The EUR/USD pair has been navigating volatile market conditions as it hovers near $1.0315, driven by diminished safe-haven demand for the US Dollar and anticipation of Donald Trump’s return to the White House. The currency pair, which recently recovered from a multi-year low of $1.0176, faces significant resistance near $1.0435, as market participants digest the potential impact of Trump's fiscal policies and the Federal Reserve's monetary stance.

Trump’s Policies and Their Immediate Impact on EUR/USD

Donald Trump’s inauguration has placed a spotlight on the potential for immediate policy shifts, including tariffs, tax reforms, and energy production initiatives. Reports suggest over 200 executive orders could be signed on his first day in office, with many focused on boosting the US economy through domestic production and deregulation. These actions could strengthen the US Dollar, weighing on EUR/USD. However, the lack of immediate tariffs against China, as indicated by the Wall Street Journal, provided temporary relief to the Euro, pushing the pair higher.

Traders are particularly focused on Trump's rhetoric around tariffs and trade relations. His previous administration’s trade wars created significant volatility in the EUR/USD pair, and any renewed protectionist policies could drive further instability.

Federal Reserve Monetary Policy and Its Influence on EUR/USD

The Federal Reserve’s monetary policy remains a cornerstone for EUR/USD dynamics. Current market expectations, as tracked by the CME FedWatch tool, suggest the Fed will maintain interest rates at 4.25%-4.50% through the next three policy meetings. This stability contrasts with speculation from some analysts, including Morgan Stanley, that a rate cut could occur as early as March if core inflation continues to decelerate.

US inflation data supports this outlook. The December Consumer Price Index (CPI) showed core inflation rising at an annualized pace of 3.2%, down from previous levels. Lower inflation could reduce the Fed’s need to maintain a hawkish stance, potentially weakening the dollar and supporting EUR/USD.

ECB Outlook: Challenges Ahead for the Euro

The European Central Bank’s (ECB) policy direction adds complexity to the EUR/USD equation. ECB policymakers, including Governor Yannis Stournaras, have expressed concerns about potential US protectionist measures dragging Eurozone inflation below the 2% target. The market is pricing in a series of ECB rate cuts totaling 100 basis points by mid-2025, reflecting expectations of subdued inflation.

Eurozone inflation data has shown signs of moderation, with service inflation increasing marginally to 4% in December, primarily driven by energy-dependent categories. Analysts project further declines in inflationary pressures, particularly if oil prices stabilize or drop, which could justify a more dovish ECB stance. This outlook puts the Euro at risk of further downside if economic data fails to meet expectations.

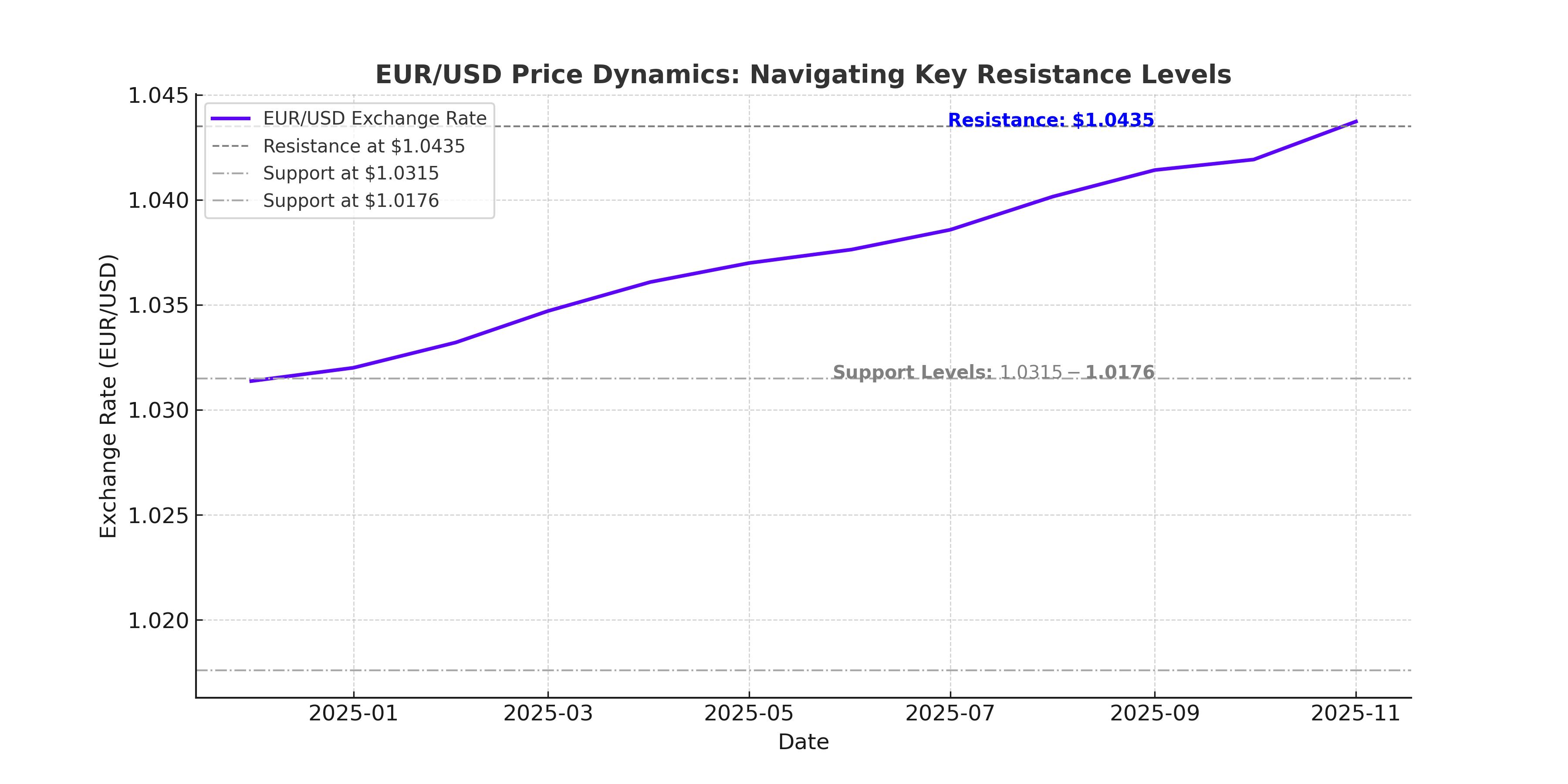

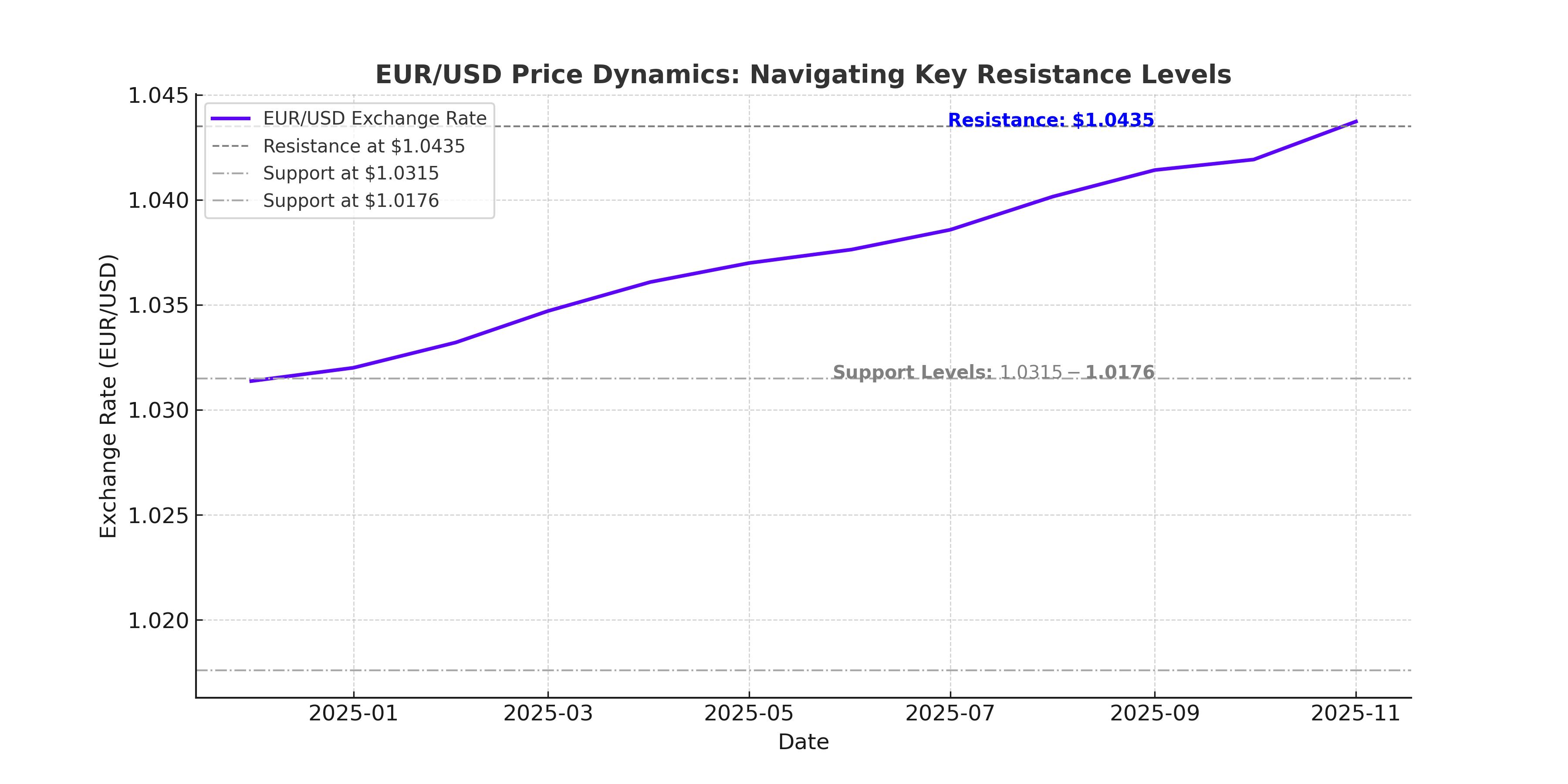

Technical Analysis: EUR/USD Faces Key Resistance at $1.0435

Technically, EUR/USD is trading within a neutral range, with the pair struggling to break above the $1.0435 resistance zone. A decisive break of this level could confirm a short-term bottom and open the door for a stronger rebound toward the 38.2% Fibonacci retracement of the $1.1213 to $1.0176 downtrend, near $1.0572.

Support remains critical at $1.0176, the recent multi-year low. A sustained break below this level would resume the broader bearish trend, targeting the 2022 low of $0.9534. Short-term momentum indicators, including the Relative Strength Index (RSI), suggest a potential bullish divergence, but downward pressure persists as long as EUR/USD remains capped below its moving averages.

Geopolitical and Economic Developments to Watch

Geopolitical factors, such as the Russia-Ukraine conflict and US-China trade relations, are crucial for EUR/USD. Trump’s potential negotiation with Russia to end the Ukraine war, coupled with easing Middle East tensions, could shift safe-haven flows and impact both the Euro and the Dollar. Additionally, China’s recent reduction in Saudi oil imports and increased reliance on Russian supplies could influence energy markets and, indirectly, EUR/USD dynamics.

US employment data and inflation trends will also play pivotal roles. The recent nonfarm payroll report showed robust job growth of 256,000 and an unemployment rate of 4.1%, underscoring the resilience of the US labor market. This strength could support the Fed’s current rate policy, favoring the Dollar.

Market Sentiment and Hedge Fund Positioning

Hedge fund managers have reduced their net short positions on the Euro, reflecting growing expectations of a short-term rebound in EUR/USD. However, the broader sentiment remains bearish, with the pair trading below all major moving averages.

Conclusion: EUR/USD at a Crossroads Amid Policy and Geopolitical Uncertainty

The EUR/USD pair’s recovery above $1.0315 reflects cautious optimism as markets await clarity on Trump’s policies and the Federal Reserve’s next steps. While the Euro faces headwinds from a dovish ECB and subdued inflation, the US Dollar’s performance will depend on the balance between Trump’s fiscal agenda and Fed policy. With resistance at $1.0435 and support at $1.0176, the pair remains vulnerable to both upside and downside risks. A clear breakout in either direction will depend on upcoming economic data and geopolitical developments, making EUR/USD a key currency pair to watch in the coming weeks.

That's TradingNEWS