Crude Oil Prices Dip Below $70 – Is This the Start of a Deeper Selloff?

WTI crude oil (CL=F) at $69.10 and Brent crude (BZ=F) at $73.17 face pressure from rising inventories and weak demand. Can oil bulls hold support, or is a breakdown inevitable? | That's TradingNEWS

Crude Oil (WTI & Brent) Price Analysis: Bearish Pressure Mounts Amid Geopolitical Uncertainty and U.S. Policy Shifts

Crude Oil Struggles Below $70 as Inventory Builds and Demand Concerns Weigh on Prices

Crude oil prices continue to face significant headwinds, with West Texas Intermediate (WTI) (CL=F) trading at $69.10 per barrel and Brent crude (BZ=F) at $73.17 per barrel, both down nearly $3 from last week’s levels. The primary driver of this recent weakness is an unexpected build in U.S. crude inventories, alongside a weaker macroeconomic outlook. The American Petroleum Institute (API) reported a smaller-than-expected inventory draw of 640,000 barrels, far below analysts' expectations of a 2.3-million-barrel decline, further dampening sentiment.

This minor draw does little to offset the 18-million-barrel build seen over the last four weeks, including a 3.3-million-barrel increase in the prior week, suggesting that demand concerns persist. Meanwhile, gasoline inventories rose by 537,000 barrels, reflecting weaker consumption patterns, while distillate stockpiles dropped by 1.109 million barrels, further highlighting mixed signals in the energy market.

Oil Market Faces Pressure from Geopolitical Tensions and U.S. Sanctions on Iran

One of the biggest upside risks to crude oil prices is the ongoing tension between the U.S. and Iran. The Trump administration has intensified sanctions, targeting Iranian crude shipments to China, with over 30 entities and vessels sanctioned for moving petroleum-related products. This has the potential to tighten supply if enforcement becomes stricter.

Iranian crude has been flowing into China through a "shadow fleet" of tankers, many of which operate with their transponders turned off to avoid detection. These aging vessels, often uninsured, create environmental and logistical risks. If the U.S. administration cracks down harder, it could create significant supply disruptions in global oil markets, potentially pushing prices higher.

Adding to the uncertainty, U.S. foreign policy remains a wildcard, with escalating trade tensions between Washington and Beijing raising fears of a prolonged trade war that could weigh on global demand. If China retaliates by imposing tariffs on U.S. crude or reduces imports, it could trigger further downside pressure on oil prices.

U.S. Inventory Trends and Strategic Petroleum Reserve Levels

The U.S. Strategic Petroleum Reserve (SPR) remains at 395.3 million barrels, well below historical levels following the massive drawdowns that occurred under the Biden administration. While the government has slowed its rate of repurchases, the reduced buffer means any unexpected supply disruptions—such as hurricanes, geopolitical conflicts, or refinery outages—could have an outsized impact on prices.

Cushing, Oklahoma, the key delivery hub for WTI contracts, saw inventories decline by 1.182 million barrels, indicating some tightening in supply at the physical market level. However, this is not enough to offset the broader inventory build seen across the U.S.

Economic Data Signals Weakening Demand, Adding to Bearish Sentiment

Oil markets are also contending with weaker economic data from both the U.S. and Europe. U.S. consumer confidence dropped to 98.3 in February, the sharpest decline since August 2021, reflecting growing economic uncertainty. Meanwhile, Germany, the Eurozone’s largest economy, posted another quarter of negative growth, further denting oil demand expectations.

The outlook for oil demand remains fragile, as central banks maintain restrictive monetary policies. The Federal Reserve has indicated that rate cuts are unlikely in the near term, as inflation remains sticky at 3.5% year-over-year. Higher borrowing costs could dampen economic activity, limiting demand for crude oil.

The Potential Impact of a Russia-Ukraine Peace Deal on Oil Prices

One of the biggest unknowns in the oil market is the possibility of a Russia-Ukraine peace deal. Reports suggest that Washington and Kyiv are working on a minerals trade agreement, a potential step toward de-escalation. If such a deal is reached, sanctions on Russian oil could be lifted, allowing more supply to return to global markets and further pressuring prices lower.

At the moment, Russian crude exports remain resilient, with Moscow continuing to find buyers in China, India, and other non-Western markets. However, if sanctions are fully removed, it could flood the market with additional supply, driving Brent and WTI even lower.

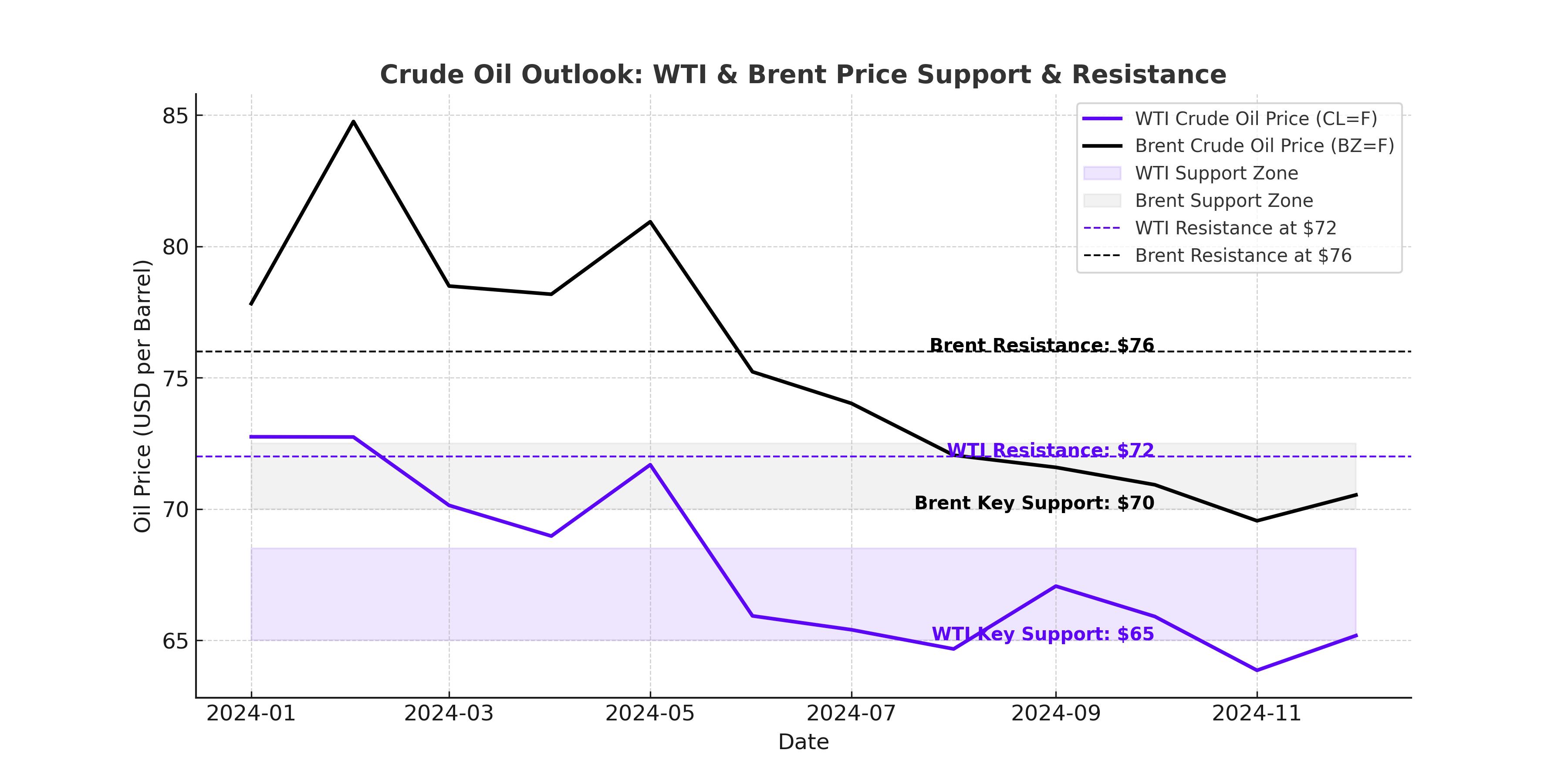

Technical Analysis: Can WTI and Brent Crude Hold Key Support Levels?

From a technical perspective, WTI crude oil is hovering just above critical support at $68.50 per barrel. A decisive break below this level could accelerate losses toward $65.00, a key psychological and technical level. The 200-day moving average at $70.30 remains an important resistance level, with any breakout above it required to restore bullish momentum.

For Brent crude, the next key support is at $72.50 per barrel, with a breakdown below this level potentially exposing $70.00 as the next downside target. The 50-day EMA at $74.80 remains a strong resistance level that bulls need to reclaim to shift the trend upward.

Momentum indicators such as the Relative Strength Index (RSI) remain neutral, sitting around 46 for both benchmarks, indicating neither extreme overbought nor oversold conditions. However, the Moving Average Convergence Divergence (MACD) shows bearish momentum, suggesting further downside risks remain.

Short-Term Oil Price Outlook: Bearish Bias Remains with Volatility Ahead

The crude oil market is currently facing a tug-of-war between bullish supply-side risks (Iran sanctions, OPEC+ cuts) and bearish macroeconomic factors (weak demand, rising inventories, a potential Russia-Ukraine peace deal). While geopolitical risks could provide occasional spikes in price, the overall trend remains bearish, especially if economic data continues to weaken.

The key levels to watch in the coming days:

- WTI Crude (CL=F): Resistance at $70.30, with support at $68.50 and $65.00

- Brent Crude (BZ=F): Resistance at $74.80, with support at $72.50 and $70.00

Investors should be cautious of further downside risks, especially if inventories continue to build and economic data deteriorates. While long-term structural supply constraints may keep oil prices from collapsing, the short-term outlook favors a bearish bias, with WTI likely to trade in the $65-$72 range and Brent fluctuating between $70-$75 per barrel.

If the U.S. tightens sanctions on Iran further or OPEC+ signals deeper production cuts, oil could see a short-term bounce. However, any sustained rally would require stronger demand signals from China and a more dovish stance from the Federal Reserve, neither of which appear imminent.

For now, oil prices remain in a fragile state, with supply-side risks preventing a complete collapse but weak demand keeping a lid on gains. Traders should monitor inventory data, geopolitical developments, and central bank policies closely, as they will dictate the next major move in crude oil markets.