Ethereum’s Recent Price Action: Will $3,000 Hold?

Ethereum (ETH-USD) is currently trading around $3,120 after struggling to maintain momentum above key resistance levels. Over the past week, ETH has seen price fluctuations between $3,042 and $3,206, indicating an indecisive market. The current question for traders is whether Ethereum can reclaim bullish territory and target new highs or if profit-taking will trigger a deeper pullback.

February’s Bullish History: Will ETH Continue Its Strong Seasonal Performance?

Ethereum has a track record of posting strong gains in February. Data from Coinglass shows that ETH’s average return for the month is 17.13%, with past surges like the 46.28% gain in February 2024. If history repeats, Ethereum could see a significant upside move in the coming weeks.

On-chain data suggests that investors are positioning for a bullish February. Daily active addresses on the Ethereum network have surged past 588,000, marking the highest level in over a year. The growing network activity indicates increased adoption and investor confidence, historically signaling price appreciation.

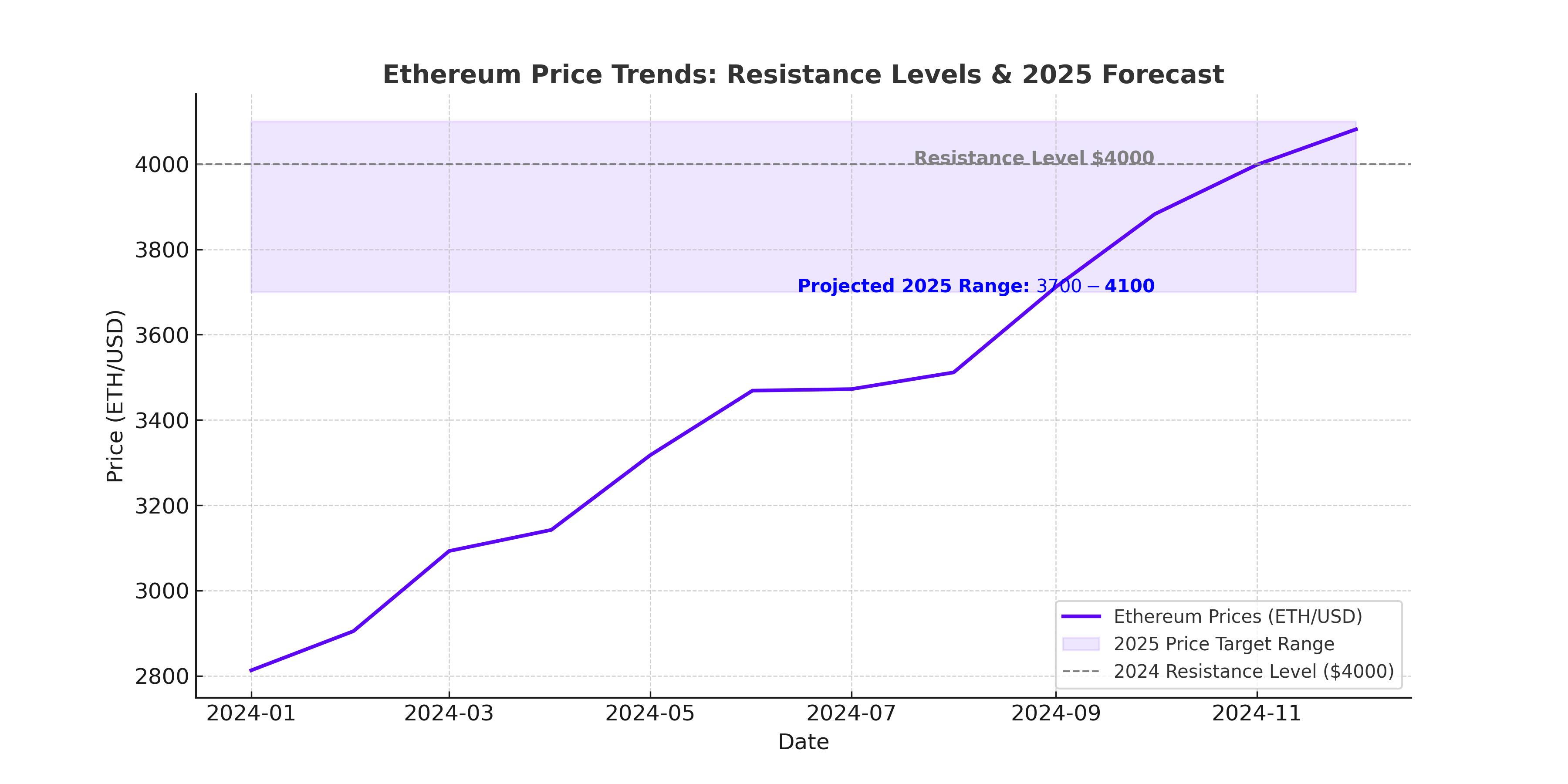

Technical Analysis: ETH Faces Resistance at $3,700 – Will It Break Out?

Ethereum is currently consolidating within a falling wedge pattern, a historically bullish formation. A breakout above the upper trendline could push ETH 35% higher toward $4,100. However, multiple resistance levels must be cleared before this rally can materialize.

Key Resistance Levels:

- $3,700: Major resistance level, last tested in late January. A breakout here would confirm bullish momentum.

- $4,000: A psychological barrier that, if surpassed, could fuel a rapid rally.

- $4,800: A strong resistance point from previous bull cycles.

Support Levels:

- $3,000: Psychological support level, with strong buying activity historically.

- $2,850 – $2,930: A crucial demand zone where buyers have defended Ethereum’s price in recent months.

- $2,800: If this level breaks, ETH could enter a sharper downtrend.

The Relative Strength Index (RSI) remains neutral at 55, suggesting room for a rally, while the Moving Average Convergence Divergence (MACD) recently flipped bearish, signaling caution. Traders should watch for a high-volume move above $3,700 to confirm a breakout.

Institutional Accumulation: Will ETH-USD Surge on Growing Demand?

Institutional interest in Ethereum remains strong. Data from Arkham Intelligence shows that Donald Trump’s DeFi platform has increased its Ethereum holdings to $250 million in staked ETH and additional DeFi assets, including AAVE and LINK. This indicates that major players are still accumulating ETH despite recent price corrections.

Ethereum ETFs have also driven institutional inflows. BlackRock’s Ethereum ETF has seen over $4 billion in inflows, reinforcing ETH’s appeal as a long-term investment. As regulatory clarity improves, more institutions are expected to enter the space, potentially driving Ethereum’s price higher.

Whale Activity: Is Smart Money Betting on an ETH Breakout?

Ethereum whales have been accumulating, signaling confidence in a potential price surge. Large holders have added over 200,000 ETH in the past month, according to on-chain data. When whales accumulate during price dips, it often precedes a strong bullish move.

However, Ethereum’s exchange-traded funds (ETFs) saw a $136 million net outflow earlier this week. This suggests some investors are taking profits while others are holding for a longer-term breakout.

Ethereum vs. Bitcoin: Which Crypto Will Lead the Market?

Ethereum has lagged behind Bitcoin in recent price movements, with the ETH/BTC ratio forming lower lows on the chart. Bitcoin’s recent strength has pulled capital away from Ethereum, but a breakout in ETH-USD could reverse this trend.

Bitcoin currently trades around $102,800, with analysts debating whether it will break past $109,000 or correct toward $90,000. If Bitcoin consolidates or moves higher, Ethereum may follow with a delayed but aggressive rally.

Ethereum Price Prediction: $4,100 or $2,800 Next?

Ethereum is at a crossroads. If ETH breaks above $3,700, bullish momentum could take it toward $4,100 and beyond. On the downside, failure to hold $3,000 support could trigger a sell-off to $2,800 – $2,850.

Bullish Scenario:

- ETH breaks $3,700 resistance

- Buyers push price above $4,000

- ETH targets $4,800 in the coming months

Bearish Scenario:

- ETH fails to break resistance and drops below $3,000

- Selling pressure increases, targeting $2,800

- Bears push ETH toward $2,400 if macro conditions worsen

The market’s next move depends on Federal Reserve policy, investor sentiment, and whether ETH can sustain its historical bullish trend in February.

Will Ethereum defy expectations and break $4,100, or is a deeper correction coming? Traders and investors must closely watch volume trends and whale accumulation as key indicators for ETH’s next big move.