Crude Oil Prices Explode Higher Amid Escalating Geopolitics and OPEC+ Strategies

WTI hits $70.17, Brent surges to $74.29—geopolitical shocks, supply fears, and OPEC’s cautious approach fuel a dramatic rally | That's TradingNEWS

Crude Oil Prices Surge Amid Geopolitical Tensions and OPEC+ Decisions

WTI and Brent Rally as Global Tensions Intensify

Crude oil prices rose sharply today, reflecting growing uncertainty in global energy markets. West Texas Intermediate (WTI) climbed 2.07% to $70.17 per barrel, while Brent crude advanced 2.03%, settling at $74.29 per barrel. These gains come amid heightened geopolitical tensions, supply concerns, and mixed demand signals, driving renewed volatility in the market.

Russia-Ukraine Conflict Adds Supply Risks

The ongoing Russia-Ukraine conflict remains a significant driver of crude price movements. Russia’s retaliatory hypersonic missile strikes against Ukraine, following missile attacks by Ukraine using Western-supplied weapons, have raised fears of potential disruptions in energy supply chains. Analysts warn that any escalation targeting Russian energy infrastructure or transportation routes could tighten global oil markets further, with Russia being the second-largest crude exporter globally.

OPEC+ Strategies Shape Market Dynamics

OPEC+, led by Saudi Arabia and Russia, continues to influence oil markets through its supply management strategies. The group recently postponed planned production hikes until 2025, signaling caution amidst lingering demand uncertainties.

Key highlights include:

- Output Decisions: OPEC+ plans to delay restoring 2.2 million barrels per day (bpd) of curtailed production, a sequence originally scheduled for January 2025.

- Market Dependence: OPEC reiterated that production increases would align with market conditions, countering trader fears of oversupply.

- Price Dynamics: While prices hover around $75 per barrel, many OPEC members, particularly Saudi Arabia, require levels closer to $100 to support their fiscal budgets and ambitious economic transformation plans.

U.S. Crude Inventory Surprises and Demand Concerns

Adding to the complexity, the latest Energy Information Administration (EIA) data revealed a surprise build in U.S. crude inventories, rising by 545,000 barrels last week, contrary to analysts’ expectations. Gasoline stocks also increased, reflecting weaker-than-expected consumer demand. These figures introduce caution into bullish outlooks, suggesting potential headwinds for crude prices.

China’s Role in Global Energy Demand

China's recent policy adjustments aimed at boosting trade and energy imports add another layer of complexity. As the world’s largest oil importer, any changes in Chinese demand directly impact global energy prices. However, faltering post-pandemic recovery in key sectors has tempered the country’s demand growth, leaving traders wary of over-optimistic projections.

Natural Gas Developments Add Long-Term Insights

Beyond crude oil, natural gas markets are witnessing transformative projects like BP’s $7 billion investment in Indonesia. This includes integrating carbon capture and storage (CCUS) to recover 3 trillion cubic feet of gas while reducing emissions. These initiatives highlight growing interest in energy sustainability but face challenges of high costs and mixed results in execution.

Record-High Global Oil Demand Supports Prices

Despite these challenges, oil markets remain bolstered by robust global demand. Data from the Joint Organisations Data Initiative (JODI) indicates that oil demand reached an all-time high of 103.79 million barrels per day (mb/d) in August, with September figures maintaining this trend at 103.01 mb/d. Strong growth in regions like South Korea, Italy, and Saudi Arabia underscores the resilience of global consumption, even as growth slows from earlier post-pandemic peaks.

Volatility Expected Amid Mixed Signals

Market sentiment reflects a mix of cautious optimism and nervous anticipation. While the International Energy Agency (IEA) forecasts supply outpacing demand in 2025, near-term pricing is heavily influenced by OPEC+ decisions and geopolitical risks. Brent crude may test the $80 resistance level if supply disruptions materialize, whereas bearish inventory data could push prices below $70.

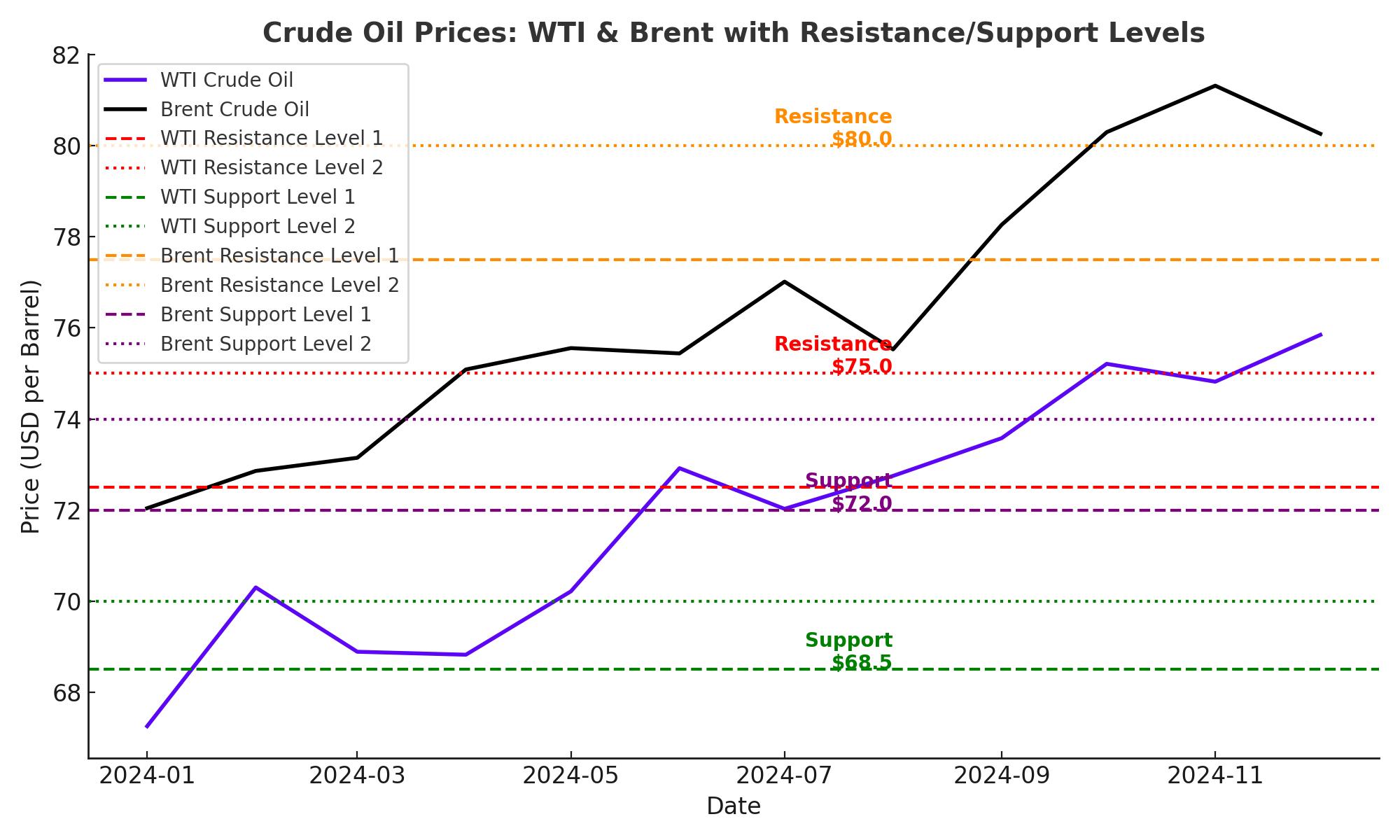

Technical Outlook: Price Levels to Watch

Technically, oil markets face key resistance and support zones:

- WTI Resistance: $72.50 (recent highs) and $75.00 (psychological barrier).

- Brent Resistance: $77.50 (50-day SMA) and $80.00.

- Support Levels: For WTI, immediate support lies at $68.50, while Brent could find stability at $72.00.

Indicators such as the Relative Strength Index (RSI) suggest potential overbought conditions, increasing the likelihood of short-term corrections.

Outlook: Is Oil a Buy, Hold, or Sell?

Given current dynamics, crude oil presents a neutral to bullish case. The rally driven by geopolitical tensions and OPEC+ strategies is likely to persist in the short term, with potential price increases if further supply risks emerge. However, traders should remain cautious of bearish inventory data and slowing global demand growth, which could trigger downward corrections.

Investors may consider WTI and Brent as buy opportunities near support levels, with stop-losses set below $68.00 and $72.00, respectively. Long-term prospects hinge on sustained demand growth and OPEC+’s ability to balance supply without fueling oversupply fears.