Ethereum Eyes Breakout Above $3,000—Is the Next Target $3,500?

ETH price faces key resistance as institutional accumulation rises. Will bulls push Ethereum past critical levels? | That's TradingNEWS

Ethereum (ETH-USD) Analysis: Can It Break $3,000 or Is a Deeper Correction Coming?

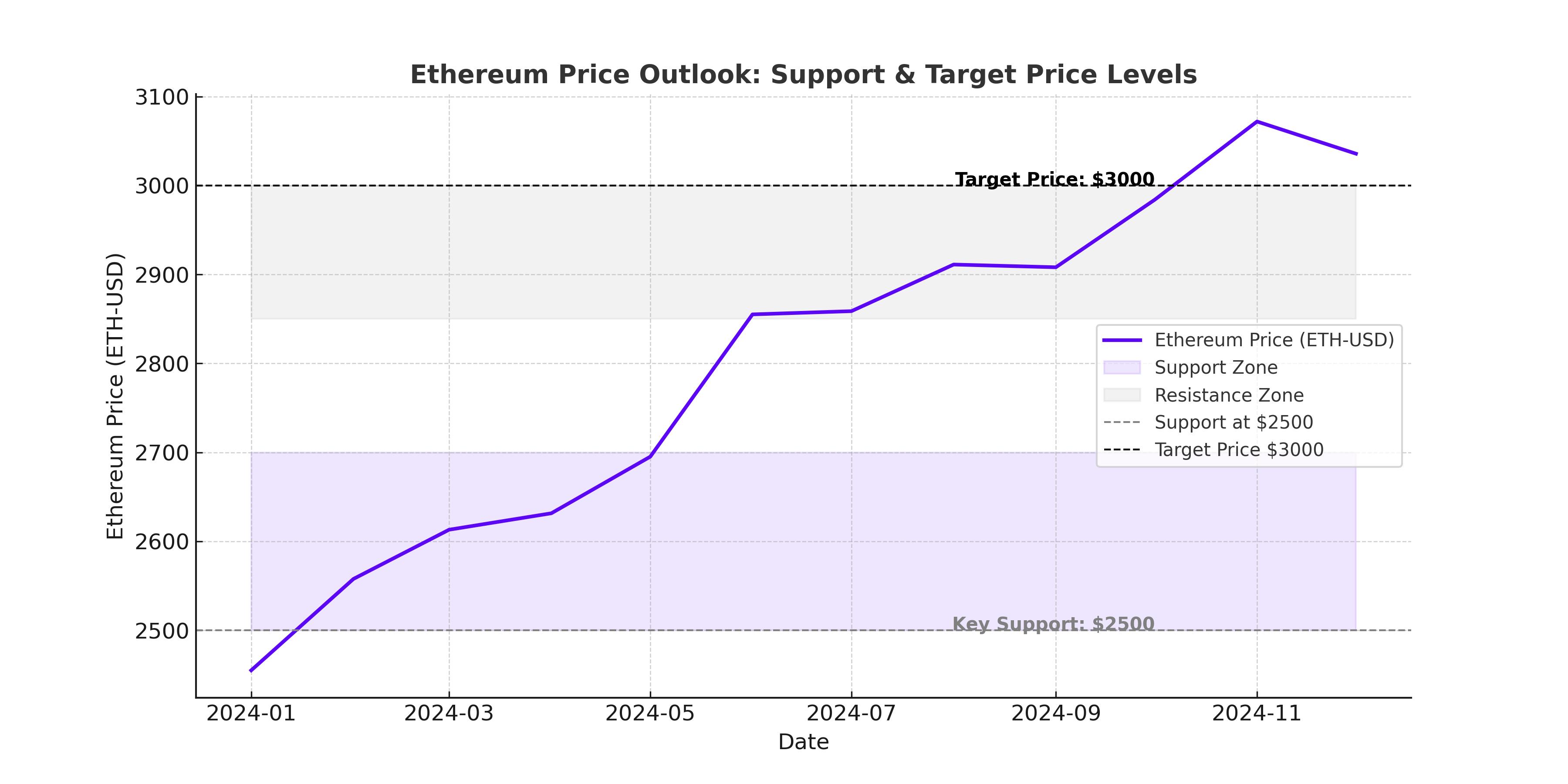

Ethereum has been moving through a volatile trading range, testing key support at $2,600 while facing strong resistance near $2,800. After dropping more than 35% from its December highs, ETH is showing mixed signals, leaving traders uncertain whether a rally toward $3,000-$3,500 is imminent or if a further drop is on the horizon. Institutional interest, ETF developments, and on-chain data are all playing a significant role in shaping Ethereum’s price action.

Ethereum Faces Critical Resistance at $2,800 - $3,000

ETH’s struggle to break above $2,800 has been a defining trend over the past few weeks. Each time Ethereum attempts to push higher, sellers step in to defend key levels. The 50-day and 200-day moving averages have formed a death cross, a bearish technical indicator that historically signals a deeper pullback. Last time Ethereum experienced this pattern in August 2023, the price fell by 20%.

Adding to the bearish case, ETH has invalidated its inverse head and shoulders pattern after breaking below $2,821, a level that previously acted as a strong pivot point for bullish momentum. If Ethereum cannot reclaim this price zone, a test of $2,400 or even $2,140—which serves as the neckline of a double-top formation—could be next. A further breakdown from there could send ETH toward $1,530, a price last seen in November 2023.

Institutional Demand and ETF Developments: A Game Changer?

Despite these bearish signals, institutional interest in Ethereum remains strong. BlackRock, the world’s largest asset manager, has increased its Ethereum holdings to $4.44 billion, following an additional $12.5 million ETH purchase on February 11. Additionally, the Ethereum ETF narrative is intensifying, with CBOE filing for Ethereum ETF staking approval, a move that could dramatically change Ethereum’s long-term adoption and institutional inflows.

Even though Ethereum ETFs have recorded net outflows of $40.95 million in the past week, the cumulative inflows since launch remain at $3.1 billion, signaling ongoing demand from institutional investors. If staking gets approved for ETH-based ETFs, it could create an entirely new demand cycle, locking up ETH and reducing circulating supply.

Ethereum Whales Are Accumulating—A Bullish Sign?

On-chain data provides further insights into Ethereum’s potential upside. Whales have accumulated over 600,000 ETH in the past week, leading to a significant drop in Ethereum’s exchange reserves. A lower supply of ETH on exchanges typically indicates a reduction in selling pressure and could set the stage for a strong rally.

At the same time, exchange outflows have reached a 23-month high, with over 768,500 ETH withdrawn from exchanges in a single day. Historically, large outflows suggest strong accumulation by institutional players, which can act as a precursor to a price breakout.

Ethereum’s Technical Indicators: Signs of a Reversal?

From a technical standpoint, Ethereum’s indicators are flashing mixed signals:

- RSI at 36% suggests that Ethereum is in oversold territory, meaning a bounce could be near.

- MACD shows a weakening bearish trend, indicating that downside momentum is slowing.

- Bollinger Bands are tightening, hinting at an imminent volatility surge—historically a signal that a breakout or breakdown is coming.

If ETH breaks above $2,800 and sustains it as a support level, the next target will be $3,000, with an extension toward $3,200-$3,500 if bullish momentum continues. However, failure to hold above $2,600-$2,500 could send Ethereum into a deeper correction toward $2,140 or even $1,530.

Final Outlook: Is Ethereum a Buy, Hold, or Sell?

Ethereum’s price action is at a make-or-break point. Institutional demand, ETF momentum, and whale accumulation provide strong bullish tailwinds. However, technical indicators still suggest significant resistance, and Ethereum must break through $2,800-$3,000 to confirm a sustainable rally.

If ETH clears $3,000, it’s a strong buy with a price target of $3,500-$4,000. If it fails to hold above $2,500, traders should be cautious, as the next support zones at $2,140 and $1,530 could come into play.

Will Ethereum’s growing institutional interest be enough to push it past resistance, or is a deeper correction coming first? The next few weeks will be crucial in determining ETH’s trajectory for 2025.