EUR/USD Holds 1.0440 – Can Bulls Push Higher, or Will the Euro Break Down?

The EUR/USD pair is testing critical support at 1.0440 as the US Dollar remains volatile. Is this a short-term rebound, or is the Euro set for further losses? | That's TradingNEWS

EUR/USD Price Outlook: Will 1.0440 Hold or Is a Breakdown Coming?

EUR/USD Rebounds, But Can It Sustain the Gains?

After a sharp three-day decline, EUR/USD staged a comeback, rising to 1.0440, marking a 0.40% gain. The pair rebounded from its 20-day SMA, which served as a crucial technical floor, preventing further downside pressure. This move comes as momentum indicators stabilize, with the RSI climbing to 57 and MACD flattening in green territory, signaling that bearish momentum is stalling.

However, while this short-term recovery has brought some relief, the bigger question remains: Is this just a technical bounce, or is the Euro preparing for a deeper drop?

Key Technical Levels to Watch: Bulls Need to Defend 1.0420

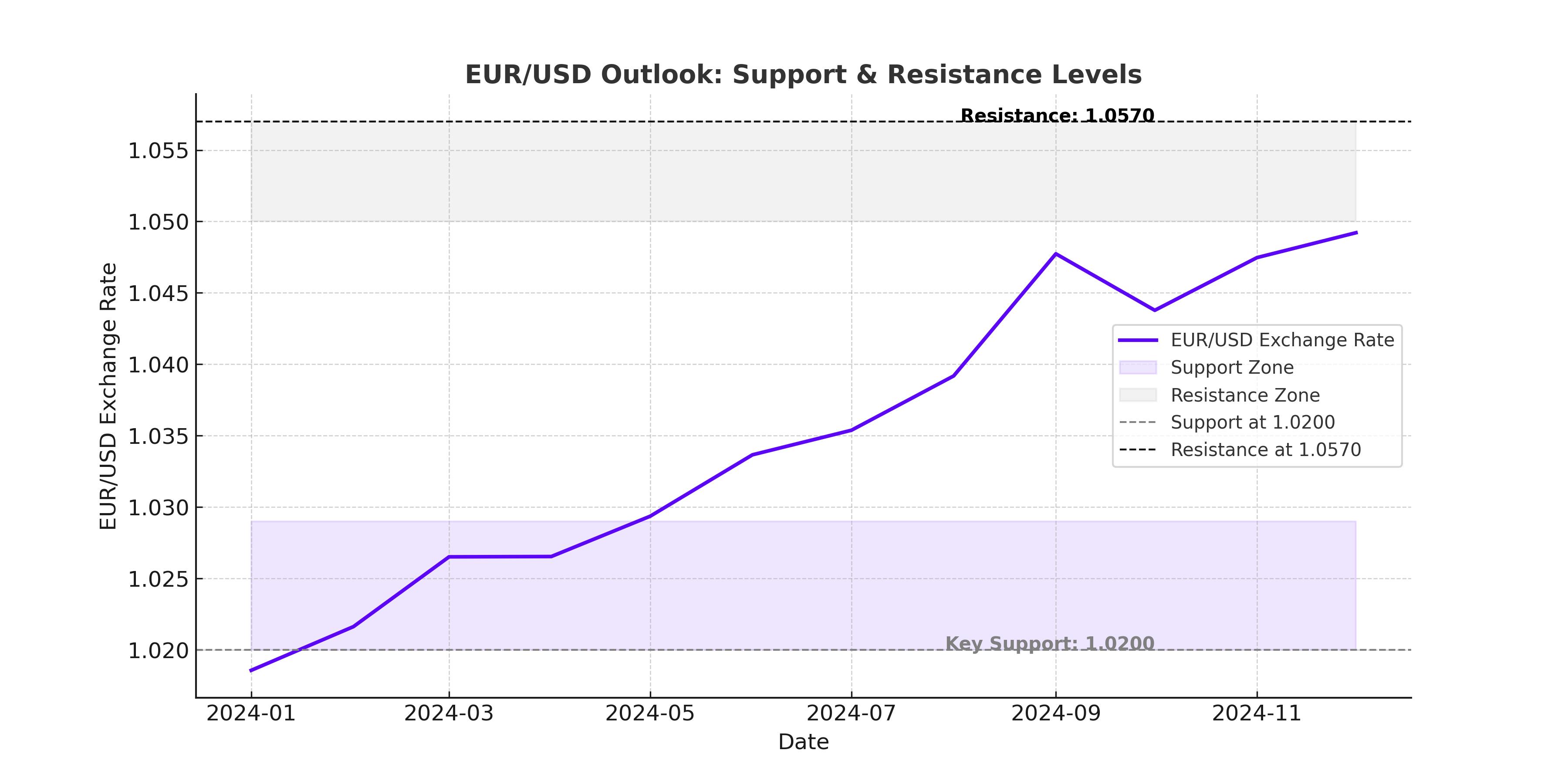

If buyers maintain control, the next key resistance level stands at 1.0500, where stronger selling pressure could emerge. A successful break above this level could trigger an extended rally toward 1.0570, an area of previous selling interest.

On the downside, 1.0420 remains the first line of defense. A failure to hold this level would expose EUR/USD to a further decline toward 1.0380, with deeper losses possible if sellers regain control.

US Dollar Strength: Is the DXY Setting Up for Another Surge?

The US Dollar Index (DXY) remains volatile, hovering around 106.973, just below the crucial resistance at 107.316. Market sentiment is mixed as investors react to President Trump’s renewed tariff threats on cars, semiconductors, and pharmaceuticals, sparking fresh concerns over a trade war.

Despite these concerns, economic data has not been entirely supportive of the USD. Housing starts missed expectations, coming in at 1.37M vs. 1.39M forecast, while building permits met expectations at 1.48M. Additionally, the latest FOMC minutes reflected a hawkish stance, with Fed officials warning of inflation risks, keeping interest rate expectations elevated.

For the DXY, a break above 107.316 could trigger a push toward 107.78 or even 108.42, while failure to hold above 106.55 could see the Dollar index slide back to 106.19.

EUR/USD Faces Additional Headwinds: Can the ECB Hold Its Ground?

The European Central Bank (ECB) remains a key wildcard for EUR/USD. ECB policymaker Isabel Schnabel recently warned that inflation risks remain elevated, suggesting that the central bank may pause its rate-cut cycle.

Traders have already priced in three rate cuts for 2024, but Schnabel’s remarks could lead to adjustments in those expectations. If the ECB signals a delay in easing, EUR/USD could find support near current levels, but if inflation cools further, expectations for aggressive cuts could intensify, putting more downward pressure on the Euro.

Market Sentiment: Can the Euro Gain Support from Global Events?

There is growing optimism surrounding a Russia-Ukraine ceasefire, with reports indicating that Trump is pushing for renewed peace talks involving Russia, Ukraine, and Europe. If a deal is reached, the Eurozone economy could benefit, as lower energy prices and improved supply chain efficiency would ease inflationary pressures.

At the same time, US Treasury yields remain a factor in the EUR/USD equation. The 10-year yield dipped slightly, but Fed policymakers continue to signal caution on rate cuts, keeping bond yields relatively elevated. If yields rise further, the Dollar could gain more strength, limiting EUR/USD’s upside potential.

Short-Term EUR/USD Forecast: Will 1.0500 or 1.0380 Come First?

With EUR/USD trading at 1.04317, the pair remains at a crossroads. If bulls hold above 1.0420, a recovery toward 1.0500 could be possible. However, a break below 1.0420 would shift the outlook bearish, potentially driving prices toward 1.0380 and beyond.

Key Resistance Levels:

- 1.0461 (February 19 high)

- 1.0500-1.0505 (psychological barrier & Bollinger Band upper boundary)

- 1.0533 (January 27 high)

Key Support Levels:

- 1.0410 (100-period EMA & Bollinger Band lower boundary)

- 1.0352 (February 6 low)

- 1.0285 (February 10 low)

Final Take: Is EUR/USD a Buy or a Sell Right Now?

The Euro’s ability to hold 1.0440 will be a key test for short-term sentiment. If DXY remains capped below 107.316, EUR/USD could extend gains. However, if the US Dollar strengthens further, pressure on the Euro could resume.

For now, the pair remains neutral to slightly bullish above 1.0420, but any break lower would shift the bias back toward a deeper correction. Traders should closely watch 1.0440 as a make-or-break level.