Ethereum (ETH-USD) at a Tipping Point – Will a $2,715 Breakout Happen or More Pain Ahead?

With Ethereum ETF inflows surging and short interest up 500%, is ETH on the verge of a short squeeze? | That's TradingNEWS

Ethereum (ETH-USD) Price Outlook: Is a Breakout Coming or More Bearish Pressure Ahead?

Ethereum Struggles to Hold Key Levels Despite Growing Institutional Interest

Ethereum (ETH-USD) has been under significant selling pressure, currently trading at $2,715, after seeing a 36% decline over the past seven weeks. While the crypto market has been reacting positively to Bitcoin’s ETF success, Ethereum has struggled to keep pace, leaving investors questioning whether the second-largest cryptocurrency by market cap can regain momentum.

The Relative Strength Index (RSI) is flashing oversold signals, indicating that ETH might be primed for a rebound. Despite this, short interest in Ethereum has skyrocketed by 500% since November 2024, and in just the past week, short bets have risen another 40%, showing strong bearish sentiment. Does this mean ETH will crash further, or is the stage set for a short squeeze that could send prices soaring?

Ethereum ETF Inflows Surge: Why Isn’t ETH Responding?

Ethereum has seen a substantial $790 million inflow into spot ETFs, surpassing Bitcoin investments for the first time in 2025. Despite this, ETH’s price remains 50% below its all-time high of $4,848 from November 2021. Institutions, including major hedge funds and financial firms, have been accumulating Ethereum ETF shares, but the price action suggests investors remain cautious.

One possible reason for the muted response is the ongoing arbitrage strategy used by institutional traders. These traders are placing bearish bets in futures markets while simultaneously buying Ethereum ETFs, allowing them to profit regardless of price direction. This dynamic has resulted in an unusual divergence where Ethereum ETF demand has grown, but the spot price has remained weak.

At the same time, the ETH/BTC ratio is at its lowest point in four years, signaling that Ethereum is lagging behind Bitcoin in relative strength. This trend could continue unless ETH manages to break key resistance levels and establish an independent bullish trend.

Ethereum’s Exchange Outflows Hit Two-Year High: What Does This Mean?

One of the most critical recent developments is the historic outflow of Ethereum from exchanges. Over 224,410 ETH was withdrawn in just two days, marking the largest single-day outflow in nearly two years. Typically, large exchange outflows signal that investors are moving their assets to private wallets for long-term holding, reducing sell-side liquidity and potentially setting the stage for a supply-driven price increase.

Following this, ETH saw a 3.5% jump from $2,850 to $2,950 within 24 hours, suggesting that buying pressure is beginning to build. However, this move has yet to translate into a sustained breakout, and Ethereum must reclaim key technical levels to confirm a trend reversal.

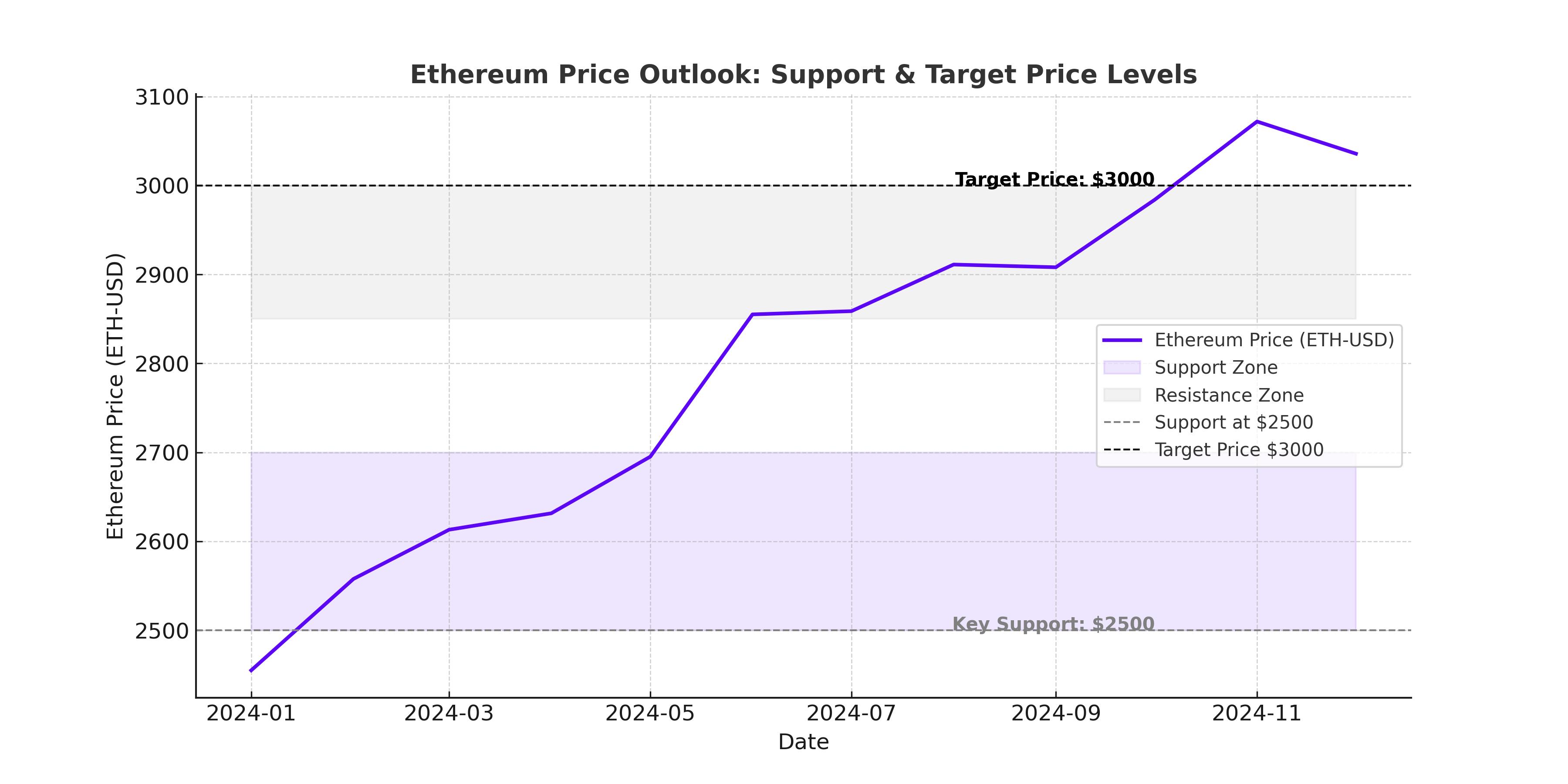

Key Technical Levels: Where Does ETH Go From Here?

Ethereum’s price action remains cautiously optimistic, but key levels must be monitored to determine whether a full recovery is on the horizon.

Support Levels:

- $2,650 – Immediate support level

- $2,550 – Strong technical floor; failure to hold could trigger further downside

- $2,400 – Critical support; losing this level could see ETH drop toward $2,100

Resistance Levels:

- $2,800 – Short-term breakout point; a move above here could signal bullish momentum

- $3,000-$3,100 – Major resistance zone; ETH must clear this area to confirm a trend reversal

- $3,500 – Long-term target; breaking this level would indicate a shift back to bullish market conditions

Technical Indicators:

- RSI at 65 – Shows ETH has room for upward movement without being overbought

- MACD turning positive – Indicates bullish momentum is building

- Bollinger Bands widening – Suggests increased volatility in the coming sessions

Ethereum is now testing its 50-day EMA, and a sustained close above this level could confirm the start of a recovery phase. However, failure to hold above $2,650 could lead to a retest of lower support levels, potentially dragging ETH toward the $2,400-$2,100 zone.

Institutional Players Accumulate Ethereum: Is This a Long-Term Play?

While retail traders have been selling off ETH, institutional investors are quietly accumulating large amounts of the asset. The Trump-linked World Liberty Financial fund now holds over $200 million in Ethereum, suggesting that major financial entities see long-term value in ETH despite short-term volatility.

Additionally, Ethereum’s Total Value Locked (TVL) has been rising, signaling increasing activity in the DeFi ecosystem. More capital being locked in Ethereum-based decentralized applications suggests that institutional and long-term investors are still engaged, even as retail sentiment remains weak.

The broader crypto market is awaiting clarity on U.S. regulatory policies, and Ethereum’s future price action will likely depend on whether further regulatory uncertainty arises. The SEC has yet to provide full guidance on Ethereum ETF approvals, and a positive ruling could be the catalyst needed for ETH to resume its bullish trajectory.

Will Ethereum Break Above $3,000 or Head Lower?

Ethereum’s current price action is at a critical juncture. If ETH manages to hold above $2,650 and break past $2,800, we could see a run toward $3,000-$3,500 in the short term. However, if selling pressure resumes and ETH falls below $2,550, the market could test lower levels, possibly dragging prices toward $2,100 before finding strong support.

With record exchange outflows, rising ETF inflows, and increased institutional accumulation, the fundamental backdrop for Ethereum remains strong. However, until ETH can clear key resistance levels, investors should remain cautious, as the market still faces significant short pressure and potential volatility.

The next few weeks will be crucial, with Ethereum poised to either confirm a long-term recovery or remain stuck in a bearish consolidation phase. Traders should closely monitor on-chain activity, ETF demand, and resistance breakouts to determine ETH’s next major move.