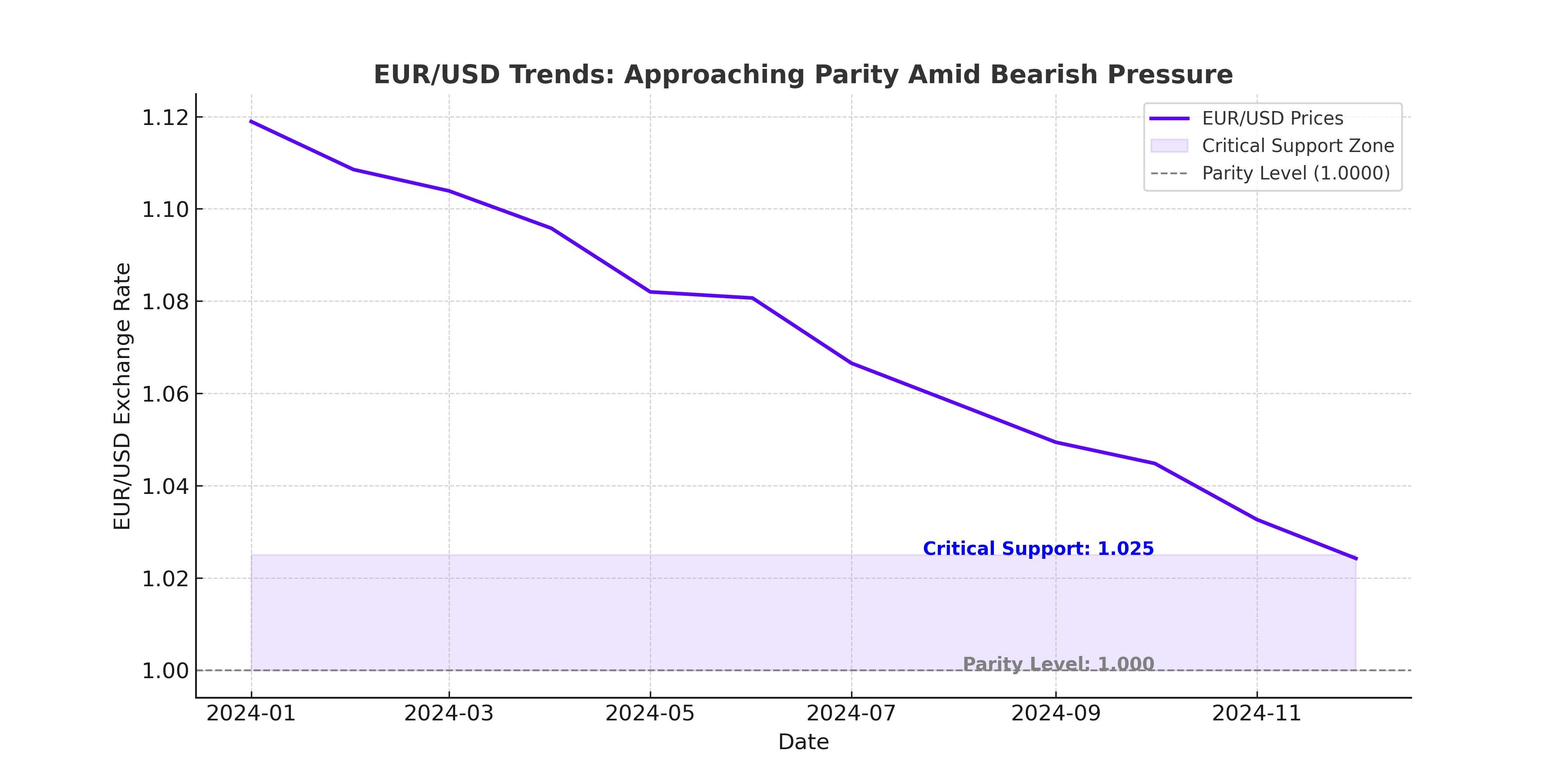

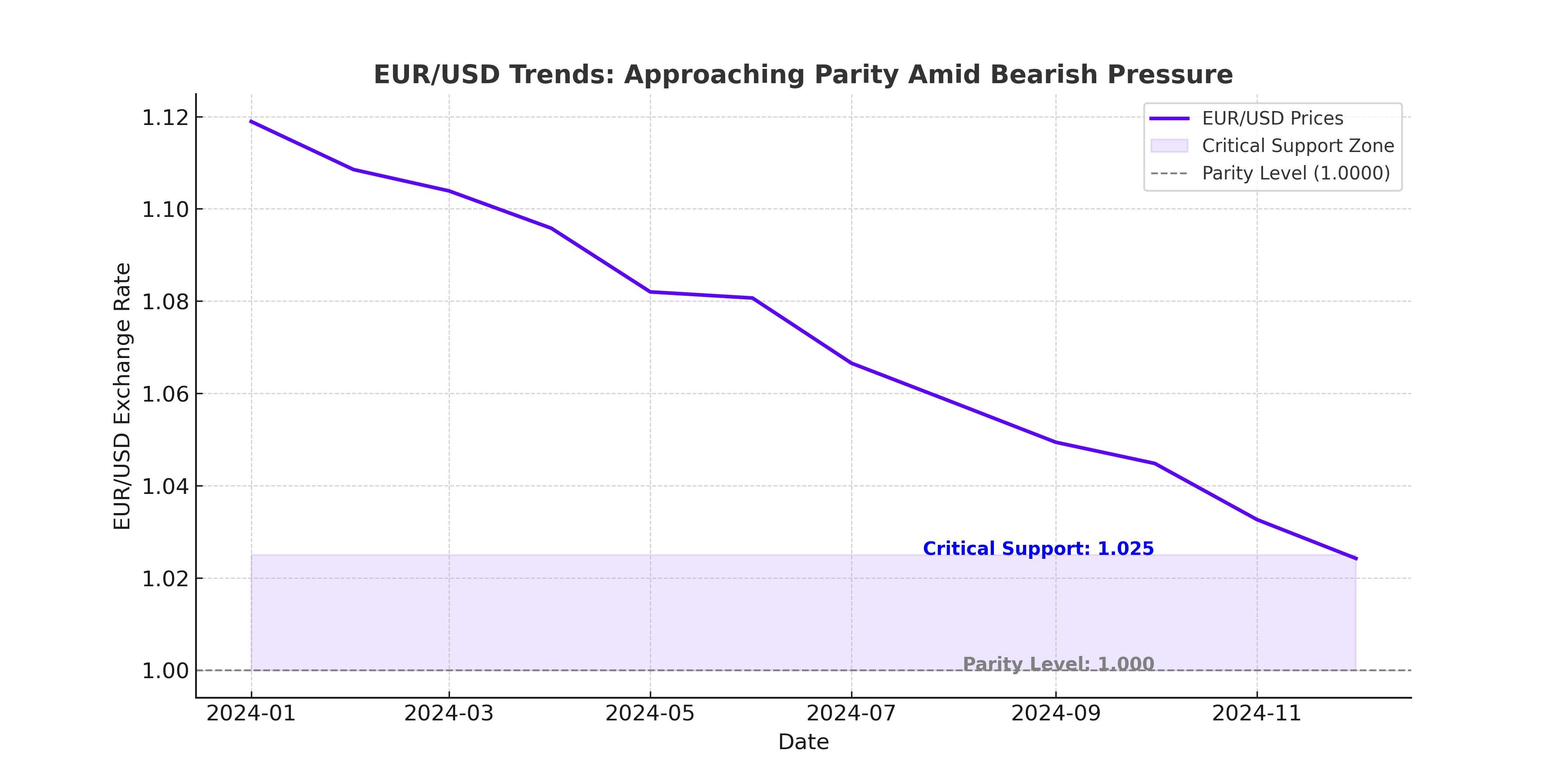

EUR/USD Decline Accelerates Toward Parity

The EUR/USD pair has continued its sharp decline in early 2025, breaking critical support levels to trade near 1.0250—its lowest level since November 2022. This marks a year-to-date drop of 8.82% from its September peak above 1.1200. With bearish sentiment dominating the market, the pair is poised to test parity if key technical and fundamental factors remain aligned against the euro.

The European Central Bank (ECB) is signaling a dovish stance, with policymakers such as Yannis Stournaras highlighting plans for steady rate cuts throughout 2025. Current market expectations suggest the ECB will reduce rates to around 2% by year-end to combat slowing growth in the eurozone. This contrasts sharply with the Federal Reserve’s cautious approach, which is now anticipated to deliver only two rate cuts in 2025 due to robust U.S. economic performance.

U.S. Dollar Strength Undermines Euro Recovery

The U.S. dollar remains on a solid upward trajectory, with the Dollar Index (DXY) surging past 109 points—its highest level since November 2022. Bolstered by strong economic fundamentals, including a large budget deficit, rising productivity, and robust consumer spending, the greenback has outperformed its peers. Analysts at Brown Brothers Harriman and Capital Economics emphasize the "American exceptionalism" narrative, with the U.S. economy weathering global shocks more effectively than the eurozone.

The divergence in monetary policy between the Federal Reserve and the ECB further fuels this dynamic. With the Fed maintaining a relatively higher interest rate environment compared to the ECB's aggressive easing cycle, the rate differential favors continued dollar strength against the euro.

European Economic Woes Weigh Heavily on the Euro

The eurozone economy continues to grapple with significant challenges, including weak manufacturing data and rising energy costs. The latest Pan-European PMI data fell to 45.1 in December, reflecting contractionary conditions that are pressuring policymakers to adopt more accommodative measures. Additionally, geopolitical risks and the expiration of gas transit agreements with Russia have exacerbated energy price volatility, adding to the eurozone's economic struggles.

The weak economic outlook is compounded by concerns over potential trade tensions with the United States. President Donald Trump's tariff threats targeting European exports could further strain the eurozone economy, which is already battling subdued demand and high inflation in key sectors.

Technical Analysis: Key Levels to Watch

Technically, EUR/USD remains under bearish pressure, with the pair trading below critical moving averages. The 50-day EMA has fallen to 1.0550, providing strong resistance. Further upside attempts may encounter resistance at the 200-day EMA near 1.0760. On the downside, immediate support lies at 1.0250, with a break potentially targeting 1.0170 and eventually parity at 1.0000.

The Relative Strength Index (RSI) on the daily chart signals oversold conditions, but any relief rally is likely to be short-lived given the prevailing bearish sentiment. A sustained move above 1.0400 could challenge the current downtrend, but this appears unlikely without a significant shift in fundamentals.

U.S. Non-Farm Payrolls and Eurozone Data in Focus

The upcoming U.S. Non-Farm Payrolls (NFP) report is expected to provide additional clarity on the Federal Reserve's policy trajectory. Analysts forecast an increase in jobless claims to 224,000 from the prior 219,000, with any deviation likely to influence USD strength. A strong labor market report could reinforce expectations for a less aggressive Fed easing cycle, further supporting the dollar.

In the eurozone, ECB President Christine Lagarde’s recent comments indicate progress in curbing inflation but fall short of sparking market optimism. Traders will closely monitor upcoming economic releases, including inflation and PMI data, to gauge the ECB's next moves.

Long-Term Outlook for EUR/USD

The long-term outlook for EUR/USD remains bleak as the pair continues to trade within a descending channel established since its 2023 high of 1.1274. Unless the euro can reclaim and sustain levels above this resistance, the path of least resistance points lower. The pair is projected to revisit its 2022 lows near 0.9534 if current trends persist.

Market sentiment heavily favors the dollar, with analysts projecting a potential move to parity by mid-2025. While the euro may see temporary relief from oversold technical conditions, the broader macroeconomic backdrop remains unfavorable for a sustained recovery.

Investment Decision: Bearish Bias Prevails

Given the stark divergence in monetary policies, economic growth trajectories, and technical indicators, EUR/USD remains a compelling short position. Traders and investors may consider selling the pair on rallies toward resistance levels near 1.0400, targeting 1.0170 or even parity. However, caution is warranted, as unexpected geopolitical developments or shifts in central bank rhetoric could introduce volatility. For now, the bias remains firmly bearish, aligning with market expectations of a challenging year for the euro.

That's TradingNEWS