Ethereum (ETH-USD) Battles Market Pressure: Can It Reclaim $3,000 or Fall Below $2,500?

Will ETH-USD Break Resistance and Surge, or Is Another Drop Below Key Support Levels Coming? | That's TradingNEWS

Ethereum (ETH-USD) at a Crossroads: Will It Rebound Above $3,000 or Collapse Below $2,500?

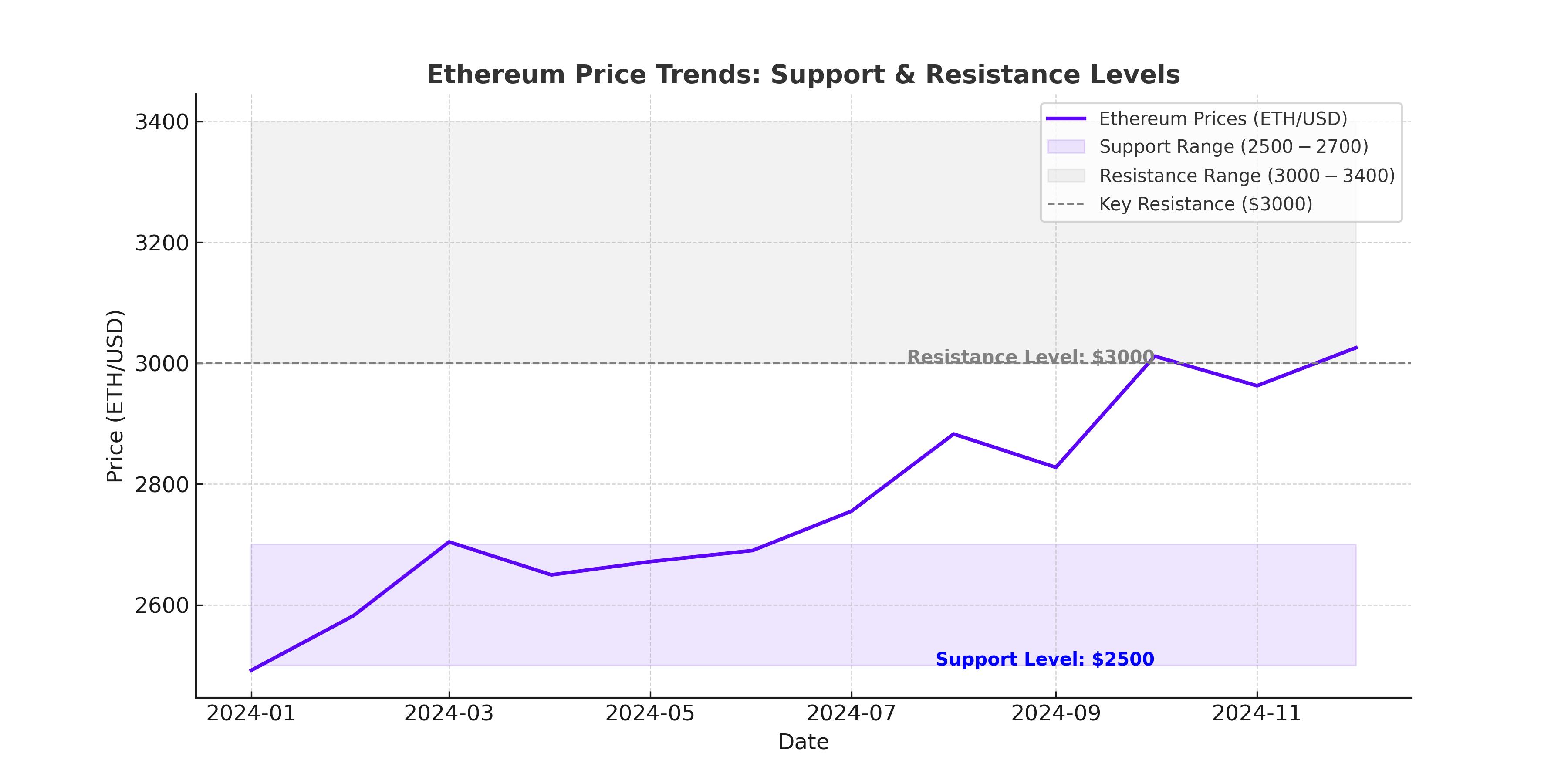

Ethereum (ETH-USD) remains under pressure as it hovers around $2,700, struggling to reclaim the $3,000 mark. The broader crypto market downturn, triggered by macroeconomic uncertainties and aggressive U.S. trade policies, has kept ETH in a volatile range. Recent price action suggests a potential breakout, but whether Ethereum can push higher or fall to new lows depends on key resistance and support levels, institutional flows, and network fundamentals.

Ethereum’s Struggle at Key Resistance: Can Bulls Take Control?

Ethereum’s price has seen wild swings, crashing to $2,150 earlier in February before bouncing back to $2,700. The failed attempts to break above $3,000 signal ongoing bearish pressure, with multiple resistance levels acting as barriers. The 200-day moving average, now sitting around $3,000, remains a major hurdle for Ethereum’s recovery. If ETH fails to breach this level convincingly, traders could see another sharp decline.

Technical indicators paint a mixed picture. The Relative Strength Index (RSI) sits at 37, nearing oversold territory, which could hint at a relief rally. However, the Moving Average Convergence Divergence (MACD) remains in a bearish crossover, signaling potential downside risks. If Ethereum fails to hold above $2,500, selling pressure could intensify, sending prices toward $2,200 or even $2,000 in the near term.

Institutional Interest: Can It Drive Ethereum Higher?

Ethereum’s long-term strength has historically been fueled by institutional adoption. Fidelity recently added $49.75 million worth of ETH to its holdings, a bullish sign that institutional players still see value in the asset despite market uncertainty. BlackRock’s Ethereum ETF proposal has also driven speculation that Wall Street firms could accelerate ETH accumulation, particularly if the SEC approves spot Ethereum ETFs in 2025.

However, Ethereum ETF inflows have been significantly weaker than Bitcoin ETFs, raising concerns about ETH’s ability to compete in the institutional space. Bitcoin ETFs attracted over $107 billion in assets, while Ethereum’s counterparts have struggled to gain similar traction. If Ethereum fails to attract sustained institutional interest, its relative weakness compared to Bitcoin (BTC-USD) could continue.

Ethereum’s Market Position vs. Bitcoin: Is ETH Losing Ground?

Ethereum has long been considered the second-largest cryptocurrency by market cap, but its dominance is under threat. The ETH/BTC ratio has fallen to 0.027, its lowest level since March 2021, showing Ethereum’s underperformance relative to Bitcoin. With Bitcoin surging past $98,000 and attracting heavy institutional investment, Ethereum has failed to keep pace, raising concerns about its ability to maintain market dominance.

At the same time, layer-1 competitors like Solana (SOL-USD) and Avalanche (AVAX-USD) have gained momentum, processing transactions faster and at lower costs. Ethereum’s scalability issues continue to push users toward alternative blockchains, despite its dominance in DeFi and NFTs. If ETH cannot improve network efficiency and reduce gas fees, its long-term position as the leading smart contract platform could be challenged.

Ethereum’s Upcoming Upgrades: Will They Help?

Ethereum’s developers are actively working to improve scalability, with the Pectra upgrade set to go live in early 2025. This update will double Ethereum’s blob target from 3 to 6, increasing layer-2 network efficiency and reducing transaction costs. Layer-2 solutions like Arbitrum, Optimism, and zkSync are already easing congestion, but Ethereum’s reliance on external scaling solutions highlights its limitations compared to faster native layer-1 blockchains.

Additionally, Ethereum’s recent gas limit increase to 31 million units is expected to improve transaction throughput. However, this does not address Ethereum’s fundamental issues with high fees and slow settlement times. Until Ethereum achieves the kind of efficiency seen in Solana or Avalanche, it may struggle to reclaim its dominant position in the crypto market.

Ethereum’s On-Chain Data: What Are Whales Doing?

On-chain data reveals a massive $402 million outflow of ETH from exchanges in the past 48 hours, signaling potential accumulation. Historically, large outflows suggest that whales and institutional investors are buying and moving ETH into cold storage, reducing sell pressure. However, open interest in Ethereum futures has also dropped significantly, indicating that speculative demand is waning.

If accumulation continues at this pace, Ethereum could see a supply squeeze, potentially triggering a rally. However, if sell pressure from short-term traders intensifies, Ethereum could retest $2,400-$2,500 before any meaningful recovery.

Will ETH Reclaim $3,000 or Fall to $2,000?

Ethereum is currently trapped between strong resistance at $3,000 and key support at $2,500. A decisive breakout above $3,000 could trigger a bullish rally toward $3,400-$3,800, especially if ETF approval news or institutional buying accelerates. However, if Ethereum breaks below $2,500, a deeper correction to $2,200 or even $2,000 could be on the table.

Buy, Sell, or Hold?

Given the current market structure, Ethereum remains in a neutral to slightly bearish position. If ETH reclaims $3,000, it could be a buy signal with upside potential toward $3,500. However, if it fails to hold above $2,500, it may be best to wait for a deeper correction before re-entering.

Bullish Scenario: Ethereum clears $3,000, confirming a trend reversal, with targets at $3,400-$3,800.

Bearish Scenario: ETH fails to hold above $2,500, leading to a drop toward $2,200-$2,000 before a potential recovery.

Final Verdict: Ethereum remains a high-risk asset in the short term, but long-term fundamentals favor accumulation at lower levels. If institutional interest grows and upcoming upgrades succeed, ETH could see a strong mid-to-long-term rally. Until then, traders should monitor support and resistance levels closely before making any major moves.