Ethereum Price Analysis: Resilience Amid Volatility and Institutional Confidence

Ethereum's Historical February Strength and Current Price Movements

Ethereum (ETH-USD), the second-largest cryptocurrency by market capitalization, has demonstrated notable historical performance during February. Over the past six years, ETH has consistently posted gains in this month, including a remarkable 46% surge in February 2024. Currently trading near $3,159, Ethereum has faced significant pressure, with a 7.87% drop over the past week, testing critical support at the $3,000 level. This price dip follows broader crypto market volatility and a selloff attributed to a downturn in risk assets. Despite this correction, ETH supporters maintain a bullish outlook, supported by historical trends indicating that February and March have typically delivered strong returns.

On-Chain Data Suggests a Bullish Outlook for ETH

On-chain analysis reinforces optimism surrounding Ethereum's potential recovery. The Market Value to Realized Value (MVRV) ratio, a key metric used to evaluate Ethereum's valuation relative to its realized value, suggests significant upside potential. In every previous bull cycle, ETH has surpassed the critical 3.2 MVRV level, which currently corresponds to a price target of approximately $6,770. Additionally, Ethereum's robust fundamentals continue to bolster confidence. The blockchain generated $2.48 billion in fees in 2024, maintaining its position as the highest-earning network, nearly tripling the revenue of its closest competitor, Solana.

Ethereum's decreasing exchange balances further signal a reduction in sell pressure. According to CoinGlass, centralized exchange holdings of ETH have dropped to 16.04 million from a high of 16.09 million earlier this month. This decline suggests that investors are moving their assets to self-custody wallets, a bullish sign indicating confidence in Ethereum's long-term value.

Institutional Participation and Strategic Developments

Institutional interest in Ethereum continues to grow, with high-profile players like Donald Trump’s World Liberty Financial accumulating ETH worth approximately $200 million. Similarly, Ethereum spot ETFs recorded a net inflow of $139 million last week, led by BlackRock’s Ethereum ETF (ETHA), which accounted for $135 million of these inflows. This growing institutional adoption highlights Ethereum's increasing appeal among traditional finance players.

Strategic initiatives by Ethereum’s leadership also underline its evolving ecosystem. The launch of Etherealize, a platform designed to bridge traditional financial institutions with decentralized finance (DeFi), aims to simplify Ethereum adoption among institutional investors. Additionally, Ethereum co-founder Vitalik Buterin’s backing of Etherealize reflects the network's commitment to expanding its market reach and enhancing its utility.

Technical Patterns Indicate a Potential Breakout

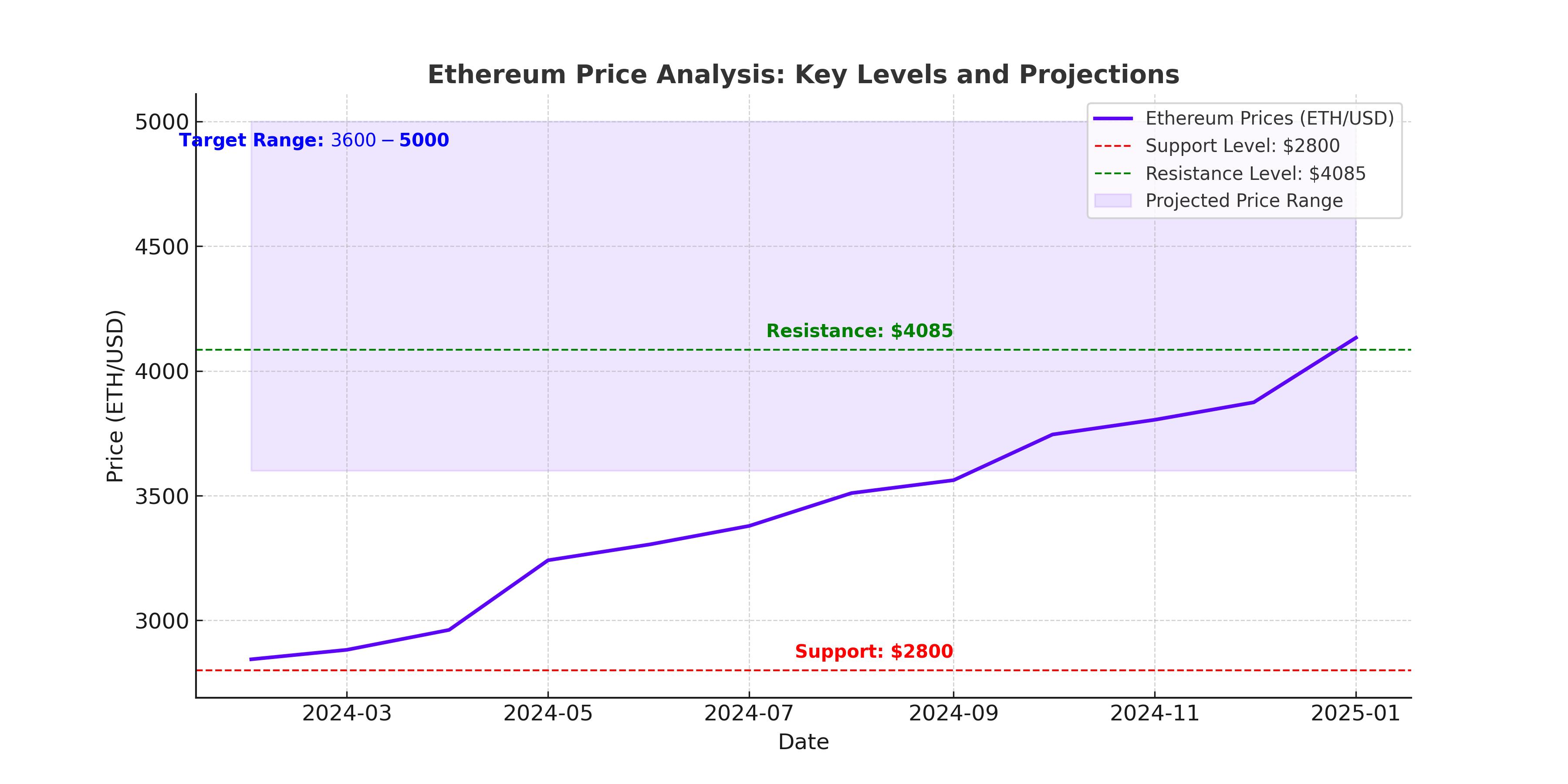

From a technical perspective, Ethereum is exhibiting signs of a bullish reversal. The weekly chart shows the formation of an inverse head-and-shoulders pattern, with the neckline positioned at $4,085. A breakout above this level could signal a significant rally, potentially pushing ETH toward the $5,000 mark. The price has also formed a flag-and-pole pattern during its recent downtrend, with $2,800 emerging as a crucial support level. Analysts project that if this support holds, Ethereum could reach $3,600 and potentially retest the $4,000 resistance zone.

Ethereum's performance relative to Bitcoin (BTC-USD) is also noteworthy. The ETH/BTC trading pair recently hit four-year lows, indicating a period of relative weakness. However, this dynamic may shift as ETH gains momentum, supported by bullish technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD).

Upcoming Catalysts: Pectra Upgrade and Supply Burn Mechanisms

Ethereum's upcoming Pectra upgrade, scheduled for March 2025, is expected to enhance network efficiency and scalability, serving as a potential catalyst for price appreciation. Additionally, Ethereum's built-in supply burn mechanism, introduced through EIP-1559, continues to exert deflationary pressure on the network. During periods of high activity, transaction fee burning reduces circulating supply, creating favorable conditions for price growth.

The growing adoption of staking further supports Ethereum's bullish case. With over 30% of ETH’s total supply now locked in staking contracts, the network is experiencing natural supply constraints. Institutional platforms offering staking-as-a-service are expected to drive this percentage even higher, reinforcing Ethereum’s appeal as a yield-generating asset.

Market Sentiment and Broader Implications

Despite recent price declines, sentiment surrounding Ethereum remains optimistic. Market analysts highlight the network's expanding adoption across DeFi, NFTs, and digital payments as key drivers of long-term value. The network’s ability to attract new users, as evidenced by the creation of over 200,000 new Ethereum addresses in a single day, underscores its resilience amid market volatility.

Conclusion

Ethereum’s current price action reflects a consolidation phase within a broader bullish trend. Supported by strong on-chain metrics, institutional interest, and upcoming technical upgrades, Ethereum is well-positioned for a potential breakout. Key levels to watch include the $2,800 support zone and the $4,085 resistance level, with a successful breakout likely paving the way for further gains. As the network continues to demonstrate its value through growing adoption and innovative developments, Ethereum remains a compelling asset for both retail and institutional investors.