EUR/USD Falls to $1.0223 as Dollar Strength Surges on U.S. Job Gains and Inflation Risks

Hawkish Federal Reserve outlook and record-breaking U.S. labor market resilience drive EUR/USD to a two-year low, as Eurozone growth falters under weak economic fundamentals | That's TradingNEWS

EUR/USD Pressured as Dollar Dominates Amid Hawkish Fed Signals and Strong U.S. Data

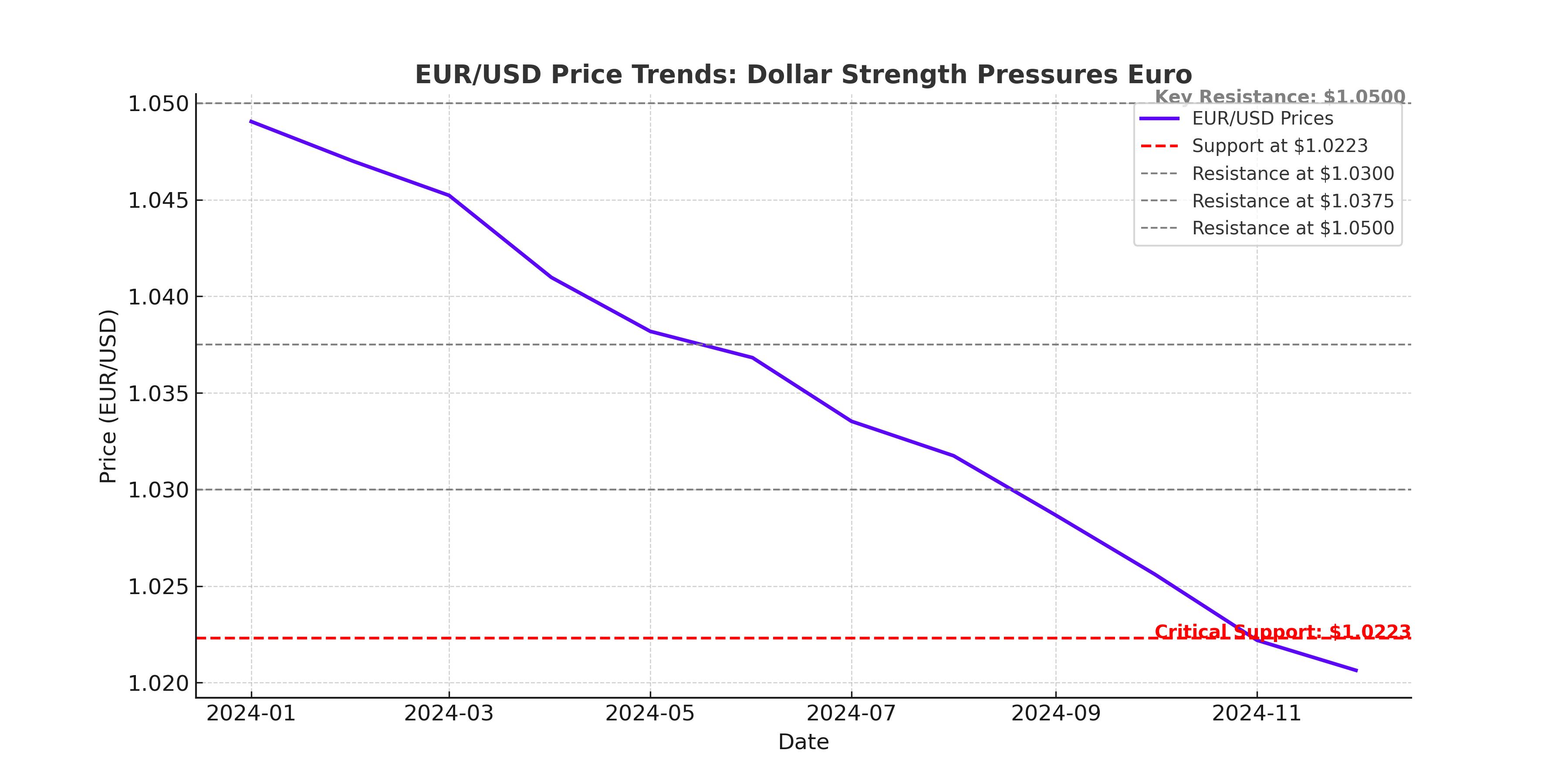

The EUR/USD pair continues to face significant downward pressure, reflecting the dollar's strength fueled by robust U.S. economic data and hawkish Federal Reserve expectations. The euro-dollar pair hit a multi-year low of $1.0223 last week, driven largely by the greenback’s surge following a surprisingly strong U.S. labor market report and rising Treasury yields. With the pair on track for a fourth consecutive monthly loss, bearish momentum appears intact. Markets remain focused on upcoming U.S. inflation data and its implications for future monetary policy decisions.

Dollar Strength Driven by Labor Market Resilience

The U.S. labor market demonstrated remarkable resilience, with December non-farm payrolls adding 256,000 jobs, significantly surpassing the 160,000 consensus estimate. The unemployment rate dropped to 4.1% from 4.2%, while average hourly earnings increased by 0.3% month-over-month and 3.9% year-over-year. This strong performance tempered expectations of aggressive rate cuts in 2025, with futures markets now pricing in only a single rate reduction later in the year. Treasury yields soared, with the 10-year yield rising to 4.76%, marking its highest level in over a year. The dollar index (DXY) reached 109.64, extending a six-week rally to multi-year highs.

Euro Vulnerability Amid Weak Regional Growth and Inflation Risks

In contrast, the euro has struggled under the weight of weak economic fundamentals in the Eurozone. Preliminary German CPI data came in slightly higher than expected, but it failed to inspire confidence amid broader concerns about stagnant growth and political instability in key member states such as Germany and France. The lack of robust inflationary pressures and the European Central Bank’s cautious stance on policy tightening have further limited the euro's upside potential.

Key Support and Resistance Levels in Focus

From a technical perspective, EUR/USD remains firmly within a long-term bearish trend. The pair’s inability to hold above $1.0300 reinforces bearish sentiment, with key support at $1.0223 being a critical level to watch. A breach of this support could open the door to further declines toward parity or lower. On the upside, resistance is pegged at $1.0375, followed by a stronger barrier at $1.0500, which would require significant bullish momentum to overcome.

Upcoming CPI Data to Determine Near-Term Direction

Attention now shifts to U.S. Consumer Price Index (CPI) data, scheduled for release on January 15. Analysts expect the report to provide crucial insights into inflation trends and the Federal Reserve’s monetary policy trajectory. A hotter-than-expected print could reinforce the dollar's bullish momentum, potentially pushing EUR/USD below key support levels. Conversely, a softer reading might offer the euro a brief respite, though structural challenges in the Eurozone are likely to limit any sustained recovery.

Geopolitical and Macro Risks Add to Uncertainty

The broader macroeconomic landscape adds further complexity to EUR/USD dynamics. Geopolitical tensions, including trade policy uncertainties surrounding the incoming U.S. administration, and concerns about China's slowing economic growth weigh heavily on market sentiment. China's GDP and industrial production data, also due this week, will be closely monitored for signs of stabilization or further deterioration, given their potential spillover effects on global trade and European export demand.

Is EUR/USD a Buy, Sell, or Hold?

Considering the current data and market conditions, EUR/USD remains a clear sell in the near term. The pair’s long-term bearish trend is supported by strong U.S. fundamentals, rising Treasury yields, and the euro’s vulnerability to weak regional growth and inflation concerns. However, traders should remain cautious, as short-term volatility around key data releases could create sharp reversals.

The path forward for EUR/USD will hinge on the interplay of U.S. monetary policy, Eurozone economic performance, and external risks. While the dollar's dominance appears set to persist, any shifts in market sentiment driven by softer inflation data or improved Eurozone fundamentals could alter the trajectory of this closely watched currency pair. For now, bearish sentiment continues to dominate the landscape.

That's TradingNEWS

Read More

-

SMH ETF: NASDAQ:SMH Hovering at $350 With AI, NVDA and CHIPS Act Fueling the Next Move

16.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR: Can $1B Inflows Lift XRP-USD From $1.93 Back Toward $3.66?

16.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Falls to $3.80–$3.94 as Warm Winter Kills $5.50 Spike

16.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Slides, BoJ 0.50% Hike, Fed Cut and NFP Set the Next Big Move

16.12.2025 · TradingNEWS ArchiveForex

additional text