NYSEARCA:NVDY: Breaking Down Its High-Yield Potential and Risks

The YieldMax NVDA Option Income Strategy ETF (NYSEARCA:NVDY) has attracted significant attention for its extraordinarily high dividend yield, currently hovering around 84%. While the fund’s promise of robust monthly income sounds appealing to investors seeking immediate cash flow, a closer look at its mechanics and historical performance reveals complex trade-offs. This analysis examines whether NVDY offers a sustainable income solution or if it comes at the expense of long-term total returns, especially when compared to its underlying stock, NVIDIA Corporation (NASDAQ:NVDA).

NVDY’s Structure and Income Strategy: Maximizing Yield with Covered Calls

The YieldMax NVDA Option Income Strategy ETF employs a sophisticated approach to income generation by selling call options against a synthetic long position in NVIDIA. The fund primarily uses the following structure: it invests its cash reserves in short-term Treasuries to serve as collateral, creates synthetic exposure to NVIDIA through long calls and short puts, and writes call options against its synthetic holdings to harvest premium income. This strategy is dynamic, with options positions frequently adjusted by fund managers to optimize income while managing risk.

The result is a fund that aims to generate income in both rising and flat market environments. However, this approach inherently caps the upside potential for investors during periods of rapid price appreciation in NVIDIA shares. For example, during NVIDIA’s explosive 2024 run where the stock appreciated over 200%, NVDY significantly lagged, delivering total returns of around 84% due to its limited price participation.

Dividend Volatility: High Yields But Unpredictable Payouts

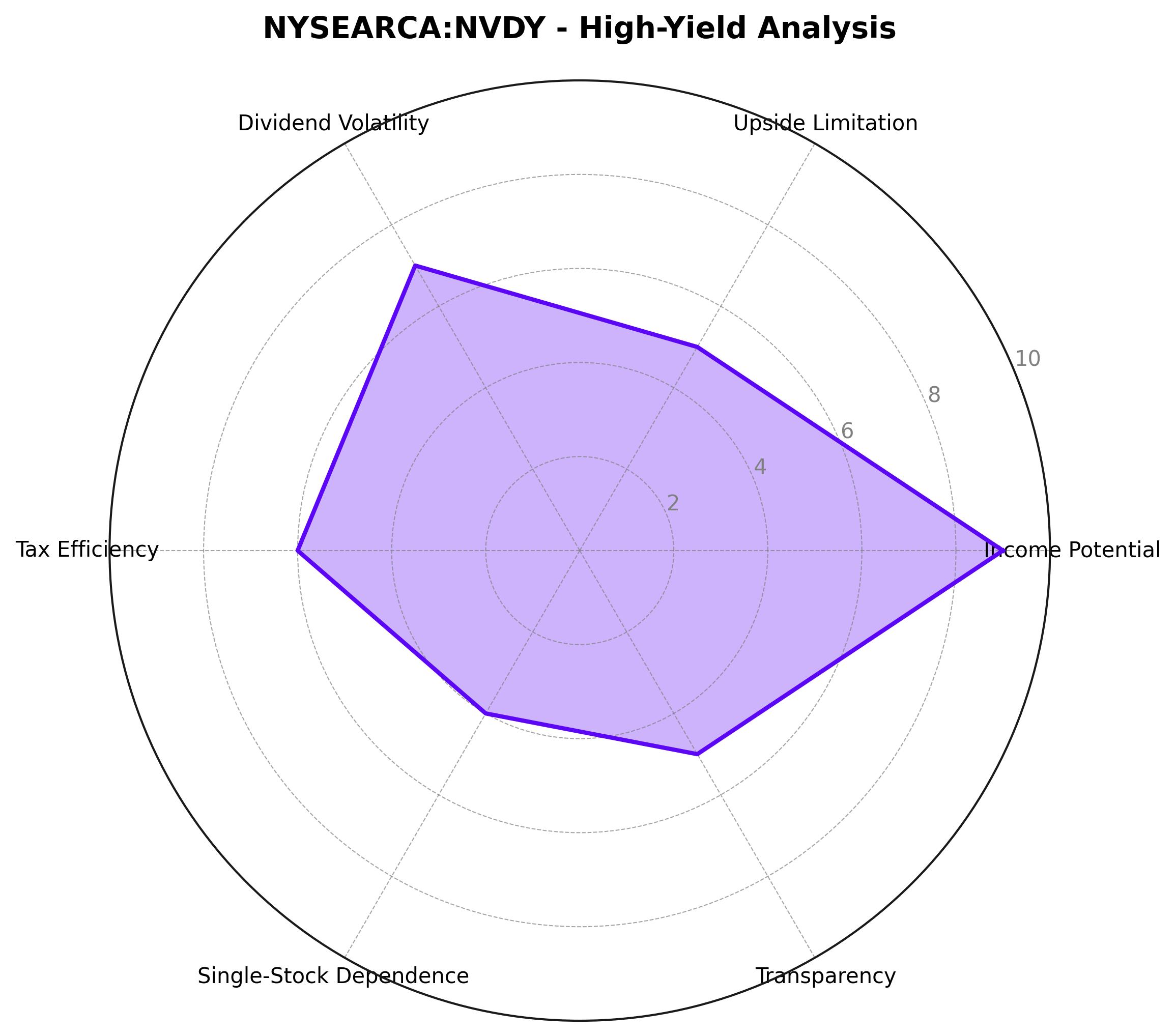

One of NVDY’s most attractive features is its monthly distribution, which has ranged from $0.41 to $2.62 per share. The fund’s payout size is highly tied to NVIDIA’s volatility, as higher implied volatility leads to greater option premiums. However, this creates a double-edged sword for income-focused investors. While the headline yield is impressive, the inconsistency in monthly distributions introduces uncertainty, making it challenging for investors relying on regular income. For example, payouts surged during periods of heightened market activity, such as around NVIDIA’s quarterly earnings reports, but dipped during less volatile stretches.

This erratic nature of dividends may dissuade investors seeking stable and predictable income streams, especially those planning retirement withdrawals or other fixed expenses.

Performance Comparison: NVDY vs. NVIDIA Stock

Since its inception, NYSEARCA:NVDY has underperformed NVIDIA’s stock on a total return basis. NVIDIA, which surged by over 370% during the same period, dwarfed NVDY’s 84% return. While NVDY generated meaningful income along the way, its strategy inherently limits its ability to capture outsized gains during NVIDIA’s explosive rallies. This outcome highlights a critical consideration for potential investors: NVDY’s appeal lies in its income generation rather than maximizing total return.

Investors who were highly bullish on NVIDIA’s long-term growth missed out on significant capital appreciation by holding NVDY instead of directly owning NVIDIA shares. Conversely, moderately bullish investors who prioritized income over growth could find NVDY’s strategy more appealing, as long as they are willing to accept its capped upside potential.

Risk Assessment: Unpacking NVDY’s Complexities

While NVDY delivers on its promise of income generation, its intricate structure and dependence on active management introduce several layers of risk. Key concerns include:

-

Key Person Risk: The fund’s performance heavily relies on the expertise and decision-making of its management team. Any changes in leadership or strategy could materially impact its results.

-

Upside Limitation: The fund’s covered call strategy caps price gains, making it less suitable for investors expecting significant appreciation in NVIDIA’s stock.

-

Transparency Concerns: The fund’s proprietary trading strategies lack detailed disclosure, leaving investors in the dark about how positions are selected and managed on a day-to-day basis.

-

Single-Stock Dependence: NVDY’s success is tied exclusively to NVIDIA’s performance, introducing concentrated exposure risk. A significant downturn in NVIDIA shares would negatively impact NVDY, as the fund does not hedge against downside risk effectively.

-

Tax Inefficiency: For investors holding NVDY in taxable accounts, the fund’s reliance on income generation through options may result in less favorable tax treatment compared to capital gains from directly holding NVIDIA.

Suitability: Who Should Consider NVDY?

NVDY caters to a niche group of investors. It is well-suited for moderately bullish individuals seeking to generate high income from a single stock while accepting capped upside potential. However, the fund is not an optimal choice for highly bullish investors who want full participation in NVIDIA’s price appreciation or for bearish investors concerned about downside risks. For those seeking diversification or reduced single-stock risk, alternative funds like the YieldMax Magnificent Seven Fund (YMAG) may be more appropriate.

Final Thoughts: Is NYSEARCA:NVDY Worth the Risk?

While the YieldMax NVDA Option Income Strategy ETF (NYSEARCA:NVDY) offers an eye-popping yield, investors must weigh its benefits against its significant limitations. The fund’s capped upside makes it less attractive during periods of strong stock performance, as seen with NVIDIA’s recent rally. Its reliance on volatility for income generation also introduces unpredictability, making it less ideal for those requiring steady cash flow. Despite its flaws, NVDY may serve as a niche solution for income-focused investors who are moderately bullish on NVIDIA’s prospects but are unwilling to bet solely on capital gains. Whether NVDY is a buy, sell, or hold ultimately depends on your risk tolerance, income needs, and outlook on NVIDIA’s growth trajectory.