EUR/USD Analysis: Critical Support Levels & Upcoming Economic Events

In-depth examination of EUR/USD's pivotal support and resistance levels, the effects of European elections, US Non-Farm Payrolls, and geopolitical developments on the currency pair | That's TradingNEWS

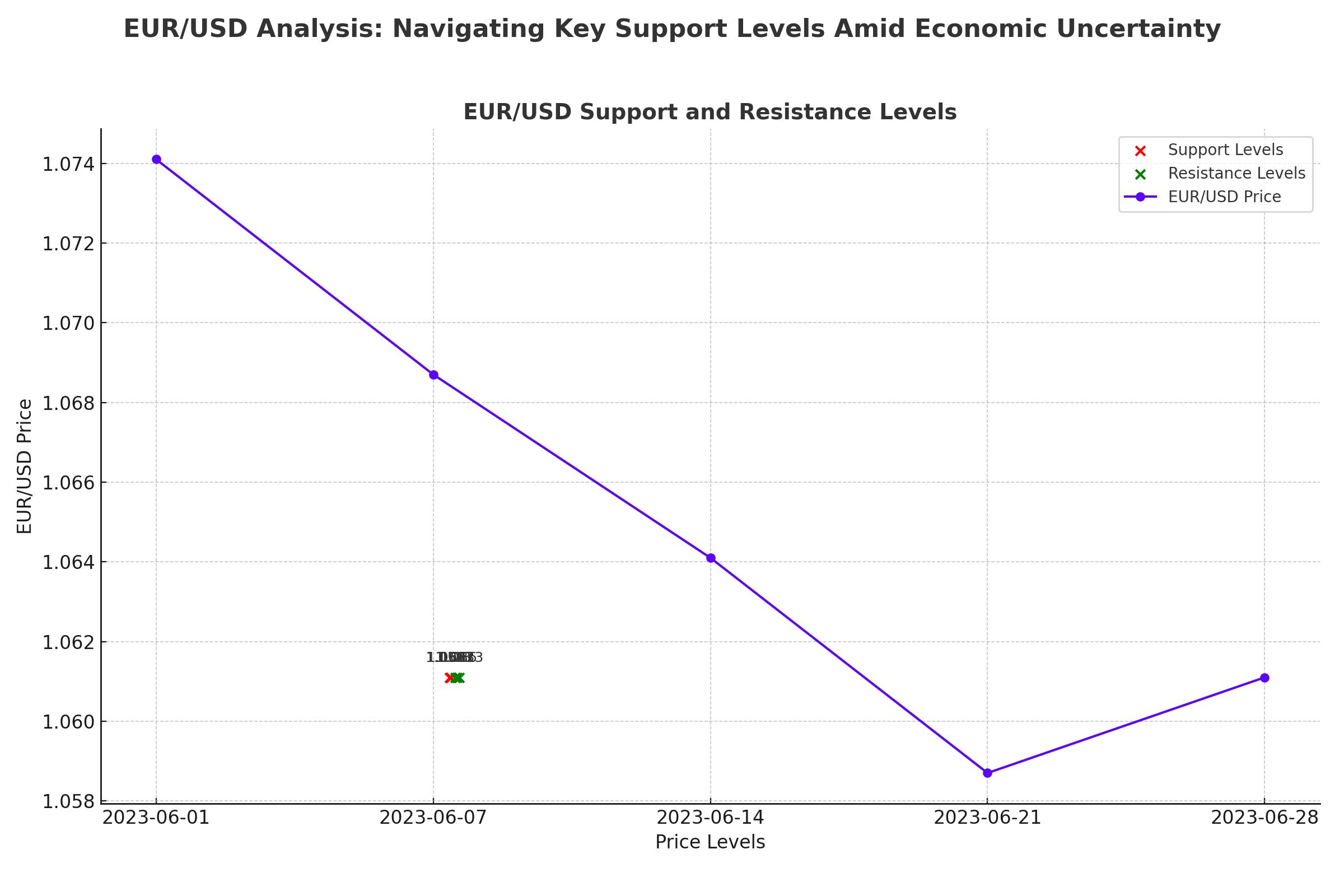

EUR/USD Analysis: Navigating Key Support Levels Amid Economic Uncertainty

EUR/USD Overview: Technical Analysis and Market Sentiment

The EUR/USD pair (EURUSD) has been a focal point of interest as it navigates pivotal support levels amid a complex economic landscape. Recent weeks have seen the Euro snapping a three-week losing streak against the US Dollar, poised to close June down nearly 1.3%. As we head into July and Q3, the focus shifts to critical support and resistance levels, European elections, and key economic data releases.

Technical Outlook: Key Support and Resistance Levels

Support Levels:

- 1.0641/77: This region has been a critical support zone, defined by the 2024 low-close and the low-week close, converging with basic slope support extending from the 2023 low.

- 1.0587/96: A break below this level would validate a break of the yearly opening range, potentially targeting subsequent objectives at 1.05 and the 2023 low at 1.0448.

Resistance Levels:

- 1.080/14: Initial weekly resistance at the June high-week reversal close, supported by the 52-week moving average.

- 1.0860s: Longer-term slope resistance.

- 1.0933/42: Key resistance zone defined by the 61.8% Fibonacci retracement of the December decline and the objective 2024 high-week close.

The EUR/USD has been testing key support for the past three weeks. A break below 1.0641 could signal further declines, while resistance at 1.0933/42 remains a critical barrier for any bullish momentum.

Economic Data and Market Reactions

European Elections and ECB Decisions: The upcoming European elections and the ECB's cautious stance on monetary policy have significantly influenced market sentiment. The French elections, with the first round on June 30 and the second round on July 7, are crucial. Financial institutions are closely monitoring the outcomes, given France's pivotal role in the Eurozone economy.

US Non-Farm Payrolls (NFP): The US NFP data, set to release next week, is another critical factor. A robust NFP report could strengthen the US Dollar, adding downward pressure on the EUR/USD pair. Conversely, weaker-than-expected data could provide some relief to the Euro.

Market Dynamics and Price Movements

Volatility and Institutional Sentiment: June saw significant volatility in the EUR/USD pair. From a high of nearly 1.09167 on June 3, the pair fell sharply to around 1.0641 by mid-June. This volatility reflects speculative positioning and reactions to geopolitical and economic uncertainties.

Speculative Price Range for July:

- Lower Bound: 1.06110

- Upper Bound: 1.09200

Given the upcoming French election results and US economic data, traders should expect continued volatility. The initial reaction to the French election's first round and the subsequent second round on July 7 will be critical in determining the pair's direction.

Geopolitical Tensions and Economic Indicators

Geopolitical Influences: Tensions in the Middle East and the ongoing Russia-Ukraine conflict add layers of complexity to the EUR/USD analysis. These geopolitical factors can drive safe-haven flows into the US Dollar, impacting the Euro negatively.

Economic Indicators:

- German Inflation: Deflationary pressures in Germany, one of the Eurozone's largest economies, pose significant challenges. This economic backdrop influences the ECB's monetary policy and, subsequently, the EUR/USD pair.

- US Federal Reserve: The Fed's cautious approach and potential interest rate cuts are pivotal. Market expectations of a rate cut in September, as indicated by the CME FedWatch Tool, show a 68% probability. Such moves could weaken the US Dollar, providing support for the Euro.

Strategic Outlook and Trade Recommendations

Short-Term Strategy:

- Monitor support levels at 1.0641 and 1.0587 closely. A break below these levels could signal further downside.

- Watch for resistance around 1.080/14 and 1.0933/42. Successful breaches could indicate bullish momentum.

Long-Term Strategy for EUR/USD

Monitor Institutional Investor Moves and Geopolitical Developments

- Geopolitical Developments: Stay vigilant about geopolitical events, such as the upcoming French elections and ongoing Russia-Ukraine conflict. The first round of the French elections on June 30 and the decisive second round on July 7 will be pivotal. Outcomes of these elections, along with any significant developments in the Middle East or other global hotspots, can impact market stability and drive safe-haven flows into or out of the US Dollar.

Stay Updated on Key Economic Indicators

- Eurozone Inflation Data: Regularly review reports from Eurostat and national statistics agencies. Recent deflationary pressures in Germany, for instance, pose significant challenges for the ECB. Understanding these trends helps anticipate ECB policy adjustments.

- US Inflation Data: Monitor the US Bureau of Labor Statistics for CPI and PCE reports. The latest data showed core PCE at 2.6% year-over-year, the lowest since March 2021, indicating cooling inflation that could influence Fed decisions.

- Central Bank Decisions: Follow announcements from the European Central Bank (ECB) and the US Federal Reserve. The ECB's recent decision to cut the Main Refinancing Rate and its neutral tone post-decision, coupled with market expectations of a Fed rate cut in September (68% probability as per CME FedWatch Tool), are crucial. These policies on interest rates and economic support measures are critical drivers of the EUR/USD exchange rate.

- US Non-Farm Payrolls (NFP): The upcoming NFP report is another critical indicator. A robust NFP could strengthen the US Dollar, adding downward pressure on EUR/USD, while weaker data could provide some relief to the Euro.

Conclusion

The EUR/USD pair faces a complex landscape of economic data, geopolitical tensions, and institutional sentiment. Traders should remain nimble, closely monitoring support and resistance levels, and be prepared for significant volatility driven by upcoming election results and economic reports. By integrating technical analysis with a keen understanding of macroeconomic factors, investors can navigate the challenges and opportunities in the EUR/USD market effectively.