Crude Oil Prices Decline: Is $76.46 WTI a Sign of Further Weakness?

Brent at $79.66 and WTI at $76.46: Are Markets Overreacting to Policy Shifts? | That's TradingNEWS

Crude Oil Price Dynamics: Key Drivers and Market Analysis

WTI Crude (CL=F) and Brent Crude (BZ=F) Facing Volatility Amid Policy Uncertainty

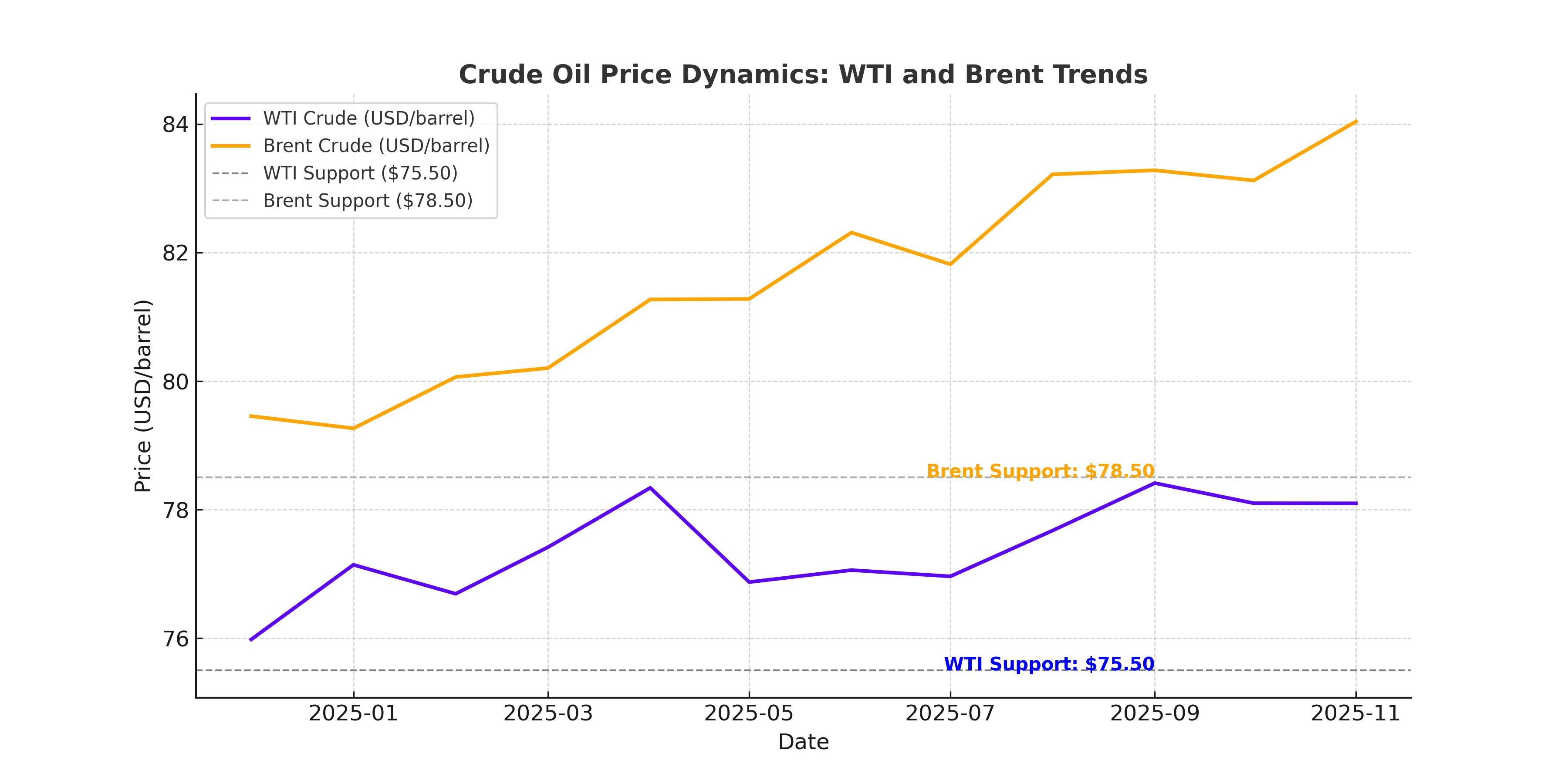

Oil prices exhibited notable declines, with WTI Crude Oil (CL=F) trading down by 1.8% to $76.46 per barrel and Brent Crude (BZ=F) falling 1.5% to $79.66 as traders grappled with policy uncertainty surrounding U.S. President-elect Donald Trump’s administration. Market participants are particularly concerned about the potential for significant changes in energy policies, with Trump signaling increased domestic production and possible tariff adjustments.

The latest figures reflect investor caution. Over the past week, WTI and Brent posted gains of 1.1% and 1.2%, respectively, fueled by sanctions imposed by the Biden administration on over 100 tankers and two Russian oil producers. These sanctions have already reduced Russian exports by nearly 1 million barrels per day, pushing up transportation costs and creating logistical bottlenecks. China and India, two of the largest buyers of Russian oil, have scrambled to secure alternatives, driving up spot demand for non-sanctioned supplies.

Trump's Policy Agenda and Its Implications for Oil Markets

Donald Trump has pledged to issue executive orders aimed at revitalizing U.S. energy production. A proposed declaration of a national energy emergency would focus on expanding U.S. oil and gas output, potentially reducing domestic energy prices. However, analysts warn that ramping up production too aggressively could exacerbate the global supply glut and drive prices lower. Trump’s focus on increasing exports to allies and lifting restrictions on liquefied natural gas (LNG) licensing has been met with both optimism and skepticism from market analysts.

UBS analyst Giovanni Staunovo highlighted the pivotal nature of Trump's forthcoming policy announcements. Staunovo noted that moves to alleviate energy sanctions on Russia in exchange for concessions in the Ukraine conflict could drastically alter market dynamics, potentially offsetting the effects of current restrictions.

Middle East Tensions and the Russia-Ukraine Conflict

Oil prices are also being shaped by geopolitical developments. Easing tensions in the Middle East, marked by a ceasefire between Hamas and Israel, have tempered market fears of supply disruptions. Meanwhile, reports suggest that Trump is considering relaxing sanctions on Russia to facilitate peace talks. Such a move could reintroduce significant volumes of Russian oil into global markets, potentially pushing prices lower.

However, these developments come against a backdrop of increasing Chinese reliance on Russian crude. In 2024, China imported an average of 2.17 million barrels per day from Russia, a 1% year-over-year increase. This growing dependency, coupled with reduced imports from Saudi Arabia, underscores a strategic pivot toward lower-cost suppliers amid rising energy costs.

The Role of U.S. Shale in Market Stabilization

U.S. shale producers, once characterized by aggressive drilling, have adopted a more disciplined approach. This shift is reflected in the industry's capital allocation strategies, with many firms prioritizing shareholder returns through dividends and buybacks over rapid production growth. Analysts at Standard Chartered emphasized that the era of "drill, baby, drill" appears to be over, as producers focus on long-term operational efficiency.

Technological advancements, including multi-pad drilling and extended lateral well completions, have allowed shale operators to optimize output despite a moderated production pace. As of January 2025, the U.S. shale industry accounts for approximately 8.5 million barrels per day of global supply, a figure expected to remain steady as companies navigate volatile market conditions.

China's Strategic Role in the Global Energy Landscape

China's energy policy remains a focal point for global markets. With a reduction in overall crude imports by 1.9% in 2024, the country has diversified its sourcing strategy. Increased reliance on Russian and Iranian crude, facilitated by Malaysia's transshipment operations, highlights China's effort to secure cost-effective supplies amid economic challenges. However, geopolitical risks persist, particularly as the U.S. continues to monitor Chinese-Russian energy ties.

Saudi Arabia's Fiscal Outlook Amid Price Volatility

Saudi Arabia’s fiscal health remains tied to crude prices. Capital Economics projects that the Kingdom's public debt-to-GDP ratio, currently at 29.6%, could rise significantly under bearish price scenarios. If prices were to fall to $55 per barrel by 2030, the debt ratio could reach 50%. A steeper decline to $40 per barrel would push the figure to nearly 90%, raising sovereign risk concerns. Saudi Arabia’s ability to stabilize its finances hinges on maintaining prices above $80 per barrel, aligning with its current production and pricing strategy.

WTI and Brent Outlook: Technical and Fundamental Indicators

Technical indicators show WTI Crude (CL=F) trading below its 50-day moving average of $78.12, with the Relative Strength Index (RSI) signaling bearish momentum at 43. Similarly, Brent Crude (BZ=F) remains under pressure, trading at $79.84, down from a recent high of $83.60. Analysts are closely monitoring these benchmarks as Trump’s policy decisions unfold, with potential implications for global demand and supply equilibrium.

Conclusion: Market Poised for Uncertainty

The oil market faces a confluence of factors, from U.S. policy shifts to Middle Eastern stability and evolving Chinese energy strategies. WTI Crude (CL=F) and Brent Crude (BZ=F) prices will likely remain volatile in the short term, with significant upside or downside risks tied to geopolitical and macroeconomic developments. Investors should prepare for heightened market fluctuations as the global energy landscape continues to evolve in 2025.