Crude Oil Prices Surge on Economic Optimism and Supply Concerns

Analyzing the Impact of Job Market Stability, Inflation Data, and Geopolitical Tensions on Oil Prices | That's TradingNEWS

Crude Prices Edge Higher Amid Economic Optimism and Supply Concerns

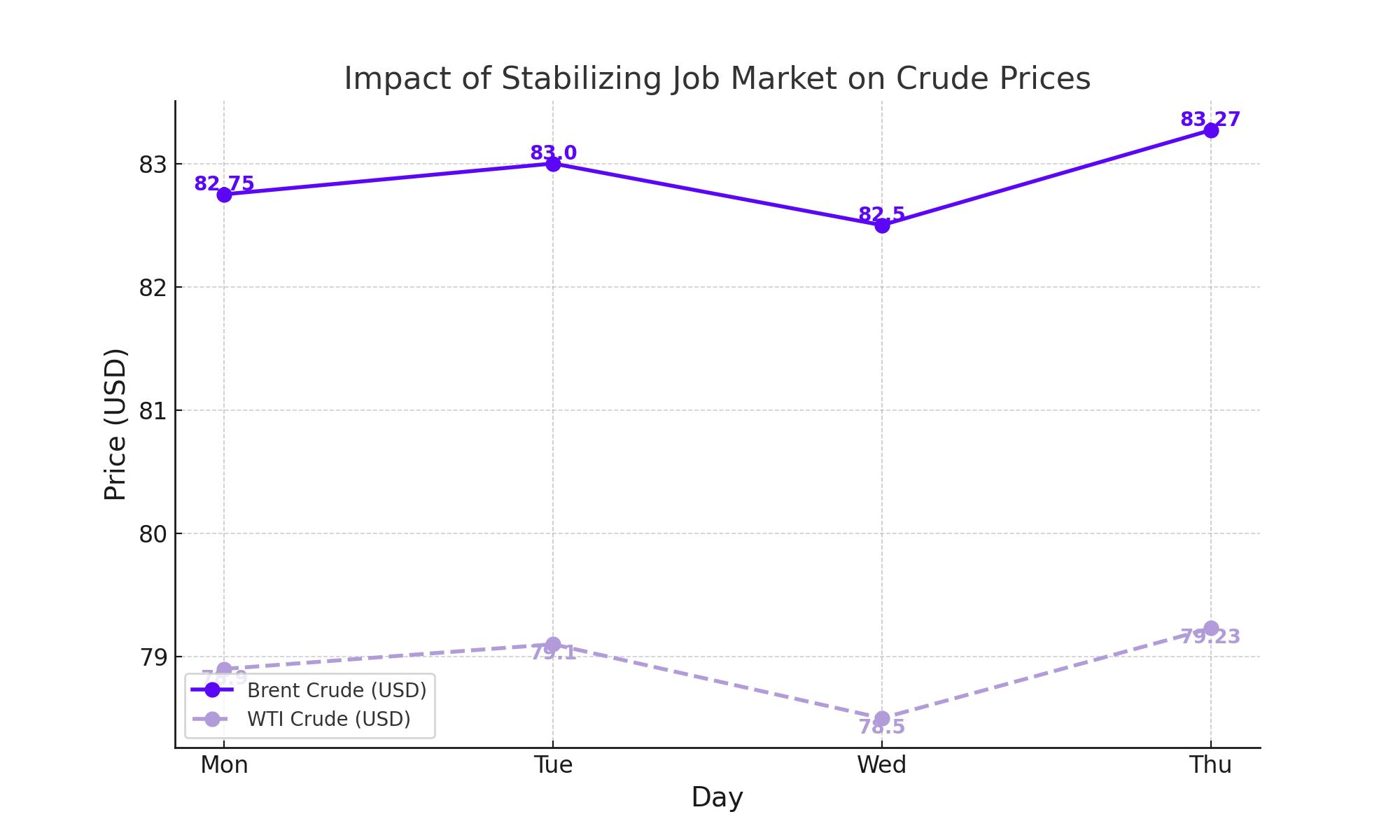

Impact of Stabilizing Job Market on Crude Prices

Crude prices increased on Thursday, buoyed by a stabilizing U.S. job market. The latest data showed a decrease in new unemployment claims, indicating a robust labor market. This has fueled expectations that the Federal Reserve might cut interest rates in autumn, potentially stimulating the economy and boosting oil demand. Brent crude futures settled 52 cents higher at $83.27 per barrel, while U.S. West Texas Intermediate (WTI) rose 60 cents to $79.23 per barrel.

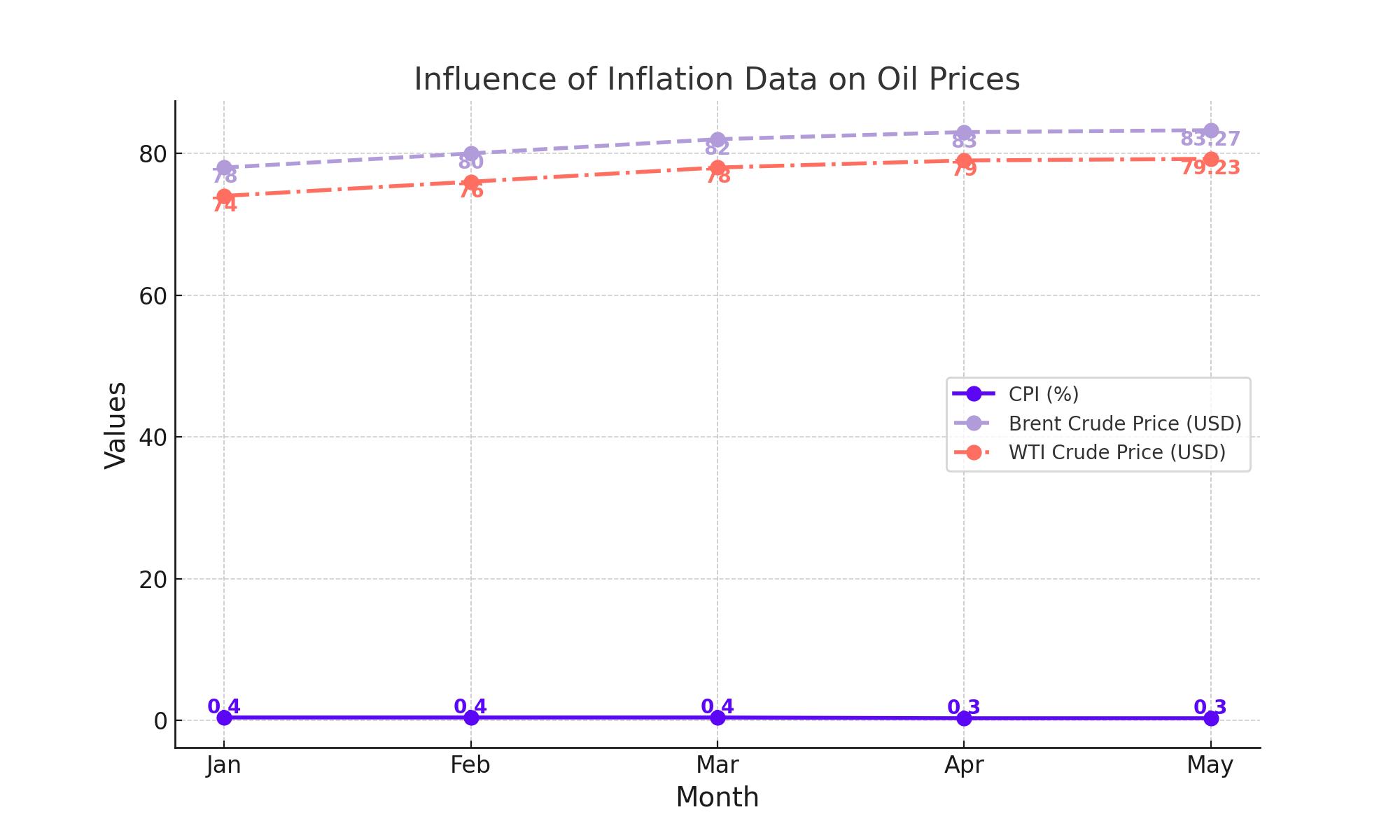

Influence of Inflation Data on Oil Prices

Wednesday's slower-than-expected U.S. inflation data for April further bolstered market expectations of a rate cut by the Federal Reserve in September. This prospect has weakened the dollar, making dollar-denominated oil more affordable for holders of other currencies. This dynamic contributed to the rise in crude prices, with Brent and WTI both experiencing gains.

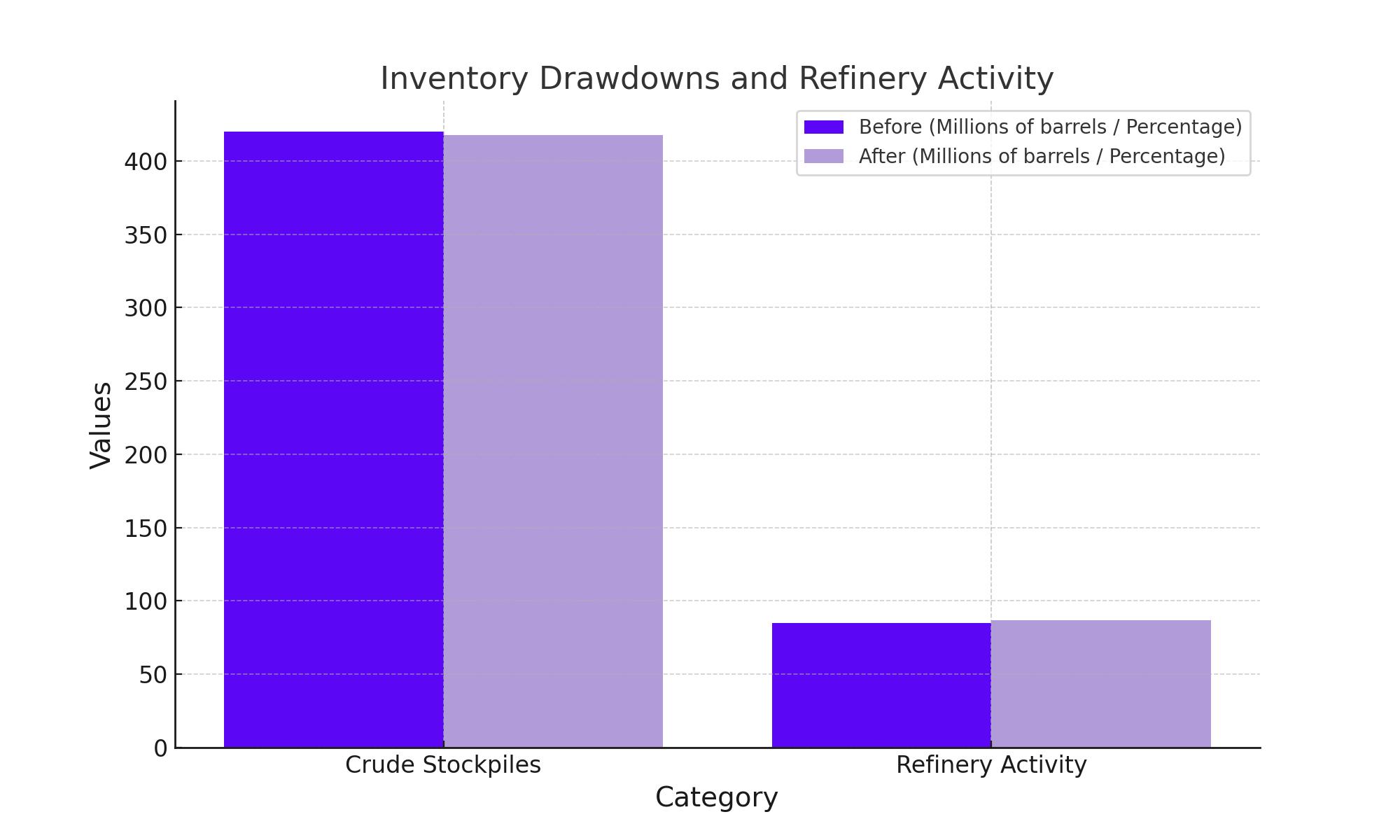

Inventory Drawdowns and Refinery Activity

U.S. crude stockpiles fell by 2.5 million barrels last week, according to the Energy Information Administration. This decline, coupled with increased refinery activity and higher fuel demand, provided additional support for oil prices. Despite this, U.S. gasoline demand remained under 9 million barrels per day for the sixth consecutive week, below typical levels for the summer driving season.

Middle East Tensions and Oil Market Impact

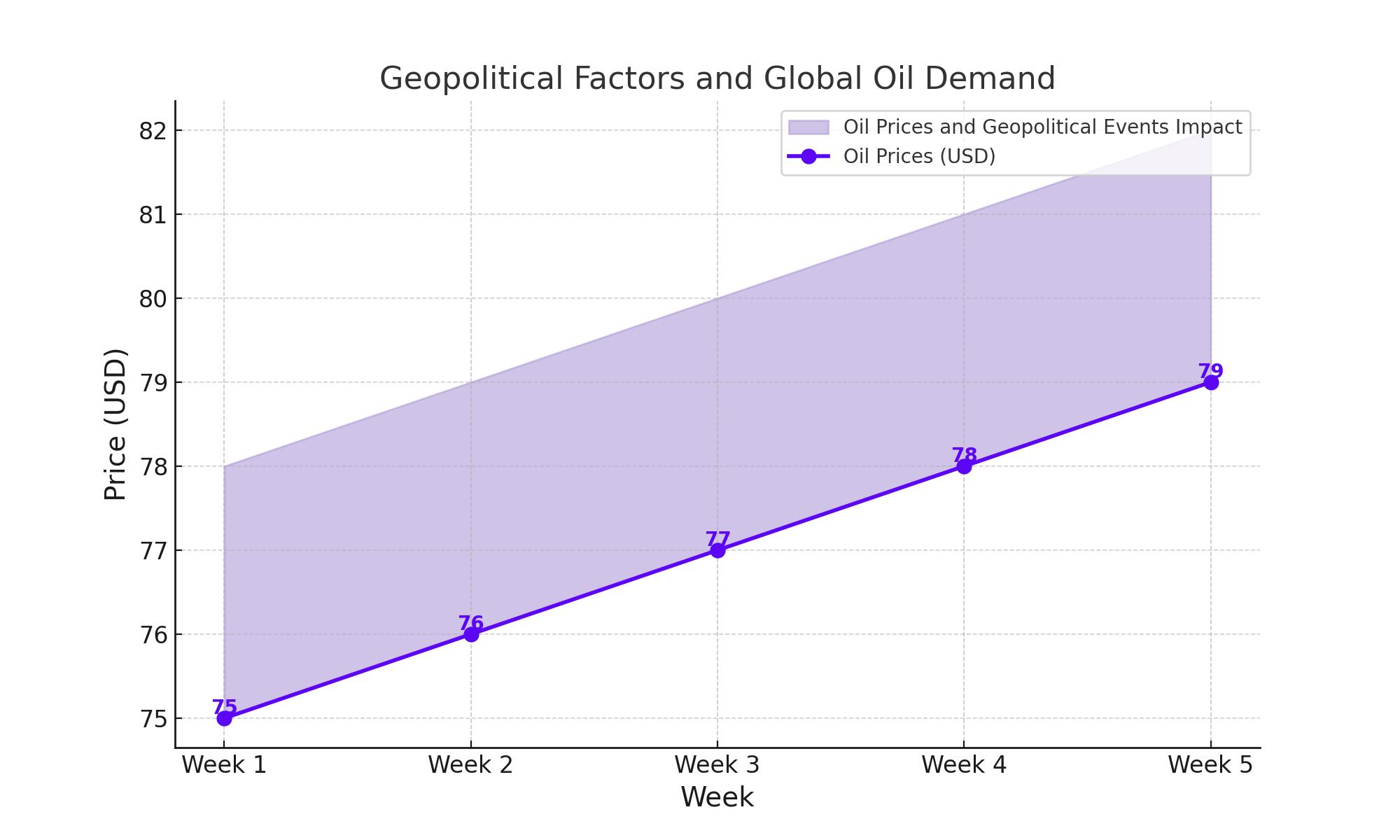

Geopolitical tensions in the Middle East also played a role in the recent price movements. Israeli military actions in Gaza and stalled ceasefire talks have heightened concerns about potential disruptions in oil supply from the region. This uncertainty added to the bullish sentiment in the oil market.

Rising Institutional Interest and Market Dynamics

Institutional interest in the gold market is intensifying, with significant investments from major financial entities like Deutsche Börse and CBOE Global Markets. This trend signals a robust future for gold, driven by macroeconomic factors and geopolitical developments. The spot price of gold recently reached $1,977 per ounce, reflecting strong upward momentum. Increasing participation from institutional investors underscores gold's potential as a safe haven asset amid economic uncertainties.

Bullish Outlook for Gold Prices

Gold prices are benefiting from a combination of economic data, geopolitical shifts, and market sentiment. The recent CPI report showing a drop in inflation from 0.4% to 0.3% has strengthened expectations for Federal Reserve rate cuts, creating a favorable environment for gold. As the market anticipates a potential rate cut by September, gold prices have edged higher, currently trading around $2,345 per ounce with potential to reach new highs. This bullish momentum is further supported by global trade dynamics and increasing demand from countries diversifying away from the US dollar. Gold's position as a leading asset is reinforced by these trends, signaling continued growth and stability in its value.

Geopolitical Factors and Global Oil Demand

Geopolitical developments, particularly in the Middle East, continue to impact global oil prices. Ongoing conflicts and potential supply disruptions contribute to market volatility. Additionally, the shift from a dollar-denominated trade system by countries like China and Russia is influencing demand for gold and oil. This move towards trading in national currencies increases the importance of gold as a reserve asset, supporting its price.

Supply Concerns and Market Reactions

The prospect of tighter global oil supplies due to geopolitical tensions and potential disruptions from wildfires in Canada has also supported oil prices. Official data showed that U.S. oil inventories shrank by a larger-than-expected 2.5 million barrels, boosting hopes for improving demand as the travel-heavy summer season approaches.

Contrasting Demand Outlooks

While tighter supplies have bolstered the market, demand forecasts remain mixed. The International Energy Agency (IEA) recently cut its demand outlook for 2024 by 140,000 barrels per day, contrasting with OPEC's forecast of 2.25 million barrels per day. These differing perspectives highlight the uncertainties in the global oil market.

Asian Refiners and Diversification Trends

Asian refiners are diversifying their oil sources, reducing intake from the Middle East in favor of U.S. and Brazilian crude. This shift is driven by rising Saudi oil prices and shrinking margins. Despite this diversification, Saudi Arabia remains the top supplier to Asia. However, continued high prices from OPEC+ could further drive refiners towards alternative sources, influencing global oil trade patterns.

Conclusion

Crude prices are influenced by a complex interplay of economic data, geopolitical tensions, and market dynamics. The recent stabilization in the U.S. job market, coupled with lower inflation and expectations of Federal Reserve rate cuts, has created a bullish environment for both oil and gold. Institutional interest and geopolitical factors further support the positive outlook for these commodities. As global economic conditions evolve, these trends are likely to shape the future of the energy and precious metals markets.

That's TradingNEWS

Read More

-

XSMO ETF Price Around $80 as Small-Cap Momentum Starts to Lead in 2026

21.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF inflows stay positive while price struggles below the $1.50 ceiling

21.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Rebound Toward $3.14 on Cold Snap and LNG Export Strength

21.02.2026 · TradingNEWS ArchiveCommodities

-

GBP/USD Price Forecast - Pound Clings to 1.34–1.35 Zone After Supreme Court Tariff Shock

21.02.2026 · TradingNEWS ArchiveForex