Ethereum Price Battles $3,500 Resistance – Will ETH-USD Surge or Sink?

Ethereum is struggling between $3,000 support and $3,500 resistance, with bulls and bears fighting for control. Will ETH break out and target $4,000, or is a drop to $2,600 on the horizon? | That's TradingNEWS

Ethereum Price Faces Critical Breakout Decision – Will ETH-USD Rally Past $3,500 or Drop Below $3,000?

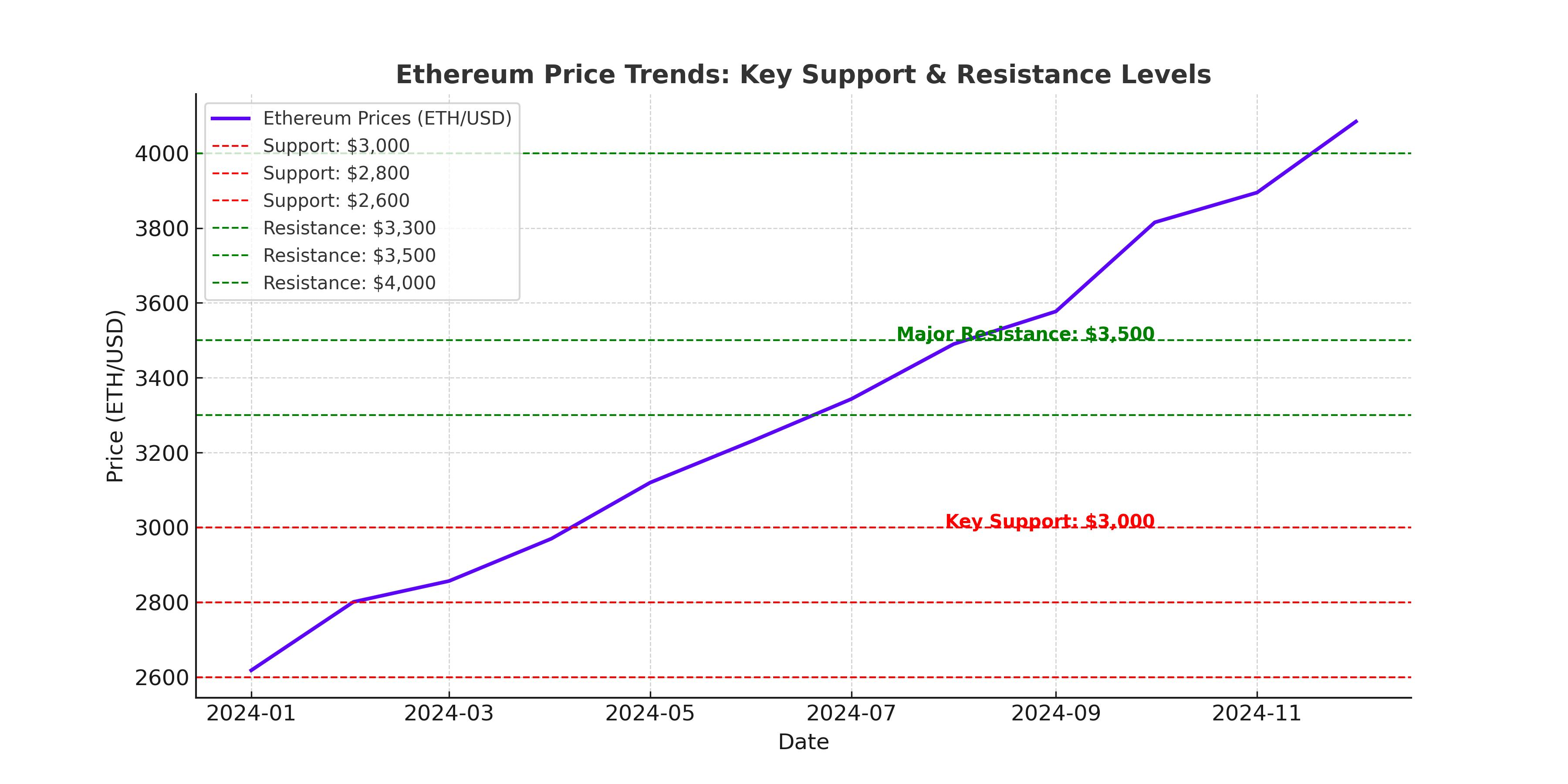

Ethereum (ETH-USD) has been locked in a tight trading range between $3,000 and $3,300, with the 100-day moving average capping upside moves at $3,300, while buyers aggressively defend the 200-day moving average support at $3,000. Despite selling pressure, ETH remains resilient, and technical indicators suggest an imminent breakout that could either propel it toward $4,000 or lead to a deeper correction below $3,000.

Ethereum Consolidation Near $3,000 – Is a Bullish Breakout Coming?

Ethereum's price has been trapped in a falling wedge formation since mid-December, with lower highs and lower lows keeping the cryptocurrency in a consolidating downtrend. The $3,000 support level has held firm, preventing deeper losses, but bulls have been unable to push past $3,300, leaving the market in limbo.

Technical indicators are mixed. The Relative Strength Index (RSI) remains below 50, signaling weak bullish momentum, while on-chain data from Glassnode suggests that Ethereum whales have been reducing their exposure, transferring significant amounts of ETH to exchanges. Over 122,000 ETH ($390 million) was deposited into exchanges recently, a sign that some investors are taking profits rather than accumulating.

However, the funding rate for ETH perpetual futures has started to turn positive, suggesting that bullish traders are returning to the market. If demand continues to rise, Ethereum could see a strong rally toward $3,500 and beyond, but failure to break resistance may trigger a deeper correction toward $2,600-$2,800.

Ethereum ETF Flows and Institutional Demand – A Key Driver for Price Action

Ethereum’s long-term trajectory is being shaped by institutional participation, particularly through Ethereum spot ETFs. Since the launch of US spot ETH ETFs, over $2 billion has flowed into these investment vehicles, signaling growing interest from institutional investors. However, recent outflows have raised concerns about short-term selling pressure, with $346 million in net outflows recorded this week alone.

A crucial factor impacting Ethereum’s ETF flows is the absence of staking rewards. Unlike direct ETH ownership, where investors can stake their holdings and earn yield from the Ethereum network, ETFs currently do not offer this benefit. This has made ETH ETFs less attractive compared to direct ownership, leading to periodic outflows when short-term price movements weaken sentiment.

For Ethereum to sustain a long-term rally, ETF inflows must stabilize, and potential regulatory clarity on staking-enabled ETFs could provide a fresh catalyst for demand.

Donald Trump’s Influence on Ethereum – Could the US Government Buy ETH?

One of the more surprising bullish narratives for Ethereum has emerged from Donald Trump’s administration, which has taken a pro-crypto stance since returning to the White House. Trump’s World Liberty Financial, a crypto-focused investment firm, has reportedly accumulated over $200 million worth of ETH, outpacing its Bitcoin holdings.

This has fueled speculation that Trump may introduce a national Ethereum reserve, a concept that has gained traction among crypto investors and Polymarket bettors, with odds rising from 9% to 32% in just two weeks. If such a reserve materializes, ETH prices could surge past $6,000, making it one of the biggest bullish catalysts in Ethereum’s history.

Trump’s support for blockchain innovation also extends to Ethereum-based meme coins, with projects like Pepe, Brett, and the Meme Index gaining momentum. This growing institutional and speculative interest suggests that Ethereum could play a central role in the US government’s evolving crypto strategy.

Ethereum’s Technical Battle – Can It Hold Above $3,000?

Ethereum has been flirting with the $3,000 support level for weeks, and analysts warn that a break below this threshold could accelerate losses toward $2,600. However, if bullish momentum builds, ETH could quickly reclaim $3,500 and attempt a run toward $4,000.

Key resistance levels:

- $3,300 (100-day moving average) – Immediate short-term resistance

- $3,500 – Major psychological and technical barrier

- $4,000 – A breakout above this level would confirm a bullish trend

Key support levels:

- $3,000 (200-day moving average) – Critical support holding Ethereum’s price

- $2,800 – A break below $3,000 could trigger a move toward this level

- $2,600 – Final line of defense before a major market breakdown

Ethereum Price Forecast – Buy, Sell, or Hold?

Ethereum remains in a neutral consolidation phase, with both bullish and bearish scenarios in play. If ETF inflows resume and buying pressure increases, Ethereum could rally toward $4,000, making it a buy opportunity at current levels. However, if bearish sentiment persists and ETH loses $3,000, the cryptocurrency could experience a sharp decline toward $2,600, suggesting a wait-and-see approach for new buyers.

For now, Ethereum remains a hold, with a bullish bias if key resistance levels are broken. Traders should closely watch institutional flows, technical breakouts, and macroeconomic conditions for the next major move.