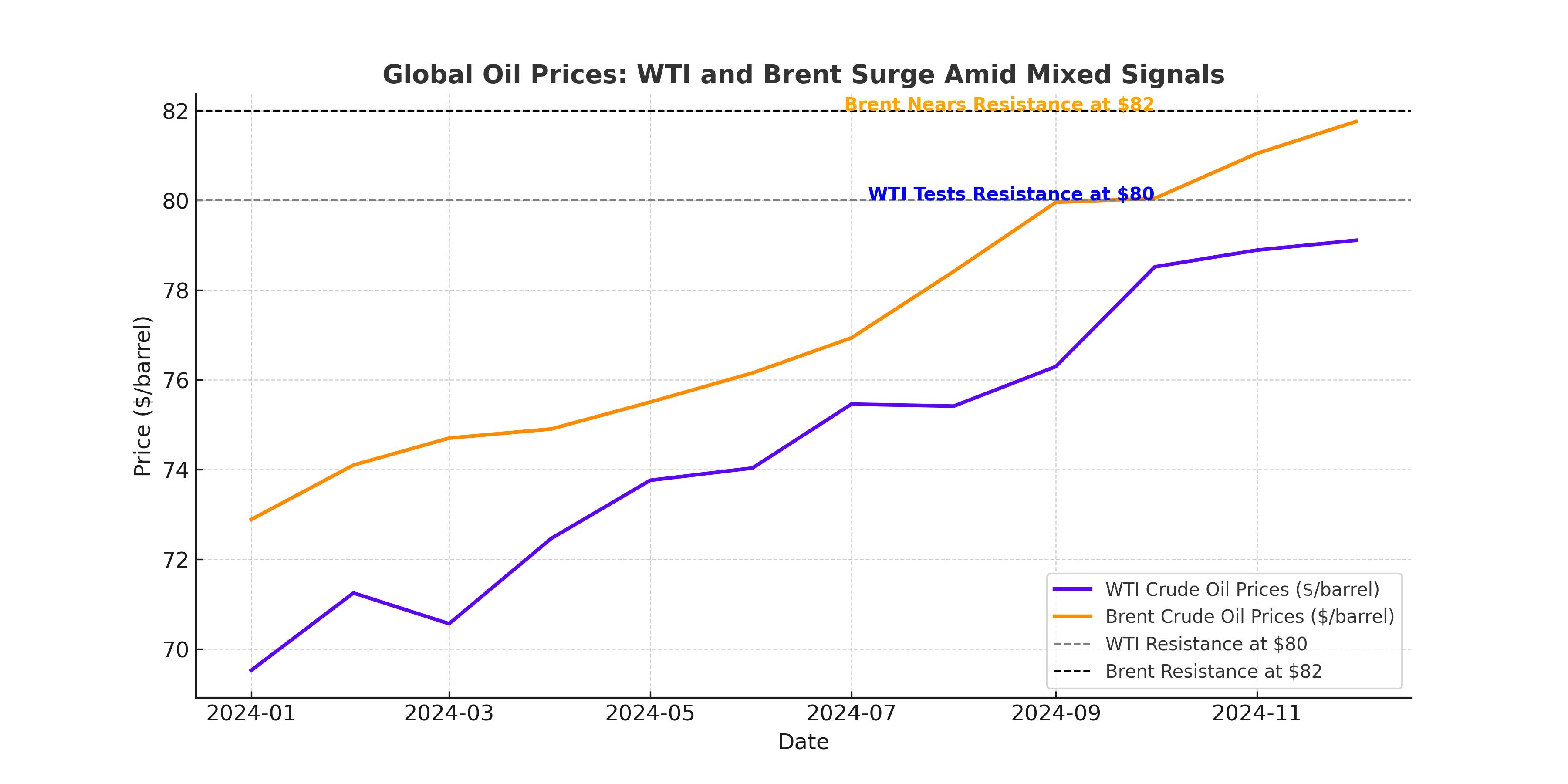

Global oil prices experienced a notable upswing this week as West Texas Intermediate (WTI) crude climbed to $80.04 per barrel, its highest since July, and Brent crude settled at $82.03 per barrel, marking a 2.64% increase. The upward momentum comes in response to significant supply constraints driven by escalating U.S. sanctions on Russian oil exports, a drawdown in U.S. crude inventories, and improving demand in key markets. These developments underscore a complex landscape of supply risks and geopolitical uncertainty, balanced by strengthening demand expectations for 2025.

WTI and Brent Crude Rally Amid Supply Disruptions and Sanctions

WTI (CL=F) gained 3.28% this week, reaching levels not seen since mid-2024, driven by a reported 2 million-barrel inventory draw in the U.S., as noted by the Energy Information Administration (EIA). This drawdown follows the American Petroleum Institute's preliminary estimate of a 2.6-million-barrel reduction, reinforcing a narrative of tightening supply. Similarly, Brent crude (BZ=F) rallied by $2.11, supported by the latest U.S. sanctions targeting Russian oil, including measures affecting shipping logistics and key producers such as Gazprom Neft. These restrictions have hindered Russia’s crude distribution, exacerbating global supply constraints.

Analysts from Saxo Bank highlighted logistical challenges for tankers carrying Russian crude, noting increasing difficulty offloading shipments amid sanctions. The International Energy Agency (IEA) has warned that these disruptions could curtail global oil supply by up to 1 million barrels per day (mb/d) in 2025, creating further upward pressure on prices.

Geopolitical Developments Influence Market Sentiment

The ongoing Israel-Hamas ceasefire negotiations have also shaped market dynamics. While progress on a truce could reduce the immediate risk of Middle Eastern supply disruptions, uncertainty persists. Traders are monitoring the potential ripple effects of these negotiations on broader geopolitical stability and their subsequent impact on energy markets.

U.S. sanctions on Iran further complicate the global oil picture. New restrictions announced in December 2024 target vessels transporting Iranian crude, affecting over 500 kb/d, nearly a third of Iran's exports. This move has already led some operators to reduce engagement with Iranian oil, tightening market supplies. The Biden administration’s policies on both Russian and Iranian oil exports have become focal points for market watchers as the U.S. transitions to a new administration.

Demand Outlook for 2025

Global oil demand is forecast to grow by 1.05 mb/d in 2025, driven by improved economic activity and lower energy prices. Demand in OECD countries has surged due to colder-than-expected weather, with heating degree days significantly above the five-year average. However, growth in non-OECD economies remains mixed. While China showed modest increases in consumption, key markets like Saudi Arabia and Brazil underperformed expectations.

Refinery activity has surged to a five-year high, with global crude runs reaching 84.3 mb/d in December, an increase of 1.2 mb/d month-over-month. The United States led these gains, alongside the Middle East and Africa, as improved margins encouraged higher throughput.

The Impact of Inventory Levels and Non-OPEC Production

Global observed oil inventories increased by 12.2 million barrels in November, driven by higher crude stock levels on land and sea. However, OECD industry stocks fell by 20.1 million barrels to 2,749.2 million, the lowest since August 2022 and 118.3 million barrels below the five-year average. Non-OPEC production is expected to offset some supply risks, with output projected to rise by 1.5 mb/d in 2025, led by the United States, Brazil, and Guyana.

Despite these additions, the market remains cautious about near-term disruptions. Weather-related shut-ins in North America could exacerbate supply constraints, as demonstrated by last winter’s 1.8 mb/d production drop during extreme cold. This year’s weather impacts, though less severe, have already tightened inventories.

Technical and Market Outlook

WTI and Brent prices are testing critical resistance levels. WTI’s recent rally positions it for a potential retest of the $84 level seen in early July, while Brent may push toward $85 if current momentum holds. However, both benchmarks face downside risks from a potential oversupply scenario as projected by the EIA, which estimates Brent and WTI averaging $74 and $70 per barrel in 2025, respectively. These forecasts hinge on assumptions that OPEC+ will relax production cuts and non-OPEC supply growth will remain robust.

Investor Takeaway

Oil markets are at a crossroads, with bullish supply constraints clashing against bearish oversupply forecasts. The trajectory for WTI and Brent will depend heavily on geopolitical developments, U.S. inventory trends, and the pace of demand recovery in key markets. With Brent nearing $82 and WTI above $80, traders must weigh the likelihood of further upside against the risk of a market correction driven by easing supply pressures or unexpected demand shocks.