Cloud Infrastructure Leadership and Strategic AI Partnerships

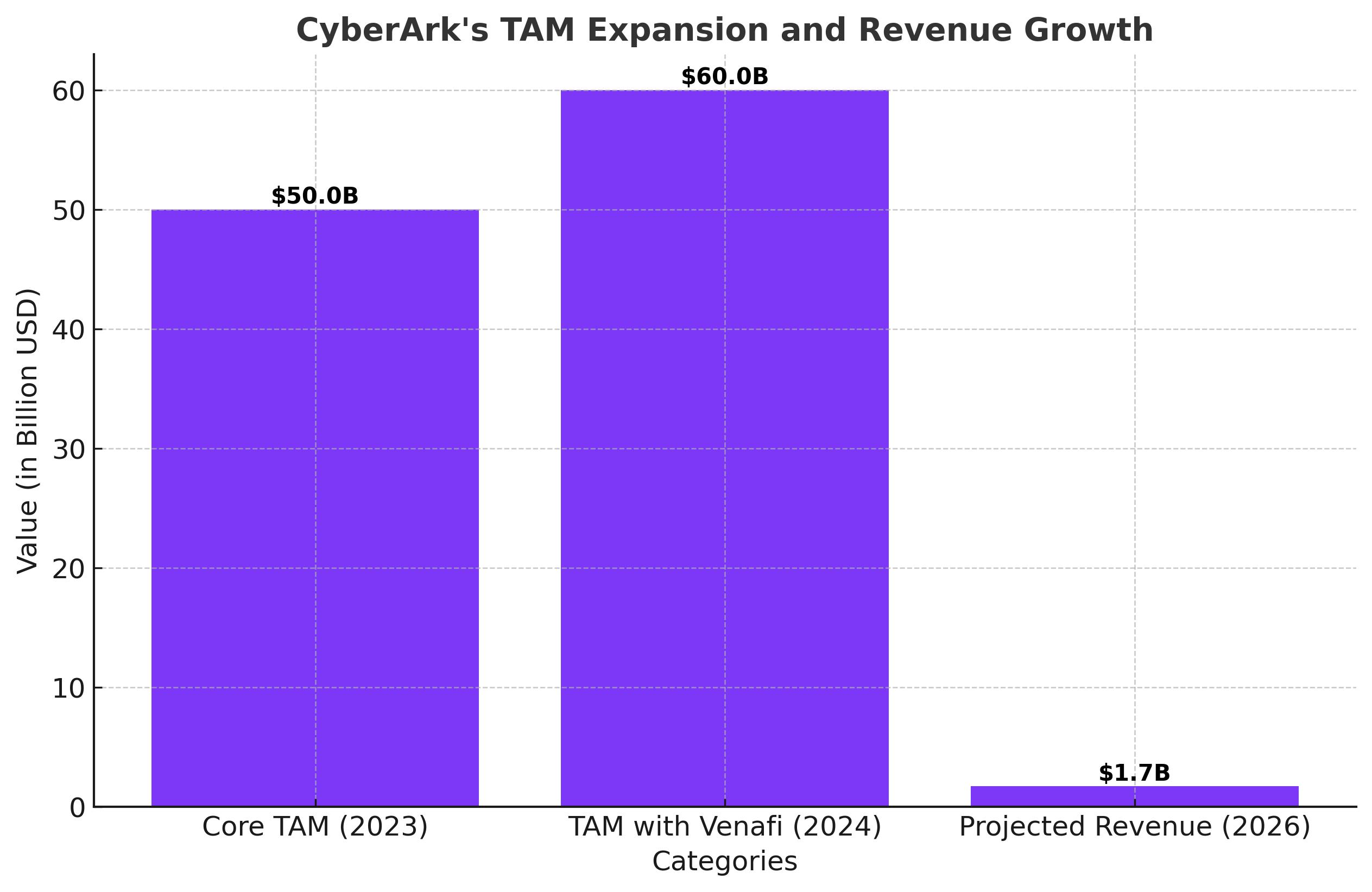

CyberArk Software Ltd. (NASDAQ:CYBR) has firmly positioned itself as a leader in Privileged Access Management (PAM), capitalizing on a rapidly expanding addressable market. Currently trading at $166.73, CYBR has an upward trajectory, supported by its ability to target a $50 billion core market, which has expanded to $60 billion following its $1.5 billion acquisition of Venafi. This strategic move highlights CYBR’s ambition to secure not just human identities but also machine identities, which are increasingly critical in AI-driven workflows.

The company’s Venafi acquisition strengthens its dominance in the identity security space by integrating machine identity protection with its established portfolio. Venafi’s recurring revenue of $150 million provides a solid financial base, and CYBR’s global sales infrastructure can scale this revenue further. Notably, CYBR plans to leverage its network of 200 quota-carrying representatives to sell Venafi’s offerings internationally, potentially boosting growth beyond Venafi’s historically US-focused market.

Venafi’s immediate financial impact is evident as the pipeline for Q4 2024 is already robust. CYBR’s strategic decision to incorporate Venafi into its broader sales ecosystem illustrates its commitment to capturing new revenue streams. With AI infrastructure investments projected to grow at a compound annual rate of over 20% through 2030, CYBR’s integrated solutions make it a compelling partner for enterprises managing both human and machine identity security challenges.

Massive Total Addressable Market and Cross-Selling Potential

CyberArk’s ability to target a massive total addressable market (TAM) is a key driver of its 30% growth projection. Its $50 billion TAM for identity security solutions reflects the increasing importance of cybersecurity in a world transitioning to remote and hybrid work models. CYBR’s core offering addresses critical needs across identity management, cloud security, and endpoint privilege management. With Venafi adding an incremental $10 billion to its TAM, CYBR is well-positioned to dominate the $60 billion identity security market.

Cross-selling opportunities within CYBR’s 10,300-strong customer base add another layer of growth. Currently, only 375 customers contribute over $500,000 in annual recurring revenue (ARR), while more than 8,500 customers generate less than $100,000 ARR. This discrepancy underscores the untapped potential for CYBR to increase its ARR per customer. Products like Endpoint Privilege Manager (EPAM), which recently achieved FedRAMP High authorization, are only 20% penetrated within CYBR’s customer base. By expanding adoption of such solutions, CYBR can drive substantial revenue growth.

The Venafi acquisition further amplifies cross-selling opportunities. CYBR’s broader distribution network can introduce Venafi’s machine identity security products to a global audience. This aligns with CYBR’s long-term vision of becoming the go-to provider for identity security solutions across diverse industries.

US Treasury Hack: A Competitive Opportunity for CYBR

Recent cybersecurity incidents, such as the US Treasury Department hack attributed to Chinese state-sponsored actors, underscore the critical importance of robust PAM solutions. In this instance, hackers bypassed BeyondTrust, a competitor of CYBR, to access sensitive government data. This breach has shaken confidence in BeyondTrust’s offerings, creating a potential opening for CYBR to capture disgruntled customers.

CYBR’s reputation as a leader in the PAM space, validated by Gartner’s Magic Quadrant, positions it to capitalize on this opportunity. Enterprises prioritizing cybersecurity will likely reassess their existing contracts and explore alternatives, placing CYBR in a favorable position to expand its market share.

Valuation and Growth Projections

CYBR’s valuation metrics suggest substantial upside potential. Trading at a forward revenue multiple of 12x, CYBR is attractively valued compared to peers like CrowdStrike (CRWD) and Palo Alto Networks (PANW), which trade at 18x and 11.65x, respectively. With CYBR projected to grow revenue by 30% annually, the stock’s current valuation appears conservative.

Management’s guidance for FY2024 indicates revenue growth of 32% at the high end, setting the stage for CYBR to achieve $1.7 billion in revenue by FY2026. Based on these projections and assuming its current valuation multiple holds, CYBR is expected to reach a price target of $425 by 2026. The company’s robust cash flow generation, exceeding $200 million annually, further supports this optimistic outlook.

Navigating Competitive Risks

While CYBR’s growth prospects are compelling, the company operates in a highly competitive landscape dominated by industry giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These competitors are ramping up their AI and multi-cloud security offerings, which could pressure CYBR to innovate continuously or adjust its pricing strategies.

Another potential risk is the possibility of a cybersecurity breach within CYBR’s solutions. Such an event could severely impact its reputation and customer confidence, as evidenced by the market reaction to similar incidents involving competitors. To mitigate this risk, CYBR has consistently invested in R&D to ensure its solutions remain cutting-edge.

Real-Time Stock Performance and Investment Outlook

As of the latest session, CYBR is trading at $166.73. Investors can monitor real-time price movements and key metrics via CyberArk’s stock profile.

CyberArk’s strategic pivot toward securing machine identities, coupled with its robust financial performance and undervaluation relative to peers, positions it as a strong contender in the cybersecurity market. With a price target of $389 by YE2025, supported by consistent revenue growth and improving margins, CYBR represents a compelling investment opportunity for those seeking exposure to the rapidly evolving cybersecurity sector.