EUR/USD Price Analysis: Is the Euro Ready for a Breakout or Further Decline?

Will EUR/USD Continue Its Downtrend or Find Support Above 1.02?

The EUR/USD pair remains under heavy pressure, struggling to gain momentum as it hovers around key support and resistance levels. With the euro trading near 1.0359 after failing to sustain a rally beyond 1.0381, traders remain cautious as US inflation data looms large. The broader outlook for the currency pair is still dominated by a strong US dollar, fueled by the Federal Reserve’s cautious stance on rate cuts and ongoing concerns over tariffs imposed by the US on European imports.

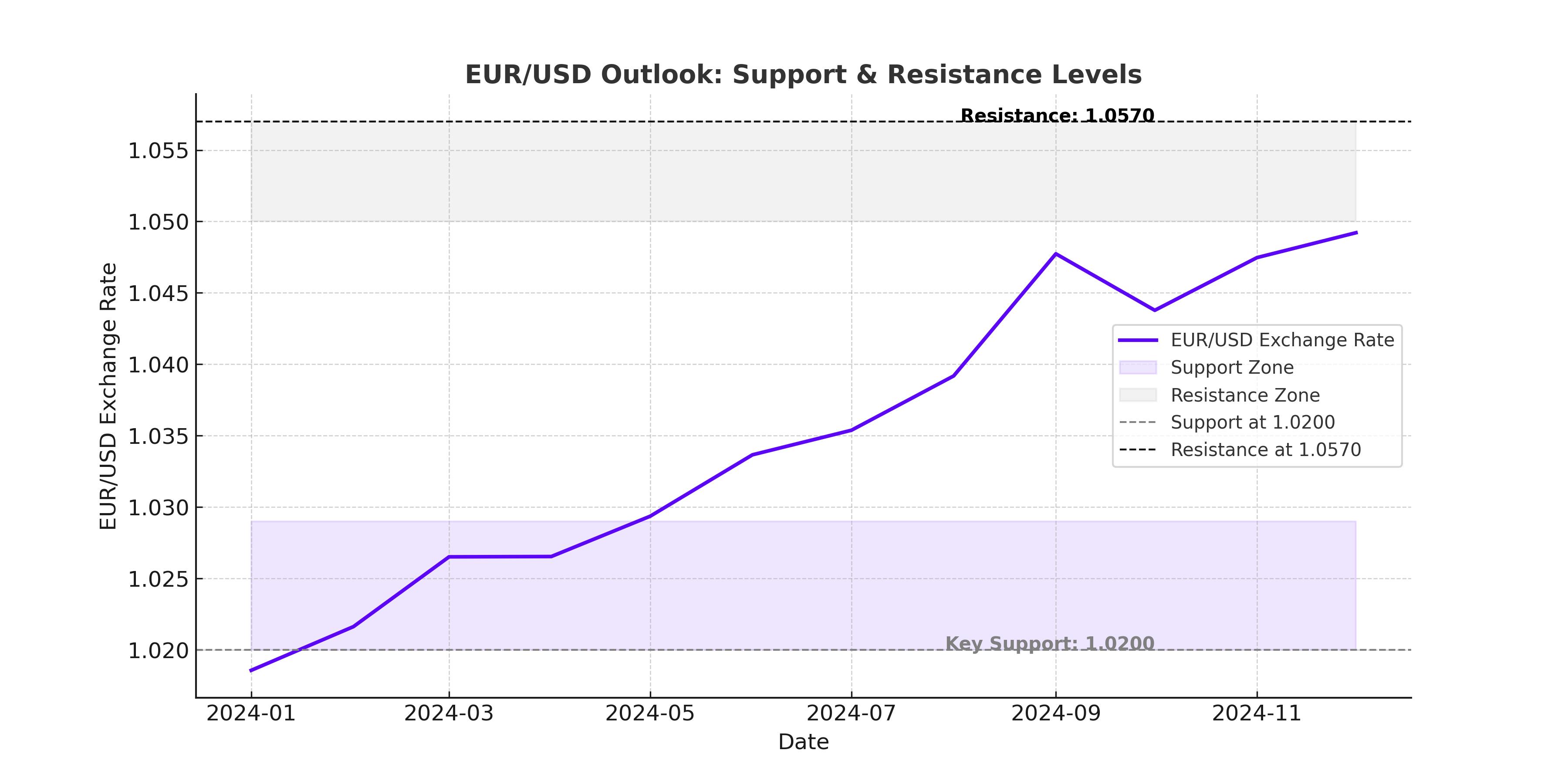

While technical indicators show signs of a potential recovery, the euro remains vulnerable to renewed selling pressure if critical resistance at 1.05 is not breached. Investors are closely watching whether EUR/USD can stabilize above 1.02, a key level that has been acting as a psychological floor. If it fails, a drop toward parity (1.0000) or even further to 0.9735 could be in play. On the other hand, a break above 1.0573/87 could open the door for a push toward 1.0719/77, a critical resistance level that would signal a broader bullish reversal.

EUR/USD Faces Major Test with CPI Data and Fed Policy

The biggest near-term catalyst for EUR/USD remains US inflation data and Federal Reserve policy expectations. The Consumer Price Index (CPI) report for January is expected to show a 0.3% increase, which could have significant implications for Fed rate decisions. A stronger-than-expected CPI print would likely boost the US dollar, reinforcing the Fed’s reluctance to cut rates aggressively. This would push EUR/USD lower, potentially testing key support levels at 1.0290 and 1.0200.

On the other hand, if inflation surprises to the downside, expectations for an earlier rate cut would rise, putting pressure on the dollar and allowing EUR/USD to attempt a breakout above 1.05. However, with Fed Chair Jerome Powell recently reaffirming that rate cuts are not imminent, the upside for EUR/USD may be limited unless economic data forces a shift in policy.

Technical Outlook: EUR/USD Remains Trapped in a Tight Range

From a technical perspective, EUR/USD continues to consolidate within a well-defined range between 1.02 and 1.05, struggling to gain traction for a decisive breakout. The 50-day EMA is currently sitting around 1.0425, acting as an initial resistance level that bulls must overcome. The next major resistance comes at 1.05, followed by the 1.0573/87 zone, which aligns with the 38.2% Fibonacci retracement of the 2024 decline. A break above this level would confirm a larger bullish reversal, opening the path toward 1.0719/77, where the 52-week moving average and key historical resistance levels converge.

On the downside, immediate support is found at 1.0290, followed by the critical 1.02 level. A break below 1.02 would indicate that sellers remain in full control, targeting the next major support at parity (1.0000). If this level fails, EUR/USD could continue its decline toward the 2022 low at 0.9735, marking a significant shift in market sentiment.

Tariff Tensions and the Euro’s Struggle Against the US Dollar

Adding another layer of complexity to the euro’s outlook is the escalating trade tension between the US and the European Union. With President Trump pushing for new tariffs on European steel and aluminum imports, the European Commission has vowed retaliation, promising countermeasures that could escalate into a broader trade war.

This uncertainty weighs on the euro, as trade tensions typically hurt European exports while benefiting the safe-haven appeal of the US dollar. If the situation escalates, the euro could face additional downward pressure, making a break below 1.02 even more likely. German Chancellor Olaf Scholz has warned that the EU would retaliate "within an hour" if the US imposes tariffs, adding to market volatility.

Is the Euro a Buy, Sell, or Hold at Current Levels?

With EUR/USD currently trading around 1.0359, the question remains whether this is a buying opportunity or a signal to stay cautious. The bearish case remains strong as long as the pair stays below 1.05, with traders continuing to sell rallies into resistance. However, if EUR/USD manages to hold above 1.02 and break past 1.0573/87, it could signal a major shift in sentiment, turning the euro bullish toward the 1.07 region.

For now, the downtrend remains intact, and traders should continue selling into strength while keeping an eye on CPI data, Fed rate expectations, and trade tensions. If the US dollar strengthens further, EUR/USD could see another leg lower toward parity, making it a compelling short trade. However, a weaker inflation report or a more dovish shift from the Fed could trigger a short squeeze, forcing EUR/USD back above resistance.

Given the technical setup and fundamental backdrop, EUR/USD remains a "sell" below 1.05 and a "buy" only if it confirms a breakout above 1.0573/87. The upcoming CPI data will be crucial in determining the next major move, but for now, the bears remain in control.