EUR/USD on the Edge: Will the Euro Hold Above 1.0300 or Crash Below 1.0250?

With the US dollar surging on trade tensions and rate cut uncertainty, EUR/USD faces a critical test. Will the euro recover from 1.0310, or is another sharp decline ahead? | That's TradingNEWS

EUR/USD Outlook: Is the Euro Poised for a Breakout or More Declines?

Will EUR/USD Hold Above 1.0300 or Break Lower? What Traders Need to Watch Now

EUR/USD is under pressure as the euro struggles to hold above the 1.0300 level while the US dollar gains strength on risk-off sentiment and shifting Federal Reserve expectations. A combination of trade war fears, shifting interest rate projections, and upcoming inflation data is keeping volatility high in the forex market. With traders eyeing the European Central Bank’s (ECB) next move and the US Federal Reserve's policy stance, the EUR/USD exchange rate remains at a critical inflection point.

Recent economic indicators and order flow data suggest that bearish momentum may still be in play. Market participants are analyzing whether the euro can stage a recovery or if further downside is ahead. The technical landscape also hints at continued selling pressure, with key support levels at 1.0280 and 1.0250 acting as potential downside targets.

US Tariff Threats Boost Dollar Strength: Will EUR/USD Continue to Weaken?

The latest tariff threats from the US have created fresh concerns in global markets, sending investors flocking to the dollar as a safe haven. President Trump announced 25% tariffs on steel and aluminum imports, sparking uncertainty over trade relations between the US and the European Union. The EU is expected to retaliate, which could further weigh on the euro.

Historically, trade conflicts have favored the US dollar as investors seek stability in the world's reserve currency. The EUR/USD pair dipped to 1.0285 earlier this session in response to these concerns but has since rebounded slightly. However, without a clear resolution on tariffs, market sentiment remains cautious, and the euro could see additional downside if the trade war escalates.

Federal Reserve Rate Cut Expectations Keep Dollar in Focus

The US Federal Reserve’s policy outlook remains a key driver for EUR/USD. While recent Non-Farm Payrolls (NFP) data showed a weaker-than-expected jobs report at 143K jobs added in January (below the expected 169K), wage growth was stronger than anticipated. Average hourly earnings rose by 0.5%, indicating continued inflationary pressure.

Markets are closely watching the upcoming US CPI (Consumer Price Index) report, which is expected to show year-over-year inflation holding at 2.9%. A higher-than-expected reading could reinforce expectations that the Fed will keep rates higher for longer, providing additional support for the US dollar and putting more pressure on the euro.

The US Dollar Index (DXY) is currently trading at 108.27, maintaining a bullish outlook as long as it stays above 108.10. If the index breaks higher, EUR/USD could see further losses, with potential downside targets at 1.0250 and 1.0200.

ECB Rate Policy and Growth Concerns Weigh on Euro

On the European side, the ECB is facing pressure to continue cutting interest rates as economic growth in the Eurozone stagnates. The latest Sentix Investor Confidence Index showed further deterioration in sentiment, reflecting concerns over slowing inflation and weak economic momentum.

ECB policymakers have signaled multiple rate cuts for 2025, which contrasts sharply with the Fed’s stance of keeping rates elevated. This divergence is a major headwind for the euro, as lower interest rates reduce the currency’s attractiveness for global investors.

ECB President Christine Lagarde is set to speak later today, and traders will be closely analyzing her comments for any clues about the central bank’s next policy move. If Lagarde reinforces the expectation of more rate cuts, EUR/USD could see renewed selling pressure.

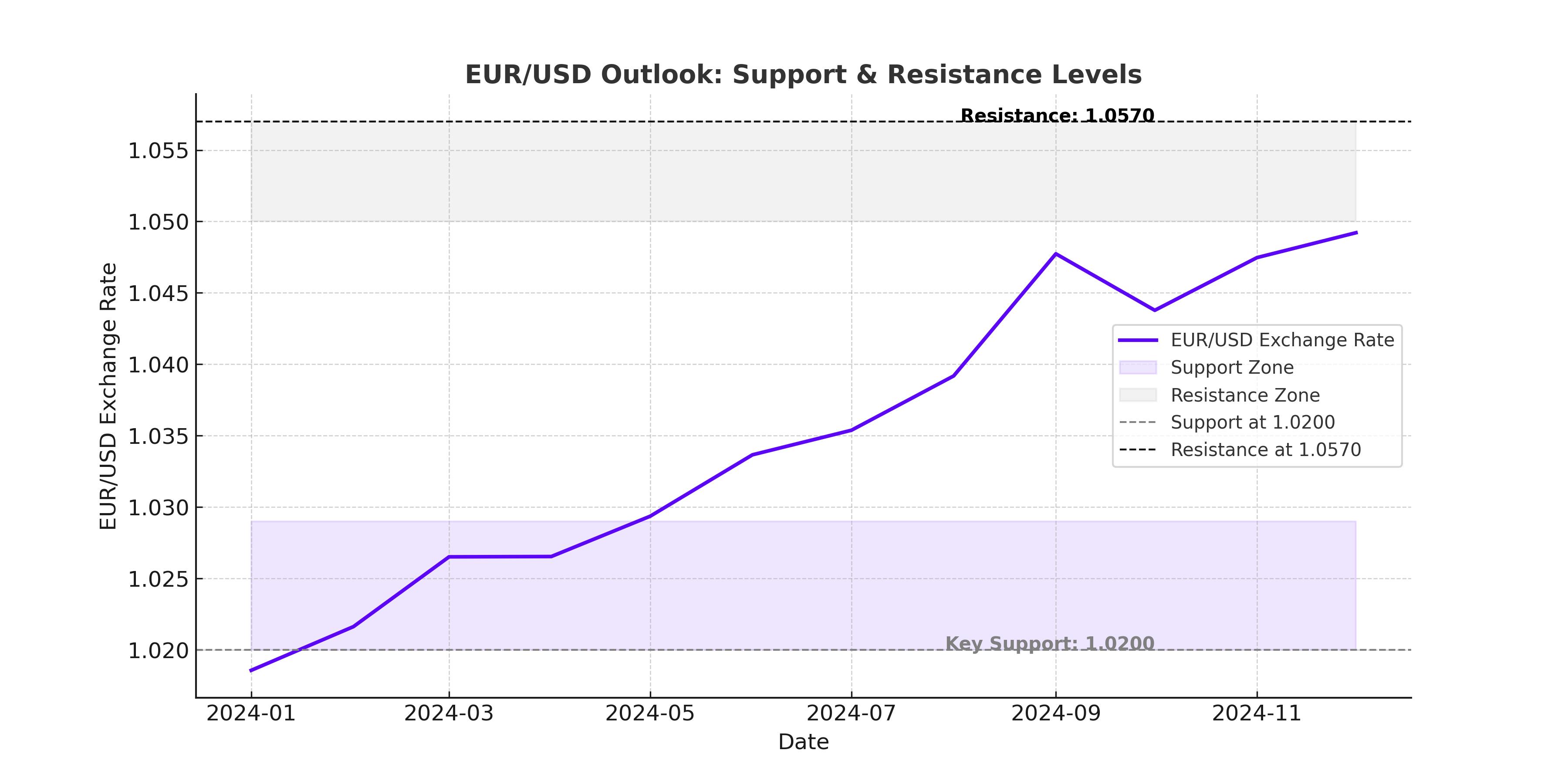

Technical Analysis: Key Support and Resistance Levels for EUR/USD

EUR/USD remains in bearish territory, with technical indicators suggesting that downside risks persist. The pair is trading near 1.0310, with the 50-day Exponential Moving Average (EMA) at 1.0436 acting as strong resistance.

The Relative Strength Index (RSI) is hovering below 50, signaling that selling momentum is still in play.

- Immediate resistance: 1.0330, followed by 1.0400

- Support levels: 1.0285, 1.0250, and 1.0200

- Key pivot level: 1.0348

If EUR/USD fails to break above 1.0330, bears could regain control and push the pair toward the 1.0250 level. A break below 1.0200 would open the door for a potential retest of 1.0176, a key low from recent sessions.

On the other hand, a move above 1.0400 could shift sentiment in favor of the bulls, with 1.0500 as the next major target. However, given the current macroeconomic landscape, the path of least resistance remains to the downside.

Market Sentiment: Will EUR/USD Find Support or Continue Lower?

With geopolitical tensions rising, US inflation data ahead, and diverging central bank policies, EUR/USD remains vulnerable to further declines. Traders are closely monitoring US CPI data, ECB policy signals, and potential US-EU trade retaliation for the next major move.

If the US dollar continues its dominance, we could see EUR/USD break below 1.0250 in the coming sessions. However, if risk sentiment stabilizes and the euro finds support at 1.0300, a short-term recovery could be on the table.

For now, EUR/USD remains in a bearish trend, with traders watching for key levels to determine the next breakout or breakdown. Will buyers step in, or is the euro set for another leg lower?