Ethereum Price Analysis: Can ETH-USD Break Above $3,000 or Face Another Drop?

Ethereum Struggles at $2,800 – Is a Breakout or Breakdown Next?

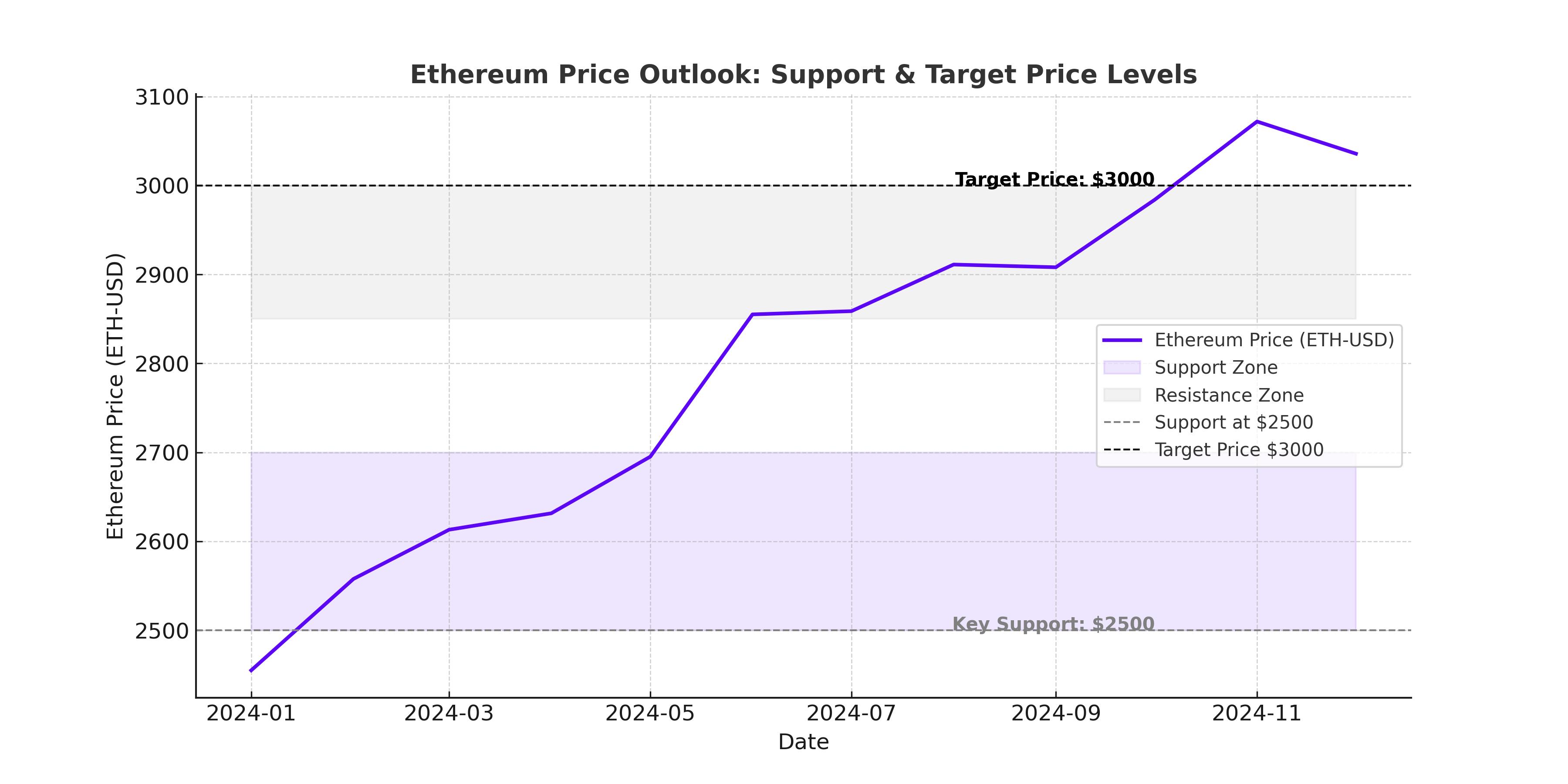

Ethereum (ETH-USD) is at a crucial technical juncture, hovering around $2,750, with traders and investors watching whether bulls can push it past $3,000 or if another sell-off will send it below $2,500.

Over the past week, Ethereum has bounced between $2,600 and $2,800, consolidating after failing to sustain momentum above $2,850. Whale activity has increased dramatically, with large holders redistributing over $1 billion worth of ETH into the market in the past 48 hours. Despite this, institutional investors continue to show confidence, with 740,000 ETH withdrawn from exchanges in the last two weeks—a sign of long-term accumulation.

At the same time, options data indicates a 30% chance that ETH will break above $3,000 before the end of Q1 2025, up from 28% last week. However, Ethereum’s price action remains uncertain, with technical signals pointing in both directions.

Ethereum ETFs and Institutional Demand – Will It Drive a Surge?

One of the biggest factors influencing Ethereum's price is the growing adoption of ETH ETFs. Since their launch, Ethereum ETFs have attracted over $3.15 billion in inflows, signaling strong institutional demand. If this trend continues, it could mirror Bitcoin's ETF-driven surge and provide the necessary momentum for ETH to break key resistance levels.

Further supporting Ethereum’s case is the decline in exchange reserves, which suggests that investors are moving ETH into self-custody rather than selling it. The current balance of Ethereum on exchanges is down to 15.34 million ETH, the lowest level in months. This could lead to a supply squeeze, which historically has resulted in higher prices.

Another bullish factor is Ethereum’s dominance in decentralized finance (DeFi). Over $2.28 billion in transactions were recorded on Ethereum-based DEXs in the last 24 hours, surpassing rival blockchain Solana (SOL-USD). With DeFi and NFT activity growing, Ethereum remains the most widely used smart contract platform.

Technical Outlook – Key Support and Resistance Levels to Watch

Ethereum's price is currently in a tight range, and traders are eyeing several critical levels:

- Resistance at $2,850: ETH must break and hold above this level to confirm bullish momentum. If it does, $3,200 is the next major target.

- Support at $2,500: If Ethereum fails to break higher, a drop below $2,500 could trigger a deeper sell-off to $2,200 or even $2,000.

- 50-day and 200-day moving averages are converging, forming a potential death cross—a bearish signal that could lead to a steep decline if bears take control.

Ethereum’s weekly RSI is hovering around neutral, meaning it could go either way. If bulls step in at $2,700-$2,800, it could lead to an explosive move above $3,000. However, failure to hold current levels could result in another dip to test lower supports.

Will Ethereum Break $3,000 or Drop to $2,200?

The next big move for Ethereum depends on several key factors:

- Can ETH maintain institutional demand? If ETF inflows continue and whales stop selling, Ethereum could quickly rally toward $3,200 and beyond.

- Will Bitcoin’s price action influence ETH? Bitcoin’s strength often drives Ethereum’s momentum, and if BTC consolidates or pulls back, ETH might struggle to break higher.

- Can bulls break key resistance? Ethereum needs a daily close above $2,850 with strong volume to confirm a push toward $3,200-$3,500.

Right now, Ethereum is at a make-or-break moment. If bullish momentum builds, ETH-USD could surge past $3,000 and target $3,500-$4,000 in the coming months. However, if selling pressure increases, a drop toward $2,200-$2,500 is still very much on the table.

So, is Ethereum a buy, sell, or hold? Long-term holders may continue accumulating on dips, but short-term traders should wait for a confirmed breakout or breakdown before making their move. Ethereum’s future looks bullish in the long run, but short-term volatility is still in play.