EUR/USD Under Pressure as ECB Rate Cut Signals Further Weakness—Will the Euro Hold Above 1.0400?

The EUR/USD (Euro/US Dollar) pair has been trading in a volatile range, reacting to the latest European Central Bank (ECB) rate decision and diverging monetary policies between the Eurozone and the United States. The ECB cut interest rates by 25 basis points, bringing the Deposit Facility Rate down to 2.75% and the Main Refinancing Rate to 2.9%, marking the fifth consecutive rate reduction. Meanwhile, the Federal Reserve (Fed) held rates steady at 4.25%-4.50%, reinforcing its cautious stance amid inflation concerns.

Traders now face a critical question: Is the EUR/USD poised for a deeper decline, or can the Euro mount a comeback?

ECB’s Rate Cut and Eurozone’s Struggling Economy Weigh on EUR/USD

The ECB’s decision was widely anticipated, but the Eurozone's weakening economic conditions make the path forward uncertain. Flash GDP data for Q4 2024 revealed that economic growth stagnated at 0.1% year-over-year, with Germany—the region’s largest economy—contracting -0.2% for the second consecutive quarter. The Eurozone’s inflation rate, measured at 2.4%, is approaching the ECB’s 2% target, but sluggish growth is forcing the central bank to prioritize stimulus over price stability.

Markets have already priced in three additional rate cuts in 2025, which could bring the Deposit Facility Rate down to 2% by year-end. This forward guidance keeps the Euro under pressure, as traders expect a prolonged period of monetary easing compared to the Fed’s more restrictive stance.

Adding to concerns, US President Donald Trump’s proposed trade tariffs could further weaken the Eurozone’s fragile economic outlook. If Trump reintroduces tariffs on European goods, the bloc’s struggling manufacturing sector could see another downturn, leading to even weaker demand for the Euro.

Federal Reserve Holds Firm, Keeping the US Dollar Strong

The Federal Reserve chose to keep interest rates steady at 4.50%, signaling that it is in no rush to cut rates despite market expectations. Fed Chair Jerome Powell emphasized that while inflation has cooled from its peak of 9.1% in 2022 to 2.9%, it is not low enough to warrant immediate monetary easing. Powell also noted that the labor market remains resilient, with weekly jobless claims holding at 224K, suggesting that the US economy is not showing signs of weakness that would justify rate cuts.

Markets are closely watching US GDP growth, expected to slow to 2.7% from 3.1%, as well as inflation data from the Personal Consumption Expenditures (PCE) Index. If these indicators come in stronger than expected, the US dollar could rally further, adding more downside pressure on EUR/USD.

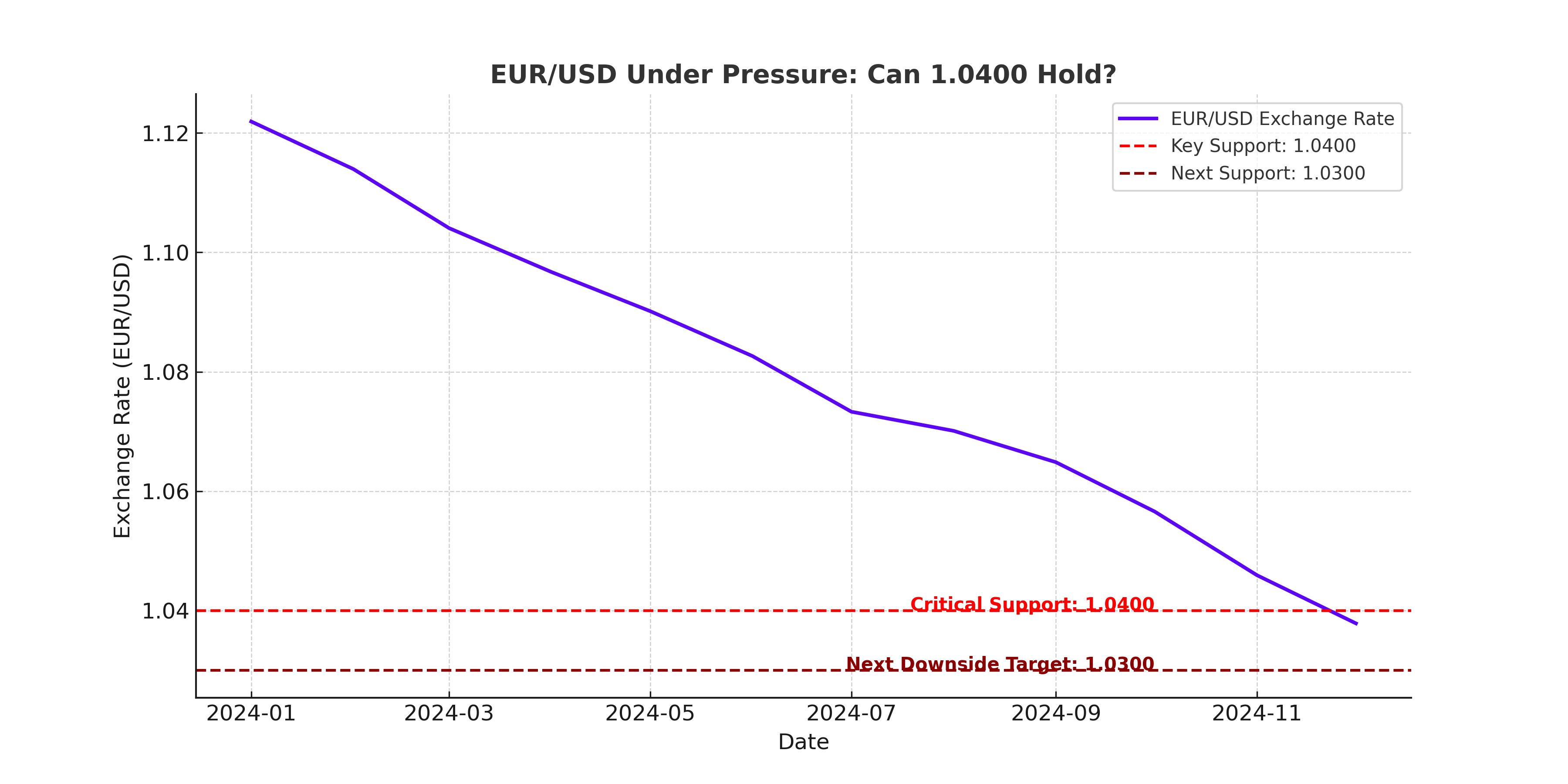

Technical Analysis: Key Support at 1.0400 Holds, but For How Long?

EUR/USD has been testing the 1.0400 support level, a key psychological barrier for traders. After briefly dipping to 1.0380, the pair rebounded slightly to 1.0435, indicating some buying interest at lower levels. However, technical indicators remain bearish, signaling a potential continuation of the downtrend unless the euro can break above resistance.

The 30-day Simple Moving Average (SMA) sits at 1.0450, while the 50-day SMA at 1.0480 presents another resistance zone. The Relative Strength Index (RSI) is currently below 50, indicating bearish momentum. If EUR/USD fails to reclaim 1.0480, it could lead to a break below 1.0400, exposing 1.0300 as the next major downside target.

Conversely, a sustained move above 1.0480-1.0500 could attract bullish momentum, potentially pushing the pair toward the 1.0630 December high.

Market Outlook: Will the Euro Recover or Slide Further?

For EUR/USD to stabilize or recover, several key factors must align:

- The ECB must signal caution on further rate cuts, reducing expectations of aggressive easing.

- US economic data needs to show signs of softening, leading to increased expectations for Fed rate cuts in 2025.

- Trump’s tariff threats must not escalate into full-blown trade wars that could further damage the Eurozone economy.

For now, the path of least resistance remains to the downside as the policy divergence between the Fed and the ECB widens. Traders will closely monitor upcoming data, including Eurozone inflation figures, US job market reports, and Fed commentary, to determine the next big move in EUR/USD.

Final Verdict: Bearish Bias Unless 1.0480 Breaks

Given the macroeconomic backdrop, EUR/USD remains vulnerable. As long as the pair trades below 1.0480, the risk of a break below 1.0400 and a drop toward 1.0300 remains high. However, if bullish momentum returns and 1.0500 is breached, we could see a potential recovery toward 1.0630.

For now, EUR/USD is a sell on rallies unless key resistance levels are broken.