EUR/USD Faces Uncertain Path as Market Weighs Fed Signals and Trump’s Tariff Impact

US Dollar Strength and Its Pressure on EUR/USD

The EUR/USD pair remains under pressure as the US Dollar Index (DXY) holds near 108.3, reflecting the resilience of the greenback ahead of Federal Reserve Chair Jerome Powell’s testimony and the release of key inflation data. Investors are closely monitoring the February 12 Consumer Price Index (CPI) report, which is projected to show 0.3% month-over-month and 2.9% year-over-year inflation. If inflation exceeds expectations, the dollar could surge further, tightening financial conditions and pushing EUR/USD lower.

Traders are also bracing for Powell’s remarks at 3:00 PM, expecting potential hints about future rate hikes or cuts. Given that FOMC members Hammack, Bowman, and Williams are also scheduled to speak, volatility is likely in the forex market. If Powell maintains a hawkish stance, the USD could gain strength, dragging EUR/USD below its key support levels.

EUR/USD Technical Picture: Key Resistance and Support Levels

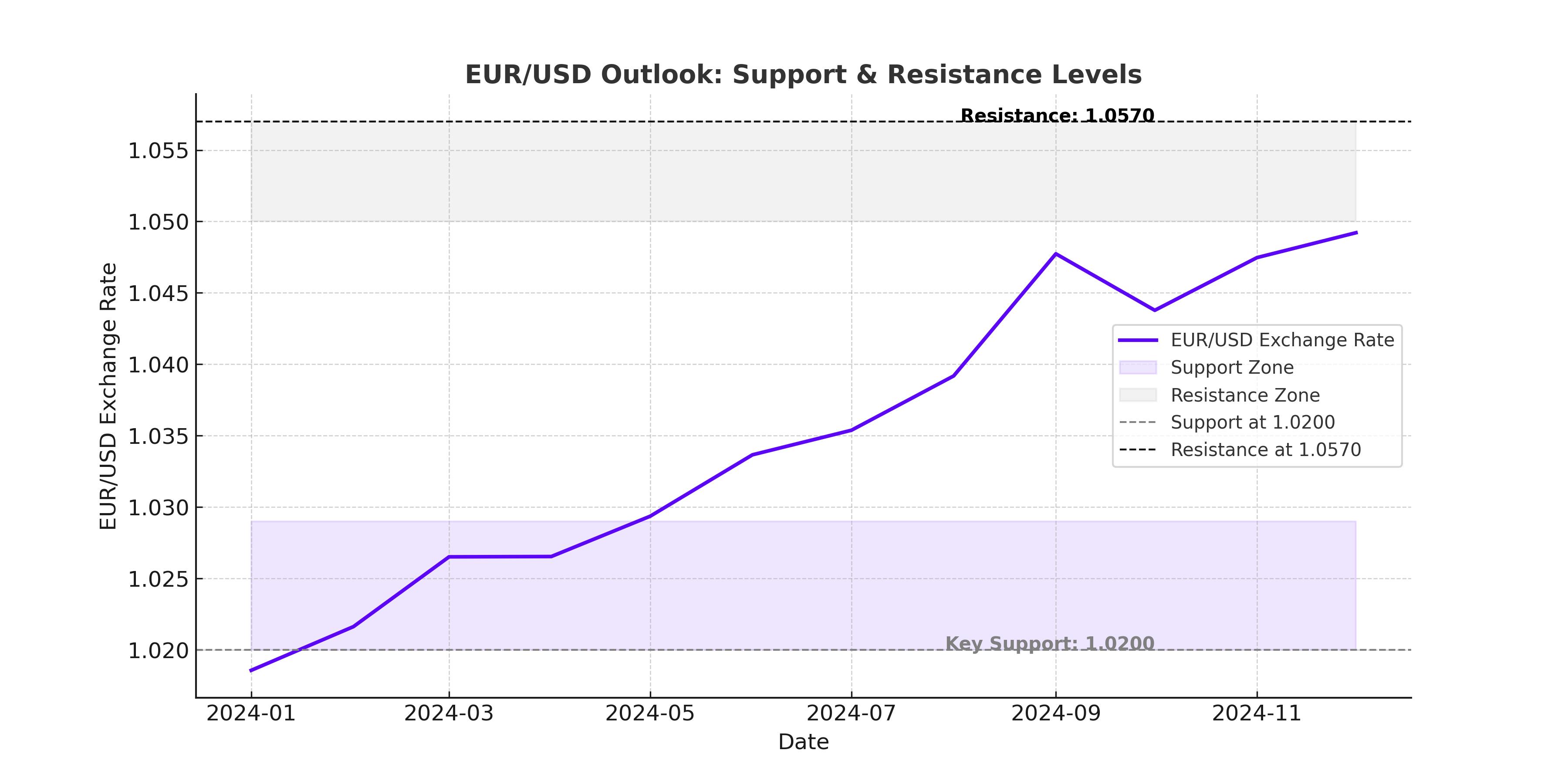

The EUR/USD pair is currently trading at 1.03049, struggling to maintain upward momentum amid strong US Dollar performance. The pivot point at 1.03353 remains a significant resistance level, and failure to break above this level could reinforce bearish sentiment. Additionally, the 50-day EMA at 1.03538 and the 200-day EMA at 1.03893 indicate that downside risks persist.

Immediate support is located at 1.02412, and if this level breaks, the pair could slide further toward 1.01779. A decisive break below this range could accelerate losses, potentially exposing EUR/USD to a move toward the psychological barrier of 1.0100. On the other hand, a strong move above 1.03983 could open the door for a trend reversal, with resistance at 1.0450 becoming the next upside target.

Impact of Powell’s Testimony on EUR/USD

The upcoming Powell testimony before Congress is the most significant event for EUR/USD in the short term. Traders will be looking for any changes in the Fed’s interest rate guidance. The central bank has so far maintained its stance of keeping rates in the 4.25%-4.50% range, waiting for “real progress in inflation or some weakness in the labor market.”

If Powell signals that rate cuts are unlikely in the near term, the US Dollar could strengthen further, driving EUR/USD toward its next major support levels. On the other hand, if Powell hints at potential easing, EUR/USD could rebound, especially if inflation data comes in softer than expected.

Trump’s 25% Tariff Plan and Its Eurozone Implications

Another key factor influencing EUR/USD is President Donald Trump’s decision to impose a 25% tariff on steel and aluminum imports from all nations. The move, effective March 12, is expected to trigger retaliatory measures from global trading partners, including the Eurozone, which is heavily dependent on exports.

The Eurozone could become a major casualty of these trade tensions, as European automakers and manufacturers rely on US markets. The imbalance in trade duties—where the EU charges 10% tariffs on US auto imports while the US only charges 2.5%—could worsen tensions, ultimately weighing on EUR/USD.

Furthermore, higher tariffs are inflationary, meaning that if global prices rise, central banks may adjust their monetary policy stance accordingly. The European Central Bank (ECB) may be forced into a dovish pivot if economic conditions deteriorate, further weakening the Euro against the Dollar.

ECB Rate Cut Expectations Weigh on EUR/USD

The European Central Bank’s policy stance remains a major drag on the EUR/USD pair. Market participants have fully priced in three ECB rate cuts of 25 basis points each by the summer of 2025, pushing the Deposit Facility Rate closer to 2%. This contrasts sharply with the Federal Reserve’s more cautious approach, which has so far resisted aggressive rate cuts.

ECB officials are divided, with some policymakers advocating for cuts beyond the neutral rate, citing a weaker-than-expected Eurozone economy. If the ECB proceeds with aggressive easing, the Euro’s interest rate differential against the Dollar will widen, adding to EUR/USD bearish pressure.

EUR/USD Short-Term Outlook: More Downside Ahead?

The technical outlook for EUR/USD remains weak, with three straight days of losses pushing the pair into 1.0300 territory. The recent failure to break above the 50-day Exponential Moving Average (EMA) in late January led to continued selling pressure, and the next major target for bears remains the 1.0200 handle.

The Relative Strength Index (RSI) at 42.20 suggests further downside, while the Moving Average Convergence Divergence (MACD) remains in negative territory, reinforcing the bearish bias. However, if Powell’s comments turn dovish and inflation data disappoints, a rebound toward 1.0350-1.0400 remains possible.

Final Decision: Sell, Hold, or Buy EUR/USD?

Given the current macro backdrop, EUR/USD remains a sell in the near term, with downside risks outweighing bullish catalysts. The strong US labor market, stubbornly high inflation, and the Fed’s reluctance to cut rates aggressively all favor further Dollar strength. Moreover, Trump’s tariff policies could escalate trade tensions, adding pressure on the Euro.

The key levels to watch remain 1.0250 as support and 1.0350 as resistance. A break below 1.0250 would confirm further downside, potentially targeting 1.0200 and lower, while a recovery above 1.0350 could open a path for a short-term bullish move. Given these factors, traders should remain cautious and closely monitor upcoming economic data releases, especially US CPI and Powell’s testimony, which could be decisive for EUR/USD’s next major move.