Divergent Views on Pound to Euro (GBP/EUR) Exchange Rate

Analyzing ING’s Bearish Outlook and MUFG’s Bullish Prediction for GBP/EUR, and the Broader Economic Implications | That's TradingNEWS

Pound to Euro (GBP/EUR) Exchange Rate Outlook: Divergent Views on Future Movements

ING's Bearish Outlook

ING projects that the Pound to Euro exchange rate (GBP/EUR) will weaken to 1.1365 over the next 12 months. This forecast is grounded in the broader economic context and recent political developments in Europe. The Bank of England (BoE) recently held interest rates steady at 5.25%, aligning with consensus expectations. However, there is considerable division within the BoE's Monetary Policy Committee (MPC), indicating differing views on inflation and deflation trends.

MUFG's Bullish Prediction

Contrary to ING, MUFG forecasts a more optimistic future for the GBP/EUR pair, expecting gains to at least 1.1975. This divergence in predictions underscores the complexity and uncertainty in the current economic landscape. Recent political stability in France, coupled with Labour's strong lead in UK opinion polls, has provided some support for the Pound. However, the overall UK economic outlook remains slightly negative.

BoE's Interest Rate Decision and Internal Divisions

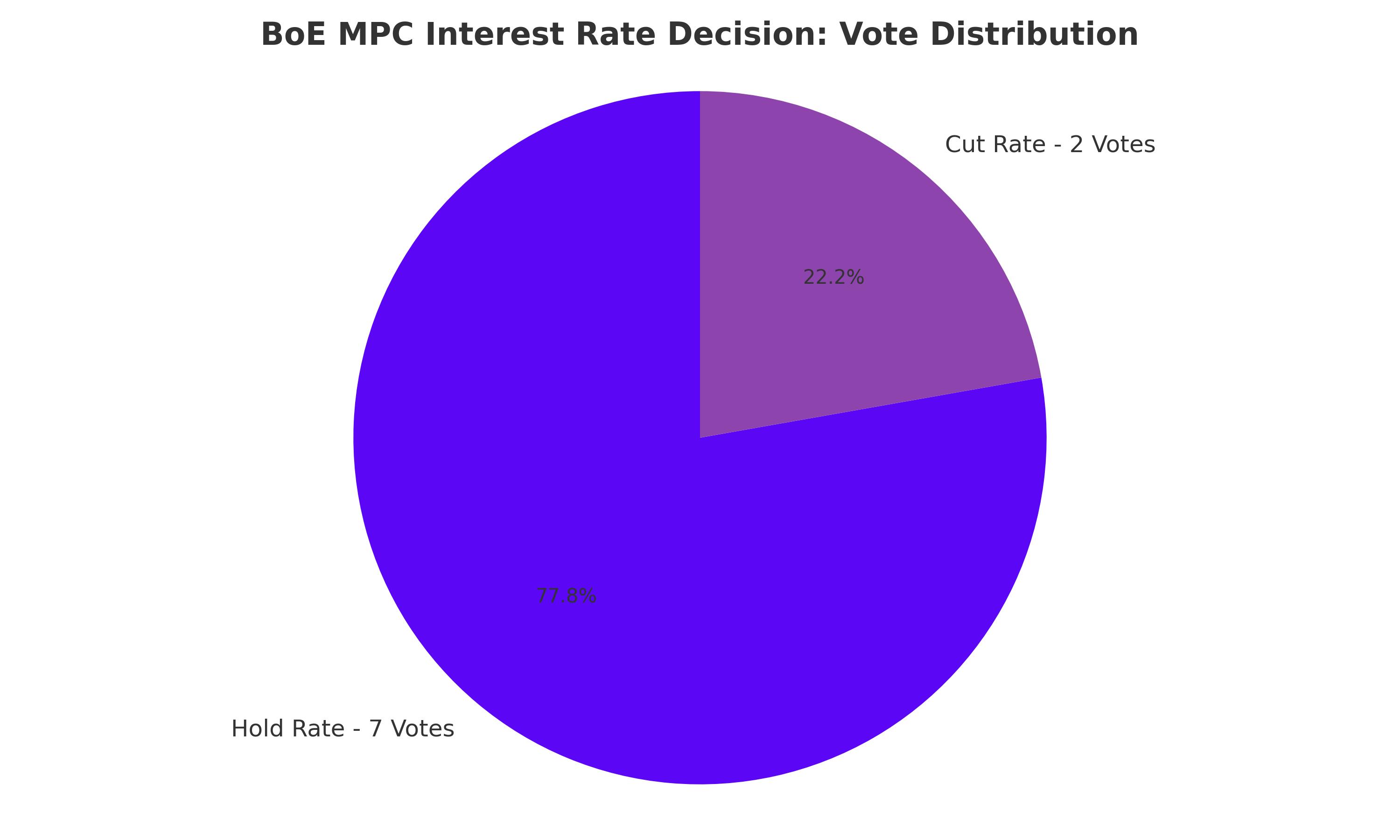

The BoE's decision to maintain interest rates at 5.25% came with a 7-2 vote. Members Dhingra and Ramsden voted for a 25 basis point cut, highlighting internal divisions. Notably, some members are more confident in the deflationary trends, suggesting that the decision was finely balanced. This division within the BoE signals a potential rate cut in the near future, which ING believes could occur in August if the next inflation report does not contain any negative surprises.

Market Expectations and Political Influences

Market expectations have priced in at least a 60% chance of an August rate cut. ING suggests that post-election speeches by key BoE officials could further firm up expectations for a summer rate cut. However, lower yields could undermine the Pound. MUFG notes that an earlier BoE rate cut in August alone is unlikely to reverse the Pound's outperformance this year. The BoE would need to signal a willingness to cut rates more quickly and deeply to significantly impact the currency.

Economic and Political Risks in Europe

Economic developments and political risks in Europe continue to influence the GBP/EUR exchange rate. Although immediate concerns have slightly eased, markets remain nervous ahead of the French parliamentary elections. ING expects European politics to provide near-term support for the Pound, especially given the weaker-than-expected Euro-Zone PMI data, which raises doubts about the potential for a Euro-Zone economic recovery.

Euro to Dollar (EUR/USD) Exchange Rate: Navigating Economic Uncertainties

Impact of French Political Concerns

The EUR/USD exchange rate recently dipped to 6-week lows below 1.0700 due to French political concerns, before recovering to 1.0720. Danske Bank highlights the downside risks for both the Euro and the Dollar in the near term but points to underlying fundamentals that favor the Dollar in the second half of 2024.

ECB and Fed Policy Expectations

Both the European Central Bank (ECB) and the Federal Reserve (Fed) are expected to be data-dependent in their policy decisions. Danske Bank anticipates further ECB rate cuts in September and December, while the Fed is expected to cut rates in September, with a possibility of an earlier move in July. This anticipated divergence in monetary policy is likely to support the Dollar over the Euro.

Market Sensitivity to Political Headlines

Danske Bank notes that markets will remain sensitive to headlines surrounding the French parliamentary elections. A victory for Macron would likely be positive for the Euro, while a win for the National Rally could hurt the currency.

US Dollar Dynamics and Broader Economic Indicators

Volatility in USD/CAD

The US Dollar has experienced significant volatility against the Canadian Dollar, influenced by stronger-than-expected PMI numbers in the US. This volatility is likely to continue, driven by interest rate differentials and broader economic indicators.

Bitcoin's Market Dynamics

Bitcoin's price has shown considerable volatility, initially attempting to rally to $67,000 before retreating. The price has been supported by a major level at $60,000, which remains a critical support level. Institutional interest in Bitcoin continues to rise, adding a layer of stability to the market.

WTI Crude Oil Trends

The West Texas Intermediate (WTI) Crude Oil market has rallied significantly, breaking above the crucial $80 level. This breakout suggests potential for further gains, with buyers likely to step in on any short-term pullbacks.

European Market Insights

The DAX index has stabilized after a significant selloff, with a potential for recovery if the market breaks above the €18,250 level. Meanwhile, the EUR/USD pair continues to struggle, reflecting broader economic uncertainties in the Euro-Zone.

Conclusion

Overall, the foreign exchange and broader financial markets are navigating a complex landscape marked by political risks, economic uncertainties, and divergent central bank policies. Investors should closely monitor upcoming economic data and central bank communications to navigate these volatile markets effectively. The ongoing developments will likely continue to shape market sentiment and drive currency movements in the coming months.