Electronic Arts NYSE:EA - Review of Financial Health and Strategic Revenue

Unpacking EA's Revenue Growth, Market Expansion Strategies, and the Impact of Technological Innovations on Its Business Model and Investment Potential | That's TradingNEWS

Detailed Analysis of Electronic Arts Inc. (NYSE:EA) Financial Health and Revenue Metrics

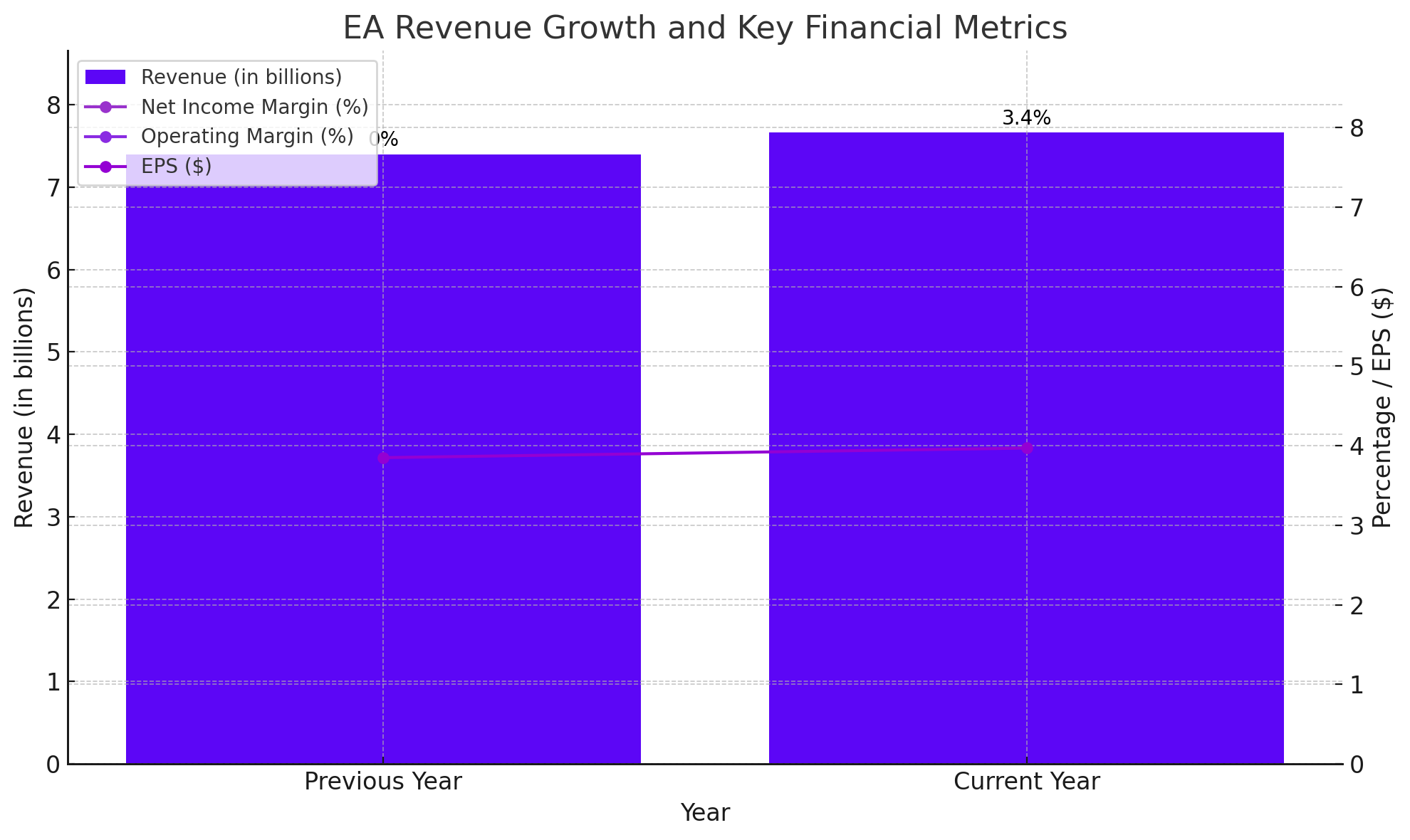

Electronic Arts Inc. (NYSE:EA), a pioneer in the video game industry, continues to leverage its robust portfolio of games to generate significant revenue and maintain strong market positioning. As of the last fiscal year, EA reported impressive revenues totaling $7.66 billion, reflecting a growth of 3.40% year-over-year. Despite this growth, the company navigates the complexities of transitioning from traditional game sales to a more dynamic revenue model that includes digital content and microtransactions.

Key Financial Metrics:

- Net Income Margin: EA's profitability, as measured by its net income margin, stands at 14.09%. This figure highlights the company’s ability to convert revenue into actual profit, despite the high costs associated with content creation and technological investments.

- Operating Margin: With an operating margin of 18.77%, EA efficiently manages its operating expenses, underscoring its effective cost control measures in game production and distribution.

- Earnings Per Share (EPS): The EPS of $3.97 indicates solid earnings power relative to the company's share price, reflecting investor confidence in its operational success.

Strategic Revenue Streams and Their Implications

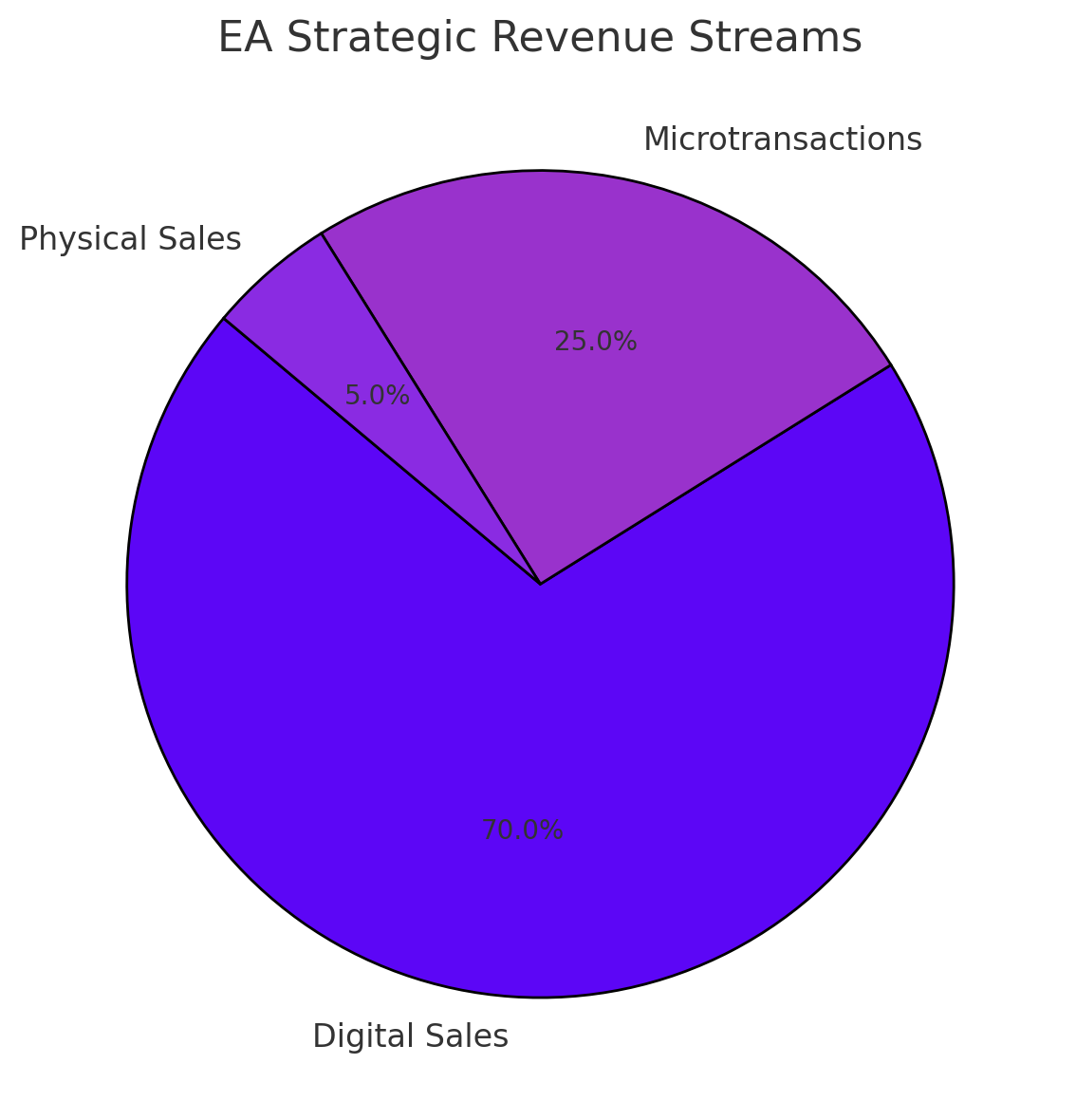

EA’s innovative revenue-sharing model, particularly through its virtual currency in games like EA SPORTS FC, facilitates a continuous cash flow beyond initial game sales. This model not only enhances player engagement through regular updates and expansions but also presents challenges in maintaining a balance between user acquisition costs and long-term profitability.

Revenue Breakdown and Growth Drivers:

- Digital Sales: A significant portion of EA's revenue comes from digital sales, including downloadable content and full-game downloads, which have higher margins than physical sales.

- Microtransactions: These transactions represent a recurring revenue model that allows EA to monetize individual player engagements long after the initial sale.

Competitive Landscape and Market Positioning

EA holds a formidable position in the gaming industry with key franchises like Madden NFL and EA SPORTS FC. However, it faces rigorous competition from major players like Activision Blizzard and emerging indie developers who are also capitalizing on the digital and microtransaction trends.

Market Dynamics:

- Market Share: EA commands a substantial market share, backed by its popular franchises and successful marketing strategies.

- Innovation and Adaptation: To maintain its competitive edge, EA continuously invests in new technologies, including AI, to enhance game development and user experience.

Financial Performance and Market Dynamics

EA's strategy to focus on high-margin digital content is evident in its financial outcomes, with a sustained increase in user base and session lengths. However, the company's journey towards profitability is challenged by significant investment in innovation and market expansion.

Operational Costs and Profitability Challenges:

- Research and Development (R&D): High R&D costs reflect EA's commitment to staying at the forefront of technology and gaming trends, which, while necessary, impact short-term profitability.

- Marketing and Sales: As the gaming industry becomes increasingly saturated, EA’s marketing expenses rise, essential for maintaining visibility and relevance in a competitive market.

Technological Advancements and Their Impact

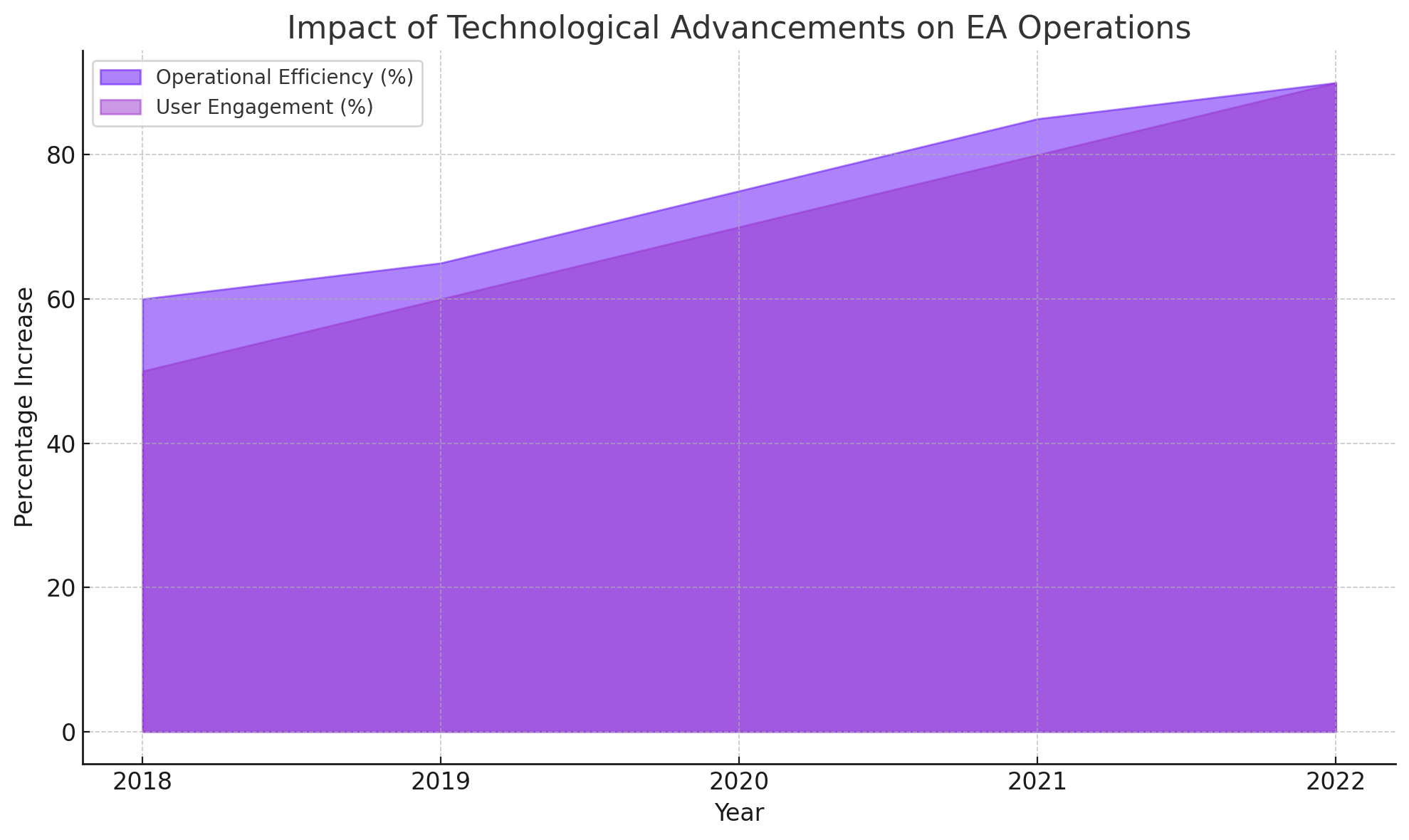

EA’s adoption of AI and machine learning not only streamlines game development processes but also introduces new gameplay features that can attract a broader audience. These technologies are integral to developing more personalized and immersive gaming experiences, crucial for user retention and market expansion.

Impact on Operations:

- Efficiency: Automation and AI-driven tools reduce time-to-market for new games and updates, improving operational efficiency.

- User Engagement: Advanced technologies enhance the gaming experience, making EA’s titles more appealing to both new and existing players.

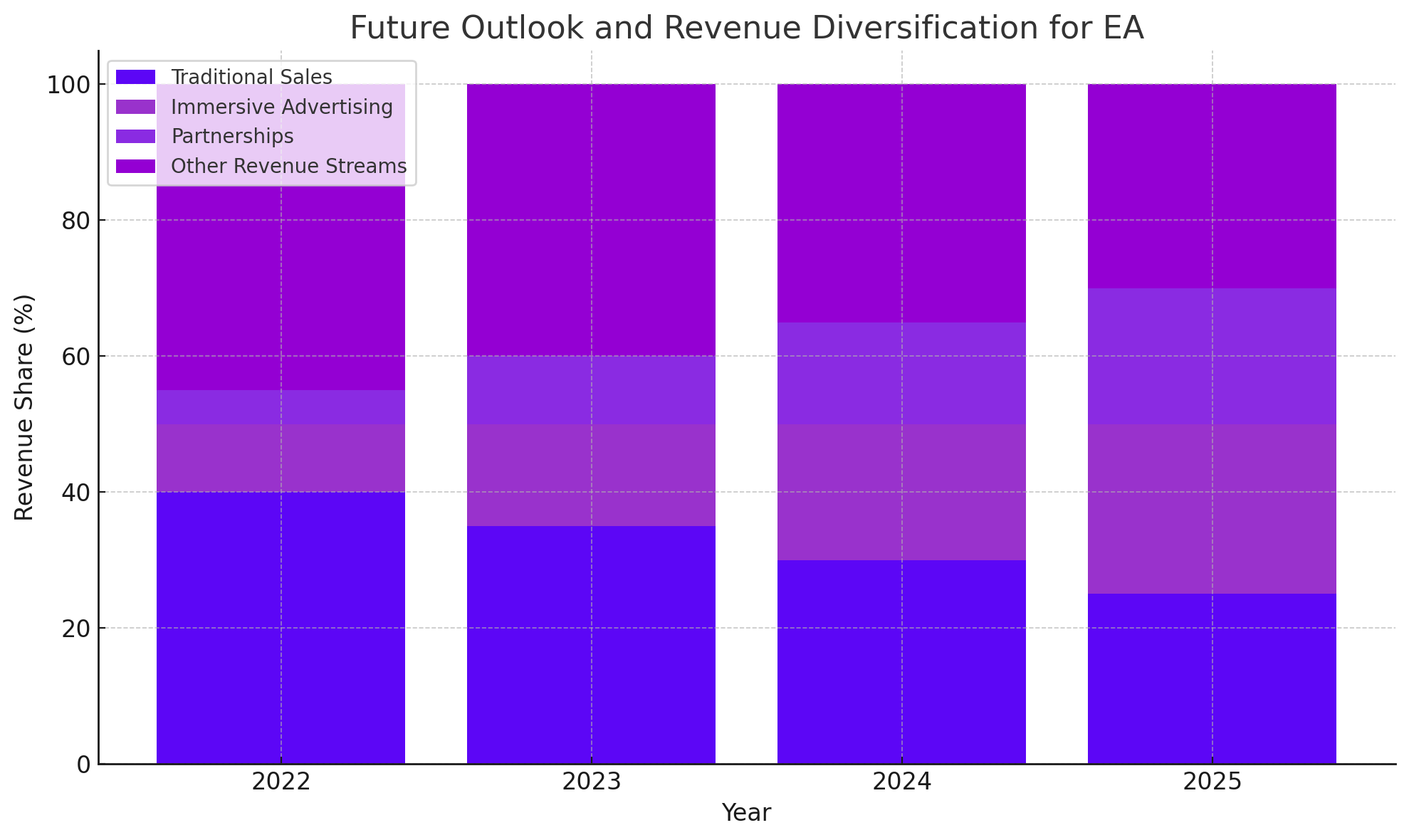

Revenue Growth and Strategic Initiatives

With a strategic focus on increasing user engagement and expanding market reach, EA explores new revenue streams such as immersive advertising and partnerships. These initiatives are designed to tap into the growing digital economy and diversify income sources beyond traditional game sales.