Eli Lilly (NYSE:LLY) Stock Soars on Strong Revenue Growth and Clinical Wins

Mounjaro and Zepbound Fuel Eli Lilly's Market Dominance as Revenue Outlook Continues to Improve | That's TradingNEWS

Eli Lilly (NYSE:LLY) Poised for Continued Growth Amidst Strong Clinical Results and Financial Performance

Zepbound's Pricing Strategy and Its Impact

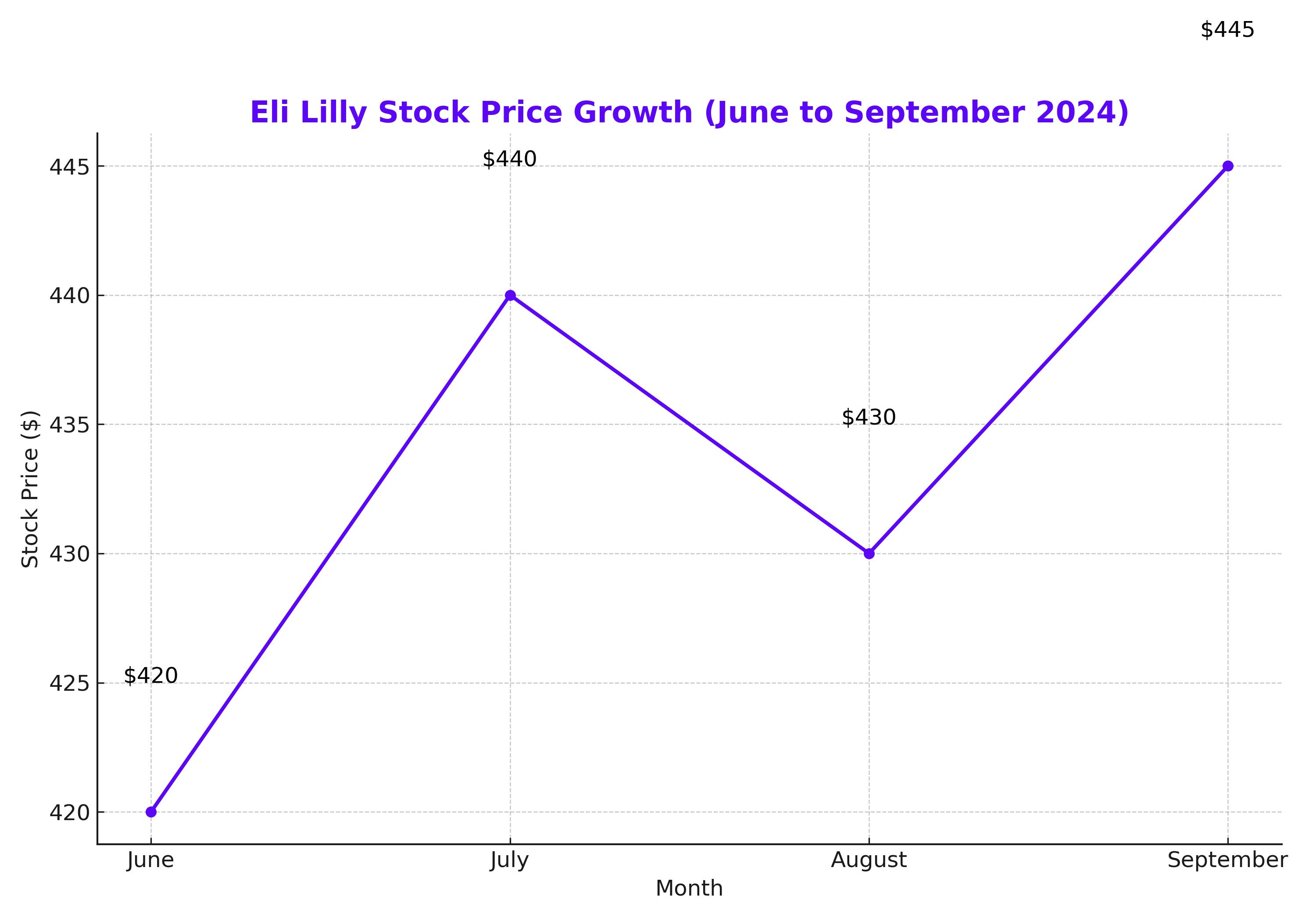

Eli Lilly (NYSE:LLY) has seen continued stock price growth, up 5.3% since June, despite temporary pullbacks in early August. A significant factor contributing to this upward trend is its weight management drug, Zepbound, which brought in 11% of the company’s Q2 2024 revenues, a substantial increase from 6% in Q1 2024. However, criticism regarding high prices from President Biden and Senator Bernie Sanders led to substantial price cuts for the 2.5mg and 5mg doses of Zepbound, slashing prices by nearly half compared to earlier levels.

This pricing adjustment places Zepbound 50% below rival Novo Nordisk's (NVO) products, which could boost accessibility and curb issues such as counterfeit and non-prescription usage. Additionally, Eli Lilly has transitioned from using injectable pens to vials, allowing patients to buy their own syringes. This shift is expected to ease supply shortages while maintaining accessibility, helping the company navigate market challenges without a major impact on earnings.

Earnings Outlook Remains Positive Despite Pricing Revisions

The question arises: Will these price cuts negatively affect Eli Lilly’s earnings? Several factors suggest otherwise. The cuts apply to only the lowest two doses of Zepbound and are limited to self-paying patients, while insured patients may see higher prices. Moreover, cost savings from switching to vials could help protect profit margins. These considerations, combined with Zepbound's growing contribution to revenues, indicate that the overall impact on earnings may be minimal.

This is further supported by Eli Lilly’s upgraded guidance for 2024, which now projects a 35% revenue growth, up from 26.1%. The company’s expected operating margin has also improved, now forecasted at 37%. Despite the recent price cuts, the company anticipates strong performance moving forward, bolstered by other high-performing treatments like Mounjaro for diabetes.

Tirzepatide and Clinical Wins Driving Growth

Tirzepatide, marketed as Mounjaro for diabetes and Zepbound for obesity, remains a key driver of Eli Lilly’s financial success. In Q2 2024, the drug generated $3.1 billion in revenue for its Type 2 Diabetes treatment, up from $1.8 billion in Q1, and $1.24 billion from its obesity indication. As tirzepatide continues to outperform expectations, Eli Lilly has solidified its position as a leader in the diabetes and obesity market.

The company's recent clinical wins further strengthen this position. The SURMOUNT-1 trial demonstrated that tirzepatide significantly reduced the risk of progression to Type 2 diabetes by 94% among pre-diabetic adults with obesity, in addition to sustained weight loss. These results underscore the drug’s efficacy, further boosting confidence in its future growth prospects.

Looking ahead, a head-to-head trial against Novo Nordisk’s semaglutide is expected to reveal superior weight loss outcomes for tirzepatide. Given tirzepatide's dual GLP-1/GIP agonist mechanism compared to semaglutide’s single GLP-1 agonist approach, expectations for tirzepatide’s continued dominance are high.

Strong Oncology and Immunology Performance

While tirzepatide leads the charge, Eli Lilly’s other divisions continue to contribute to the company’s overall success. The oncology segment, driven by Verzenio, delivered impressive 46% year-on-year growth in Q2 2024. Verzenio’s breast cancer therapy has reached $1.33 billion in quarterly net sales, positioning it as a major revenue driver for Eli Lilly.

In immunology, Taltz and Olumiant have shown strong performance, with revenues growing to $825 million and $228 million, respectively. Newly approved therapies, such as mirikizumab for ulcerative colitis, are expected to further bolster the company's portfolio in the coming years.

Future Prospects and Market Leadership

Eli Lilly’s outlook remains promising. With an expanded manufacturing capacity and continued clinical successes, the company is well-positioned to meet the growing demand for tirzepatide. In addition to its current pipeline, Eli Lilly is developing two more GLP-1 agonist drugs—Orforglipron and Retatrutide—both of which show strong potential for significant weight loss outcomes. These developments highlight Eli Lilly’s dominance in the diabetes and obesity market, with the potential for further growth on the horizon.

As the global market for GLP-1 agonist drugs expands, projected to reach $70 billion to $200 billion annually, Eli Lilly is poised to maintain its leadership position. With robust demand for its flagship drugs, continued clinical wins, and a solid pipeline, Eli Lilly's valuation is expected to reach new heights, potentially surpassing the $1 trillion market cap mark in the near future.

Investment Decision: Buy, Hold, or Sell?

Eli Lilly's growth trajectory, the stock remains a buy. The company's strong earnings, innovative product pipeline, and market leadership position in the diabetes and obesity space make it a solid long-term investment.

Read More

-

GDX ETF at $88 While Gold Tests $4,400: Are Gold Miners Poised for $100?

19.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETF Boom: XRPI at $10.94 and XRPR at $15.49 as XRP-USD Clings to the $1.80–$1.90 Zone

19.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Hovering Near $3.92 As Weather, LNG And Storage Collide

19.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen Near 157 as BoJ’s 0.75% Rate Hike Backfires on the Yen

19.12.2025 · TradingNEWS ArchiveForex