EUR/USD Price Outlook: Can the Euro Withstand Pressure from the U.S. Dollar Surge?

EUR/USD Struggles Amid Dollar Strength and Rate Cut Expectations

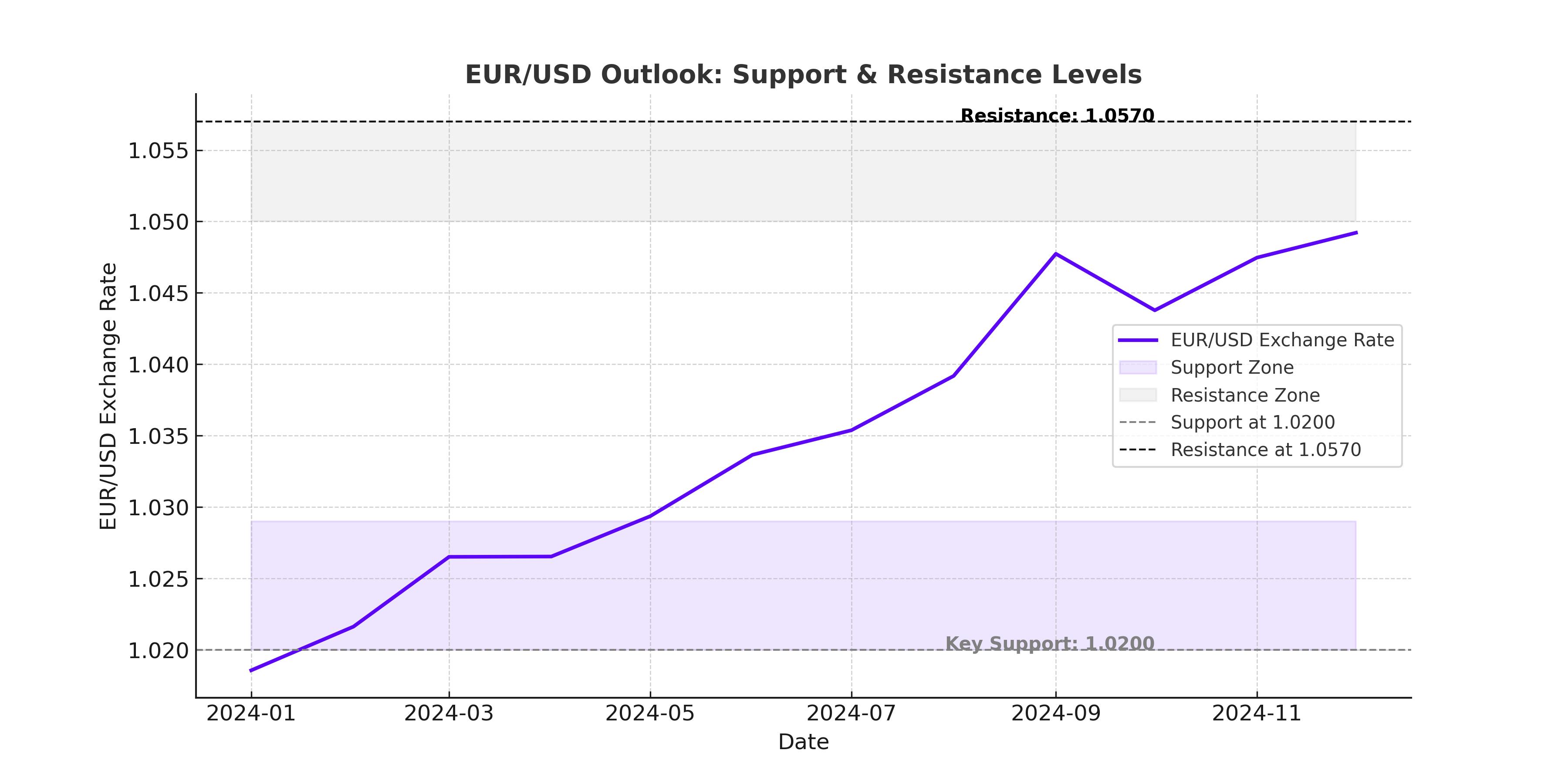

The EUR/USD exchange rate has entered a retracement phase after a strong rally last week, climbing from 1.0290 to a peak of 1.0515 before retreating. The pair is now down 0.3% today, hovering near the 1.0460 support level, which aligns with the bullish trendline from last week’s rally. A minor rebound in the European session saw EUR/USD edge back to 1.0465, but upside momentum remains fragile.

The broader picture remains challenging for the euro, as economic uncertainty in the Eurozone deepens. A key concern is the European Central Bank’s (ECB) rate policy, with markets already pricing in a total of -75 basis points in cuts by year-end. Analysts suggest that up to four additional cuts could bring the ECB rate to 1.75%. Meanwhile, the U.S. Federal Reserve remains cautious about easing monetary policy, reinforcing dollar strength.

U.S. Dollar Strength Driven by Treasury Yields and Fed Policy Outlook

The U.S. Dollar Index (DXY) has rebounded from a two-month low, trading near 107.00 as Treasury yields surpass 4.5%. Federal Reserve Governor Michelle Bowman and Philadelphia Fed President Patrick Harker have indicated that rate cuts are not imminent, as inflation risks remain a concern. This stance has reinforced the dollar’s dominance against the euro, adding downside pressure to EUR/USD.

A key level to watch for the DXY is 107.315, where resistance has capped further gains. If the dollar strengthens beyond this point, EUR/USD could break below its key support at 1.0420. However, if the Federal Open Market Committee (FOMC) minutes—due for release on Wednesday—suggest a more dovish stance, the dollar could weaken, providing some relief for EUR/USD.

Eurozone Economic Uncertainty and Trump’s Tariff Threats Weigh on the Euro

Economic concerns in the Eurozone continue to mount. ECB policymaker Joachim Nagel has warned that Germany, Europe’s largest economy, is particularly vulnerable to new U.S. tariffs. The German economy, already struggling with two years of contraction, could face additional pressure if President Donald Trump follows through on his proposed auto tariffs, scheduled to take effect on April 2.

The Eurozone ZEW Economic Sentiment Index disappointed expectations, coming in at 24.2 in February, just below the forecast of 24.3. Meanwhile, the Bundesbank has revised down Germany’s economic growth projection for 2027, expecting GDP to be 1.5% lower than previously forecast. These developments underscore the fragile state of the euro, making it more susceptible to a bearish breakdown.

Technical Analysis: Key Levels to Watch for EUR/USD

The EUR/USD pair has been consolidating after last week’s rally but now faces strong resistance at 1.0500. The 14-day Relative Strength Index (RSI) has dropped to 55, signaling weakening bullish momentum. Meanwhile, the 20-day and 100-day Simple Moving Averages (SMA) are converging near 1.0450, raising concerns about a potential bearish crossover.

If EUR/USD fails to hold 1.0460, the next key support is 1.0420, aligning with the 50-day Exponential Moving Average (EMA). A further break could expose 1.0380. On the upside, a decisive break above 1.0500 could trigger a move toward 1.0533 and then 1.0611, both key Fibonacci retracement levels.

Market Sentiment: Will the Euro Break Higher or Head for Another Decline?

Despite its recent pullback, the EUR/USD outlook remains closely tied to U.S. economic data and Fed policy signals. The upcoming FOMC minutes could shape expectations for future rate decisions. If the minutes suggest policymakers are open to rate cuts sooner than expected, the dollar could weaken, providing relief for the euro.

Additionally, geopolitical factors could influence EUR/USD price action. Reports indicate that U.S. and Russian officials are set to meet in Saudi Arabia to discuss a potential ceasefire in Ukraine. A resolution could stabilize European energy markets, boosting the euro. However, if the situation escalates, further downside risks remain.

Final Verdict: Buy, Sell, or Hold EUR/USD?

Given the euro’s vulnerability to ECB rate cuts, U.S. dollar strength, and global economic risks, the bias remains bearish unless key resistance levels break. A drop below 1.0420 could trigger further losses toward 1.0380, while a recovery beyond 1.0500 could set the stage for a move toward 1.0611.

For now, EUR/USD remains a cautious hold, with short-term downside risks dominating. Investors should closely watch upcoming FOMC minutes, ECB policy signals, and any developments on U.S. tariffs before making a definitive trade decision.