EUR/USD at $1.0410 – Will the Euro Survive the Fed’s Hawkish Grip?

With the Fed holding rates and ECB cutting, is EUR/USD doomed to break below $1.0380? | That's TradingNEWS

EUR/USD Price Outlook: Can the Euro Hold as U.S. Dollar Strengthens?

Economic Pressures on the Eurozone and Their Impact on EUR/USD

The euro is facing multiple headwinds as weak economic data from the Eurozone continues to weigh on its outlook. Germany’s GfK Consumer Climate Index dropped to -22.4, missing expectations of -20.5, signaling deteriorating consumer confidence. Meanwhile, Spanish GDP growth met expectations at 0.8%, providing some support, but the overall liquidity in the region is tightening, as seen in the M3 Money Supply slowing to 3.5%. However, private loans increased slightly to 1.1%, indicating some resilience in credit expansion.

The German 10-year bond auction results will be closely watched, as changes in yields could influence the direction of the euro. Higher bond yields could provide some support for EUR/USD, while weak demand for bonds may add further downside pressure.

EUR/USD Technical Analysis: Key Levels to Watch

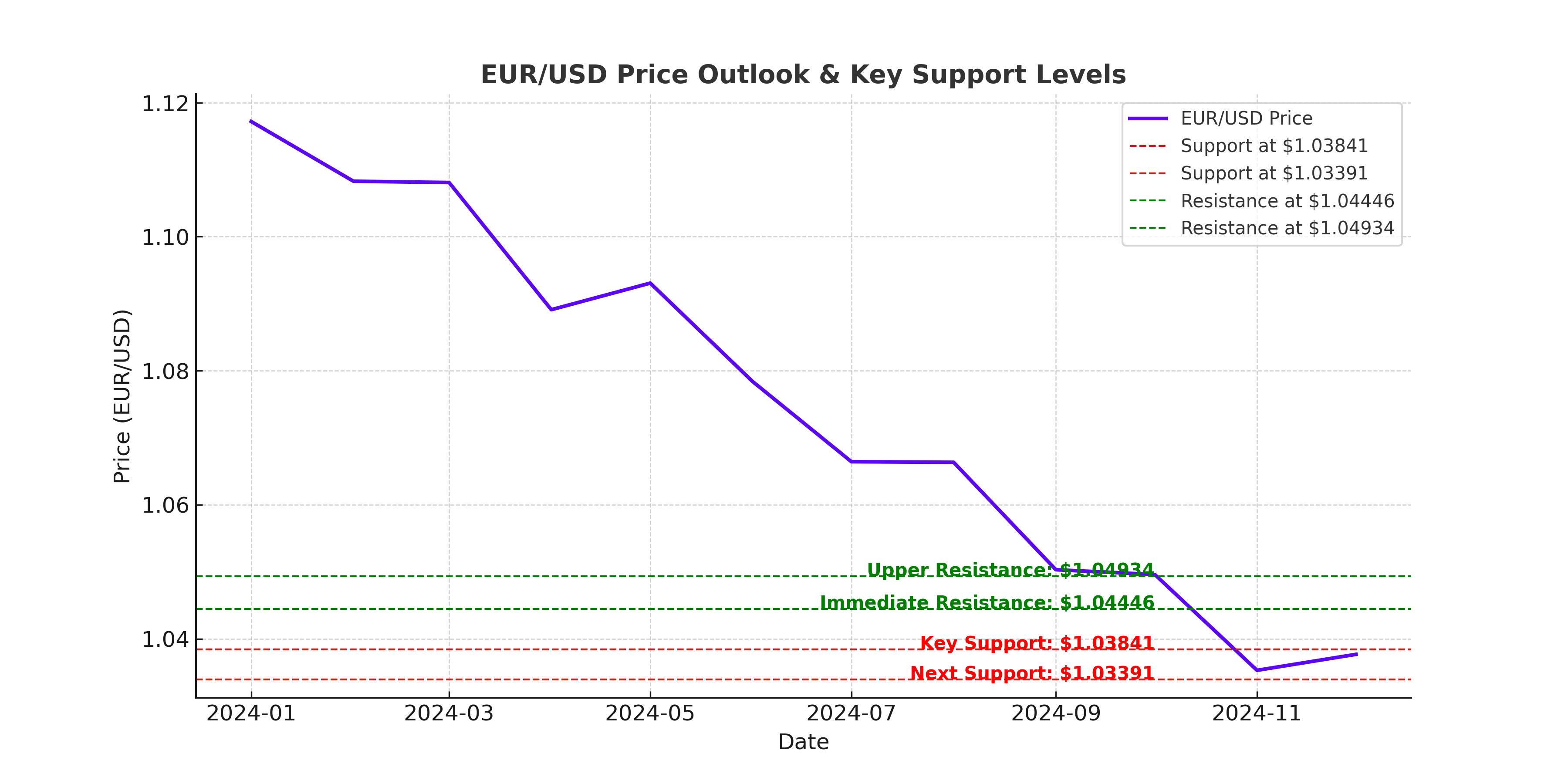

EUR/USD is trading around $1.04129, down 0.16%, with buyers defending critical support near $1.03841. The currency pair has been range-bound, consolidating between $1.03841 and $1.04934, as traders await a catalyst for a breakout.

The 50-day EMA at $1.04368 is acting as immediate resistance, while the 200-day EMA at $1.03901 serves as key support. If EUR/USD manages to break above $1.04446, it could gain momentum toward the upper range limit of $1.04934. On the downside, a failure to hold $1.03841 could accelerate selling toward $1.03391.

The broader trend remains bearish, and traders are watching the upcoming Federal Reserve and European Central Bank (ECB) decisions for the next major move.

Federal Reserve Rate Decision and Its Impact on EUR/USD

The Federal Reserve’s interest rate policy remains a key driver for EUR/USD. The Fed is expected to keep rates steady in the range of 4.25%-4.50%, as inflation remains above the 2% target and the labor market continues to show resilience.

A hawkish stance from Fed Chair Jerome Powell could strengthen the U.S. dollar, pushing EUR/USD lower. On the other hand, if the Fed signals that rate cuts could come sooner than expected, the euro might get a short-term boost.

Markets are currently pricing in two Fed rate cuts in 2025, but uncertainty remains. If inflation remains sticky and the Fed keeps rates higher for longer, EUR/USD could see further downside toward $1.0300.

ECB Rate Cut Expectations and the Euro’s Struggle

The European Central Bank is widely expected to cut rates by 25 basis points, bringing the deposit rate down to 2.75%. Markets have already priced in this move, but traders are watching for signals about future rate cuts.

The ECB's dovish stance is driven by economic weakness in Germany, which is projected to contract for the third consecutive year due to sluggish industrial growth. ECB President Christine Lagarde will likely address these concerns in her post-meeting press conference.

A more aggressive rate cut outlook from the ECB could weaken the euro further, potentially pushing EUR/USD toward $1.0300 or lower in the coming weeks.

EURO STOXX 50 Performance: European Equities at Record Highs

European stocks have remained resilient despite the economic slowdown, with the EURO STOXX 50 reaching record highs. The index has been driven by a strong rally in technology stocks, led by ASML, which surged 11.2% after reporting €7.09 billion in fourth-quarter bookings.

Other semiconductor stocks, such as STMicroelectronics and BE Semiconductor, followed ASML’s lead, boosting the sector by 4.5%, marking its best single-day gain in a year.

Industrial stocks also performed well, with Volvo rising 7% on strong orders. However, luxury stocks, including LVMH, Kering, and Dior, struggled due to underwhelming sales data.

Despite strong equity performance, the euro remains under pressure due to ECB rate cut expectations and uncertainty around global trade policies.

Potential Tariffs and Their Effect on the Euro

The Trump administration’s proposed tariffs on pharmaceuticals, steel, and semiconductors could create additional headwinds for the euro. A universal 2.5% tariff is being discussed, which could directly impact European exports.

If these tariffs are implemented, they could weaken the eurozone’s trade position, further pressuring EUR/USD. ECB President Christine Lagarde recently warned that Europe must "anticipate what will happen" and "be prepared to respond" to potential tariff policies.

JAAA ETF Holdings and Its Relationship to EUR/USD

The Janus Henderson AAA CLO ETF (NYSEARCA:JAAA) is one of the most attractive fixed-income plays in the market, offering a 6.39% trailing yield and a 6.01% SEC yield. This ETF holds AAA-rated collateralized loan obligations (CLOs), providing a floating rate income stream.

JAAA does not hold traditional stocks, but rather AAA-rated debt instruments, making it an alternative to bonds. Some of its largest holdings include:

- OCP CLO Ltd | 5.44168% | Maturity: 01/17/2037

- Magnetite XXXIX Ltd | 5.60211% | Maturity: 01/25/2037

- Ares LIII CLO Ltd | 5.57664% | Maturity: 10/24/2036

- RAD CLO 21 Ltd | 5.364% | Maturity: 01/25/2037

- AGL Core CLO 2 Ltd | 5.75317% | Maturity: 07/20/2037

The ETF’s floating rate structure makes it more resilient to rising interest rates compared to traditional bond ETFs. If the Fed maintains higher rates for longer, JAAA is likely to continue outperforming other fixed-income investments.

EUR/USD Market Sentiment and Future Outlook

EUR/USD remains vulnerable as market sentiment favors the U.S. dollar. The U.S. Dollar Index (DXY) is hovering around 107.90, reflecting strong demand for the greenback as traders expect prolonged Fed policy tightening.

With the ECB leaning toward a dovish stance and the Fed staying cautious, the risk remains skewed to the downside for EUR/USD. Key levels to watch include:

- Support at $1.03841 – A break below this level could accelerate losses toward $1.03391.

- Resistance at $1.04934 – A move above this level could signal a short-term recovery.

Final Verdict: Is EUR/USD a Buy, Sell, or Hold?

Given the fundamental and technical landscape, EUR/USD remains bearish, with further downside risks if the ECB cuts rates aggressively and the Fed maintains its current stance. The most likely scenario is continued weakness toward $1.0300-$1.0350, unless a major shift in policy expectations occurs.

For now, EUR/USD is a SELL, with any rallies likely to be short-lived. Traders should watch central bank statements and key technical levels for confirmation of the next move.

That's TradingNEWS

Read More

-

GPIX ETF At $52.52: 8% Yield And Dynamic S&P 500 Income Upside

13.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs Surge Toward $1B As XRPI Hits $11.64 And XRPR $16.48 With XRP Near $2

13.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Hovers Near $4.07 Support After 22% Weekly Slide

13.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen at 154–158 Range as BoJ 0.75% Hike and Fed Cut Debate

13.12.2025 · TradingNEWS ArchiveForex