Current Position of EUR/USD in the Market

The EUR/USD pair has displayed a corrective upward movement over the past three trading sessions. Despite this recovery, it has been unable to surpass the significant resistance level of 1.0457, which represents the highest point in nearly a month. Currently, the pair is trading near 1.0415, stabilizing after failing to gain further momentum. Market sentiment remains focused on broader economic factors, with traders closely monitoring potential catalysts to drive the pair higher or lower.

Influence of ECB Policy and Rate Cuts on EUR/USD

The European Central Bank (ECB) continues to play a pivotal role in shaping the outlook for EUR/USD. Policymakers, including President Christine Lagarde, have hinted at the possibility of additional rate cuts in 2025. With four cuts already implemented and markets pricing in another reduction during the upcoming ECB meeting, the euro remains under pressure. A deeper cut to the Deposit Facility rate is expected in subsequent meetings, further solidifying a dovish stance that could weigh on the currency.

The potential for tariffs from U.S. President Donald Trump targeting the Eurozone has added another layer of complexity. Trump’s proposed 10% universal tariff would impact goods from Europe, exacerbating economic weakness in the region. This, in turn, would force the ECB to act more aggressively, possibly leading to accelerated borrowing cost reductions. As of now, market participants anticipate the ECB to lower rates by 25 basis points during their next meeting, a move likely to support the dollar while pressuring the euro further.

US Dollar Strength and Federal Reserve Policy Impact

The Federal Reserve's upcoming monetary policy meeting will be a crucial determinant for the EUR/USD trajectory. The Fed is widely expected to maintain the current rate range of 4.25%-4.50%, with no immediate changes anticipated. However, any hawkish language from Fed policymakers suggesting potential rate hikes or prolonged monetary tightening could bolster the U.S. dollar, further challenging the euro.

The U.S. Dollar Index (DXY) reflects the dollar’s resilience, trading around 108.40 after recovering from a two-week low of 107.75. Traders remain cautious ahead of key economic reports, including unemployment claims, which are forecasted at 221,000. Positive data could reinforce dollar strength, adding downward pressure to the EUR/USD pair.

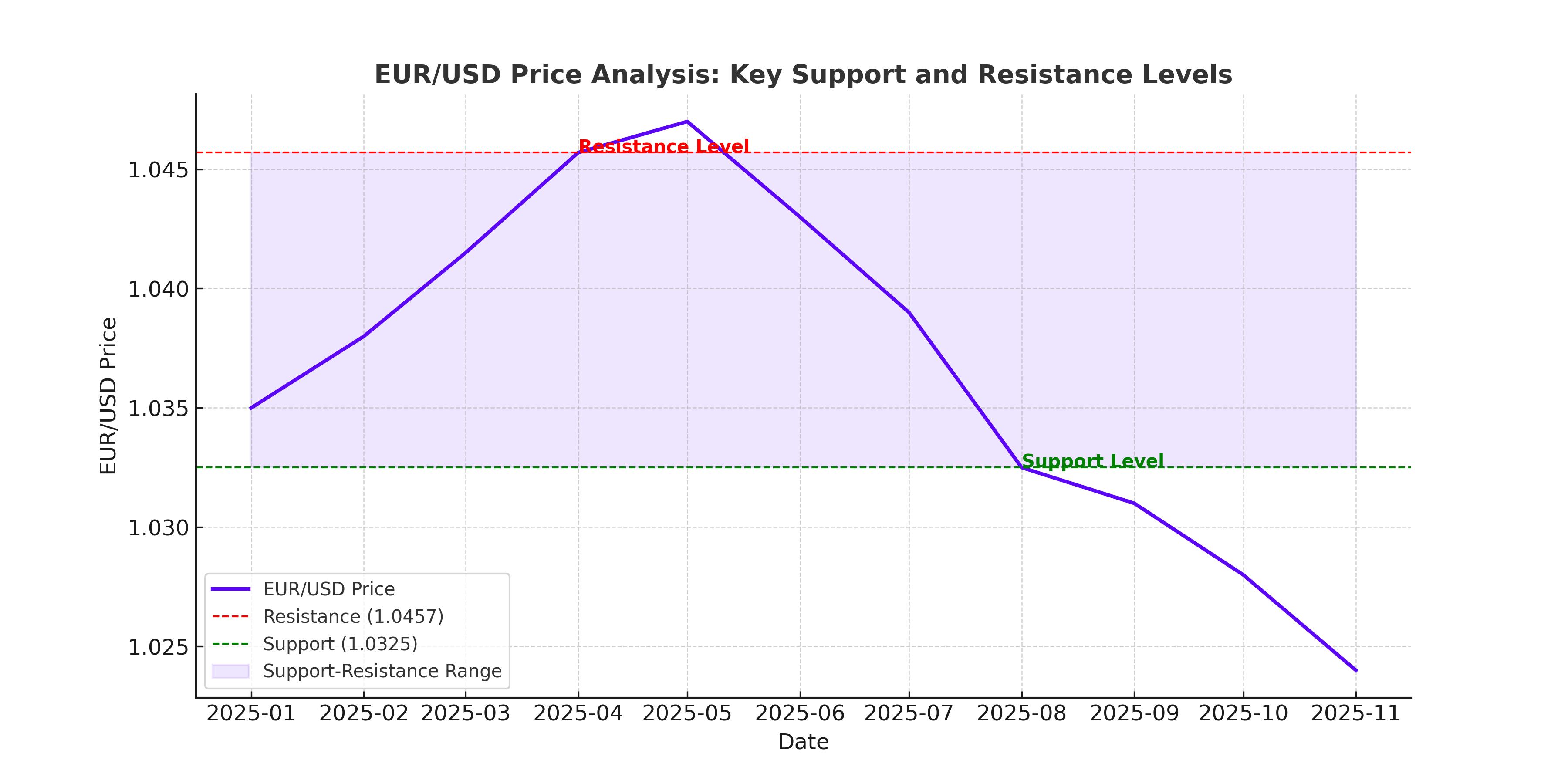

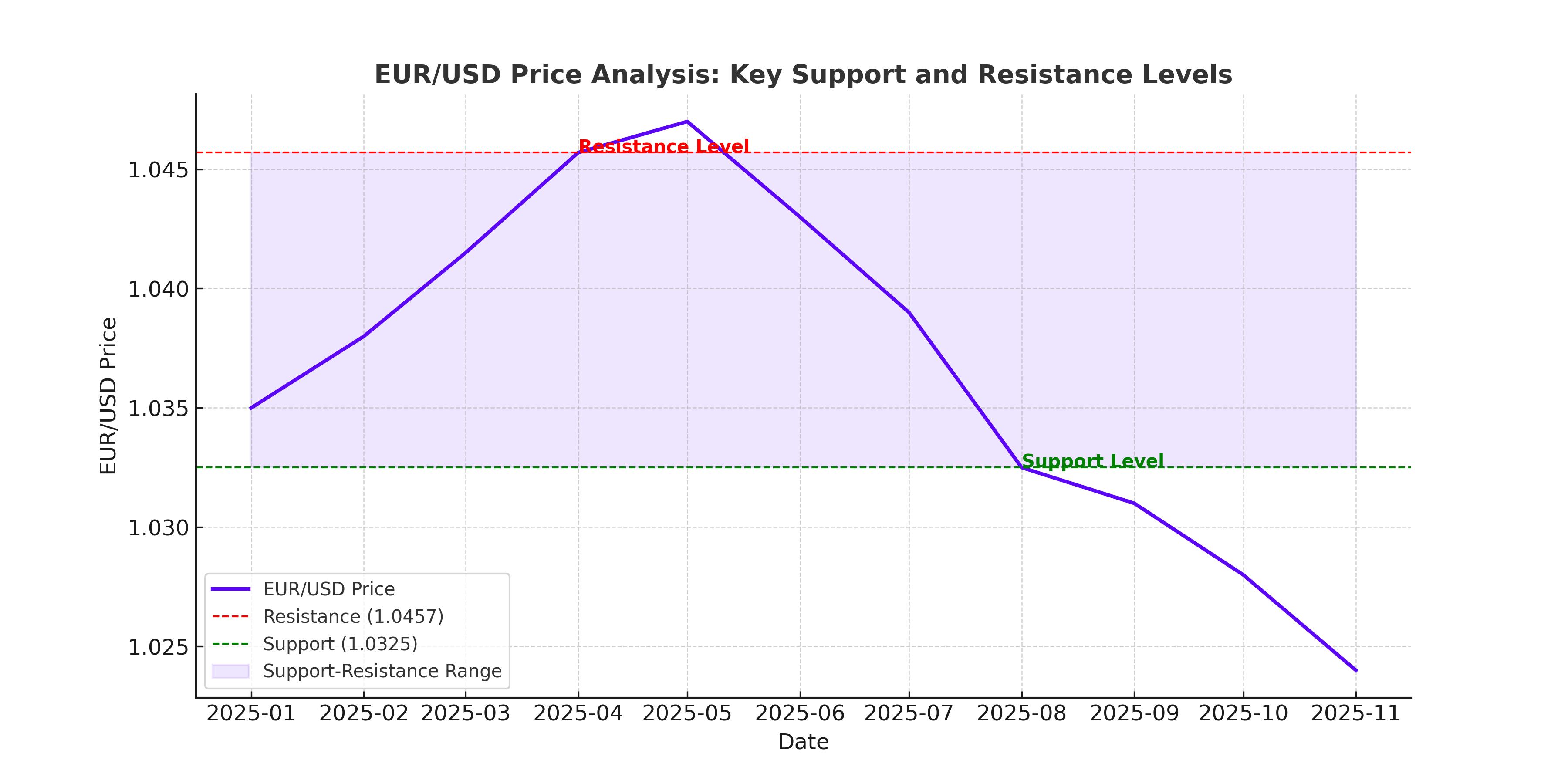

Technical Analysis of EUR/USD

From a technical perspective, the EUR/USD pair faces significant resistance near 1.0450-1.0460. This level aligns with the upper boundary of the current bullish channel observed on the 4-hour chart. Although the pair trades above the 30-SMA (simple moving average) and the RSI (relative strength index) remains in bullish territory, bearish divergence signals caution. The RSI’s failure to confirm recent higher highs suggests a potential downside movement.

Immediate support lies at 1.0350, while a more substantial support zone exists at 1.0325. A break below these levels could trigger a bearish wave targeting the January low of 1.0175. Conversely, if the pair breaches the 1.0455 resistance, a bullish correction toward 1.0600 could materialize, depending on market sentiment and external factors.

Geopolitical Factors and Trump’s Tariff Proposals

President Trump’s trade policies remain a wildcard for EUR/USD. The announcement of a 10% universal tariff targeting Eurozone goods has introduced uncertainty into the market. While the immediate impact on the euro has been subdued due to the gradual nature of the tariff implementation, the long-term implications could be detrimental to the region's already fragile economy. Trump has also threatened 25% tariffs on imports from Mexico and Canada, further complicating global trade dynamics.

The ECB has warned about the adverse effects of such tariffs, with Lagarde emphasizing the need for Europe to “anticipate” and prepare for potential economic disruptions. Should these tariffs materialize, the euro could face additional downward pressure, pushing EUR/USD toward multi-year lows.

Key Events to Watch for EUR/USD

Traders should keep a close eye on several upcoming events that could influence EUR/USD. These include the release of Eurozone Consumer Confidence data, which is projected at -14 (an improvement from -15), and the U.S. unemployment claims report. Additionally, speeches by ECB policymakers and President Lagarde will provide further insights into the central bank’s policy direction.

The Federal Reserve’s policy decision next week is another critical event. While no rate change is expected, any deviation from the anticipated narrative could cause significant volatility. A hawkish tone would support the dollar, while dovish remarks could provide temporary relief for the euro.

Broader Market Dynamics and EUR/USD Sentiment

The euro has struggled to gain ground against the dollar despite favorable technical setups. The longer-term trend remains bearish, as indicated by the downward-sloping 200-day EMA near 1.0700. Meanwhile, short-term bullish momentum persists as long as the pair trades above the 20-day EMA around 1.0360.

Market sentiment toward EUR/USD remains cautious, with many traders adopting a wait-and-see approach. The pair’s inability to break key resistance levels signals a lack of conviction among bulls, while bears appear reluctant to push prices lower without stronger catalysts.

Final Thoughts on EUR/USD’s Outlook

Considering the current macroeconomic environment, technical indicators, and geopolitical factors, the EUR/USD outlook remains mixed. While short-term bullish momentum persists, the broader trend favors the dollar, driven by stronger U.S. economic fundamentals and potential policy divergence between the Fed and ECB. The pair's near-term trajectory will depend heavily on upcoming economic data and central bank decisions.

This analysis suggests a bearish-to-neutral stance for EUR/USD in the near term, with potential downside targets at 1.0325 and 1.0175. Investors should approach the pair cautiously, closely monitoring key events and adjusting positions accordingly. For real-time EUR/USD price updates and further insights, visit EUR/USD Chart.

That's TradingNEWS