EUR/USD Rallies to 1.0900 on Weaker US Inflation and Spiked Fed Rate Cut Forecasts

Pair Supported by Declining US CPI and Anticipation of ECB Rate Decision | That's TradingNEWS

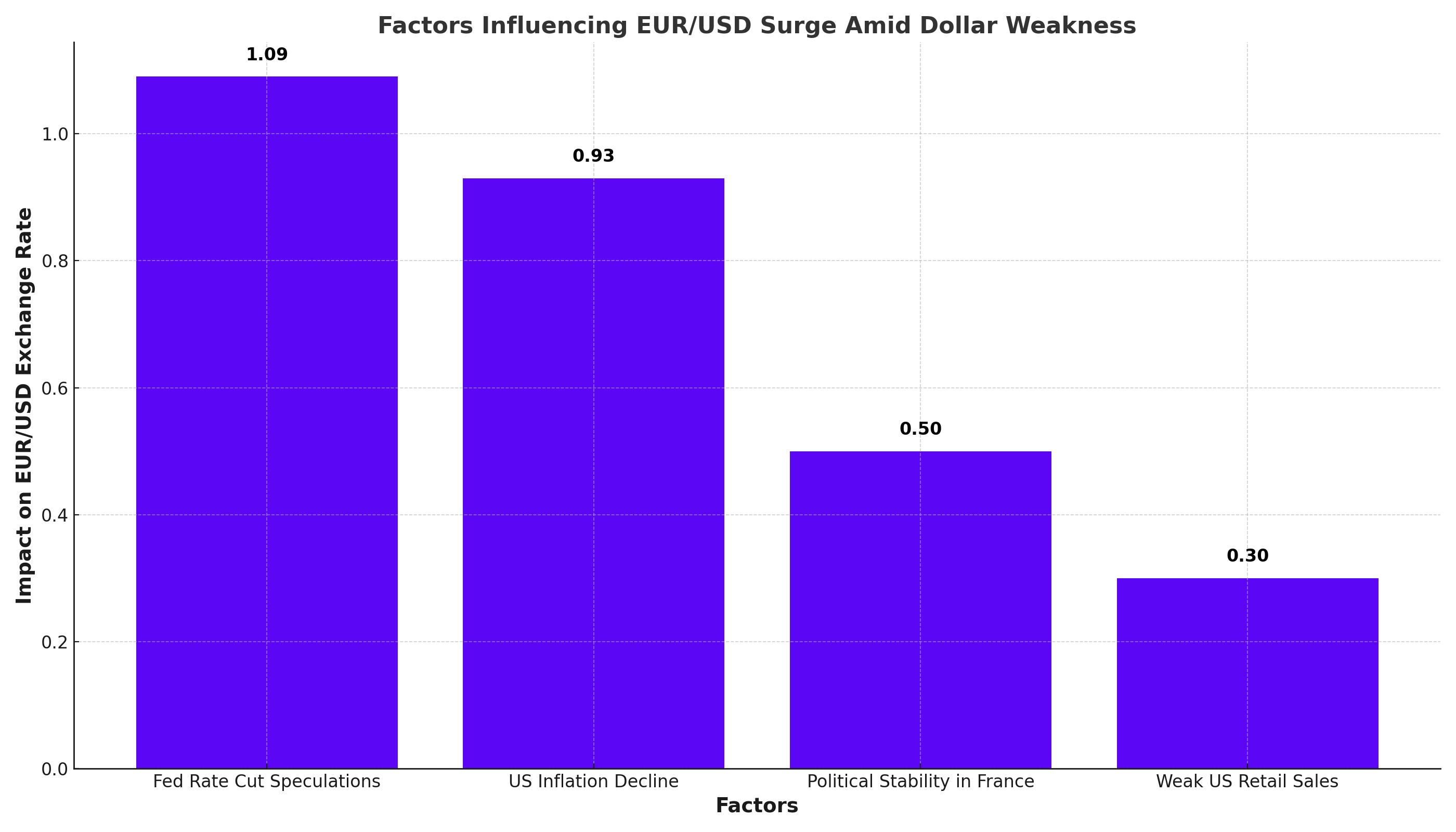

EUR/USD Surges Amid Dollar Weakness and Fed Rate Cut Speculations

Fed Chair Powell's Cautious Tone on Inflation

Federal Reserve Chair Jerome Powell recently stated that policymakers needed more confidence that inflation was falling, which initially strengthened the US dollar. However, this movement was short-lived as the US inflation data revealed a surprising decrease, causing a significant shift in market expectations.

Decline in US Inflation Sparks Rate Cut Speculations

In June, US inflation fell for the first time in four years, surprising many economists who had expected an increase. This unexpected drop pushed investors to raise the probability of a Federal Reserve rate cut in September to 93%. As a result, the dollar weakened, providing a bullish outlook for the EUR/USD pair.

Euro Gains Amid Political Stability in France

The euro also benefited from a resolution in political uncertainty in France following the recent elections. This added to the bullish sentiment for the EUR/USD as the political risk diminished, allowing the euro to strengthen against the dollar.

Key Economic Events and Their Impact on EUR/USD

Next week’s economic calendar is relatively light, focusing on the ECB bank lending survey and the US retail sales report. The recent trend of weak economic figures is expected to continue, putting more pressure on the Federal Reserve to consider lowering interest rates. A decline in retail sales would reinforce this expectation, potentially driving the EUR/USD higher.

Technical Analysis: EUR/USD Poised for Further Gains

The EUR/USD has reached a key resistance level at 1.0900 after a strong bullish move. The price is well above the 22-SMA, indicating a bullish bias. The RSI is approaching the overbought region, showing a surge in bullish momentum. There is a high chance that the price will break above 1.0900, confirming a new bullish trend and clearing the path for a rally to the 1.618 Fibonacci extension level.

Historical Performance and Future Outlook

The EUR/USD started last Monday’s trading near the 1.0800 level, showing stability despite concerns about France’s political situation. The pair saw significant buying power emerge, particularly on Thursday when US Consumer Price Index data came in below expectations. This weak inflation data led to immediate buying in the EUR/USD, pushing it towards the 1.0900 level.

Impact of ECB and Federal Reserve Policies

The upcoming ECB meeting and the Federal Reserve's stance on interest rates are crucial for the EUR/USD outlook. The ECB is expected to keep its main refinancing rate steady, but its rhetoric will be closely watched. Meanwhile, the Federal Reserve’s dovish shift could continue to support the EUR/USD’s bullish trajectory.

Speculative Price Range and Market Sentiment

The speculative price range for EUR/USD is 1.0840 to 1.0965. While some traders may look for reversals lower, the optimistic sentiment regarding a potential Fed rate cut could drive the EUR/USD higher. The pair's ability to maintain its higher levels early in the week will be critical in determining whether higher values will develop.

Long-Term Prospects for EUR/USD

The EUR/USD may attempt to test the June high of 1.0916 ahead of the ECB interest rate decision. Despite a rise in the US Producer Price Index, the pair has climbed to a fresh monthly high of 1.0909, indicating strong bullish momentum. Speculation for a looming Fed rate cut may keep EUR/USD afloat, and the exchange rate may continue to carve higher highs and lows.

Technical Levels to Watch

The EUR/USD approaches the June high of 1.0916 as it stages a three-day rally. A breach above the 1.0940 to 1.0960 region could bring the March high of 1.0981 into view. However, if the pair struggles to hold above the 1.0860 to 1.0880 region, it may move below 1.0770, opening up the monthly low of 1.0710.

Conclusion: EUR/USD Set for Continued Strength

The EUR/USD's recent performance reflects a combination of weaker US inflation data, increased expectations for a Fed rate cut, and political stability in Europe. As the ECB and Fed policies unfold, the pair is likely to see continued bullish momentum, particularly if key technical levels are breached. Traders should watch for economic data releases and central bank rhetoric that could influence the pair's trajectory in the coming weeks.

That's TradingNEWS

EUR/USD Faces Crucial Test: Will the Euro Break Above 1.1455 After ECB Rate Cut?

EUR/USD Breaks Through Key Resistance: What’s Next for the Euro?