Domino's Pizza Slicing Through Market Volatility NYSE:DPZ

An in-depth look at Domino's Pizza Inc.'s robust financial performance, innovative growth strategies, and the future outlook in the competitive fast-food industry landscape | That's TradingNEWS

Unwrapping Domino's Pizza's Robust Market Strategy and Financial Fortitude

The Financial Landscape of NYSE:DPZ

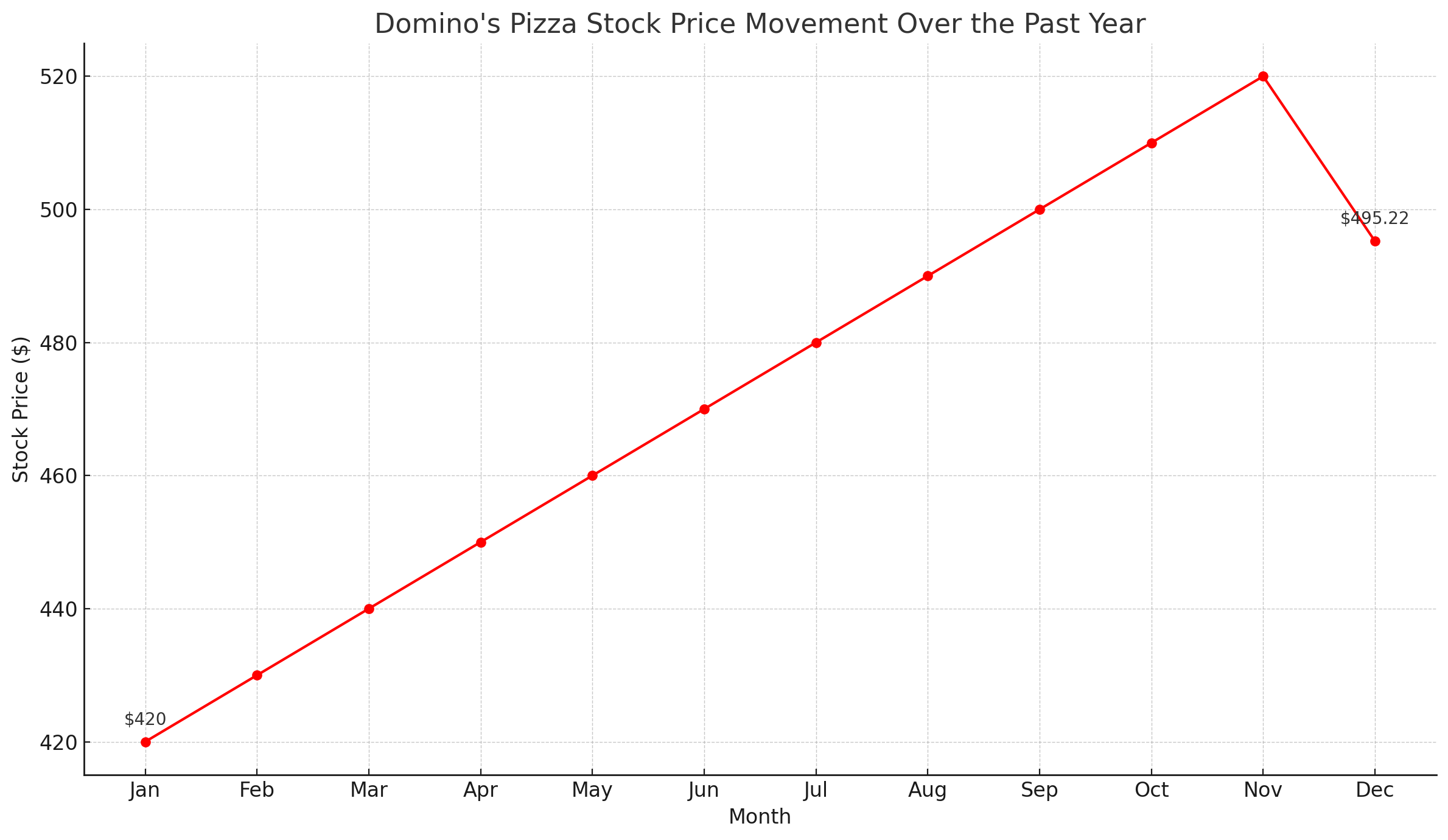

Domino's Pizza, Inc. stands as a colossus in the fast-food industry, with its stock performance and financial metrics painting a picture of resilience and strategic acumen. The company's recent trading price of $495.22, a slight dip from the previous close of $501.98, mirrors the ebbs and flows typical of the market yet underscores a broader narrative of growth and stability. With a market capitalization of $17.255 billion and a PE ratio of 33.77, Domino's showcases robust investor confidence, buoyed by a solid earnings per share (EPS) of 14.67. As we dissect Domino's fiscal journey, the story that unfolds is one of strategic triumphs and calculated maneuvers aimed at maintaining its dominance in a competitive arena.

Strategic Expansion and Performance Metrics

In an industry where dynamism and adaptability are crucial, Domino's has managed to not only navigate but also capitalize on market opportunities. The anticipated earnings date around April 29, 2024, is poised to offer insights into the company's continued financial health. Domino's strategic foresight is further evidenced by its forward dividend and yield of 6.04 (1.23%), reflecting a commitment to shareholder value. The company's stock has experienced a commendable 52-week range, showcasing its ability to reach new heights while navigating market uncertainties.

Revenue and Earnings Outlook

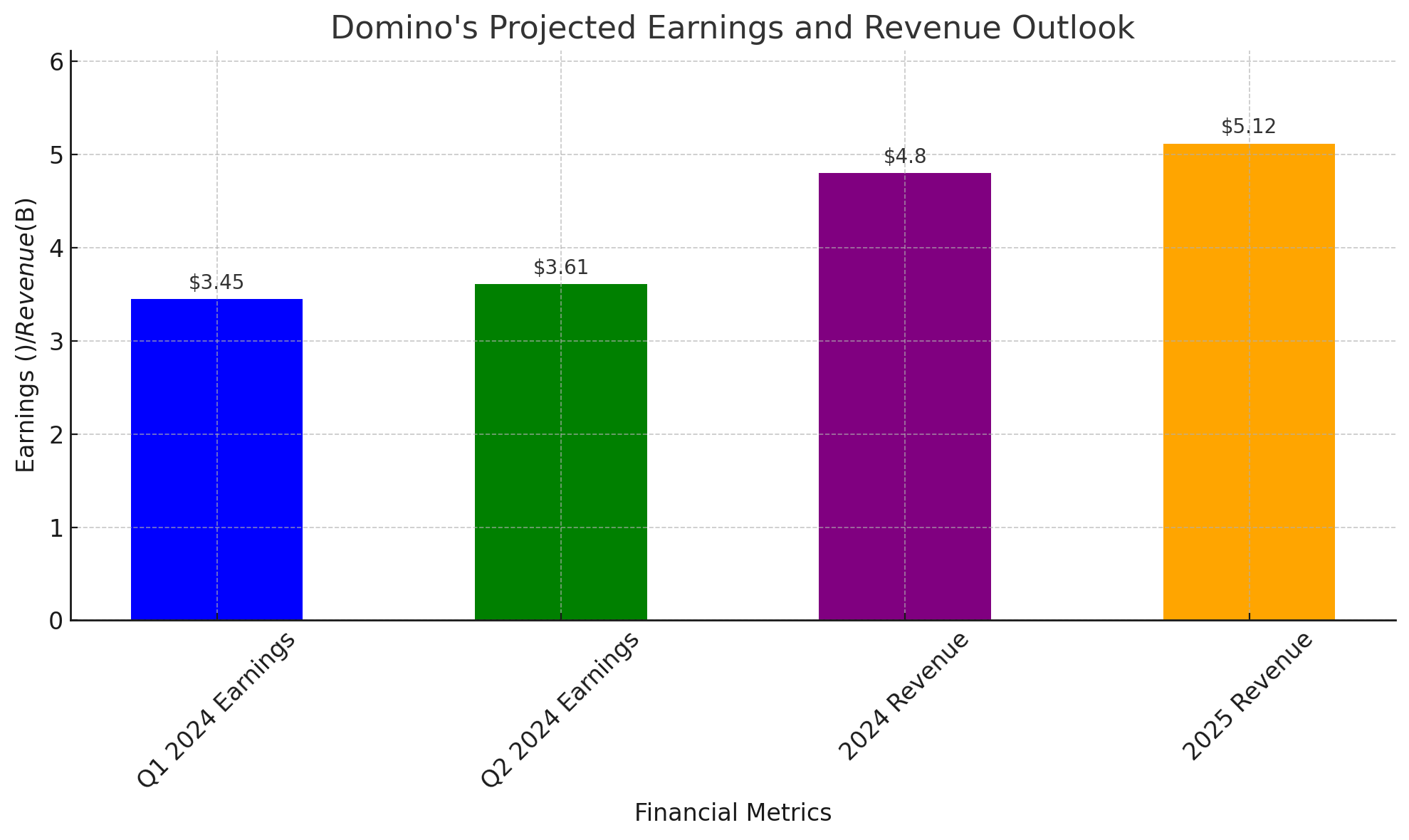

A closer examination of Domino's financial outlook reveals a company on the ascent. With analysts setting a 1-year target estimate at $495.78, there's a palpable sense of optimism surrounding its stock. The projected earnings and revenue estimates for the coming quarters highlight a trajectory of growth, with an emphasis on expanding its market share and solidifying its financial foundation.

-

Q1 and Q2 Forecasts: The average earnings estimates for Q1 and Q2 of 2024 suggest incremental growth, with figures standing at $3.45 and $3.61 respectively. This upward trend is mirrored in revenue projections, indicating a strategic focus on bolstering its financial health.

-

Annual Projections: The current year (2024) and the next (2025) promise notable advancements, with earnings estimates pegged at $15.78 for 2024 and an optimistic $17.74 for 2025. Revenue forecasts align with this growth narrative, expected to reach $4.8 billion in 2024 and $5.12 billion in 2025.

Insider Transactions: A Vote of Confidence

The linkage between insider transactions and investor sentiment cannot be overstated. With detailed insights available at Trading News, a pattern of strategic stock movements by insiders provides a window into the confidence levels among Domino's leadership. Such transactions are pivotal in understanding the internal perspectives on the company's future trajectory.

Navigating Market Challenges: The Domino's Approach

In the face of fluctuating market conditions and evolving consumer preferences, Domino's has exhibited a remarkable ability to adapt and thrive. The company's agile response to market demands, coupled with strategic investments in technology and delivery services, underscores its proactive approach to sustaining growth. As Domino's continues to expand its global footprint, the strategic emphasis on innovation and customer satisfaction remains central to its business model.

Concluding Insights

As we unwrap the layers of Domino's Pizza's operational and financial strategy, the essence of its market resilience and strategic foresight comes to the forefront. The company's robust financial health, combined with a clear trajectory of growth, positions it as a formidable player in the fast-food industry. With a keen eye on expanding its market share and enhancing shareholder value, Domino's Pizza is poised to not only navigate the currents of market volatility but also to seize opportunities for sustained growth.

For a real-time analysis and deeper insights into Domino's stock performance, interested stakeholders are encouraged to explore the real-time chart on Trading News, offering a comprehensive view of its market dynamics. As Domino's marches towards its next earnings announcement, the anticipation among investors and analysts alike is palpable, signaling yet another chapter in its storied financial journey.

That's TradingNEWS

Read More

-

SCHD ETF: 3.8% Dividend Yield, $27.93 Price And A 2026 Rotation Opportunity

05.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Boom: XRPI at $13.45 and XRPR at $19.18 Ride $1.3B Institutional Inflows

05.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Drops to $3.47 as NG=F Tests the $3.00 Support Zone

05.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: 157 Spike Fades as BoJ Hawkish Path Puts 150–140 Back on the Radar

05.01.2026 · TradingNEWS ArchiveForex