East West Bancorp’s Strategic Positioning Amid Economic Shifts

Unveiling the financial resilience, operational strengths, and strategic foresight of East West Bancorp, Inc. (EWBC) in a dynamically evolving banking landscape | That's TradingNEWS

East West Bancorp, Inc. (NASDAQ:EWBC): A Financial Analysis in the Wake of Market Changes

East West Bancorp, Inc. (NASDAQ:EWBC), a leading financial services provider, has shown a commendable performance over the recent fiscal quarters, juxtaposed against a backdrop of economic shifts and the aftermath of the Silicon Valley Bank collapse. This detailed analysis explores the bank's operational excellence, market performance, and strategic positioning, offering insights into its future trajectory.

Market Performance and Strategic Financial Outlook

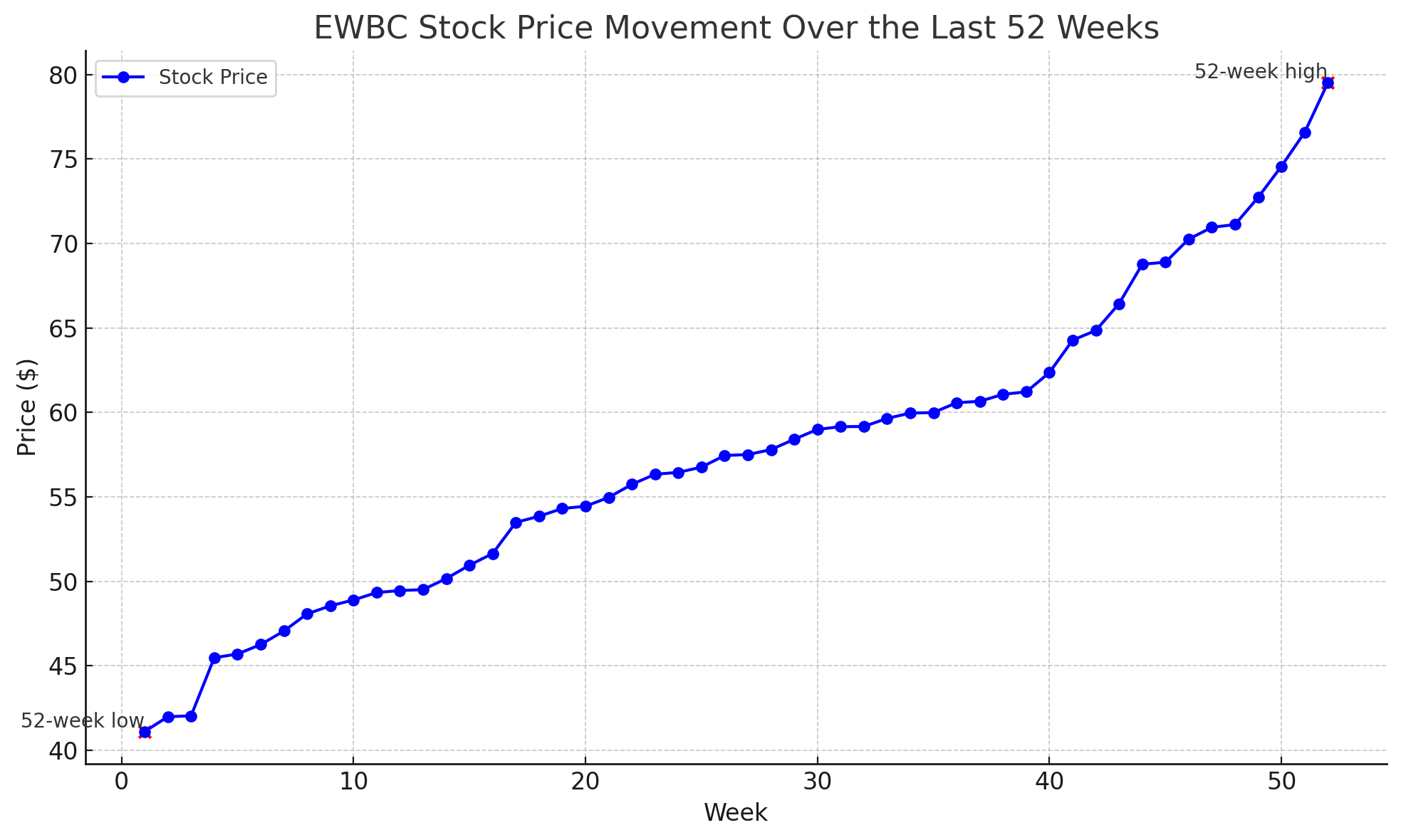

As of the close of the market on March 28, EWBC's shares stood at $79.11, reflecting a slight decrease of 0.18%. Despite this minor fluctuation, the bank's shares have reached a 52-week high of $79.51, showcasing substantial growth from a low of $41.12. This growth trajectory is underpinned by a robust market cap of $11.078B and a price-to-earnings (P/E) ratio of 9.67, indicating investor confidence in its earnings potential.

Visit EWBC's real-time chart for up-to-date stock information.

Operational Excellence and Financial Health

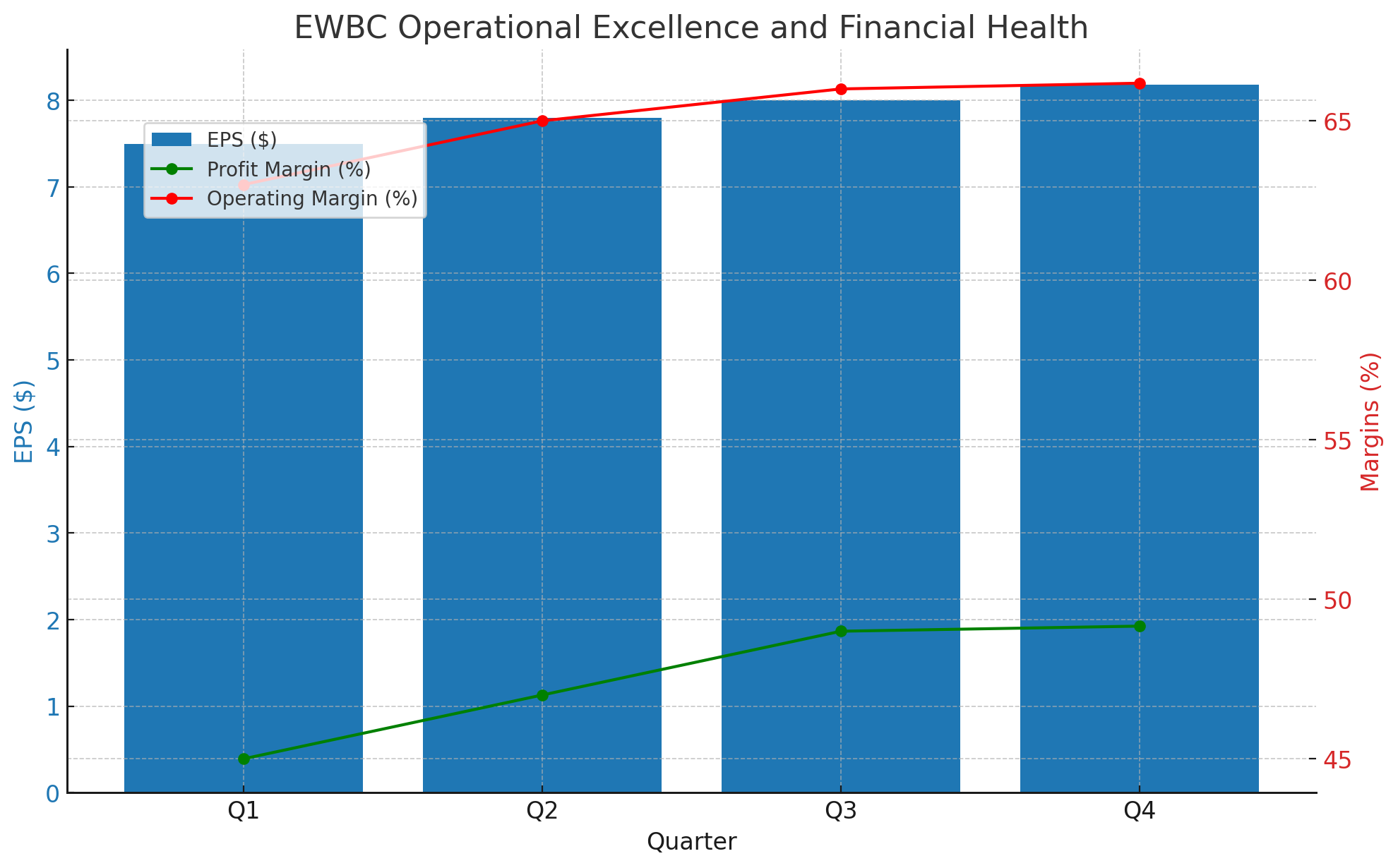

EWBC's operational metrics depict a healthy financial landscape. The bank reported earnings per share (EPS) of $8.18 for the trailing twelve months (TTM), with a forward dividend yield of 2.78%, signaling strong profitability and shareholder returns. Moreover, its profit margin stands at an impressive 49.16%, significantly bolstered by an operating margin of 66.18%.

Insider Transactions and Institutional Holdings

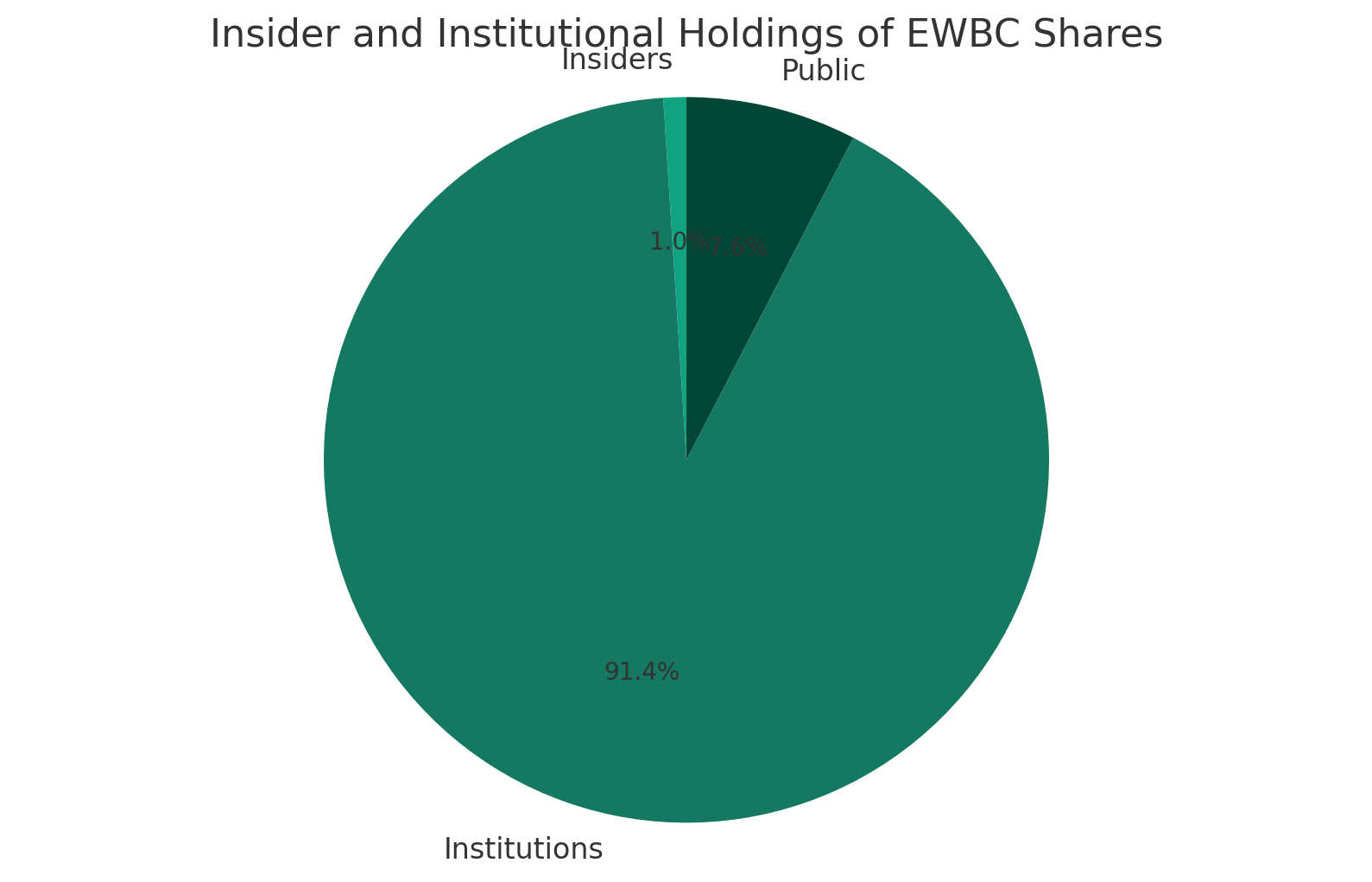

Insider activity and institutional holdings offer a window into the confidence levels of those closest to the company's operations. With insiders holding 1.02% and institutions holding a substantial 91.37% of EWBC's shares, the alignment between the bank's management and its largest shareholders is evident.

For detailed insider transaction information, visit EWBC's stock profile.

Analyzing the Silicon Valley Bank Collapse's Impact

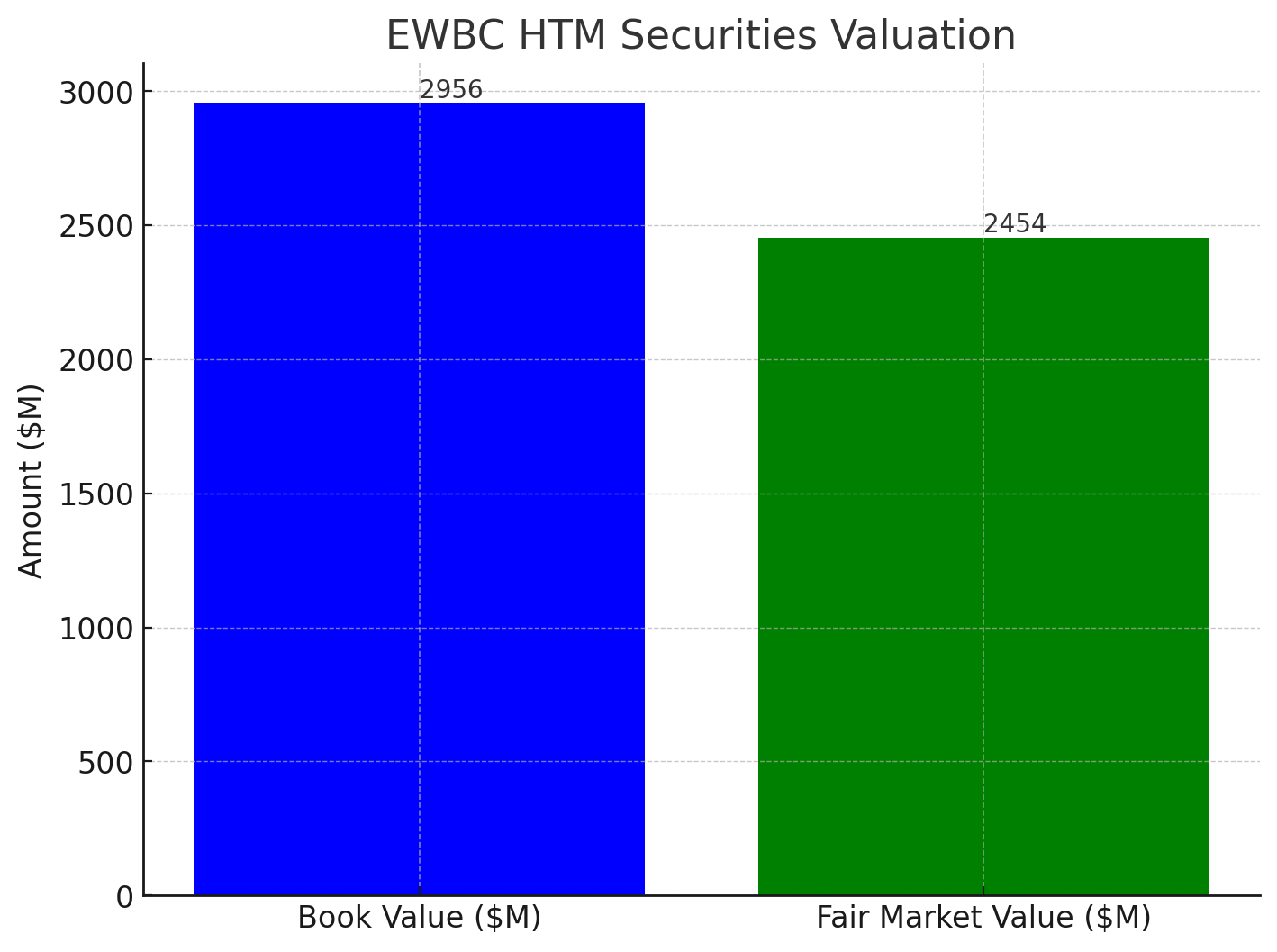

The collapse of Silicon Valley Bank (SVB) has reverberated through the banking sector, prompting a reevaluation of held-to-maturity (HTM) securities and loan portfolios. EWBC's HTM securities, valued at $2,956 million with a fair market value of $2,454 million, exhibit a manageable disparity, mitigating immediate concerns regarding asset valuation in a volatile market.

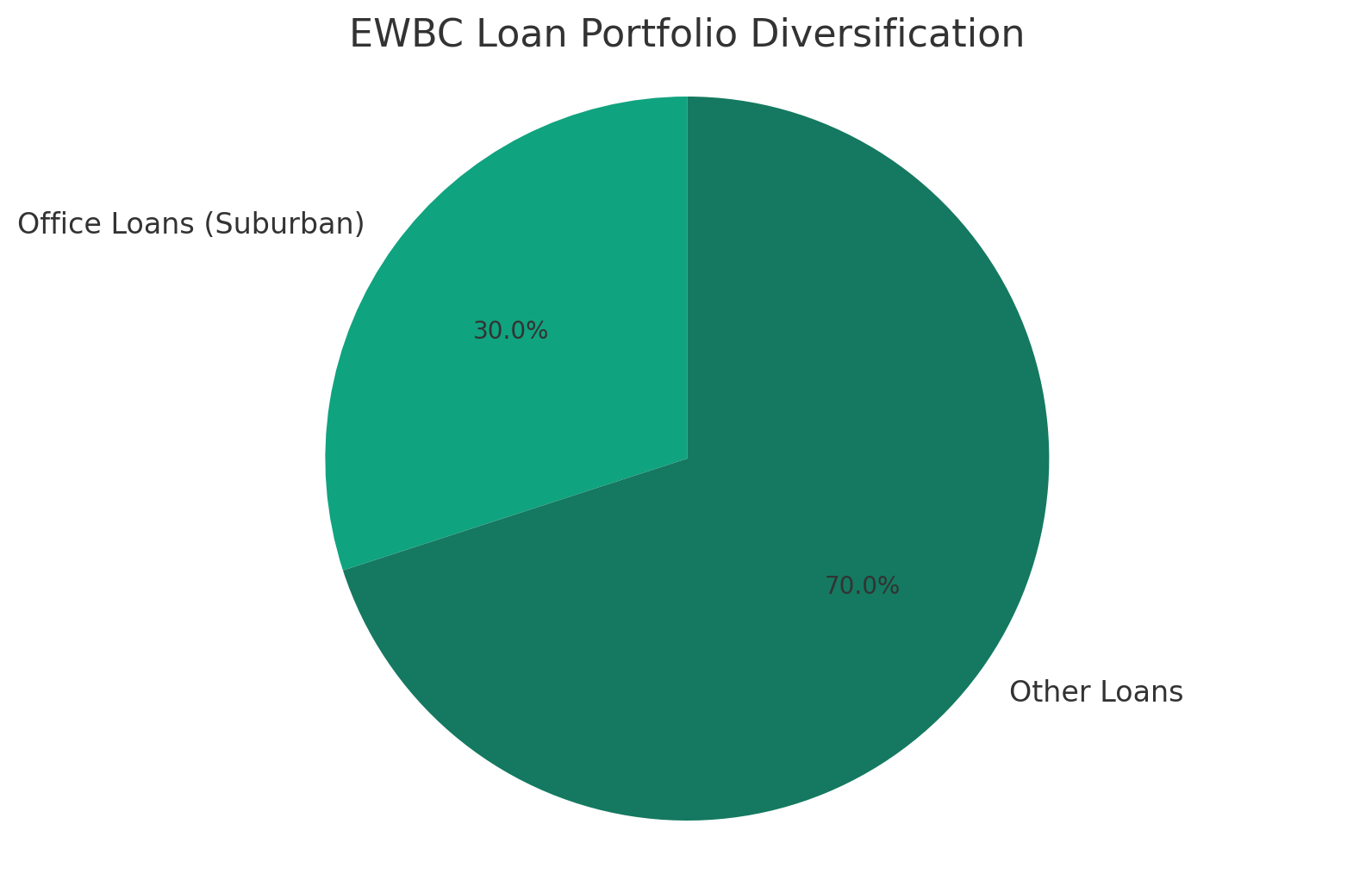

Loan Portfolio Diversification: A Defensive Moat

EWBC's loan portfolio, particularly its office loans, deserves a closer look. Unlike its peers with significant downtown exposure, EWBC's office loans primarily reside in suburban areas, where vacancy rates remain relatively low. This strategic positioning reduces potential risks associated with the changing dynamics of office space utilization post-pandemic.

Valuation Perspective: A Calculated View

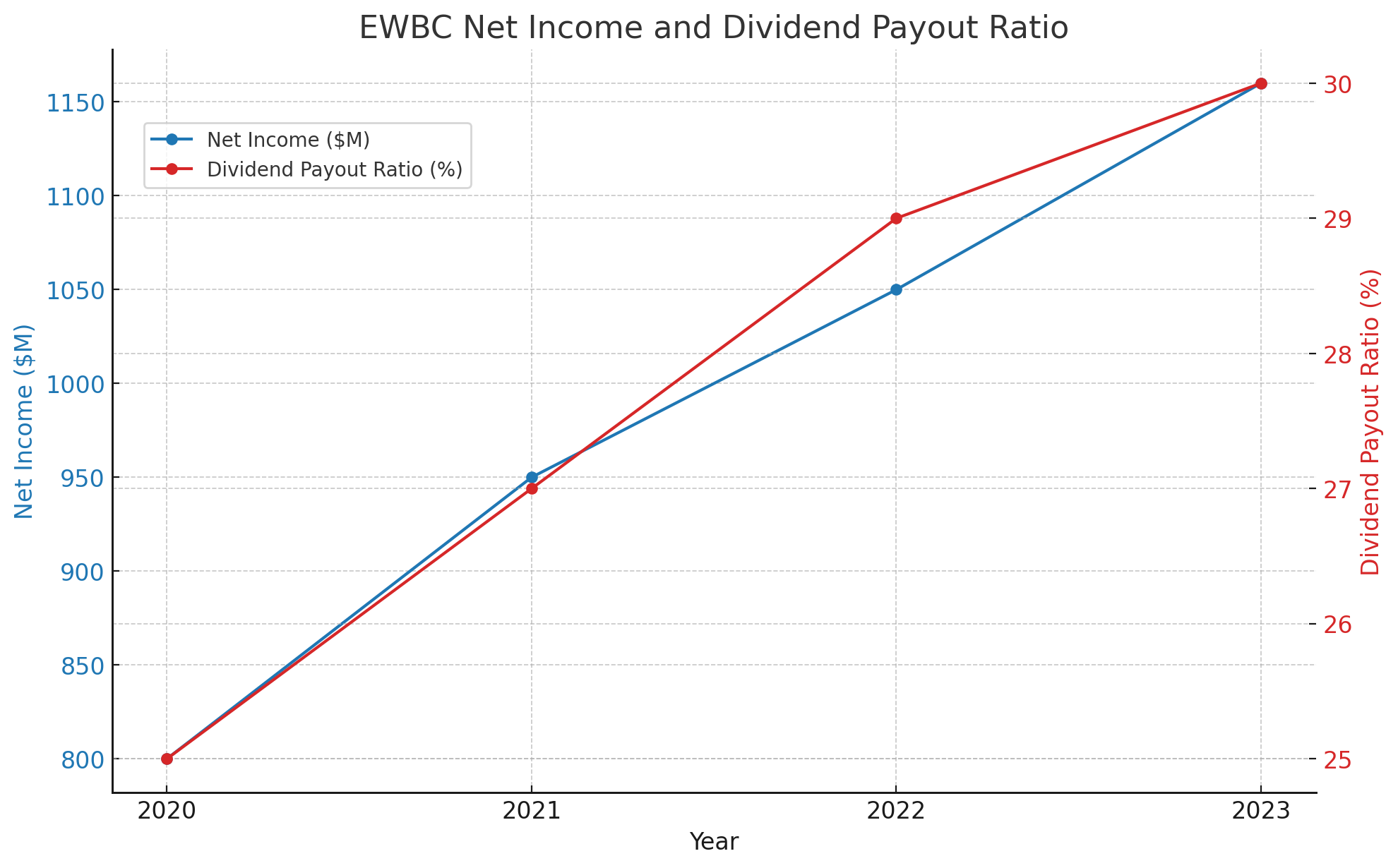

Given EWBC's net income of $1.16 billion in 2023 and a dividend payout ratio that demonstrates financial prudence, a valuation range of 10 to 12 times net income appears reasonable. This translates to an estimated valuation range of $11.6 to $13.9 billion, slightly above the current market cap of $10.1 billion, suggesting that while the stock has appreciated significantly, there may be room for cautious optimism.

Conclusion: Navigating Forward

In the face of economic uncertainties and sector-specific challenges, East West Bancorp, Inc. stands out for its operational resilience, strategic market positioning, and financial health. While the stock currently presents as a hold due to its narrowed valuation gap, its fundamentals and strategic maneuvering warrant close monitoring for potential investment opportunities. As EWBC continues to navigate the complex banking landscape, its focus on operational efficiency, prudent financial management, and strategic loan portfolio positioning will be key drivers of its future success.

NASDAQ:AMD Crashes to $89—But $2B Oracle AI Deal Hints at Massive Comeback