EUR/USD Battles 1.0500: Will Economic Data or ECB Policy Turn the Tide?

Euro struggles under geopolitical tensions and hawkish Fed sentiment, with key US jobs data and ECB actions in focus for the pair's next move | That's TradingNEWS

EUR/USD Outlook: Key Levels to Watch Amid Geopolitical and Economic Turmoil

The EUR/USD currency pair is currently navigating a complex environment of geopolitical tension, economic data releases, and shifting monetary policies, with significant implications for its short-term and long-term trajectory. As the world's most traded currency pair, the EUR/USD continues to draw intense scrutiny from traders and investors amid a volatile backdrop.

The EUR/USD has been oscillating near the 1.0500 level, reflecting the ongoing tug-of-war between bearish pressure and sporadic bullish recoveries. This level is being tested repeatedly as market participants react to the evolving macroeconomic landscape. In recent sessions, the euro struggled to hold gains, weighed down by soft economic data from the Eurozone and hawkish sentiment around the US dollar. The euro faces additional headwinds from mounting geopolitical risks, particularly the escalating tension in Ukraine, which threatens to disrupt energy supplies and dampen growth across Europe.

Eurozone Inflation Data and ECB Policy Outlook

The European Central Bank's (ECB) inflation outlook remains pivotal to the euro's valuation. Recent data revealed that the bloc's core inflation remained elevated at 2.7% in November, exceeding the ECB's 2.0% target. German inflation eased slightly, with a 0.2% dip in price pressures in October, reflecting subdued economic activity. However, the overall economic outlook remains fragile, with German retail sales falling 1.5% in the latest reading and unemployment steady at 6.1%. Such metrics underscore the challenges facing the ECB as it deliberates further rate cuts to support growth.

ECB officials have been split in their approach, with Isabel Schnabel advocating for a measured pace of cuts, while François Villeroy called for more aggressive easing in upcoming meetings. This policy divergence creates uncertainty for the EUR/USD pair, limiting its ability to mount a sustainable recovery. The ECB's next move, expected in December, will be closely watched, especially as inflation remains a persistent concern.

US Economic Resilience and Dollar Strength

The US dollar's strength has been a major obstacle for the euro. Positive US economic indicators, including the ISM Manufacturing PMI rising to 47.7 and stronger-than-expected consumer spending data, have bolstered the greenback. Additionally, Federal Reserve officials continue to hint at a cautious approach to rate cuts, further supporting the dollar. The US Dollar Index (DXY) climbed to 106.27 in recent sessions, adding to the downward pressure on the EUR/USD.

Market participants are also reacting to President-elect Donald Trump's recent comments warning against a BRICS-led move to replace the US dollar in global trade. Trump's rhetoric, combined with his threats of steep tariffs on countries supporting alternative currencies, reinforces the dollar's safe-haven appeal. Risk sentiment remains cautious, reflected in subdued equity market performance and increased demand for US Treasury bonds, keeping the dollar well-bid.

Technical Outlook for EUR/USD

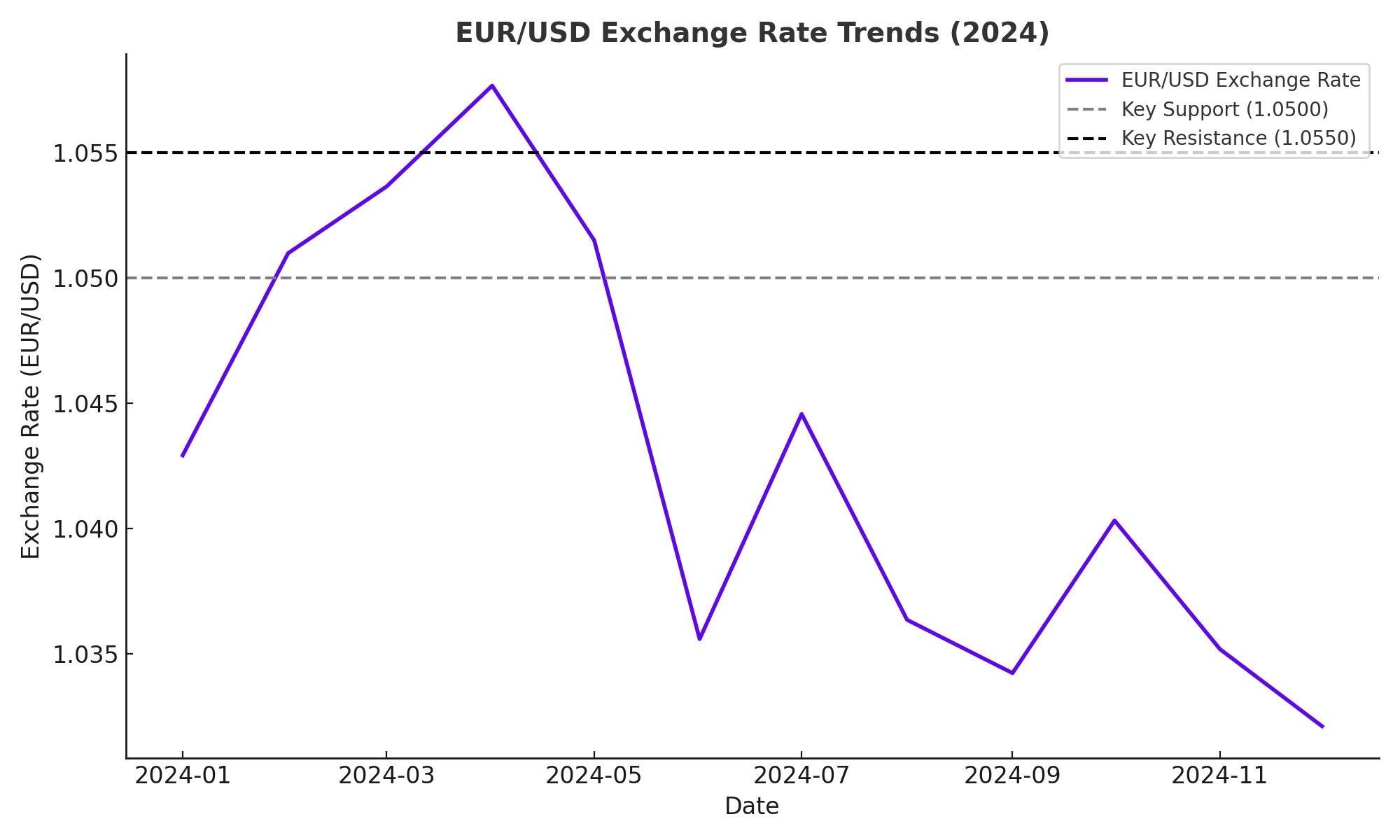

From a technical perspective, the EUR/USD remains trapped in a bearish channel, with key resistance and support levels dictating short-term price action. The pair's inability to hold above the 100-period Simple Moving Average (SMA) on the 4-hour chart highlights persistent selling pressure. Immediate resistance is pegged at 1.0550, with further hurdles at 1.0610 and 1.0660. A break above these levels could signal a shift in momentum, opening the door for a test of the 1.0700 psychological mark.

On the downside, immediate support lies at 1.0500, followed by the November low of 1.0333. A breach of this support would likely exacerbate bearish sentiment, targeting levels near 1.0300. The Relative Strength Index (RSI) and Percentage Price Oscillator (PPO) indicators suggest a bearish bias, with the pair struggling to gain traction above key moving averages.

Geopolitical Risks and Market Sentiment

Geopolitical developments add another layer of complexity to the EUR/USD outlook. The ongoing conflict in Ukraine, coupled with Trump's aggressive stance on trade and currency dynamics, creates an environment of heightened uncertainty. These factors are likely to keep risk sentiment subdued, favoring the US dollar as a safe-haven asset.

Meanwhile, the euro faces additional challenges from within the Eurozone. Weak PMI readings from major economies such as Germany and France indicate persistent contraction in manufacturing activity. The French PMI remained at a dismal 43.3, while the German PMI hovered at 43.2, underscoring the bloc's economic struggles. These data points highlight the limited scope for a robust euro recovery in the near term.

Fundamental and Event-Driven Catalysts

The week ahead holds several key events that could influence the EUR/USD trajectory. US nonfarm payrolls data, scheduled for release on Friday, will be a critical determinant of market sentiment. A stronger-than-expected jobs report could reinforce the Fed's cautious approach to rate cuts, further supporting the dollar.

In the Eurozone, inflation readings and PMI data will remain under scrutiny. Any signs of further economic deterioration could weigh heavily on the euro, increasing the likelihood of aggressive ECB policy action. The currency pair's response to these data releases will provide important insights into its directional bias.

Summary and Outlook

The EUR/USD remains under pressure as the euro contends with a challenging macroeconomic environment and the dollar benefits from relative economic resilience and safe-haven flows. The pair's near-term trajectory will be influenced by key support and resistance levels, as well as upcoming economic data and central bank policy signals. For now, the technical and fundamental backdrop suggests a bearish tilt, with limited upside potential unless there is a significant improvement in Eurozone economic conditions or a shift in US monetary policy expectations.